9.4 Account for notes receivable including computing interest and recording honored and dishonored notes PDF

| Title | 9.4 Account for notes receivable including computing interest and recording honored and dishonored notes |

|---|---|

| Author | Rosemary Saravia |

| Course | Financial Accounting I |

| Institution | FootHill College |

| Pages | 4 |

| File Size | 102.1 KB |

| File Type | |

| Total Downloads | 121 |

| Total Views | 172 |

Summary

Professor Lisa Drake...

Description

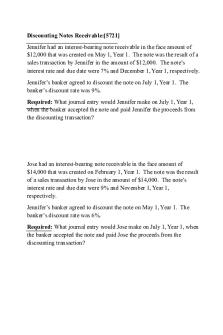

9.4 Account for notes receivable including computing interest and recording honored and dishonored notes • Notes Receivables: more formal than an account receivable—written promise to pay a specified amount at a future date, usually with interest" • Evidenced by a promissory note" • Maker—the debtor; one who will be paying back the principal + any interest" • Payee— the creditor; the now who will be receiving back the principal + any interest" • Principal— amount loaned by the payee and borrowed by the maker" • Interest—revenue to the payee for loaning $; revenue to the creditor, expense to the debtor " • Interest period—Starts on date written on promissory note " • Maturity date—date when interest period ends OR due date; time period which interested is computed" • Maturity Value— Principal + Interest due at maturity (total amount to be paid back)" • Journal entry:" 2017" September 30 Notes Receivable—Holland 1,000" #

#

#

Cash # #

#

1,000"

Accepted note in exchange for cash • Identifying Maturity Date: • Days: a note’s maturity date is determined by counting the # of days from the date of issue" • Count the maturity date but no the date the not was issued" • 180-Day note dates Feb 16 would mature on August 16"

28 days in Feb-Feb16 date note was issued = 12 " 12 + 31 days in Mar = 43, 43 + 30 days in Apr = 73, 73+31 days in May…give you Aug 15 = 180 days " • Months: the note’s maturity date falls on the same day of the month as the date the note was issued" • 6 mo note dated Feb 16 would mature on Aug 16" • Computing Interest on a Note: • Interest formula— Amount of interest = principal X interest rate X Time (based on the potion of a yr that interest has accrued on the note— x/12 mos or x/ 360 days)" • i.e.) 1,000 x 0.06 x 12/12 (because it’s the annual interest rate) = $60 ; $1,000 principal + $60 interest = $1,060 maturity value" • i.e.) Stated in months: A $2,000 9-month note was issued at a 10% interest rate " $2,000 X 0.10 X 9/12 (annual interest rate) = $150" • A $5,000 60-day note was issued at a 12% interest rate" $5,000 X 0.12 X 60/360 = $100" • Accruing Interest Revenue and Recording Honored Notes Receivables: • Revenue Recognition Principle: Requires companies to record revenue when it has been earned " • Some notes have an issue date in one period and due date in another period i.e. issued September 30, 2017 due September 30, 2018, so when dong financial statements at the end of the calendar year even though interest will not have been paid until September 2018 we need to record interest revenue that’s been accrued and earned from September 30, 2017 (note issue date)-December 31, 2017 (end of year)" • i.e) Principal $1,000, 6% annual interest rate, 3 months have gone by from issue date— October, November, December" $1,000 X 0.06 X 3/12 = $15" 2017" Dec 31 Interest Receivable 15" #

#

Interest Revenue 15"

• How much interest does the company earn in 2018?" Principal $1,000, 6% annual interest rate, 9 months have gone by from remaining time till due date—Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sept"

1,000 X 0.06 X 9/12 = $45" Assume on Maturity date customer honors the note by paying the full principal and interest" 2018" Sep 30 Cash ($1,000 + ($1,000 X 0.06 X 12/12)) 1,060" #

#

Notes Receivable—Holland# #

1,000 Principal amount"

#

#

Interest Receivable

##

#

15 interest earned in 2016"

#

#

Interest Revenue#

#

#

45 interest earned in 2018"

Collected note receivable plus interest • Sale of Merchandise for a Note: July 1, 2017 company sells household appliances for $2,000 to customer, they sign a 9-month promissory note at 10% annual interest" 2017" Jul 1 Notes Receivable—Dorman Builders 2,000" Sales Revenue

#

2,000"

Dec 31 Interest Receivable ($2,000 X 0.10 X 6/12) 100" #

#

Interest Revenue #

#

#

100"

2018" Apr 1 Cash ($2,000 + ($2,000 X 0.10 X 9/12)) 2,150" #

#

Notes Receivable—Dorman Builders 2,000"

#

#

Interest Receivable # #

#

#

Interest Revenue ($2,000 X 0.10 X 3/12) 50 Interest earned in next year"

#

100 Interest earned in current year"

• Accepting a Note for a Delinquent Accounts Receivable: (if a customer isn’t paying their accounts receivable to company will change it into a notes receivables) • This allows the customer more time to pay" • This allows the company to start charging interest" • i.e.) Sports Club can’t pay Blanding Services the amount due on account receivables of $5,000. Blanding Services may accept a 60-day, $5,000 note receivable with 12 % interest on November 19, 2017" 2017" Nov 19 Notes Receivable—Sports Club 5,000"

Accounts Receivable—Sports Club 5,000"

#

(This records change from an accts rec to a note rec and gets rid of the previous accts rec) Dec 31 Interest Receivable ($5,000 X 0.12 X 42/360) 70" Interest Revenue # #

#

#

#

70"

2018 " Jan 18 Cash ($5,000 + ($5,000 X 0.12 X 60/360)) 5,100" # #

Notes Receivable—Sports Club

5,000"

Interest Receivable

70"

Interest Revenue ($5,000 x 0.12 x 18/360)

30"

• Recording Dishonored Notes Receivable • Dishonor a Note: failure of a note’s maker to pay a note receivable at maturity " • the note is no longer in force because it expired" • the debtor still owes the payee " • The payee can transfer the note receivable to an accounts receivable" • i.e.) Rubinstein Jewelers has a 6 months, 10 % note receivable for $1,200 from Mark Adair that was signed on March 3, 2017, and Adair defaults (failure to fulfill an obligation)." 2017" Sep 3 Accounts Receivable—Adair 1,260" Notes Receivable—Adair#

#

1,200"

Interest Revenue ($1,200 X 0.10 X 6/12) 60" Rubinstein will now bill Adair for the accounts receivable. If Adair doesn’t pay, Rubinstein can write-off the receivable...

Similar Free PDFs

Notes and Loans Receivable

- 7 Pages

Dishonored Notes

- 1 Pages

Professional Recording Notes

- 25 Pages

Notes Receivable TEST BANK

- 7 Pages

Notes Receivable - CR-1

- 12 Pages

Notes Receivable Problem

- 2 Pages

Receivable Financing Notes

- 2 Pages

Notes Receivable Chapter 5

- 35 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu