5721 Discounting Notes Receivable PDF

| Title | 5721 Discounting Notes Receivable |

|---|---|

| Author | Annie Li |

| Course | Introduction to Financial Accounting |

| Institution | University of Southern California |

| Pages | 1 |

| File Size | 54.3 KB |

| File Type | |

| Total Downloads | 35 |

| Total Views | 159 |

Summary

business debt expense...

Description

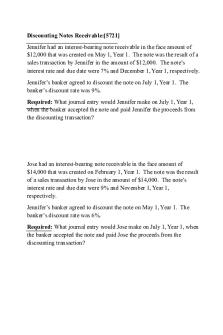

Discounting Notes Receivable:[5721] Jennifer had an interest-bearing note receivable in the face amount of $12,000 that was created on May 1, Year 1. The note was the result of a sales transaction by Jennifer in the amount of $12,000. The note’s interest rate and due date were 7% and December 1, Year 1, respectively. Jennifer’s banker agreed to discount the note on July 1, Year 1. The banker’s discount rate was 9%. Required: What journal entry would Jennifer make on July 1, Year 1, when the banker accepted the note and paid Jennifer the proceeds from the discounting transaction?

Jose had an interest-bearing note receivable in the face amount of $14,000 that was created on February 1, Year 1. The note was the result of a sales transaction by Jose in the amount of $14,000. The note’s interest rate and due date were 9% and November 1, Year 1, respectively. Jennifer’s banker agreed to discount the note on May 1, Year 1. The banker’s discount rate was 6%. Required: What journal entry would Jose make on July 1, Year 1, when the banker accepted the note and paid Jose the proceeds from the discounting transaction?...

Similar Free PDFs

Discounting of Notes(3)

- 7 Pages

Notes Receivable TEST BANK

- 7 Pages

Notes Receivable - CR-1

- 12 Pages

Notes and Loans Receivable

- 7 Pages

Notes Receivable Problem

- 2 Pages

Receivable Financing Notes

- 2 Pages

Notes Receivable Chapter 5

- 35 Pages

Chapter 6 Notes Receivable

- 15 Pages

Discounting - summary

- 3 Pages

Quiz chapter 5 notes receivable

- 8 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu