Receivable Financing Notes PDF

| Title | Receivable Financing Notes |

|---|---|

| Author | Potato Fries |

| Course | Bachelor of Science in Accountancy |

| Institution | Polytechnic University of the Philippines |

| Pages | 2 |

| File Size | 80.6 KB |

| File Type | |

| Total Downloads | 428 |

| Total Views | 617 |

Summary

RECIVABLE FINANCING – is the financial flexibility or capability of an entity to raise money out of its receivables.Forms of Receivable Financing 1. Pledge of accounts receivable. All accounts receivables serve as collateral security for the loan. No entry would be necessary. It is sufficient that d...

Description

RECIVABLE FINANCING – is the financial flexibility or capability of an entity to raise money out of its receivables. Forms of Receivable Financing 1. Pledge of accounts receivable. All accounts receivables serve as collateral security for the loan. No entry would be necessary. It is sufficient that disclosure thereof is made in note to financial statement. 2. Assignment of accounts receivable. Borrower/Assignor transfers rights in some/specific accounts receivable to a lender called assignee in consideration for a loan. Non-notification Basis. Customers are not informed that their accounts have been assigned. The customers continue to make payment to the assignor, who in return remits the collection to the assignee. Notification Basis. Customers are notified to make their payments directly to the assignee. * Accounts Receivable- assigned account is still part of “trade and other receivables” as part of Accounts Receivable account. Accounts Receivable – assigned, balance Note Payable – bank, balance *Equity in assigned accounts *Only disclosed in the notes to financial statement.

xx (xx) xx

3. Factoring. Sale of accounts receivable on a without recourse, notification basis. There is a transfer of ownership of the accounts receivable to the factor. Casual factoring. Casual sale. Direct recognition of gain or loss on factoring. Factoring as a continuing agreement. Gross amount of AR factored Commission Interest Bank Service Charge *Factor’s holdback Cash received from factoring

xx (xx) (xx) (xx) (xx) xx

Loss on factoring

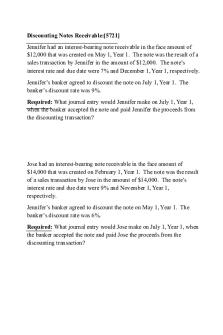

* Predetermined amount withhold by the factor as a protection against customer returns and allowances and other special adjustments. The factor’s holdback is a receivable account and classified as current asset. 4. Discounting of Note Receivable. Maker/Customer Payee/Endorser

Bank/Endorsee

Formulas to remember: Net Proceeds = Maturity Value – Discount Maturity value = Principal + Interest Discount = Maturity Value x Discount Rate x Discount Period (unexpired term)/ 360 or 365 days Gain or loss on discounting = Net Proceeds – Carrying Amount of Note Carrying amount of Note = Principal + Interest earned/Interest income Interest earned = Principal x Nominal rate x Expired term / 360 days or 365 days

Types of Endorsement 1. Without Recourse. Endorser avoids future liability even if the maker refuses to pay the endorsee on the date of maturity. No secondary liability. 2. WITH RECOURSE. Endorser shall pay the endorsee if the maker dishonors the note. Endorser has a secondary liability....

Similar Free PDFs

Receivable Financing Notes

- 2 Pages

Receivable Financing

- 9 Pages

Receivable Financing

- 4 Pages

428400909-Receivable-Financing

- 5 Pages

6. Receivable Financing

- 3 Pages

Notes Receivable TEST BANK

- 7 Pages

Notes Receivable - CR-1

- 12 Pages

Notes and Loans Receivable

- 7 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu