Wk7Assign Beltran A - Grade: B+ PDF

| Title | Wk7Assign Beltran A - Grade: B+ |

|---|---|

| Author | Alvaro Beltran |

| Course | The Changing Face of Leadership-— Diverse Perspectives |

| Institution | Walden University |

| Pages | 4 |

| File Size | 103.7 KB |

| File Type | |

| Total Downloads | 12 |

| Total Views | 133 |

Summary

Insurance Planning...

Description

Application – FICO Scoring Alvaro Beltran Walden University 21/04/2019

How is the FICO score calculated? The FICO scoring system was first introduced in 1989 by Fair, Isaac and Company, “a data Analytics Company based in San Jose, California focused on credit scoring services” (Wikipedia B). Said system is used by the vast majority of banks, credit grantors, lenders, etc, and is based in consumer credit files provided by national credit bureaus. Credit scores depend on the information in the consumer’s credit reports and different pieces of information may raise or lower the scores. FICO breaks its scoring criteria down into five categories, with a percentage value based on each category’s importance, though the importance may vary for individuals.

Payment history (35%): History of paying bills is one of the most important factors in determining the score. The payment history includes on-time and late payments on credit accounts and public records related to non-payments, such as a bankruptcy. Amounts owed (30%): How much it’s owed on credit accounts, such as installment loans and credit cards, and the portion of available credit that it's being used (known as credit utilization rate). Length of credit history (15%): The age of accounts, including how long it's being active and the newest account the person could have. Credit mix (10%): This includes the types of accounts, such as credit card accounts, mortgage loans, and retail loans. It’s not a key factor but it’s still considered in formulating the scores. New credit (10%): New credit inquiries and recently opened accounts can also influence about a tenth of the scores. Most important FICO components FICO scoring system provides 5 components of which the person, family or company is evaluated, it would be wise to say that the highest rated components are the most important but for the purpose of this assignment I will group the components into two categories and from there provide the most important components, in my opinion. The FICO system can be categorized into two categories which, to me, are present behaviour and Past behaviour, the components of the rating equation base on how the client behaves in order to predict whether they will pay their debt of default. Overall FICO model tries to predict future behaviour based in present and past actions that can trigger payment problems; of the 5 components I have grouped them out as follows:

Past behaviour: Payment history, amounts owed and length of credit history. This 3 components show how the client have behaved during past years, how is being paying their debts and how much loans does it have. Present behaviour: Credit Mix and New credits are in this category. To assess how the client is making use of its finances it’s very important to address irresponsible behaviour before it happens. For example, credit card purchases financed in 36 instalments is a good indicator that this person has no capacity of paying credit card debt in the short-term or choosing to extend the credit length on purpose to make monthly payments as low as possible to avoid affecting their quality of life.

With this two categories in mind I can now provide my 3 most important components and I will start with payment history, this component provides information on past behaviour and how well- or bad- the client acted during the length of the loan. New credits would be the second most important component because it brings present trends to the table, analysing the amount of debt and length of recently acquired loans; and finally Credit Mix, because it shows the type of credits the client have and is acquiring.

References Wikipedia A (2018) Credit score in the United States. Retrieved from https://en.wikipedia.org/wiki/Credit_score_in_the_United_States Wikipedia B (2019, February 27) FICO. Retrieved from https://en.wikipedia.org/wiki/FICO Investopedia (2019) Fico Score. Retrieved from https://www.investopedia.com/terms/f/ficoscore.asp The FICO 5: COMPONENTS THAT MAKE UP A FICO CREDIT SCORE. (2018). Retrieved from http://www.stellarrisk.com/the-fico-5-components-that-make-up-a-ficocredit-score/ Dave Ramsey (2018). What Is a FICO Score and How Does It Work?. Retrieved from https://www.daveramsey.com/blog/what-is-a-fico-score...

Similar Free PDFs

Wk7Assign Beltran A - Grade: B+

- 4 Pages

L A B 11 - Grade: A

- 5 Pages

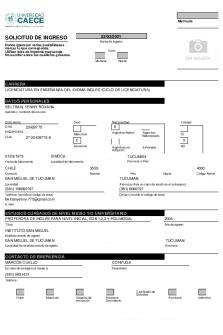

- Beltran Yenny Roxana - yfg

- 3 Pages

Engwr #4- B - Grade: B

- 7 Pages

Mod B TS Eliot essay - Grade: A

- 2 Pages

A rose for emily - Grade: B

- 3 Pages

What is a merit good - Grade: B

- 2 Pages

B Cwrit 511-Bones - Grade: N/A

- 14 Pages

Critical Analysis - Grade: B

- 6 Pages

Florida Consent - Grade: B

- 3 Pages

Oscilloscope Report - Grade: B+

- 4 Pages

Debut- Script - Grade: B+

- 6 Pages

Galanz - Grade: B+

- 10 Pages

Reflection 5 - Grade: b

- 1 Pages

Reconciliation - Grade: B-

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu