5721a Discounting Notes Receivable Solution PDF

| Title | 5721a Discounting Notes Receivable Solution |

|---|---|

| Course | Accounting Principles |

| Institution | University of California Los Angeles |

| Pages | 1 |

| File Size | 62.6 KB |

| File Type | |

| Total Downloads | 16 |

| Total Views | 159 |

Summary

Homework...

Description

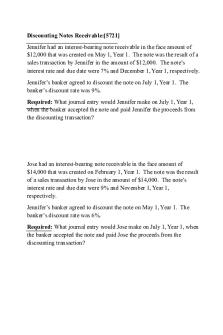

Discounting Notes Receivable:[5721a] SOLUTION Jennifer had an interest-bearing note receivable in the face amount of $12,000 that was created on May 1, Year 1. The note was the result of a sales transaction by Jennifer in the amount of $12,000. The note’s interest rate and due date were 7% and December 1, Year 1, respectively. Jennifer’s banker agreed to discount the note on July 1, Year 1. The banker’s discount rate was 9%. Required: What journal entry would Jennifer make on July 1, Year 1, when the banker accepted the note and paid Jennifer the proceeds from the discounting transaction? Maturity Value: $12,490 [12,000 x 7% x 7/12 = $490] $12,490 x 9% x 5/12 = $468 ‘the banker’s interest’ $12,490 - $468 = $12,022 proceeds to Jennifer Jennifer’s JE: Debit Cash $12,022. Credits to Int Rev and NR for $22 and $12,000, respectively. Jose had an interest-bearing note receivable in the face amount of $14,000 that was created on February 1, Year 1. The note was the result of a sales transaction by Jose in the amount of $14,000. The note’s interest rate and due date were 9% and November 1, Year 1, respectively. Jennifer’s banker agreed to discount the note on May 1, Year 1. The banker’s discount rate was 6%. Required: What journal entry would Jose make on July 1, Year 1, when the banker accepted the note and paid Jose the proceeds from the discounting transaction? Maturity Value: $14,945 [$14,000 x 9% x 9/12 = $945] $14,945 x 6% x 6/12 = $448 ‘the banker’s interest’ $14,945 - $448 = $14,497 proceeds to Jose Jose’s JE: Debit Cash $14,497. Credits to Int Rev and NR for $497 and $14,000, respectively. Mwh 031619...

Similar Free PDFs

Discounting of Notes(3)

- 7 Pages

Notes Receivable TEST BANK

- 7 Pages

Notes Receivable - CR-1

- 12 Pages

Notes and Loans Receivable

- 7 Pages

Notes Receivable Problem

- 2 Pages

Receivable Financing Notes

- 2 Pages

Notes Receivable Chapter 5

- 35 Pages

Chapter 6 Notes Receivable

- 15 Pages

Discounting - summary

- 3 Pages

Quiz chapter 5 notes receivable

- 8 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu