TABL2751 Tutorial 12 Homework PDF

| Title | TABL2751 Tutorial 12 Homework |

|---|---|

| Author | James Pham |

| Course | Business Taxation |

| Institution | University of New South Wales |

| Pages | 5 |

| File Size | 107.2 KB |

| File Type | |

| Total Downloads | 62 |

| Total Views | 131 |

Summary

Download TABL2751 Tutorial 12 Homework PDF

Description

Problem Questions Problem 1 a) Telephone bill type benefit Div.5 EXPENSE FB s20. $700 ($1000 x 70%) expense payment benefit(s20 of the FBTAA 1986) valuation: o value of the expense payment benefit o the amount paid o less any employee contribution, o less any “otherwise deductible amount ”(s23 and 24 of the FBTAA 1986) FB $1000 telephone (GST Inc) L30% (deductible)L reduce to 0 s23/24 L70% (type 1 taxable) Pro-rated: 30% deductible as if employee incurred it himself 70% subject to FBT Professional journal exempt s58y $0 FB $200 subscription GST (Included) s58y exempts professional journal subscriptions ‘eligible’ Relocation expense exempt s58y $0 don’t know exactly what is included in the relocation expenses Div.13L miscellaneous exempt benefits s58B removal and storage of effects ‘stuff’ s58F relocation transport FB $4000 Relocation s58 Taxable value $4000 (Type1) Private insurance expense FB s20. $1,200 this is a type 2 fringe benefit FB $1200 private health (GST Free) Div.5 expense payment S23N amount paid or reimbursed by employer S20B S24 not apply Not deductible Taxable value $1200 (Type2 ) Gym expense benefit s20. $900 this is type 1 fringe benefit as GST is payable. Cannot apply otherwise deductible rule

IT DOES NOT FALL UNDER AN EXEMPT FRINGE BENEFIT(MEMBERSHIP FEES) as it does not meet the definition of an eligible membership or subscription

Gym exempt s58y $0 no employee contribution and no amount is deductible Not ‘eligible’ membership Not related to work No exemption Taxable value $900 Type 1 Membership no exemption s58y Div. 5 expense payment S24 otherwise deductible rule and reduces it to $0 b) For employer: Type 1: ($900 + $700) x 2.0802 = $3,328.32 Type 2: ($1,200) x 1.8868 = $2,264 FBT payable: ($11,649 + $2,264) x 0.47 =$2,628 Employer: Deduction FBT Benefit-cost deduction Input tax credit Don’t give to low paying employees 47% as highest marginal tax rate Problem 2 a) Public rate = 6% p.a. Employee rate = 5% p.a. FB – s136(1) – in respect of employment Not exempt under Div.5 Div.4 s16. Occurs when an employer makes a loan to an employee. o It is taken to have been provided in respect of each year of tax during the whole or part of which the recipient is under an obligation to repay the whole or part of the loan. s 18(1): the taxable value is the amount (if any) by which the notional amount of interest in relation to the loan in respect of the year of tax exceeds the amount of interest that has accrued on the loan in respect of the year of tax. Notional interest: $500,000 x 5.25% = $26,250 Actual interest: $500,000 x 5% = $25,000 Taxable value of loan = $26,250 - $25,000 = $1,250

For employer: Financial supply Type 2: ($1,250) x 1.8868 = $2,358.5 FBT payable: ($2,358.5) x 0.47 = $1,108.5 b) Otherwise deductible rule (s 19) The taxable value of a loan fringe benefit may be reduced in accordance with the 'otherwise deductible' rule. Broadly, this means that the taxable value may be reduced to the extent to which interest payable on the loan is, or would be, allowable as an income tax deduction to the employee Non-deductible use of loan is 100%. Therefore the taxable value = $0 as $1,250 x 100%. Reduced to $0 Problem 3 a) $150,000 x 9.5% compulsory paid by employee = $14,250 $5,000 salary sacrifice ($14,250 + $5,000 = $19,250) Concessional contribution < $25,000 (cap) = 15% x $19,250 = $2,887 Taxed at 15% in the fund s290-60 b) Don’t have to pay FBT on the $5,000 S136(1) Fringe benefit excludes super

General Discussion Questions 1) Why is fringe benefits tax imposed on the employer rather than the employee? Fringe Benefits Tax (FBT) is a tax payable by employers for benefits paid to an employee (or an employee's associate e.g. a family member) in place of salary or wages. To secure the best workers for your business, you often have to entice them with non-income related benefits. For example, an employee may receive fringe benefits in the form of: a car car parking low interest loans payment of private expenses.

It's entirely legal and a common form of reimbursement used by businesses for their employees. 2) The taxable value of fringe benefits provided by ABC Ltd to its employees for the FBT year ended 31 March 2018 is: b. Type 1 fringe benefits: $8,000 c. Type 2 fringe benefits: $5,000 Calculate the fringe benefits tax payable for the year. ABC Ltd for FBT year ended 31 March 2018 Type 1 FBT: $8,000 x 2.0802 = $16,641.6 Type 2 FBT: $5,000 x 1.8868 - $9,434 FBT payable: ($16,641.6 + $9,434) x 47% = $12,255.53 3) What requirements need to be met in order for a person to be able to claim a deduction for personal superannuation contributions? What tax rate applies to these contributions? This includes people who get their income from: salary and wages a personal business (for example, people who are self-employed contractors, or freelancers) investments (including interest, dividends, rent and capital gains) government pensions or allowances super partnership or trust distributions a foreign source. The contributions that you claim as a deduction will count towards your concessional contributions cap. When deciding whether to claim a deduction for super contributions, you should consider the super impacts that may arise from this, including whether: you will exceed your contribution caps Division 293 tax applies to you you wish to split your contributions with your spouse it will affect your super co-contribution eligibility. If you exceed your cap, you will have to pay extra tax and any excess concessional contributions will count towards your non-concessional contributions cap....

Similar Free PDFs

TABL2751 Tutorial 12 Homework

- 5 Pages

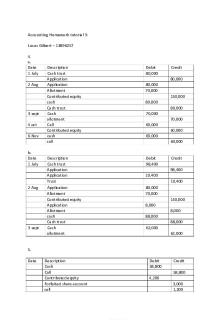

Accounting Homework tutorial 3

- 3 Pages

homework 12 digital control

- 3 Pages

Homework 12 sol

- 4 Pages

Homework Chapter 12(solution)

- 14 Pages

Homework No 12

- 1 Pages

Tutorial work - 12

- 2 Pages

Week 12 tutorial solution

- 7 Pages

E3-12 - Homework Solutions

- 2 Pages

Chapter 12 - Mastering Homework

- 23 Pages

Readng tutorial 12

- 1 Pages

Tutorial WEEK 12

- 2 Pages

BLAW 2080 - Chapter 12 Homework

- 10 Pages

Tutorial 11 in week 12

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu