CH 6 - Corporate Level Strategy PDF

| Title | CH 6 - Corporate Level Strategy |

|---|---|

| Course | Strategic Management |

| Institution | Langara College |

| Pages | 9 |

| File Size | 173.6 KB |

| File Type | |

| Total Downloads | 1 |

| Total Views | 149 |

Summary

CH 6 - Corporate Level Strategy, CH 6 - Corporate Level Strategy...

Description

CH 6 – Corporate Level Strategy 1. 2. 3. 4. 5. 6. 7.

define and purpose of corporate level strategy different levels of diversification 3 reasons why firms diversify how firms create value by using related diversification explain 2 ways firms create value with unrelated diversification incentives and resources that encourage diversification motives that encourage over diversification

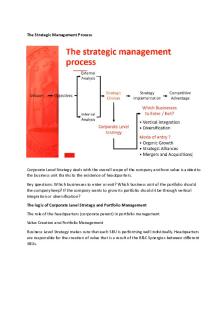

corporate level strategy o specific actions to gain competitive advantage by selecting & managing a group of different businesses in different product markets o used to grow revenue and profits o market development by entering diff geo market o acquire competitors (horizontal integration) o acquire suppliers/buyers (vertical integration) 2 issues: o what product market and business to compete in o how corporate hq manage those businesses o business level strategy selected for each businesses corp strategy value -> businesses in portfolio worth more than if not in corp? diversification allows allocating resources to where returns are highest

Levels of Diversification

firm is related thru diversification when businesses share several links o Product markets, tech, distribution channels o More links = constrained level of diversification

Low Levels Diversification Single Business: 95% or more of revenue comes from a single business Dominant Business: Between 70% and 95% of revenue comes from a single business. Example: Harley Davidson

Moderate to High Levels Diversification Related constrained: less than 70% of revenue comes from the dominant business, and all businesses share product, technological, & distribution linkages Example: Cara

Very High Level Diversification Unrelated: less than 70% of revenue comes from the dominant business, and there are no common links between businesses. Example: United Technologies

Related linked: less than 70% of revenue comes from the dominant business, and there are only limited links between businesses. Core competencies are shared by movement of key managers. Example: Canadian Tire

Low Levels of Diversification

Single-business level strategy o Firm makes 95% rev from core business o With very few product markets o Tobasco sauce partnering with other firms to make jelly beans, crackers Dominant-business level strategy o 70 - 95% rev within a single business o UPS – 61% US package delivery/ 22% int’l/ 17% non-package business Predicts growth in smaller two markets Suggest more diversified in goods and geo location Fewer challenges by managing one or small set of businesses Gain economies of scale & efficiently use resources Set of differentiated products within an industry = product proliferation strategy o Concrete machinery/ excavators/ hoisting machinery/ pile driving o Related tech for production process & related customer/markets o Also could be highly related constrained diversification

Moderate to High Levels of Diversification

Less than 70% rev from dominant business Related constrained o Businesses with similar sourcing, throughput, outbound process o shares resources and activities across businesses o Eg) Campbell Soup, Procter & Gamble

Related linked o Only few links shared among businesses o Share fewer resources btw businesses than related constrained o More on transferring knowledge and core competencies btw businesses o Constantly adjust mix in portfolio of businesses

Very High Levels of Diversification

Unrelated diversification o Less than 70% rev from dominant business o no relationships btw businesses o conglomerates o firm makes no effort to share activities or transfer core competencies o eg) HWL with ports/ property/ retail/ energy…etc

Reasons for Diversification

increase firm’s value by improving overall performance (increase rev/ reduce cost) related vs unrelated diversification Value-Creating o Operational relatedness = operational synergy/ sharing assets/ vertical integration o Corporate relatedness = capable of transferring core competencies o Unrelated diversification = financial economies Value-neutral o Does not increase firm’s value o Desire to match/ neutralize competitor’s market power (acquiring similar distribution outlet) Value-reducing o Does not increase firm’s value o Reduce managerial risk (1 firm fails but still has others so corp doesn’t fail) o Increase managerial salary (increase firm size = higher pay for top execs)

Value-Creating Economies of scope (related diver.) -sharing activities -transferring core competencies Market power (related diver.) -blocking competitors thru multipoint competition -vertical integration Financial economies (unrelated diver.) -efficient internal capital allocation -business restructuring Value-Neutral -antitrust regulation -tax laws -low performance -uncertain future cash flows -risk reduction for firm -tangible/ intangible resources Value-Reducing -diversifying managerial employment risk -increasing managerial compensation

Value-Creating Diversification (Related Constrained and Related Linked)

Builds upon/ extend resources & capabilities to build competitive advantage Develop and exploit economies of scope Economise of scope o Cost savings by sharing resources/ transferring corp-level competencies o difference between sharing activities/ transferring competencies is based on how the resources are jointly used to create economies of scope o Operational sharing tangible resources such as plant and equip shared w/ less tangible such as manufacturing know-how or tech capabilities o Corp-level competencies transfer Know-how transferred with no tangible at all

Operational Relatedness: Sharing Activities to Create Value

Sharing primary activity (inventory delivery system) Sharing support activity (purchasing practices) Eg) Sany share marketing activities since all sell to firms in construction industry Risks: o Ties among businesses create links between outcomes 1 business low sales -> not enough to cover cost of operating shared facilities o Coordination challenges (has to be managed effectively to share activities)

Corporate Relatedness: Transferring of Core Competencies

Corporate-level core competencies o Complex set of resources & capabilities that link diff businesses Managerial/ tech knowledge/ experience/ expertise Creates value by: o Save resources (1 firm already developed core competency & transfer to other firm) o Intangible resources (transfer of corp-level competence = immediate competitive adv) o Eg) Virgin Group transfer marketing across airline/ cosmetics/ music/ drinks…etc o Eg) Honda transfer engine design and manufacturing Transfer usually by moving key people into new mgmt. positions o Depends on top mgmt. team willingness of transferring knowledge and skill Don’t want key ppl transferred out b/c they’re critical to success Key people don’t want to get transferred Too much dependence on outsourcing lowers usefulness of core competencies and thereby reduce their useful transferability to other business units in the diversified firm

Market Power

Market power o Exist when firm above competitive level o Or reduce cost of value chain/ support below competitive level Gain market power by o Economies of scale o Multipoint competition 2 or more diversified firms compete in same product/geo markets Eg) UPS moved into overnight delivery (FedEx’s stronghold) -> FedEx moved into ground shipping (UPS’s stronghold) o Vertical integration when firm produces its own inputs (backward) or own source of output distribution (forward) save on operations, avoid sourcing and market costs, protect tech imitation able to improve product quality/ new tech because access to more info Risk Cheaper outside supplier Substantial cost to upgrade tech Changes in demand (producing amount above what is needed and sell to outside)

Simultaneous Operational/ Corporate Relatedness

Hard to achieve and imitate Disney has media networks/ parks/ studio entertainment/ consumer products/ interactive media o Gain economies of scope thru their diff distribution companies (touchstone, Hollywood pics, dimensions film) o Corporate-level core competencies in advertising and marketing o Cross-sell products in movies through parks and retail Hard to identify value created by firm

Unrelated Diversification

not seeking operational/ corporate relatedness value crated via 2 types financial economies financial economies o cost savings thru improved allocations of financial resources based on investment in/out of the firm o Efficient internal capital market allocation portfolio of businesses with different risk profiles o Restructuring of acquired assets firm buys another -> restructure it to operate more profit -> sells it

Efficient Internal Capital Market Allocation

efficiency from investors taking equity positions (ownership) with high expected future cash flow capital also allocated thru debt by shareholders & debt holders o trying to improve value on their investments with high growth/profitability firms diversified firms distribute capitals to its businesses to create value for overall corp corp HQ have access to more accurate and detail info on potential future performance on their businesses some info available to competitors o so efficiently allocating internal capital market helps corp protect competitive adv’s External can only indirectly force changes via board of directors (forcing bankruptcy) Internal capital markets -> corp HQ can fine-tune corrections (strategic changes) easier to imitate than operational/corporate relatedness emerging countries encourages unrelated diversification (no regulation/law/ financial intermediaries)

Restructuring Assets

private equity firms (buy->restructure->sell in 4-5 years) complex in high-tech/service firms because human-resource dependent (people can leave and reduce value)

Value-Neutral Diversification: Incentives & Resources

quality of firm’s resources permit diversification that is only value-neutral

Incentives to Diversify

external o antitrust regulations o tax laws internal o low performance o uncertain future cash flows o pursuit of synergy o reduction of risk

Antitrust Regulation & Tax Laws

laws prohibiting vertical and horizontal mergers to gain market power o lead to corp pursuing different lines of businesses high tax on dividends + less tax returns from stock sales o shareholders rather firms use free cash flows to buy and build companies

Low Performance

Coca-cola not meeting profit targets in soft drinks o so diversify into water, tea and fruit juices brand risk and lack operational expertise negative synergy, cultural fit difficulties

Uncertain Future Cash Flows

mature product lines/ industries -> diversify for long-term survival o reduce uncertainty about firm’s future cash flow

Synergy & Firm Risk Reduction

synergy o value created by working together > working independently risk corporate failure for highly related diversification because synergy produces interdependence (constrain flexibility to respond) o firms reduce tech change & new product lines (more certain environ) leads to related diversification (less risk) o firms don’t share activities leads to unrelated diversification

Resources & Diversification

must have types & levels of resources/ capabilities for corp-level diversification strategy tangible resource like free cash flow easily imitated o less likely to create long-term value

plant & equip -> excess capacity only for closely related products (less flexible asset) sales force more easily used to diversify (learn product knowledge in related diversification) intangible resource o encourages even more diversification o reputation o o

...

Similar Free PDFs

CH 6 - Corporate Level Strategy

- 9 Pages

Chapter 6 - Corporate-Level Strategy

- 10 Pages

3. Corporate Level Strategy

- 18 Pages

CH 4 - Business Level Strategy

- 9 Pages

Corporate objectives and strategy

- 14 Pages

Corporate strategy directions

- 3 Pages

Corporate- Level- Strategies

- 4 Pages

3 - Business level strategy

- 3 Pages

Business Level strategy

- 14 Pages

Corporate Diversification Strategy

- 11 Pages

Business level strategy Samsung

- 5 Pages

8 Corporate Strategy Diversification

- 44 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu