Pdfcoffee - Accounting that is helpful PDF

| Title | Pdfcoffee - Accounting that is helpful |

|---|---|

| Author | Casper John Muñoz |

| Course | accounting 1 |

| Institution | University of Negros Occidental - Recoletos |

| Pages | 9 |

| File Size | 230.6 KB |

| File Type | |

| Total Downloads | 338 |

| Total Views | 1,017 |

Summary

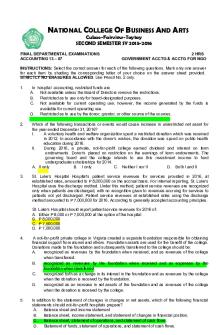

NATIONAL COLLEGE OF BUSINESS AND ARTSCubao-Fairview-TaytaySECOND SEMESTER SY 2015-FINAL DEPARTMENTAL EXAMINATIONS 2 HRSACCOUNTING 13 – 07 GOVERNMENT ACCTG & ACCTG FOR NGOINSTRUCTIONS: Select the correct answer for each of the following questions. Mark only one answer for each item by shading...

Description

NATIONAL COLLEGE OF BUSINESS AND ARTS Cubao-Fairview-Taytay SECOND SEMESTER SY 2015-2016 FINAL DEPARTMENTAL EXAMINATIONS ACCOUNTING 13 – 07

2 HRS GOVERNMENT ACCTG & ACCTG FOR NGO

INSTRUCTIONS: Select the correct answer for each of the following questions. Mark only one answer for each item by shading the corresponding letter of your choice on the answer sheet provided. STRICTLY NO ERASURES ALLOWED. Use Pencil No. 2 only. 1.

In hospital accounting, restricted funds are A. Not available unless the Board of Directors remove the restrictions. B. Restricted as to use only for board-designated purposes. C. Not available for current operating use; however, the income generated by the funds is available for current operating use. D. Restricted as to use by the donor, grantor, or other source of the sources.

2.

Which of the following transactions or events would cause increase in unrestricted net asset for the year ended December 31, 2016? I. A voluntary health and welfare organization spent a restricted donation which was received in 2012. In accordance with the donor’s wishes, the donation was spend on public health education during 2016. II. During 2016, a private, not-for-profit college earned dividend and interest on term endowments. Donor’s placed no restriction on the earnings of term endowments. The governing board and the college intends to use this investment income to fund undergraduate scholarships for 2014. A. II only B. I only C. Neither I nor II D. Both I and II

3.

St. Luke’s Hospital Hospital’s patient service revenues for services provided in 2016, at established rates, amounted to P 8,000,000 on the accrual basis. For internal reporting, St. Luke’s Hospital uses the discharge method. Under this method, patient service revenues are recognized only when patients are discharged, with no recognition given to revenues accruing for services to patients not yet discharged. Patient service revenues at established rates using the discharge method amounted to P 7,000,000 for 2016. According to generally accepted accounting principles. St. Luke’s Hospital should report patient service revenues for 2016 of: A. Either P 8,000 or P 7,000,000 at the option of the hospital B. P 8,000,000 C. P 7,500,000 D. P 7,000,000

4.

A not-for-profit private college in Virginia created a separate foundation responsible for obtaining financial support from alumni and others. Foundation assets are used for the benefit of the college. Donations made to the foundation and subsequently transferred to the college should be: A. recognized as revenues by the foundation when received, and as revenues of the college when transferred. B. recognized as revenues by the foundation when received and as expenses by the foundation when transferred. C. recognized both as a change in its interest in the foundation and as revenues by the college when the donation is received by the foundation. D. recognized as an increase in net assets of the foundation and as revenues of the college when the donation is received by the college.

5.

In addition to the statement of changes in changes in net assets, which of the following financial statements should not-for-profit hospitals prepare? A. Balance sheet and income statement B. Balance sheet, income statement, and statement of changes in financial position. C. Balance sheet, statement of operations, and statement of cash flows. D. Statement of funds, statement of operations, and statement of cash flows.

2 ACCOUNTING 13-07

ACCOUNTING FOR GOVERNMENT & ACCTG FOR NGO

6.

The statement of financial position (balance sheet) for Cecilia Library should report separate peso amounts for the library’s net assets according to which of the following classifications? A. Unrestricted and permanently restricted. B. Temporarily restricted and permanently restricted C. Unrestricted and temporarily restricted D. Unrestricted, temporarily restricted, and permanently restricted

7.

Land valued at P 400,000 and subject to a P 150,000 mortgage was donated to Makati Medical Hospital without restriction as to use. Which of the following entries should Makati Medical make to record this donation? A. Land 400,000 Mortgage payable 150,000 Endowment fund balance 250,000 B. Land 400,000 Debt fund balance 150,000 Contributions 250,000 C. Land 400,000 Debut fund balance 150,000 Endowment fund balance 250,000 D. Land 400,000 Mortgage payable 150,000 Unrestricted fund balance 250,000

8.

The following receipts were among those recorded by St. Dominic College during 2016: Unrestricted gifts P 500,000 Restricted current funds (expended for current operating purposes) 200,000 Restricted current funds (not yet expended) 100,000 The amount that should be included as Revenues Current Fund Revenue A. P 800,000 P 700,000 B. 700,000 800,000 C. 600,000 600,000 D. 500,000 500,000

9.

Manila Adventist Hospital’s accounting records disclosed the following information: Net resources invested in plant assets P 10,000,000 Board designated funds 2,000,000 What amount should be included as part of unrestricted funds? A. P 12,000 B. P 10,000 C. P 2,000,000 D. P 0

10.

Bernal Hospital fiscal year ends May 31, 2016. In March 2016, a P 300,000 unrestricted bequest and a P 500,000 pure endowment grant were received. In April 2016, a bank notified Bernal Hospital that the bank received P 10,000 to held in permanent trust by the bank. Bernal Hospital is to receive the income from this donation. Bernal Hospital should record the P 300,000 unrestricted bequest as A. Non-operating revenue B. Other operating revenue C. A direct credit to the fund balance D. A credit to operating expenses

11.

Unrestricted current funds of a private university designated by the governing board for a specific future purpose should be reported as part of: A. unrestricted net assets. C. board-restricted net assets B. temporarily restricted net assets. D. term endowments.

Page 2 of 9

3 ACCOUNTING 13-07 12.

ACCOUNTING FOR GOVERNMENT & ACCTG FOR NGO

On January 2, 2016, a graduate of Arellano established a permanent trust fund and appointed Land Bank as the trustee. The income from the trust is to be paid to Arellano and used only the school of education to support student scholarships. What entry is required on Arellano’s books to record the receipt of cash from the interest on the trust fund? A. Debit cash and credit restricted current funds deferred revenue B. Debit cash and credit restricted endowment revenue C. Debit cash and credit endowment fund balance D. Debit cash and credit unrestricted endowment revenue

13.

The following information was available from St. Therese University’s accounting records for its current funds for the year ended March 31, 2012: Restricted gifts received Expended P 100,000 Not expended 300,000 Unrestricted gifts received Expended 600,000 Not expended 75,000 What amount should be included in current funds revenues for the year ended March 31, 2012? A. P 600,000 B. P 700,000 C. P 775,000 D. P 1,000,000

14.

The following funds were among those held by UDMC University of December 31, 2012: Principal specified by the donor as non-expendable Principal expendable after the year 2012 Principal designated from current funds

P 500,000 300,000 100,000

What amount should UDMC University classify as regular endownment funds? (or permanently restricted endowments) A. P 100,000 B. P 300,000 C. P 500,000 D. P 900,000

15.

St. Scholastica’s College, a private not-for-profit college, received the following contributions during 2015: I.

P 5,000,000 from alumni for construction of a new wing on the science on the science building to be constructed in 2016. II. P 1,000,000 from a donor who stipulated that the contribution be invested indefinitely and that the earnings be used for scholarships. As of December 31, 2015, earnings from investments amounted to P 50,000. For the year ended December 31, 2015, what amount of these contributions should be reported as temporarily restricted revenues on the statement of activities? A. P 50,000 B. P 5,050,000 C. P 5,000,000 D. P 6,050,000

16.

Good Shepherd, a voluntary health and welfare organization, received a cash donation of P 500,000 from Mr. Charles on November 15, 2016. Mr. Charles requested that his donation be used to acquire equipment for the organization. Good Shepherd used the donation to acquire equipment costing P 500,000 in January of 2016. For the year ended December 31, 2016, Good Shepherd should report the P 500,000 contribution on its A. Statement of activities as unrestricted revenue B. Statement of financial position as temporarily restricted deferred revenue C. Statement of financial position as unrestricted deferred revenue. D. Statement of activities as temporarily restricted revenue.

17.

A statement of functional expenses is required for which one of the following private nonprofit organizations? A. Colleges B. Hospitals C. Voluntary health and welfare organizations D. Performing arts organizations

Page 3 of 9

4 ACCOUNTING 13-07 18.

ACCOUNTING FOR GOVERNMENT & ACCTG FOR NGO

In 2016, the Board of Trustees of Ayala Foundation, designated P 100,000 from its current funds for college scholarships. Also in 2016, the foundation received a bequest of P 200,000 from an estate of a benefactor who specified that the bequest was to be used for hiring teachers to tutor handicapped students. What amount should be accounted for as current restricted funds? A. P 0 B. P 100,000 C. P 200,000 D.

19.

P 300,000

On January 2, 2016, a nonprofit botanical society received a gift of an exhaustible fixed asset with an estimated useful life of 10 years and no salvage value. The donor’s cost of this asset was P 20,000, units fair market value at the date of the gift was P 30,000. What amount of depreciation of this asset should the society recognize in its 2016 financial statements? A. P 3,000 B. P 2,500 C. P 2,000 D. P 0

20.

Gota de Leche, a community foundation, incurred P 5,000 in management and general expenses during 2012. In Gota de Leche statement of operation and changes in net assets for the year ended December 2012, the P 5,000 should be reported as A. A contra account offsetting revenue and support B. Part of program services C. Part of supporting services D. A direct reduction of fund balance

21.

The following expenditures were made by Green Community, a society for the protection of the environment. Printing of the annual report P 12,000 Unsolicited merchandise sent to encourage contributions 25,000 Cost of an audit performed by a CPA firm 3,000 What amount should be classified as fund-raising costs in the society’s activity statement? A. P 37,000 B. P 28,000 C. P 25,000 D. P 0

22.

Samahang Ilocano, a fraternal organization, should prepare a statement of financial position and which of the following financial statements? I. Statement of activities II. Statement of changes in fund balances III. Statement of each flows A. I, II and III C. II and III B. III only D. Both I and III

23.

De Villa family lost its home in a fire. On December 25, 2012, a philanthropist sent money to the Ramos Society, a not-for-profit organization, to purchase furniture for De Villa family. During January 2012, Ramos Society purchased this furniture for De Villa family. How should Ramos Society report the receipt of the money in its 2012 financial statements? A. As an unrestricted contribution B. As a temporarily restricted contribution C. As a permanently restricted contribution D. As a liability

24.

If the Manila Museum, a not-for-profit organization, received a contribution of historical artifacts, it need not recognized the contribution if the artifacts are to be sold and the proceeds used to A. Support general museum activities B. Acquire other items for collections C. Repair existing collections D. Purchase buildings to house collections

25.

A storm broke glass windows in the building of Mediators, a not-for-profit religious organization. A member of Mediators congregation, a professional glazier, replaced the windows at no charge. In Mediators statement of activities, the breakage and replacement of the windows should A. Not be reported B. Be reported by note disclosure only

Page 4 of 9

5 ACCOUNTING 13-07

ACCOUNTING FOR GOVERNMENT & ACCTG FOR NGO

C. Be reported as an increase in both expenses and contributions. D. Be reported as an increase in both net assets and contributions. 26.

On December 5, 2016, Bar Heating and Air Conditioning Service repaired the heating system in the building occupied by Pahiyas, a voluntary health and welfare organization. An invoice for P 1,500 was received by Pahiyas for the repairs on December 15, 2016. On December 30, 2016, Bar notified Pahiyas that the invoice was cancelled and that the repairs were being donated without charge. For the year ended December 31, how should Pahiyas report these contributed services? A. Only in the notes to the financial statements B. No disclosure is required either in the financial statements or in the notes. C. As an increase in unrestricted revenues and as an increase in expenses on the statements of activities D. As an increase in temporarily restricted net assets on the statement of activities

27.

Agency RRV received the following allotment for year 2014: Capital outlay (CO) Maintenance and Other Operating Expenses (MOOE) Personal Services (PS) Financial Expenses (FE) The entry to record the above allotment would be: A. No entry B. Memorandum entry in Registry of Allotments and Obligations C. National Clearing Account 65,100,000 Appropriations Alloted D. Cash-national Treasury Modified Disb. System 65,100,000 Subsidy Income from National Government

P50,000,000 10,000,000 5,000,000 100,000 P65,100,000

65,100,000

65,100,000

28.

Agency AJP had obligation for Personal Services (PS) amounting to P300,000 for the month of February, the entry would be: A. No entry B. Memorandum entry in Registry of Allotment and Obligations for PS (RAOPS) C. Appropriations Alloted 300,000 Obligations incurred 300,000 D. Cash-Disbursing Officer 300,000 Cash-National treasury (NT), MS 300,000

29.

Agency CED was granted cash advances for payroll amounting to P280,000, the entry would be: A. No entry B. Memorandum entry in RAOPS C. Payroll fund 280,000 Cash - National Treasury, MDS 280,000 D. Cash - Disbursing Officer 280,000 Due from National Government 280,000

30.

Agency MAC’s obligation of rent for three years (3) amounted to P90,000. The entry to record this transaction would be: A. Rent Expenses 90,000 Cash-national Treasury, MDS 90,000 B. Prepaid Rent 90,000 Cash-National Treasury, MDs 90,000 C. Rent Expense 30,000 Prepaid Rent 30,000 D. Memorandum entry in RAOMO

Page 5 of 9...

Similar Free PDFs

Pdfcoffee - Helpful

- 6 Pages

Pdfcoffee - ACCOUNTING

- 28 Pages

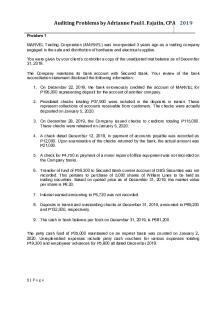

Pdfcoffee. Accounting problems

- 16 Pages

Pdfcoffee - Is ajsbq

- 20 Pages

Pdfcoffee - Cost accounting

- 3 Pages

Diosdado Macapagal - This is helpful

- 24 Pages

Joseph estrada - This is helpful

- 20 Pages

Pdfcoffee

- 88 Pages

Pdfcoffee

- 3 Pages

Pdfcoffee

- 11 Pages

Pdfcoffee

- 29 Pages

Pdfcoffee

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu