Capital Structure Diagrams PDF

| Title | Capital Structure Diagrams |

|---|---|

| Course | corporate finance |

| Institution | Sheffield Hallam University |

| Pages | 3 |

| File Size | 216.4 KB |

| File Type | |

| Total Downloads | 90 |

| Total Views | 147 |

Summary

Capital Structure Diagrams...

Description

Net Income Approach – M&M I

Ke increases due to financial risk (bankruptcy risk having been eliminated by perfect markets) Kd is flat as it is unaffected by financial risk As debt replaces equity the increased cost of existing equity is cancelled out by the cheaper cost of debt finance The implications are that there is no optimal capital structure

Market Imperfection Theory – M&M II

The value of the company increases with debt due to the rising tax shield. Beyond a certain point bankruptcy risk eats into the tax shield benefits. The optimal capital structure is where the marginal benefit of the tax shield of extra debt is exactly cancelled out by the increased bankruptcy risk. The implications are that an optimal capital structure does exist.

Cost of equity curve (ke): - Rises with increased gearing due to the increasing level of financial risk being face by shareholders. - Curve rises at a steeper rate at high gearing levels due to the risk of bankruptcy threatening the value of shareholders investments. Cost of debt curve (kd): - Will rise only at high levels of gearing, where bankruptcy risk threatens the value of debt holder’s investments. - A company finance entirely by equity will be located at point A. WACC - The companies WACC will fall initially due to the benefit of the cheaper debt finance outweighing any increase in the cost of the company’s remaining equity finance. - Hence, the company’s WACC will fall to B, to give an optimal cap structure represented by point X.

Market Imperfections View.

Miller and Modigliani’s views do not apply to the real world as their assumptions are unrealistic. That implies that an optimal capital structure does exist, i.e. along the lines of both the Traditional Approach and the

The next issue is whether there is one 'magic mix' as implied by the U shaped curves of the theories. If this is true it will be difficult for companies to locate their OCS and then maintain the structure given the 'lumpy' nature of finance. A more realistic position would be a range of optimal capital structures as indicated by the diagram below:

This would make it easier for a company to locate and stay at its optimal capital structure. Companies can look at the gearing ratios and interest cover of similar companies to see if they are 'in line' with them....

Similar Free PDFs

Capital Structure Diagrams

- 3 Pages

Chapter 12 - Capital Structure

- 12 Pages

Capital structure notes

- 42 Pages

3 - Capital Structure

- 6 Pages

Ch 15 Capital Structure Decisions

- 64 Pages

Muscle diagrams

- 4 Pages

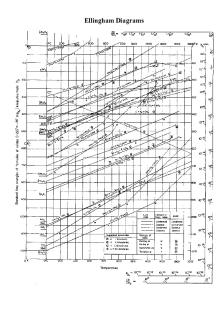

Ellingham diagrams

- 4 Pages

Ellingham diagrams

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu