Tutorial Homework 3 - Full explanation and aswer PDF

| Title | Tutorial Homework 3 - Full explanation and aswer |

|---|---|

| Author | bao chau NGUYEN |

| Course | Accounting for Business Decisions A |

| Institution | University of Technology Sydney |

| Pages | 10 |

| File Size | 1.1 MB |

| File Type | |

| Total Downloads | 4 |

| Total Views | 135 |

Summary

Full explanation and aswer...

Description

Tutorial Homework 3 Tutorial work: (complete before your tutorial held on August 8) ACCT3 Financial: pg 34-36 Exercises 1, 7, 8, 11, 12 pg 38-39 Problem 21, 23 (try using an Excel spreadsheet for the analysis part of these questions) Journal article question: Describe the role of forensic accounting. Identify the potential stakeholders that benefit from forensic accounting. Exercise 1: Miscellaneous terms The following definitions were discussed in the chapter: a A form of business in which two or more people combine their capital and talents. b Information following the financial statements that provides additional information and disclosures. c A form of business that is a separate legal entity, established by filing proper forms with ASIC. d A report that attests to the fair presentation of a company’s financial statements. e The most common form of business. f Information on role of the board and how it provides responsible leadership. REQUIRED: Match each definition with one of the following terms: sole proprietorship; governance information; notes to the financial statements; partnership; auditor’s report; company or corporation. Ans: a. Partnership corporation d. Auditor’s report

b. Notes to the financial statements e. Sole proprietorship

c. Company or

f. Governance information

Exercise 7: Statement of changes in equity A company provides the following account balances for the current year:

1|Page

REQUIRED Prepare a statement of changes in equity at year-end in a single column to give the closing balance of total equity. Ans: Statement of change in equity Year-end Contributed Add CE Retained Capital Earnings $20600 $100000 $75129

Balance at year end Retained Earnings(year-end)= Dividends

Retained

Total $195729

Earnings(Beginning)+Profit

-

=$62496+$22133-$9500=$75 129 Exercise 8: Classified balance sheet The following is a list of accounts: I. II. III. IV. V. VI. VII. VIII. IX.

Mortgage payable, due in 15 years Short-term investments Cash Prepaid rent Patents Contributed equity Accounts payable Buildings Notes payable, due in six months.

REQUIRED Identify each account as a current asset, non-current asset, intangible asset, current liability, non-current liability, contributed equity, or retained earnings. Ans: I. II. III. IV. V. VI. VII. VIII. IX.

Non-current liability Current asset Current asset Current asset Intangible asset Shareholder’s equity Current liability Non-current asset Current liability

Exercise 11: Classified balance sheet The following items were taken from the 30 June balance sheet of Samantha Solarium:

2|Page

REQUIRED Recreate the company’s classified balance sheet, assuming that $27 200 of the mortgage payable balance will be paid within three months of the balance sheet date Ans: Samantha Solarium Balance Sheet For the year-ended 30 June Assets: Current Assets: Cash Accounts Receivable Prepaid Insurance Total Current Assets

$41680 $29040 $9360 $80080

Non-Current Assets: Buildings, net Equipment Land Total Non-current assets

$120400 $127360 $123600 $371360

Total Assets

$451440

Liabilities: Current Liabilities: Accounts Payable

$24960 3|Page

Interest Payable Mortgage Payable(due next year) Total Current Liabilities

$7200 $27200 $59360

Non-Current Liabilities: Mortgage Payable(due year after)

$178880 ($206080-$27200)

Total Liabilities

$238240

Shareholder’s Equity: Ordinary Shares (Contributed Capital) Retained Earnings Total Shareholder’s Equity

$132000 $81200 $213200

Total Liabilities and Shareholder’s Equity

$451440

Total Shareholder’s Equity = $451440 - $238240 =$213200 Retained Earnings=$213200-$132000= $81200 Exercise 12: Multi-step income statement These items were taken from the financial records of Tran Nguyen Pty Ltd:

REQUIRED Prepare a multi-step income statement assuming Tran Nguyen pays the 25 per cent company rate and has a 30 June financial year end (you can assume in this case accounting profit equals taxable income). Tran Nguyen Pty Ltd Income Statement For the year ended 30 June Net sales Cost of Sales

$154900 $75620 4|Page

Gross Profit

$79280

Operating Expenses: Administrative Expenses Selling Expenses Electricity Total

$15230 $14600 $17650 $47480

Other Revenue and Expenses: Interest Revenue Interest Expense Total Profit (income) before income taxes Income Tax Expense ($32250x25%) Net Profit

$500 ($50) $450 $32250 $8062.5 $24187.5

Profit (income) before income taxes= $79280 - $47480 + $450 = $32250 Problem 21: Prepare and analyse the balance sheet The following comparative balance sheet items are available from Lim Limited as of 30 June 2021:

5|Page

REQUIRED a Prepare a comparative, classified balance sheet for Lim Limited. b Perform horizontal and vertical analyses and interpret the results. Round percentages to one decimal point (e.g. 10.1%). c Assume the same information above except that in 2021, Bonds payable is $0 while Retained earnings is $271 295. Does this new information change any interpretations previously made? Ans:

6|Page

c)

7|Page

Problem 23: Prepare and analyse an income statemen The following income statement items are available from Bugeja Limited for the years ending 31 December

8|Page

REQUIRED a Prepare a comparative, multi-step income statement for Bugeja. b Perform horizontal and vertical analyses and interpret the results. Round percentages to one decimal point (e.g. 10.1%). c Assume the following changes: Cost of sales in 2019, $62 470 and in 2018, $45 670. Does this new information change previously made interpretations? Ans:

c)

9|Page

Journal article question: Describe the role of forensic accounting. Identify the potential stakeholders that benefit from forensic accounting Ans: The role of forensic accounting:

Assist the courts, solicitors and clients understand the complex financial and accounting issues and presenting that information in a manner that all users can understand.

The potential stakeholders that benefit from forensic accounting

Minimised Losses Improve Efficiency Reduce Exploitation Risk Avoidance of Legal Problem Improved Brand Reputation and Authority

10 | P a g e...

Similar Free PDFs

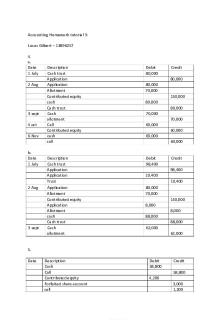

Accounting Homework tutorial 3

- 3 Pages

BP 22 - Question AND Aswer

- 2 Pages

Tutorial 2 Full Answers

- 8 Pages

Full Tutorial - pdf version

- 91 Pages

TABL2751 Tutorial 12 Homework

- 5 Pages

WACC Explanation and Answers

- 7 Pages

Weekly tutorial solutions Full Year

- 36 Pages

Homework 4.1 #2 and #3

- 3 Pages

Homework 3

- 2 Pages

Homework 3

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu