BU393 Syllabus Spring 2021 with Michael Brolley PDF

| Title | BU393 Syllabus Spring 2021 with Michael Brolley |

|---|---|

| Author | study geek |

| Course | Finance 2 |

| Institution | Wilfrid Laurier University |

| Pages | 10 |

| File Size | 430.1 KB |

| File Type | |

| Total Downloads | 102 |

| Total Views | 133 |

Summary

Outline of the course requirements and work for BU393 in the spring term with Michael Brolley...

Description

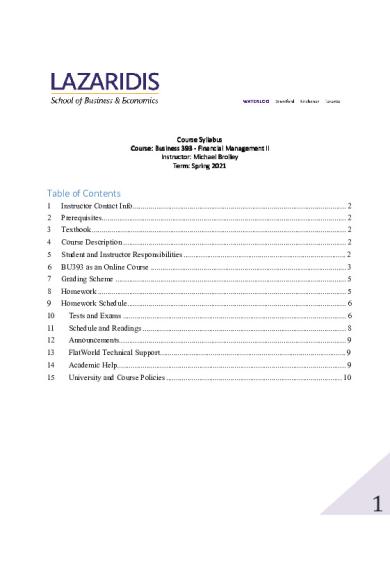

Course Sy Syllabus llabus Course: Busine Business ss 393 - Financ Financial ial Manag Management ement II Instruc Instructor: tor: Mich Michael ael Br Brolley olley Term: Spring 202 2021 1

Table of Contents 1

Instructor Contact Info............................................................................................................. 2

2

Prerequisites............................................................................................................................. 2

3

Textbook .................................................................................................................................. 2

4

Course Description .................................................................................................................. 2

5

Student and Instructor Responsibilities ................................................................................... 2

6

BU393 as an Online Course .................................................................................................... 3

7

Grading Scheme ...................................................................................................................... 5

8

Homework ............................................................................................................................... 5

9

Homework Schedule................................................................................................................ 6

10

Tests and Exams .................................................................................................................. 6

11

Schedule and Readings ........................................................................................................ 8

12

Announcements.................................................................................................................... 9

13

FlatWorld Technical Support............................................................................................... 9

14

Academic Help..................................................................................................................... 9

15

University and Course Policies .......................................................................................... 10

1

Instructor Contact Info

1 Name

Office

Phone

Email

M. Brolley

---

4836

[email protected]

Prerequisites

2

BU283 Financial Management I

Textbook

3

Required • •

Stanley Eakins and William McNally. Corporate Finance (Canadian Edition), Version 2.1 (Flatworld Publishing, ©2020). ISBN-13: 978-1-4533-3879-764. There are 4 purchasing options. Only the online-access version of the book is required (the cheapest version), although students can additionally purchase: i) downloadable etext, and/or ii) color printed textbook versions, if you prefer a different medium.

Course Description

4

BU393 develops the foundational tools and ideas of corporate finance. It is the second of two core courses required for a finance major, and hence, is crucial to that program. For other majors, this course is still important, as I will endeavour to convince you. The first third of the course shows students how to evaluate new project ideas. This is critical for convincing others to accept and adopt your ideas. It is not enough to have a good project idea, you must show that the idea will add value for the company. The tools presented in capital budgeting will give you the ability to formalize the financial impact of a project. The second topic in the course is corporate valuation. This topic is important for two reasons. First, all managers need to understand how the market arrives at its valuation of a company so that they can anticipate the market’s response to corporate initiatives, and so that they can successfully maximize the market value. Second, valuation is important because the last three topics in the course explore how certain corporate actions impact value. The final third of the course explores three very common corporate activities: 1) borrowing (leverage); 2) cash distributions (dividends and repurchases); and 3) mergers and acquisitions.

Student and Instructor Responsibilities

5

As students of this course, I expect that you: 1.

Will become self-directed learners. The design of the course provides students with regularly scheduled assignments to practice skills as they are introduced in the course. I will provide assignments as early as possible to allow students to accelerate their progress

2

2.

3.

if they so choose. This may be useful if you have future deadlines in other courses during which time you expect that you may be stressed, or too busy. Come to class prepared. In the context of this course, this generally means working steadily—doing a little finance every day—to ensure that you are keeping up with the readings and homework, so that as the class progresses, you are not without the previously taught tools required to progress to the next chapter. I also recommend reading the week’s textbook sections before class, as this allows lecture to be a “second pass” at the material, to clarify any lingering questions. Are equipped with the right tools. To participate effectively in class problem solving sessions, having the right tools is key: access to a spreadsheet program is recommended, as many numerical problems can be much more easily solved this way. MS Excel is not required; in my experience, Google Sheets is just as good for our purposes, and it is free.

Finally, the best preparation for this course is to read this syllabus carefully and pay special attention to instructor e-mails and course news postings, to ensure that you are aware of all course policies and updates. I will endeavor to provide you with updates as the needs arise. If you have any questions about the course, it is best to ask me as early as possible. As your instructor, I will help you learn by providing the following: • Recordings of lectures following our Zoom class sessions, • A list of clear and reasonable learning tasks and outcomes, with in-class activities appropriate for achieving these tasks and outcomes; • Assessment tools that treat all students equally, have academic integrity, clearly assess the stated learning tasks and outcomes, and provide useful and timely feedback so that you can learn from mistakes and move forward; • Sufficient contact time with the instructor through email and (virtual) office hours. Additionally, I have selected this textbook as it is my experience that it has the greatest volume of practice problems available to master the concepts taught in class, while remaining economical.

6

BU393 as an Online Course

Due to the COVID-19 pandemic, our regular in-class routine continues to be disrupted, and as such, we will meet via the Zoom video conferencing platform. Using the course homepage on MyLearningSpace (MyLS), you should be able to find a “Zoom Meetings” menu in the top menu bar (along with “Content”, “Grades”, etc.,). This heading will take you to a schedule of meetings which you can join at specified start times (often during the assigned lecture slot). A PDF on login details will be posted to MyLS’s “Content” section. NOTE: make sure that you activate your Laurier Zoom account if you have not done so already. Go to https://zoom.wlu.ca and click on 'Sign In', then use your Laurier username and password to login, which activates your account. Video Lectures – Information Security and Recordings Synchronous (live) class sessions will be delivered in this course through the Zoom video conferencing platform. Steps have been taken to protect the security of the information shared. For more information about Zoom, please visit ICT’s Tech Support and Services page.

3

Class sessions will be recorded with the video and audio (and in some cases transcription) made available to students in the course in MyLS for the duration of the term. The recordings may capture your name, image or voice through the video and audio recordings. By attending in these live classes, you are consenting to the collection of this information for the purposes of administering the class and associated course work. If you are concerned about the use or collection of your name and other personal information in the class, please contact the course instructor to identify possible alternatives. You are not authorized to make a copy of the recorded class; it is provided for viewing purposes of students enrolled in the class and further distribution of sharing is strictly prohibited. To learn more about how your personal information is collected, used and disclosed by the University, please see Laurier’s Notice of Collection, Use and Disclosure of Personal Information. Weekly Work Schedule In general, finance is a problem-based discipline. That is, most of the learning you will do occurs while you work on problems; as such, this should dictate how you approach the course. Keeping a regular schedule can be difficult when there is no physical in-class regimen to follow, so I offer some pointers on how best to keep to a schedule of your own. Readings: To get the most out of this course I recommend that you approach each week as follows. At the beginning of the week you should do the assigned readings. A how-to approach to finance readings can be found via video here: https://youtu.be/3V-t7XFkoOE. On your first pass of a chapter your goal is to understand the basic learning objectives and broad ideas within each objective, and get comfortable with the basic terminology. Practice Problems The textbook provides a wealth of practice problems (not graded), which are great practice while you are reading through the material. Be sure to read each of the learning objectives through one at a time. Go through each of the examples and watch the appropriate videos if you do not understand the written description. After you are finished reading the learning objective, you should attempt some of the practice problems for that learning objective. When you are stuck, look back through the text for help. There might be a worked example on a similar problem. When working on problems, I strongly recommend that you do not look at the solution tools until you have worked through the problem and have your own answer. Peaking at the learning tools often creates the illusion of understanding more than actually learning the material. Homework Once you feel confident that you understand the material, move on to the graded assignment associated with the chapter. See the “Homework Schedule” section for due dates. Student

4

performance in introductory finance improves with the number of questions attempted and with the number completed correctly1, so try to do as many problems as possible. The average student should expect to spend roughly six hours per week—two for each lecture hour—outside of class reading, watching videos and working on problems. Students with weaker quantitative skills may need to spend more time. Since this is a relatively large amount of time, students should do a little every day.

7

Grading Scheme

The course follows the grading scheme in the table below.

Homework Test 1 Test 2 Valuation Project Final Exam Total Grade

8

Mark Breakdown 15% 17.5% 17.5% 15% 35% 100%

Homework

There will be homework regularly delivered through the online textbook platform. Details about finding the homework will be provided on MyLS. The graded homework assignments are just a subset of the problems available for each chapter. The homework can be started and stopped as desired, and answers will be saved. The homework can be completed on any computer. For the Homework, questions can be attempted an unlimited number of times. The numeric homework questions are algorithmic. Each student’s homework assignment has the same questions, but the questions have different numbers. Each time a question is regenerated it will have different numbers. Each student’s homework mark will be constructed as follows: = min � , 100� − 10 Where k is the number of points earned and N is the total number of points possible across all graded homework. If there are 160 questions and you answer 120 correctly, then your homework mark is 120/(160-10) = 82.6%. The 10 subtracted questions (in the denominator) are ‘gimme’ marks. You can miss up to ten questions without penalty. The maximum mark is 100. With so many deadlines, disruptions may cause you to miss a deadline; e.g., your home internet connection or computer might fail on the due date, you might have a minor health problem or a family emergency, etc,. Regardless of the reason, no extensions will be given to students who 1

“Determinants of Performance in a Hybrid Finance Course” with Brian F. Smith. 2010. Advances in Financial Education. Vol. 8, Issues 1&2, pp. 22-34.

5

cannot complete an assignment on time. 2 The 10 ‘gimme’ marks (described above) are provided to mitigate the loss associated with one of these events. To reduce the risk of a disruption impacting your homework performance, all assignments are available at the beginning of the term.

9

Homework Schedule

All homework will open on the textbook homework system at the beginning of the semester, so that you can work on them earlier than the week that the topics are covered, if you wish. Some homework questions can be done simply by reading and understanding the chapter, while others may require some in-class discussion and practice before they can be satisfactorily completed. Note that CFO will include all posted problem sets in your grade, but this is not your actual grade, as only the assignments with the titles listed on the schedule below will count towards your grade.

DUE MAY 29

GRADED HOMEWORK TITLE Homework: Chapter 11

MAY 29

Homework: Chapter 9

JUN 12

Homework: Chapter 10

JUN 19

Homework: Chapter 14

JUN 26

Homework: Chapter 17

JUL 10

Homework: Chapter 13

JUL 24

Homework: Chapter 12

JUL 31

Homework: Chapter 19

AUG 7

Homework: Chapter 20

IN CASE OF DISCREPANCIES, THE DATES AND TIMES SET BY THE HOMEWORK SYSTEM ARE OFFICIAL.

10

Tests and Exams

I have scheduled two tests and a final exam (see schedule below) to help spread out the evaluations across the material of the term. Because the course is online, I feel that two tests that are designed

2

Note: if an illness or injury is expected to require that a student to miss a significant amount of class time, this should be brought to the instructor at the earliest possible time, so that accommodations can be made.

6

to be shorter than a typical midterm partitions the material in more manageable blocks. These tests and the final exam will be delivered through MyLS.

Name Test 1 Test 2 Final

Date Jun 14 Jul 12 TBA

Time In Class In Class TBA

Duration (mins) 75 75 150

Students may not communicate with anyone with any software (i.e., Facebook or Google Chat.). While the tests and exam allow you to access course material, you should not rely on being able to look-up facts or techniques. The tests and exams will have more questions than can reasonably be looked up and answered in the time allotted. Thus, the more you look up the fewer questions you can complete. Students who are better prepared will answer more questions and score higher. More information on each evaluation will be provided closer to each evaluation date. Missed term work If a student misses a test because of illness, or other unexpected major life event, such as a death or a serious illness in their immediate family, the student must complete the following steps: 1. Give immediate email notice of student illness or unexpected major life event to the instructor prior to the scheduled test start time. 2. Within 48 hours of the start time of the test, complete the self-declaration form found here. https://web.wlu.ca/illness/ Provided the student fulfills both steps 1 and 2 with sufficient detail to confirm the existence of illness or unexpected major life event and no other contradictory information becomes known to the instructor, then the weight of the test will be transferred to the final exam. In all other cases, the student will receive zero on the examination. It is academic misconduct to submit a false self-declaration form. If other contradictory information becomes known to the instructor, the student may be asked for further evidence to corroborate the existence of the illness or unexpected major life event. Under no circumstances should students assume that special alternate assignments or deferred test will be set by the instructor. Vacations are not considered a sufficient excuse for missing an examination. Missed Final Examinations are not covered by this process. Requests for a deferred final examination must be made by filing a petition using the process and form described here: https://students.wlu.ca/academics/exams/deferred-exams.html https://students.wlu.ca/academics/exams/assets/documents/lazaridis-petition-form.pdf All deadlines, due dates, examination times and class times are set in Eastern Standard Time (EST). If you are in another time zone you are responsible for making the adjustment to EST. Final Course Grades

7

The course average will be no lower than a ‘B’. Thus, you should not focus on your absolute exam score, but rather on your position in the distribution. Hence, students who obtain an average score across all evaluation metrics will earn a course grade of B or better.

Schedule and Readings

11 1 2 3 4 5

Class May 10 May 12 May 17 May 19 May 24 May 26

Topic Introduction COC CB CB ---CB

Learning Objective Intro, Cost of Debt and Equity (Review) Weighted Average Cost of Capital Capital Budgeting (CB) Techniques Depreciation & Expansion Projects Victoria Day (no class) Depreciation & Expansion Projects

Readings Ch. 1, 6, 7 Ch. 11 Ch. 9 Ch. 10.1, 10.2

6

May 31

CB

Real Options

Supplemental PDF

7

Jun 2

CB

Replacement Projects

Ch. 10.3

8

Jun 7

CB

Ch. 10.4

9

Jun 9

Valuation

10

Jun 14

CB Refinements Projects with Unequal Lives Sales Forecasting and F/S Forecasting In-Class Test: Capital Budgeting

11

Jun 16

Valuation

12 13

Jun 21 Jun 23

Valuation Distributions

Adv. F/S Forecasting Free Cash Flow DCF Valuation Dividends

Ch. 17.1 Ch. 17.2 Ch. 17.3, 17.4 Ch. 13.1, 13.2

14

Jun 28

Distributions

Ch. 13.3

15

Jul 5

Distributions

16

Jul 7

Capital Structure

17 18

Jul 12 Jul 14

19

Jul 19

20

Jul 21 Jul 26

22

Jul 28

Similar Free PDFs

BU393 outline 2021

- 8 Pages

Syllabus GP2 Spring 2021

- 6 Pages

CHEM437L Spring 2021 Syllabus

- 5 Pages

WRT101 Syllabus spring 2021

- 5 Pages

Syllabus Spring 2021

- 4 Pages

CHE132 Syllabus Spring 2021

- 9 Pages

GWU Syllabus Spring 2021

- 6 Pages

Evidence Syllabus Spring 2021

- 9 Pages

Syllabus 227 Spring 2021

- 5 Pages

PHY7E-Spring 2021 Syllabus

- 3 Pages

MET3101 Syllabus Spring 2021

- 12 Pages

Syllabus spring 2021

- 6 Pages

BA342 Spring 2021 Syllabus

- 16 Pages

BSC1005 Spring 2021 Syllabus v

- 9 Pages

ASTR 100 Spring 2021 Syllabus

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu