Summary International Business Strategy - Final exam PDF

| Title | Summary International Business Strategy - Final exam |

|---|---|

| Course | Introduction to International Business |

| Institution | Rijksuniversiteit Groningen |

| Pages | 21 |

| File Size | 248.3 KB |

| File Type | |

| Total Downloads | 456 |

| Total Views | 686 |

Summary

Chapter 11: Entry mode dynamics 1: foreign distributors Arnold: MNE should maintain relat with local distributors on long term even after establishing own local network distributors provide local knowledge and aid to efficiency seeking, minimizing up- front risk distributors only adds complement...

Description

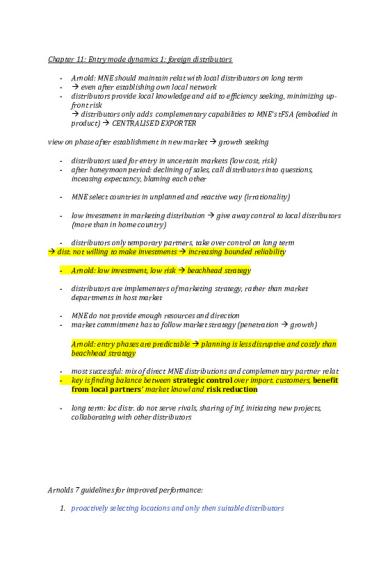

Chapter 11: Entry mode dynamics 1: foreign distributors -

Arnold: MNE should maintain relat with local distributors on long term even after establishing own local network distributors provide local knowledge and aid to efficiency seeking, minimizing upfront risk distributors only adds complementary capabilities to MNE’s tFSA (embodied in product) CENTRALISED EXPORTER

view on phase after establishment in new market growth seeking -

distributors used for entry in uncertain markets (low cost, risk) after honeymoon period: declining of sales, call distributors into questions, inceasing expectancy, blaming each other

-

MNE select countries in unplanned and reactive way (irrationality)

-

low investment in marketing distribution give away control to local distributors (more than in home country)

- distributors only temporary partners, take over control on long term dist. not willing to make investments increasing bounded reliability -

Arnold: low investment, low risk beachhead strategy

-

distributors are implementers of marketing strategy, rather than market departments in host market

-

MNE do not provide enough resources and direction market commitment has to follow market strategy (penetration growth) Arnold: entry phases are predictable planning is less disruptive and costly than beachhead strategy

-

most successful: mix of direct MNE distributions and complementary partner relat key is finding balance between strategic control over import. customers, benefit from local partners’ market knowl and risk reduction

-

long term: loc distr. do not serve rivals, sharing of inf, initiating new projects, collaborating with other distributors

Arnolds 7 guidelines for improved performance: 1. proactively selecting locations and only then suitable distributors

-

identify host countries for itself not responding to distributors promises in loc countries dist may be interested to split up market among rivals benefit for distr.

2. Focus on distr. market development capabilities - company fit more important than market fit 3. Manage distributors as long-term partners - incentives to sales performance distributors will invest more in long term develop. - short term: bound reliability - distributors may harm products placement in the market 4. Provide resources (mgmt., financial, knowl.) to support distributors market development purposes - MNEs do not withdraw from a market suggest earlier commitment 5. Do not delegate marketing strategy to distributors - MNE should provide clear leadership (position, budgets) 6. -

Secure shared access to the distributors’ market and financial intelligence only actors holding these information willingness to share commitment to long term decrease of bounded reliability

7. Link national distributors with each other, especially at regional level ( spanning several countries) - regional HQ coordinate distr. diffusion of FSA, monitoring, guarantee consistency of strategy implementation

Chapter 12

Entry mode dynamics 2: strategic alliance partners -

Prahalad, Hamel: firms should learn as much as possible from their partners

-

3 benefits of strat. alliance : sharing of risks and cost (R&D), benefit from partners complementary resources, quicker development of capabilities to deliver outputs developing FSAs independently no dependency on partner

-

how to win learning race: 4 key principles 1. 2. 3. 4.

collaboration is competition in a different form harmony is not the most important measure of success cooperation has limits learning from partners is paramount (vorrangig)

- Japanese, Asian MNE benefit most from SA because: 1. intrinsically more willing to learn from partner Western arrogance in leadership 2. Asian MNEs view SA as opportunity to gain new FSA, not primarily as an objective to reduce cost contrary to Western 3. Asian MNEs definded learning objects what they want to achieve from SA focus of efforts on observing partners practices 4. Asian MNEs contributions to SA involved tacit knowl. difficult to imitate for partners ( Western contribute easily codified knowl) -

Asian MNEs are original equipment manufacturers (OEM) lower investments into R&D FSA developing activities are transferred to Asian partner Asian firm can enter market with knowl on its own

troubled laggards and surging latecomers often pair up innovation lagging comp try to fix deficiencies new comers try to fill specific capability gaps in stand alone knowl (product or market) easily absorbed - weaker firm finds itself in dependency spiral SA shifts to satisfying partner (crucial for firms survival)

-

to avoid this: 1. 2. 3. 4. -

-

outsourcing to provide compet. prod. can not replace need to build FSA on long term negative: capability losses, not just considering short term efficiency cumulative effects of outsourcing decisions dependence on outside actors disspated FSA (aufgeteilte) towards outsourcing partners should be regenerated and strengthened knowledge acquired from partners is only contributing when diffused throughout org mobility: the more mobile FSA the easier diffusible embeddedness: When FSA can not easily be shared through commun

stand alone knowl Hamel: limit easily replicable FSA in SA limiting formal scope location of SA away from HQ no access to full range of MNE’s FSAs sharing only within alliance context -

gate keepers to control informal inf transfer, prohibiting access

Chapter 13: Entry mode dynamics 3: mergers and acquisitions Ghemawat, Ghadar: question if mergers make economic sense -

M&A supposed to deal better in global markets survival research: decreasing market share of internationalizing comp

conventional theory: countries which have advantages over other countries only predicts geographic concentration of production not concentration on companies in an industry Herfindahl index: measure of market share concentration -

M&A fail on long-term aim of consolidation is creating value but often do the opposite because of pre/post integration challenges - purchase price premiums (competing for a firm which can be taken over)

Ghemawats and Ghadars 6 bounded rationality/reliability mgmt. biases: 1. Top line obsession: - too focused on creating revenues, not profits - strategy formulated in revenues ill conceived revenues for mgmt., self serving 2. Stock price exploitation: - overvalued stock price more affordable to engage in large M&A transactions - mainting high share price, opportunistic behaviour to stockholders bounded reliability 3. 4. -

Grooved thinking: senior mgmt. will follow traditional mindset Herd behaviour: mgmt. follows actions of main competitors reduce risk for mgmt. self serving bounded reliability

5. Personal commitments: - mgmt. may hold to personal views and act irrational 6. Trust in interested parties: - investment bankers can influence mgmt. decision incentive to own interest bounded reliability from external parties companies have to aim on acquiring FSAs and not growth: 1. Pick up the scraps: - buy off unusable assets can lead to profit 2. Stay home: - consider local opportunities 3. Keep your eye on the ball: - focus on development of key FSAs, while rivals struggle with M&A obstacles 4. Make friends: - SA offers less internal and external resistance 5. Appeal to the referee: - calling regulators in order to slow down rivals M&A 6. Stalk your target: - uncertain markets: wait and observe actions of rivals 7. Sell out: - it may be more profitable to sell MNE regarding price premiums seller perspective Critical analysis: -

authors reject that FSA are gained trough megers but das not describe when mergers are adequate FSA can be gained through M&A but melting and diffusing these with recent FSAs is difficult effectiveness and efficiency

two reasons: 1. FSA may be location bound, unique expected in large distances 2. not all routines can reinforce each other or co-exist (no two ways of doing things)

-

related stand alone resources are easier to transfer (common knowl of emp) M&A may be best opportunity for large global acting companies mgmt. is aware of these obstacles

-

benefit of M&A do not derive solely from generating FSAs effectiveness and efficiency satisfying crucial constituencies, legitimization slow short term dip regarding stock price is more valued than long term decline due to absence of M&A failure underlies distance general problem can also underlie the problem of expanding globally rather than selection of entry mode choice of partner

Chapter 6: International Innovation -

Kuemmerle: MNEs ( especially internat. projectors) should decentralize R&D in global network

Reasons for offshoring - MNEs want to be present in knowledge clusters - R&D has to be closer connected to manufacturing plant in host country Home-base- exploiting: - R&D supports manufacturing in host country - Flow of inf from home country to subsidiary -

should be located close to key markets and plants fast adaption of innovation (loc bound FSA in host market) use highly regarded managers close tie between engineering and manufac reducing distance (utilizing managers incorporating culture)

Home-base-augmenting: - access knowledge from rivals - cluster monitoring, boundary spanning activity -

using local scientists to draw connection to host cluster strengthen insider status

R&D unit leaders: - respected scientists and skilled managers - able to integrate new site into corporations R&D network - understanding of technology trends - overcome barriers in becoming an insider in local network all labs should communicate sufficiently with home lab, marketing and manufacturing

key stages in development of R&D units: 1. selecting decision maker

- committee from 5-8 members (technical and org. knowl) - direct report to CEO no bounded rationality 2. set of dec and actions which strengthen R&D capabilities 3. dec and action designed to improve lab’s contribution to corporate strategic goals limitations: 1. tension between host and home country labs for setting strategy (home versus subsidiary mgmt.) 2. does not include possibility of joint venture or SA as option to tap host knowl. 3. hidden and rising costs of offshoring

Chapter 7: International sourcing and production

-

Ferdow: upgrading of host country factories in order to develop FSAs development of FSAs as important as low cost how can a factory lead to competitive advantage not just in own but in overall corporation’s markets resource allocation depend on mgmt.

-

factories should get closer to customer, suppliers and skilled labour force

-

3 changes leading to an upgrade of factories: 1. decline of trade tariffs no need to overcome trade barriers with plants 2. highly complex and technological manufacturing overall productivity 3. shorter time frame between developing and manufacturing, close allocation general build up from tFSA to lFSA in host country for successful penetration classification of plants assessed by - strategic purpose of plant related host country advantages (market, efficiency) - level of FSA held by plant ( regarding higher order FSA of acquiring new knowl) role of accessing input or output market: -

proximity to market (selling purpose) access to knowl and skills (input and output market purpose) innovation access to low-cost production (input market)

6 specific factory roles: p. 202, 7.1 1. Offshore factory:

-

access to low cost production (input) export of output (centrally) no autonomy, no develop. of FSAs

2. -

Server factory: produce goods to serve regional market due to trade barriers, exchange exposure, logistics low FSA development and little autonomy

3. Outpost factory: - similar to black hole - gather inf from host clusters (input side) - manufac. side either offshore or server factory 4. -

Source factory: input side low cost (offshore) receives resources for recombination FSA development (best practice) more autonomy regarding product design, logistics areas with good infrastruc, and skilled workforce strategic leader on input side

5. -

Contributor factory: output market in host country similar to server but more resources upstream recombination capability (process improvement, product development)

6. -

Lead factory: most important in terms of resource recombination and new FSA develop input from local cluster key role in localized manufac. innovation connected with research labs (input side) and end users (output side)

upgrading requires commitment, changes in factory culture and mgmt. style 3 stages of resources recombination spread: 1. enhancing internal performance (emp education, JIT) 2. accessing and developing external resources (strengthen supplier network, distributors) 3. develop. knowledge contributing to entire company greater importance on intangible strength, than tangible (low cost) for upgrading recombination, tapping into local knowl Ferdows: no duplication of R&D, each plant leadership role in specific area 4 mgmt obstacles of upgrading

1. 2. 3. 4.

relying on foreign critical skills neglecting long term investment (cash cow treatment) shifting production as response to exchange rate fluctuation enticement of government incentives, to shift to minimal upgrading potential locations

critique on ferdows: 1. ferdows believes that mgmt. should upgrade all factories, not true 2. underestimates value of low cost 3. firm’s FSA can be flexible offshoring

Chapter 8: International Finance Lessard and Lightstone: economic exposure (operating exposure) impact on real exchange rates relative to competitors suggestions: 1. have a flexible sourcing structure 2. capability to engage in exchange rates pass through ( raise prices without losing sales) market leader position, differentiated products negative currency fluctuation taken into account of location advantages fluctuations in foreign exchange rates cause net present value reduction of income streams economic exposure transaction exposure: unfulfilled contracts in foreign currency income streams are known translation exposure: risk of losses resulting from accounting translation into home currency) -

economic exposure: negative effects on unexpected exchange rates, relative to competitors geographic distance of input and output market issue is to - move production flexibly - insight in long- term impacts - firms with different sourcing strategies will be affected by exchange rates lowest impact on firm with (net present value) - strongest market position - most differentiated products

-

flexibility to shift production

economic exposure: real- and nominal exchange rates: Nominal exchange rates: - direct exchange ratio between currencies - euros for dollar Real exchange rate: - changes in nominal exchange rate minus difference in inflation rates between two countries nominal exchange rate: 4% - inflation difference: 3% = real exchange rate: 1% higher inflation drop in value of currency more expensive products -

real exchange rates affect level of economic exposure

- economic exposure is also affected by rivals decisions econ exp adds uncertainty to loc advantage also considered as future risk for cash flows develop of FSAs leading to risk mitigation immunizing exchange pass through (market leader, differentiated products no loss in sales volume) p. 223 figure 8.1 -

exposure absorption capability needs to be assessed relative to competitors market position

quadrant 3 is most desirable quadrant 2 least desirable ( centralised exporter, dependent on home) approaches for managing economic exposure: 1. each business unit is assessed individually configures own operations - trade off between increased production costs and lowered risk ( higher number of operating plants in various countries no economies of scale) 2. company wide perspective: - portfolio of business with offsetting exposures balance in entire corp. - high subsidiary risk 3. flexibility in operational planning - exploitation of fluctuating exchange rates switching production between factories - trade off between increased cost of carrying excess capacity – lowered risk senior mgmt. should assess mgmt. performance by not including economic exposure but increasing expectations real reduction of bounded rationality communication

Chapter 9: International Marketing Levitt: all customers want quality, reliability and low price homogenization, economies of scale through standardization -

multi centred MNE replaced by centralized exporters and internat. projectors due to advances in travel and commun. higher exploitation/value of tFSA efficiency and standardisation as compet. advantage over customization

culture: are unstable technology guiding homogenization -

loses relevance to economic dec making diffuse and becomes trend

-

also standardization in down stream activities in every foreign market are equivalent segments to attack domestical market is no longer a safe haven

Complementary perspectives: -

article published when there were trade barriers, exchange rate uncertainty no global market place leading to local responsiveness

First complementary perspective Quelch and Klein: -

-

internet can lead to global economies of scale because of availability of services number of customers affect the next customer (increasing frequency Airlines) conclusion: standardized products provide advantages Internet reduces bounded rationality less investment in bounded FSA in host country intermediaries logistics provider, product assessment corp.

negative aspects of internet: -

quick global spread of negative reputation government restrictions

MNE must have: -1. 24 hour order taking - expertise to ship internationally - knowledge about foreign marketing - after sales service - internet sales should not be on expense of foreign affiliates (where to credit sales)

Chapter 14: The role of emerging economies Khanna: coping with voids in emerging countries - efficient intermediary firms - broader macro level institutions state owned, not functioning, no legislative (contracts), not functioning fin. markets advantages of emerging economies: 1. inexpensive skilled labour and mgmt. 2. innovation ability solutions for large and poor customer segment 3. counter strategy (response) to emerging country MNEs into developed markets definition of emerging econ: 1. GDP per capita (absolute level of econ develop) 2. GDP growth rate (pace of development) 3. stability of free market system features Khanna, Palepu: - most importanta criteria of emerg. econ. are institutional voids (forms of market failure), no fin. markets self financing - 2005: face difficulties due to two kinds of voids: - efficient local intermediary firms - broader macro level institutions (contract enforcing govern inst.) in emerg. econ. these institutions are not granted - customization of penetration strategy for each country (reduction of institutional distance) - inst. voids require new loc bound FSA in order exploit the corporations tFSA - empirical data conceal the ...

Similar Free PDFs

International Business - Exam 1

- 11 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu

![[ Group 17 Report] Netflix\'s International Business Strategy](https://pdfedu.com/img/crop/172x258/oy9geogk2dzn.jpg)