Accounting Principles-Lecture 3 PDF

| Title | Accounting Principles-Lecture 3 |

|---|---|

| Course | Accounting principles |

| Institution | جامعة المنصورة |

| Pages | 9 |

| File Size | 530.1 KB |

| File Type | |

| Total Downloads | 40 |

| Total Views | 179 |

Summary

Lectures...

Description

10/27/2016

Accounting Principles Lecture 3

Dr. Mohamed Elmaghrabi

1

Problem 1-2 A (page 36) • Sue Kojima opened a law office on July 1, 2014. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner’s Capital $8,800. During August, the following transactions occurred. 1. Collected $1,200 of accounts receivable 2. Paid $2,800 cash on accounts payable 3. Recognized revenue of $7,500 of which $3,000 is collected in cash and the balance is due in September. 4. Purchased additional equipment for $2,000,paying $400 in cash and the balance on account. 5. Paid salaries $2,500, rent for August $900, and advertising expenses $400. 6. Withdrew $700 in cash for personal use. 7. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. Mohamed Elmaghrabi 2 8. Incurred utility expensesDr.for month on account $270.

1

10/27/2016

Required a) Prepare a tabular analysis of the August transactions beginning with July 31 balances. The column headings should be as follows: Cash + Accounts Receivable + Supplies + Equipment = Notes payable + Accounts Payable + Owner’s Capital – Owner’s Drawings + Revenues – Expenses.

Dr. Mohamed Elmaghrabi

3

Dr. Mohamed Elmaghrabi

4

2

10/27/2016

Required b) Prepare an income statement for August, and owners’ equity statement for August, and a balance sheet at August 31.

Dr. Mohamed Elmaghrabi

5

Financial Statements • Four financial statements are prepared from the summarized accounting data: 1. Income Statement revenues and expenses and resulting net income or net loss for a specific period of time. • The income statement: Net income = Revenues – Expenses a. Revenues > Expenses: Net Income. b. Revenues < Expenses: Net Loss. Dr. Mohamed Elmaghrabi

6

3

10/27/2016

Solution

Dr. Mohamed Elmaghrabi

7

Financial Statements 2. Owner’s Equity Statement changes in owner’s equity for a specific period of time. • Owners’ Equity, End of period = OE, beginning of period + Additional investment + net Income – drawings • Owners’ Equity, End of period = OE, beginning of period + Additional investment + Revenues – expenses – drawings Dr. Mohamed Elmaghrabi

8

4

10/27/2016

Solution

Dr. Mohamed Elmaghrabi

9

Financial Statements 3. Balance Sheet assets, liabilities, and owner’s equity at a specific date • The balance sheet: • Assets = Liabilities + Owners’ Equity

Dr. Mohamed Elmaghrabi

10

5

10/27/2016

Solution

Dr. Mohamed Elmaghrabi

11

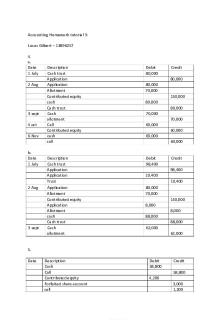

Problem 1-3A • On June 1, Tamara Eder started Crazy Creations Co., a company that provides craft opportunities, by investing $12,000 cash in the business. Following are the assets and liabilities of the company at June 30 and the revenues and expenses for the month of June.

Dr. Mohamed Elmaghrabi

12

6

10/27/2016

Cash $10,150 Service Revenue $6,500 Accounts Receivable 2,800 Advertising Expense 500 Supplies 2,000 Rent Expense 1,600 Equipment 10,000 Gasoline Expense 200 Notes Payable 9,000 Utilities Expense 150 Accounts Payable 1,200 Tamara made no additional investment in June but withdrew $1,300 in cash for personal use during the month. • Instructions • (a) Prepare an income statement and owner’s equity statement for the month of June and a balance sheet at June 30, 2014.

• • • • • • •

Dr. Mohamed Elmaghrabi

13

Solution

Dr. Mohamed Elmaghrabi

14

7

10/27/2016

Dr. Mohamed Elmaghrabi

15

Dr. Mohamed Elmaghrabi

16

8

10/27/2016

End of Lecture 3

Dr. Mohamed Elmaghrabi

17

9...

Similar Free PDFs

Accounting Principles-Lecture 3

- 9 Pages

Accounting Exam 3 Practice

- 8 Pages

5 - Accounting Example 3

- 1 Pages

Chapter 3 Accounting Interface

- 20 Pages

Accounting Homework tutorial 3

- 3 Pages

accounting notes 3

- 23 Pages

Accounting Chapter 3 Notes

- 23 Pages

Accounting Tutorial - Week 3

- 7 Pages

Intermediate Accounting 3 Reviewerr

- 47 Pages

3 Trust Accounting

- 15 Pages

Accounting topic 3 - lol

- 5 Pages

Assignment 3 - Accounting

- 2 Pages

Chapter-3 - Cost Accounting

- 52 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu