Assignment-1 COST Sheet PDF

| Title | Assignment-1 COST Sheet |

|---|---|

| Author | Tanmay Mehta |

| Course | Cost Accounting |

| Institution | Guru Gobind Singh Indraprastha University |

| Pages | 3 |

| File Size | 220.4 KB |

| File Type | |

| Total Downloads | 7 |

| Total Views | 166 |

Summary

COST SHEET...

Description

INSTITUTE OF INNOVATION IN TECHNOLOGY AND MANAGEMENT COST ACCOUNTING (BBA-110) BBA-II SEMESTER PRACTICAL ASSIGNMENT-1 “COST SHEET” Prepared by: Ms. Shilpa Arora Q.1. From the following particulars, you are required to prepare Cost Sheet of Soap manufacturers Ltd. Particulars Opening inventory (1.1.2010): Raw materials Work in progress Finished goods (1000 units) Closing inventory (31.1.2010): Raw materials Work in progress Finished goods Donations to home for destitutes Raw materials purchased Import duty on raw materials purchased Productive wages Machine hours worked Machine hour rat Chargeable expenses Office and administration expenses Selling expenses Units sold = 8000 units Units produced = 8200 units Profit on sale = 10% (Ans. Rs. 16320)

Amount (Rs) 6000 9620 13680 7000 8020 ? 2100 72000 14400 18000 21600 hours Rs. 1.50 Rs. 2000 Rs. 1 per unit Rs. 0.90 per unit

Q.2. Tirupati Electonics Ltd. Produces a standard product and provides you the following information for the year ending 31st March, 2010: Particulars Raw materials Opening stock Purchases Closing stock Direct wages Other direct expenses Factory overheads Office overheads Selling expenses Finished goods Opening stock Produced during the year Closing stock

Amount (Rs) 10000 85000 4000 20000 10000 100% of direct labour 10% of works cost Rs. 2 per unit sold 1000 units (Rs. 16000) 10000 units 2000 unitss

Prepare cost sheet for the year ending 31 st March, 2010. Also ascertain the selling pirce per unit so as to yield a profit of 20% on the selling price. (Ans. Profit = Rs. 39520 ; Sales = Rs. 197600) Hint: Selling price = Sales/Units sold = Rs.21.96 p.u. ; Units sold = 9000 units) Q.3. Calculate: i. ii. iii. iv.

Value of raw-materials consumed Total cost of production Cost of goods sold Profit

Particulars Amount (Rs) Opening inventory: Raw materials 1350 Finished goods 2500 Closing inventory: Raw materials 750 Finished goods 1500 Raw materials purchased 20000 Wages paid to labourers 8000 Direct expenses 1250 Experimental expenses 450 Factory printing and stationary 350 Rent : Factory 250 Rent: office 120 Wages of fireman 1000 Lighting – office 125 Audit fees 150 Telephone expenses 500 Advertising 1250 Market research expenses 550 Salary of godown-keepers 175 Travelling expenses 750 Commission of travelling agents 500 Sales 50000 (Ans : value of raw material consumed = Rs. 20600, cost of production = Rs. 32795 , cost of goods sold = Rs.33795 , Profit = Rs. 12980) Q.4. Vijay industries manufactures a product X. On 1st April, 2009, there was 5000 units of finished goods in stock. Other stocks on 1st April, 2009 were as follows: WIP Raw materials

57400 116200

The information available from cost records for the year ended 31 st March, 2010 was as follows: Direct materials Direct labour Freight on raw materials purchased Indirect labour Other factory overheads

906900 326400 55700 121600 317300

Stock of raw materials on 31.3.2010 96400 WIP on 31.3.2010 78200 Sales (1,50,000 units) 3000000 Indirect materials 231900 st There are 15000 units of finished product in hand on 31 March, 2010. You are required to prepare : Cost and profit statement assuming that opening stock of finished goods is to be valued at the same cost per unit as the finished stock at the end of the period. (Ans. 11,80,500)

******...

Similar Free PDFs

14167572 Cost Sheet Format

- 1 Pages

Assignment-1 COST Sheet

- 3 Pages

Cost sheet theory

- 7 Pages

Cost Sheet or Statement of Cost

- 16 Pages

Service quality assignment1

- 7 Pages

Business Case Assignment1

- 3 Pages

Greek Crisis-assignment1

- 11 Pages

Assignment1 Relation Function

- 10 Pages

FULL COST :: Direct COST

- 1 Pages

Cost Behavior - Cost Accounting

- 78 Pages

COST Acctg 2 - cost

- 1 Pages

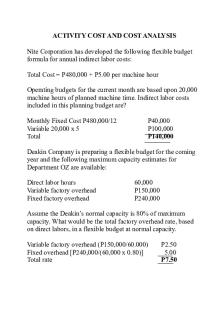

Activity COST AND COST Analysis

- 5 Pages

Cost hw - Cost accounting homework

- 18 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu