Accounting Tutorial - Week 3 PDF

| Title | Accounting Tutorial - Week 3 |

|---|---|

| Author | Anonymous User |

| Course | Financial Accounting |

| Institution | University of Western Australia |

| Pages | 7 |

| File Size | 395.4 KB |

| File Type | |

| Total Downloads | 58 |

| Total Views | 163 |

Summary

Download Accounting Tutorial - Week 3 PDF

Description

Accounting Tutorial: Week 3 Why are journals required as part of the recording process? Would not a set of ledger accounts be sufficient?

Journals are important because they provide a chronological record of transactions and events effecting an entity. Whereas, a ledger groups like transactions together, and thus does not give an adequate record like the journals do.

Explain why when a business pays GST on the purchase of goods or services it records this as GST Receivable and an asset. When a business provides goods or services which are taxable it records the GST component of the transaction as GST Payable, a liability

When a business pays GST on goods and services it usually pays more GST than what is required (more GST than what it receives from its customers). Thus, the ATO will owe them money (a GST refund) and this is therefore classified as an asset because it will bring future economic benefit (will receive money from the ATO). When a business provides goods or services which are taxable it needs to pay the ATO for the goods and services it produces because it is essentially collecting tax on behalf of the ATO. Hence, it is classified as a liability because the business owes money to the ATO.

The accounts below appear in the chart of accounts of Brightspark Electrical Services. Show whether the normal balance is a debit or a credit. Indicate whether the account would appear in the balance sheet or in the income statement, and under what classification, e.g. liability, asset, equity, income or expense. 1. Service Vehicles - Asset, the normal balance is a debit. Would appear in the balance sheet. 2. Repairs Expense - Expense, the normal balance is a debit. Would appear in the income statement. 3. Prepaid Insurance - Asset, the normal balance is a debit. Would appear in the balance sheet. 4. Accounts Payable - Liability, the normal balance is a credit. Would appear in the balance sheet. 5. Unearned Service Fees - Liability, the normal balance is a credit. Would appear in the balance sheet. 6. Telephone Expense - Expense, the normal balance is a debit. Would appear in the income statement. 7. Accounts Receivable - Asset, the normal balance is a debit. Would appear in the balance sheet. 8. Electrical Supplies - Asset, the normal balance is a debit. Would appear in the balance sheet. 9. B.A. Brightspark, Drawings - Equity, the normal balance is a credit. Would appear in the balance sheet 10. GST Payable - Liability, the normal balance is a credit. Would appear in the balance sheet. 11. GST Receivable - Asset, the normal balance is a debit. Would appear in the balance sheet. 12. Mortgage Payable - Liability, the normal balance is a credit. Would appear in the balance sheet. 13. Interest Revenue - Income, the normal balance is a credit. Would appear in the income statement. 14. B. A. Brightspark, Capital - Equity, the normal balance is a credit. Would appear in the balance sheet. 15. Electrical Services Revenue - Income, the normal balance is a credit. Would appear in the income statement.

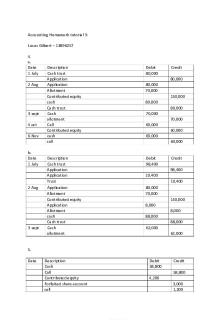

Exercise 3.8:

General Journal: Date: December 1

3

8

14

19

Particulars:

Debit:

Hairdressing Equipment Cash at Bank Accounts Payable (purchased hair-drying equipment, paid cash and on credit)

65 000

H Bouffant, Drawings Cash at Bank (Withdrew from business to pay for a new dress)

1200

Salaries Expense Cash at Bank (Paid salaries of employees)

6800

Advertising Expense Cash at Bank (Paid for advertisements in local newspaper)

800

Cash at Bank Accounts Receivable (Received money from customers to reduce balance on their accounts)

540

23 Accounts Payable Cash at Bank (Paid creditors for supplies that had been purchased on credit) 30

Credit:

5000 60 000

1200

6800

800

540

3700

46 080 Cash at Bank 11 520 Accounts Receivable Hairdressing Revenue (Earned hairdressing revenue, 80% paid in cash and 20% to be paid within a month)

3700

57 600

Journal: Date:

Particulars:

Post Ref: Debit:

Credit:

Cash at Bank Nicole Andreou, Capital (Initial investment, Cash invested by owner)

100 300

120 000 120 000

Rent Expense Cash at Bank (Paid for first month's rent)

500 100

1800

Equipment Cash at Bank Loan Payable (Equipment purchased for cash and on loan)

103 100 200

70 000

Supplies Cash at Bank (Supplies purchased)

102 100

8400

Advertising Expense Cash at Bank (Paid for advertising in cash)

501 100

890

Cash at Bank Accounts Receivable Revenue

100 101 400

3250 620

July 2018: 2

3

4

6

16

1800

32 000 38 000

8400

890

3870

(Received revenue for the first half of the month, part in cash and part in credit) Insurance Expense Cash at Bank (Paid for insurance using online bank transfer)

502 100

480

Cash at Bank Accounts Receivable (Customers paid of credit)

100 101

140

23

Nicole Andreou, Drawings Cash at Bank (Drawings by owner to pay for living expenses)

301 100

560

28

Cash at Bank Accounts Receivable Revenue (Revenue for the second half of month)

100 101 400

3680 580

Telephone Expenses Cash at Bank (Paid for telephone expenses)

503 100

330

20

31

31

480

140

560

4260

330

General Ledger Accounts: Account: Cash in Bank (Account Number 100) Date Particulars Debit

Credit

Balance

July 2018 2

Nicole Andreou, Capital

120 000

120 000

2 3 4 6 16 20 23 28 31 31

Rent Expense Equipment Supplies Advertising Expense Revenue 3 250 Insurance Expense Accounts Receivable 140 Nicole Andreou, Drawings Revenue 3 680 Telephone Expense

Account: Accounts Receivable (Account 101) Date Particulars

1 800 32 000 8 400 890

118 200 86 200 77 800 76 910 80 160 79 680 79 820 79 260 82 940 82 610

480 560 330

Debit

Credit

Balance

140

620 480 1060

Credit

Balance

July 2018 16 23 31

Revenue Cash at Bank Revenue

Account: Supplies (Account Number 102) Date Particulars

620 580

Debit

July 2018 4

Cash at Bank

8 400

Account: Equipment (Account Number 103) Date Particulars

Debit

8400

Credit

Balance

July 2018 3

Equipment

Account: Loan Payable (Account Number 200) Date Particulars

70 000

70 000

Debit

Credit

Balance

38 000

38 000

Credit

Balance

July 2018 3

Cash and Loan Payable

Account: Nicole, Andreou Capital (Account Number 300) Date Particulars Debit July 2018 2

Cash at Bank

120 000

Account: Nicole Andreo, Drawings (Account Number 301) Date Particulars Debit

120 000

Credit

Balance

July 2018 28

Cash at Bank

560

Account: Revenue (Account Number 400) Date Particulars

560

Debit

Credit

Balance

3 870 4 260

3 870 8 130

Credit

Balance

July 2018 16 31

Cash and Accounts Receivable Cash and Accounts Receivable

Account: Rent Expense (Account Number 500) Date Particulars

Debit

July 2018 2

Cash at Bank

1 800

1 800

Account: Advertising Expense (Account Number 501) Date Particulars Debit

Credit

Balance

July 2018 6

Cash at Bank

890

890

Account: Insurance Expense (Account Number 502) Date Particulars Debit

Credit

Balance

July 2018 20

Cash at Bank

480

480

Account: Telephone Expense (Account Number 503) Date Particulars Debit

Credit

Balance

July 2018 31

Cash at Bank

330

330

Trial Balance: Account:

Account Number:

Debits:

Cash At Bank Accounts Receivable

100 101

82 610 1060

Credits:

Supplies Equipment Loans Payable Nicole Andreou, Capital Nicole Andreou, Drawings Revenue Rent Expenses Advertising Expenses Insurance Expenses Telephone Expenses Totals

102 103 200 300 301 400 500 501 502 503

8400 70 000 38 000 120 000 560 8130 1800 890 480 330 166 130

166 130...

Similar Free PDFs

Accounting Tutorial - Week 3

- 7 Pages

Accounting Homework tutorial 3

- 3 Pages

Tutorial week 3 Notes

- 3 Pages

Tutorial Questions week 3

- 2 Pages

Week 3 - Tutorial 2 Tutorial Notes

- 12 Pages

Comp3311 Week 3 Tutorial Answers

- 32 Pages

Tutorial 2 - Week 3 Questions

- 1 Pages

Notes for Week 3 Tutorial

- 6 Pages

Tutorial work - week 2-3

- 10 Pages

WEEK 6 Bankruptcy Tutorial 3

- 14 Pages

Week 2 2020-3 - tutorial

- 3 Pages

LLB101 WEEK 3 Tutorial Answers

- 4 Pages

ANS week 3 - Tutorial work

- 2 Pages

Tutorial 3 - notes on week 3

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu