Accounting Homework tutorial 3 PDF

| Title | Accounting Homework tutorial 3 |

|---|---|

| Author | lucas Gilbert |

| Course | Accounting for Business Decisions B |

| Institution | University of Technology Sydney |

| Pages | 3 |

| File Size | 160.1 KB |

| File Type | |

| Total Downloads | 48 |

| Total Views | 158 |

Summary

Accounting homework answers for tutorial 3 week 4....

Description

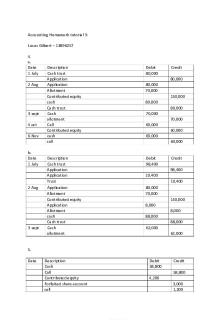

Accounting Homework tutorial 3: Lucas Gilbert – 13896257 4. a. Date 1 July 2 Aug

3 sept 4 oct 6 Nov

b. Date 1 July

2 Aug

3 sept

Description Cash trust Application Application Allotment Contributed equity cash Cash trust Cash allotment Call Contributed equity cash call

Description Cash trust Application Application Trust Application Allotment Contributed equity Application Allotment cash Cash trust Cash allotment

Debit 80,000

Credit 80,000

80,000 70,000 150,000 80,000 80,000 70,000 70,000 60,000 60,000 60,000 60,000

Debit 98,400

Credit 98,400

10,400 10,400 80,000 70,000 150,000 8,000 8,000 88,000 88,000 62,000 62,000

5. Date

Description Cash Call Contributed equity Forfeited share account call

Debit 58,800

Credit 58,800

4,200 3,000 1,200

9. a. Date 1 July 1 Aug

Cash Forfeited share account Contributed equity

3,800 400

Description Retained earnings Dividends payable Dividends payable Contributed equity

Debit 375,000

4,200

Credit 375,000

375,000 375,000

b. shareholder needs $15 worth of shares to get one share in dividend. The dividend is $1.50, so therefore an individual needs 10 shares to receive one share in dividend. 1,000 shares would get you 100 shares in dividend. 17. a. Date 1 Mar 1 Jul 1 Aug 15 Aug 15 sept 1 Oct 31 Dec

Description Cash Contributed Equity Retained earnings Dividend payable Dividend payable Contributed equity Retained earnings Ordinary share dividends payable Ordinary share dividends payable Cash Contributed equity Cash Revenues Expenses Retained earnings

Debit 1,600,000

Credit 1,600,000

450,000 450,000 450,000 450,000 357,500 357,500 357,500 357,500 45,000 45,000 1,620,000 1,100,000 520,000

A share dividend is a dividend payed to shareholders in the forms of shares whereas, a cash dividend is a dividend payed to shareholders in the form of cash. Many individuals think that it is better to receive a cash dividend as it gives a direct result from an individual’s investment. However, I disagree. A cash dividend gives you limited options unlike the share dividend in which you are given shares and you can choose whether you want to sell those excess shares or keep them in the company to hopefully increase on your investment.

Therefore, it can be seen that the share dividend option is more versatile than the cash dividend option....

Similar Free PDFs

Accounting Homework tutorial 3

- 3 Pages

Accounting Tutorial - Week 3

- 7 Pages

TABL2751 Tutorial 12 Homework

- 5 Pages

Managerial accounting homework

- 1 Pages

My Accounting Lab Homework

- 18 Pages

Hw accounting - homework

- 9 Pages

Tutorial work - accounting cycle

- 1 Pages

Tutorial 1 Managerial accounting

- 5 Pages

Chapter 5 Accounting homework

- 4 Pages

Accounting basics tutorial

- 15 Pages

Homework 3

- 2 Pages

Homework 3

- 2 Pages

Homework 3

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu