Chap 15- receivable financing discounting of nr Fin acct 1 PDF

| Title | Chap 15- receivable financing discounting of nr Fin acct 1 |

|---|---|

| Author | Charmaine Samson |

| Course | Accountancy |

| Institution | Far Eastern University |

| Pages | 3 |

| File Size | 102.7 KB |

| File Type | |

| Total Downloads | 27 |

| Total Views | 175 |

Summary

Lecture for Financial Acctg...

Description

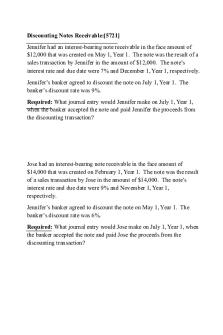

Chapter 15: RECEIVABLE FINANCING (Discounting of Notes Receivable) Concept of Discounting: A holder of a note can readily convert it to cash by discounting it at a bank, either with or without recourse. The bank accepts the note and gives the holder cash equal to its maturity value less a discount computed by a discount rate to the maturity value. The bank gets its money back plus the discount when the note is paid by its maker at maturity. If the note is not paid at maturity, the bank can collect from the original holder if it was discounted with recourse. If the arrangement is without recourse, the bank must find another remedy. Discounting without recourse- The holder/endorser is not held liable in case the maker fails to pay. Illustration: Without recourse On April 1, 20xx ABC Co. received from customer a P100,000, 6-month 8% note and discounted it after holding for 2 months. The entity discounted the note at 10%. Solution: Maturity Value= Principal + Interest for the full term of the note =100,000+ (100,000 x 8% x 6/12)

=104,000

Discount Period= full term-expired term =6 months- 2 months Discount

= Maturity value x Discount rate x Discount Period = 104,000 x 10% x 4/12

Net Proceeds

=4 months

=3,467

= Maturity Value – Discount = 104,000 – 3,467

=100,533

Interest Income= accrued interest as of date of discounting =100,000 x 8% x 2/12

=1,333

To entry:

Cash on hand

100,533

Loss on Discounting (squeeze)

800

Note Receivable

100,000

Interest Income

1,333

Discounting with Recourse – The holder/endorser is held liable in case the maker fails to pay. The discounting is accounted either: a. Conditional Sale b. Secured borrowing Illustration: With Recourse (same problem) a. If the discounting is treated as a conditional sale of note receivable, the entry to record the discounting is as follows: Cash on hand 100,533 Loss on discounting(squeeze) 800 Note receivable discounted 100,000 Interest Income 1,333 The “note receivable discounted” account is deducted from total notes receivable when presenting financial statements. The corresponding contingent liability is disclosed in notes. Note is paid by maker on maturity: Note receivable discounted Note receivable

100,000 100,000

Note is dishonored by maker: maturity value plus any costs directly attributable to the dishonor. - The entity pays the bank the maturity value of the note P104,000, plus protest fee and other bank charges of P5,000. 1. Payment to the bank: Accounts receivable 109,000 Cash 109,000 2. To cancel contingent liability: Notes receivable discounted Note receivable

100,000 100,000

b. If the discounting is treated as a secured borrowing, the entry to record the discounting is as follows: Cash on hand Interest Expense(squeeze) Liability on note discounted Interest Income Note is paid by maker on maturity: Liability on note discounted 100,000

100,533 800 100,000 1,333

Note receivable

100,000

Note is dishonored by maker: maturity value plus any costs directly attributable to the dishonor. The entity pays the bank the maturity value of the note P104,000, plus protest fee and other bank charges of P5,000. 1. Payment to the bank: Accounts receivable

109,000

Cash

109,000

2. To derecognize the liability for note receivable discounted and note receivable: Liability on note discounted

100,000

Note receivable

100,000

Discounting of “own” note A transaction wherein the maker issues a promissory note to borrow a sum of money. A liability in the form of notes Payable is being incurred. The concept of discounting implies, that the INTEREST IS DEDUCTED IN ADVANCE, thus the PROCEEDS from discounting were already reduced by the interest. Illustration: On July 1, 20xx, XYZ Co. discounted its own note of P1,000,000 to a bank at 12% for one year. July 1. Cash on hand

880,000

Discount on note payable Note payable

Principal

1000,000

Discount (1M x 12%)

(120,000)

Net Proceeds

880,000

120,000 1,000,000...

Similar Free PDFs

Receivable Financing

- 9 Pages

Receivable Financing

- 4 Pages

428400909-Receivable-Financing

- 5 Pages

Receivable Financing Notes

- 2 Pages

6. Receivable Financing

- 3 Pages

Acct 2521 chap 1 learnsmart

- 3 Pages

Acct 2521 chap 1 learnsmart

- 3 Pages

ACCT 320 Chap 1 - 5 Class Notes

- 17 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu