8 Corporate Strategy Diversification PDF

| Title | 8 Corporate Strategy Diversification |

|---|---|

| Course | Strategic Business Management |

| Institution | University of Dhaka |

| Pages | 44 |

| File Size | 1.2 MB |

| File Type | |

| Total Downloads | 72 |

| Total Views | 165 |

Summary

study...

Description

CHAPTER 8

Corporate Strategy Diversification and the Multibusiness Company

Learning Objectives

© Roy Scott/Ikon Images/age fotostock

THIS CHAPTER WILL HELP YOU UNDERSTAND:

LO 1

When and how business diversification can enhance shareholder value.

LO 2

How related diversification strategies can produce cross-business strategic fit capable of delivering competitive advantage.

LO 3

The merits and risks of unrelated diversification strategies.

LO 4

The analytic tools for evaluating a company’s diversification strategy.

LO 5

What four main corporate strategy options a diversified company can employ for solidifying its strategy and improving company performance.

The roll of takeovers is to improve unsatisfactory companies and to allow healthy companies to grow strategically by acquisitions. Sir James Goldsmith—Billionaire financier

Fit between a parent and its businesses is a two-edged sword: A good fit can create value; a bad one can destroy it. Andrew Campbell, Michael Goold, and Marcus Alexander—Academics, authors, and consultants

Make winners out of every business in your company. Don’t carry losers. Jack Welch—Legendary CEO of General Electric

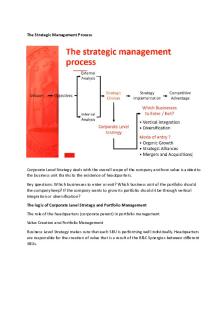

This chapter moves up one level in the strategymaking hierarchy, from strategy making in a single-business enterprise to strategy making in a diversified enterprise. Because a diversified company is a collection of individual businesses, the strategy-making task is more complicated. In a one-business company, managers have to come up with a plan for competing successfully in only a single industry environment—the result is what Chapter 2 labeled as business strategy (or businesslevel strategy). But in a diversified company, the strategy-making challenge involves assessing multiple industry environments and developing a set of business strategies, one for each industry arena in which the diversified company operates. And top executives at a diversified company must still go

one step further and devise a companywide (or corporate) strategy for improving the performance of the company’s overall business lineup and for making a rational whole out of its diversified collection of individual businesses. In the first portion of this chapter, we describe what crafting a diversification strategy entails, when and why diversification makes good strategic sense, the various approaches to diversifying a company’s business lineup, and the pros and cons of related versus unrelated diversification strategies. The second part of the chapter looks at how to evaluate the attractiveness of a diversified company’s business lineup, how to decide whether it has a good diversification strategy, and the strategic options for improving a diversified company’s future performance.

WHAT DOES CRAFTING A DIVERSIFICATION STRATEGY ENTAIL? The task of crafting a diversified company’s overall corporate strategy falls squarely in the lap of top-level executives and involves three distinct facets: 1. Picking new industries to enter and deciding on the means of entry. Pursuing a diversification strategy requires that management decide which new industries to enter and then, for each new industry, whether to enter by starting a new business

216

PART 1

Concepts and Techniques for Crafting and Executing Strategy

from the ground up, by acquiring a company already in the target industry, or by forming a joint venture or strategic alliance with another company. 2. Pursuing opportunities to leverage cross-business value chain relationships, where there is strategic fit, into competitive advantage. The task here is to determine whether there are opportunities to strengthen a diversified company’s businesses by such means as transferring competitively valuable resources and capabilities from one business to another, combining the related value chain activities of different businesses to achieve lower costs, sharing the use of a powerful and wellrespected brand name across multiple businesses, and encouraging knowledge sharing and collaborative activity among the businesses. 3. Initiating actions to boost the combined performance of the corporation’s collection of businesses. Strategic options for improving the corporation’s overall performance include (1) sticking closely with the existing business lineup and pursuing opportunities presented by these businesses, (2) broadening the scope of diversification by entering additional industries, (3) retrenching to a narrower scope of diversification by divesting either poorly performing businesses or those that no longer fit into management’s long-range plans, and (4) broadly restructuring the entire company by divesting some businesses, acquiring others, and reorganizing, to put a whole new face on the company’s business lineup. The demanding and time-consuming nature of these four tasks explains why corporate executives generally refrain from becoming immersed in the details of crafting and executing business-level strategies. Rather, the normal procedure is to delegate lead responsibility for business strategy to the heads of each business, giving them the latitude to develop strategies suited to the particular industry environment in which their business operates and holding them accountable for producing good financial and strategic results.

WHEN TO CONSIDER DIVERSIFYING As long as a company has plentiful opportunities for profitable growth in its present industry, there is no urgency to pursue diversification. But growth opportunities are often limited in mature industries and markets where buyer demand is flat or declining. In addition, changing industry conditions—new technologies, inroads being made by substitute products, fast-shifting buyer preferences, or intensifying competition— can undermine a company’s ability to deliver ongoing gains in revenues and profits. Consider, for example, what the growing use of debit cards and online bill payment has done to the check-printing business and what mobile phone companies and marketers of Voice over Internet Protocol (VoIP) have done to the revenues of longdistance providers such as AT&T, British Telecommunications, and NTT in Japan. Thus, diversifying into new industries always merits strong consideration whenever a single-business company encounters diminishing market opportunities and stagnating sales in its principal business. The decision to diversify presents wide-ranging possibilities. A company can diversify into closely related businesses or into totally unrelated businesses. It can diversify its present revenue and earnings base to a small or major extent. It can move into one or two large new businesses or a greater number of small ones. It can achieve diversification by acquiring an existing company, starting up a new business from

CHAPTER 8

Corporate Strategy

217

scratch, or forming a joint venture with one or more companies to enter new businesses. In every case, however, the decision to diversify must start with a strong economic justification for doing so.

BUILDING SHAREHOLDER VALUE: THE ULTIMATE JUSTIFICATION FOR DIVERSIFYING Diversification must do more for a company than simply spread its business risk across various industries. In principle, diversification cannot be considered wise or justifiable unless it results in added long-term economic value for shareholders— value that shareholders cannot capture on their own by purchasing stock in companies in different industries or investing in mutual funds to spread their investments across several industries. A move to diversify into a new business stands little chance of building shareholder value without passing the following three Tests of Corporate Advantage.1 1. The industry attractiveness test. The industry to be entered through diversification must be structurally attractive (in terms of the five forces), have resource requirements that match those of the parent company, and offer good prospects for growth, profitability, and return on investment. 2. The cost of entry test. The cost of entering the target industry must not be so high as to exceed the potential for good profitability. A catch-22 can prevail here, however. The more attractive an industry’s prospects are for growth and good long-term profitability, the more expensive it can be to enter. Entry barriers for startup companies are likely to be high in attractive industries—if barriers were low, a rush of new entrants would soon erode the potential for high profitability. And buying a well-positioned company in an appealing industry often entails a high acquisition cost that makes passing the cost of entry test less likely. Since the owners of a successful and growing company usually demand a price that reflects their business’s profit prospects, it’s easy for such an acquisition to fail the cost of entry test. 3. The better-off test. Diversifying into a new business must offer potential for the company’s existing businesses and the new business to perform better together under a single corporate umbrella than they would perform operating as independent, stand-alone businesses—an effect known as synergy. For example, let’s say that company A diversifies by purchasing company B in another industry. If A and B’s consolidated profits in the years to come prove no greater than what each could have earned on its own, then A’s diversification won’t provide its shareholders with any added value. Company A’s shareholders could have achieved the same 1 + 1 = 2 result by merely purchasing stock in company B. Diversification does not result in added long-term value for shareholders unless it produces a 1 + 1 = 3 effect, whereby the businesses perform better together as part of the same firm than they could have performed as independent companies. Diversification moves must satisfy all three tests to grow shareholder value over the long term. Diversification moves that can pass only one or two tests are suspect.

LO 1 When and how business diversification can enhance shareholder value.

CORE CONCEPT To add shareholder value, a move to diversify into a new business must pass the three Tests of Corporate Advantage: 1. The industry attractiveness test 2. The cost of entry test 3. The better-off test

CORE CONCEPT Creating added value for shareholders via diversification requires building a multibusiness company in which the whole is greater than the sum of its parts; such 1 + 1 = 3 effects are called synergy.

218

PART 1

Concepts and Techniques for Crafting and Executing Strategy

APPROACHES TO DIVERSIFYING THE BUSINESS LINEUP The means of entering new businesses can take any of three forms: acquisition, internal startup, or joint ventures with other companies.

Diversifying by Acquisition of an Existing Business

CORE CONCEPT An acquisition premium, or control premium, is the amount by which the price offered exceeds the preacquisition market value of the target company.

CORE CONCEPT Corporate venturing (or new venture development) is the process of developing new businesses as an outgrowth of a company’s established business operations. It is also referred to as corporate entrepreneurship or intrapreneurship since it requires entrepreneuriallike qualities within a larger enterprise.

Acquisition is a popular means of diversifying into another industry. Not only is it quicker than trying to launch a new operation, but it also offers an effective way to hurdle such entry barriers as acquiring technological know-how, establishing supplier relationships, achieving scale economies, building brand awareness, and securing adequate distribution. Acquisitions are also commonly employed to access resources and capabilities that are complementary to those of the acquiring firm and that cannot be developed readily internally. Buying an ongoing operation allows the acquirer to move directly to the task of building a strong market position in the target industry, rather than getting bogged down in trying to develop the knowledge, experience, scale of operation, and market reputation necessary for a startup entrant to become an effective competitor. However, acquiring an existing business can prove quite expensive. The costs of acquiring another business include not only the acquisition price but also the costs of performing the due diligence to ascertain the worth of the other company, the costs of negotiating the purchase transaction, and the costs of integrating the business into the diversified company’s portfolio. If the company to be acquired is a successful company, the acquisition price will include a hefty premium over the preacquisition value of the company for the right to control the company. For example, the $28 billion that Berkshire Hathaway and 3G Capital agreed to pay for H. J. Heinz Company in 2014 included a 30 percent premium over its one-year average share price.2 Premiums are paid in order to convince the shareholders and managers of the target company that it is in their financial interests to approve the deal. The average premium paid by U.S. companies was 19 percent in 2013, but it was more often in the 20 to 25 percent range over the last 10 years.3 While acquisitions offer an enticing means for entering a new business, many fail to deliver on their promise.4 Realizing the potential gains from an acquisition requires a successful integration of the acquired company into the culture, systems, and structure of the acquiring firm. This can be a costly and time-consuming operation. Acquisitions can also fail to deliver long-term shareholder value if the acquirer overestimates the potential gains and pays a premium in excess of the realized gains. High integration costs and excessive price premiums are two reasons that an acquisition might fail the cost of entry test. Firms with significant experience in making acquisitions are better able to avoid these types of problems.5

Entering a New Line of Business through Internal Development Achieving diversification through internal development involves starting a new business subsidiary from scratch. Internal development has become an increasingly important way for companies to diversify and is often referred to as corporate venturing or new venture development. Although building a new business from the ground up is generally a time-consuming and uncertain process, it avoids the

CHAPTER 8

Corporate Strategy

pitfalls associated with entry via acquisition and may allow the firm to realize greater profits in the end. It may offer a viable means of entering a new or emerging industry where there are no good acquisition candidates. Entering a new business via internal development, however, poses some significant hurdles. An internal new venture not only has to overcome industry entry barriers but also must invest in new production capacity, develop sources of supply, hire and train employees, build channels of distribution, grow a customer base, and so on, unless the new business is quite similar to the company’s existing business. The risks associated with internal startups can be substantial, and the likelihood of failure is often high. Moreover, the culture, structures, and organizational systems of some companies may impede innovation and make it difficult for corporate entrepreneurship to flourish. Generally, internal development of a new business has appeal only when (1) the parent company already has in-house most of the resources and capabilities it needs to piece together a new business and compete effectively; (2) there is ample time to launch the business; (3) the internal cost of entry is lower than the cost of entry via acquisition; (4) adding new production capacity will not adversely impact the supply– demand balance in the industry; and (5) incumbent firms are likely to be slow or ineffective in responding to a new entrant’s efforts to crack the market.

Using Joint Ventures to Achieve Diversification Entering a new business via a joint venture can be useful in at least three types of situations.6 First, a joint venture is a good vehicle for pursuing an opportunity that is too complex, uneconomical, or risky for one company to pursue alone. Second, joint ventures make sense when the opportunities in a new industry require a broader range of competencies and know-how than a company can marshal on its own. Many of the opportunities in satellite-based telecommunications, biotechnology, and networkbased systems that blend hardware, software, and services call for the coordinated development of complementary innovations and the tackling of an intricate web of financial, technical, political, and regulatory factors simultaneously. In such cases, pooling the resources and competencies of two or more companies is a wiser and less risky way to proceed. Third, companies sometimes use joint ventures to diversify into a new industry when the diversification move entails having operations in a foreign country. However, as discussed in Chapters 6 and 7, partnering with another company has significant drawbacks due to the potential for conflicting objectives, disagreements over how to best operate the venture, culture clashes, and so on. Joint ventures are generally the least durable of the entry options, usually lasting only until the partners decide to go their own ways.

Choosing a Mode of Entry The choice of how best to enter a new business—whether through internal development, acquisition, or joint venture—depends on the answers to four important questions: ∙ Does the company have all of the resources and capabilities it requires to enter the business through internal development, or is it lacking some critical resources? ∙ Are there entry barriers to overcome? ∙ Is speed an important factor in the firm’s chances for successful entry? ∙ Which is the least costly mode of entry, given the company’s objectives?

219

220

PART 1

Concepts and Techniques for Crafting and Executing Strategy

The Question of Critical Resources and Capabilities If a firm has all the resources it needs to start up a new business or will be able to easily purchase or lease any missing resources, it may choose to enter the business via internal development. However, if missing critical resources cannot be easily purchased or leased, a firm wishing to enter a new business must obtain these missing resources through either acquisition or joint venture. Bank of America acquired Merrill Lynch to obtain critical investment banking resources and capabilities that it lacked. The acquisition of these additional capabilities complemented Bank of America’s strengths in corporate banking and opened up new business opportunities for the company. Firms often acquire other companies as a way to enter foreign markets where they lack local marketing knowledge, distribution capabilities, and relationships with local suppliers or customers. McDonald’s acquisition of Burghy, Italy’s only national hamburger chain, offers an example.7 If there are no good acquisition opportunities or if the firm wants to avoid the high cost of acquiring and integrating another firm, it may choose to enter via joint venture. This type of entry mode has the added advantage of spreading the risk of entering a new business, an advantage that is particularly attractive when uncertainty is high. De Beers’s joint venture with the luxury goods company LVMH provided De Beers not only with the complementary marketing capabilities it needed to enter the diamond retailing business but also with a partner to share the risk. The Question of Entry Barriers

The second question to ask is whether entry barriers would prevent a new entrant from gaining a foothold and succeeding in the industry. If entry barriers are low and the industry is populated by small firms, internal development may be the preferred mode of entry. If entry barriers...

Similar Free PDFs

8 Corporate Strategy Diversification

- 44 Pages

Corporate Diversification Strategy

- 11 Pages

Corporate Diversification Strategies

- 10 Pages

Corporate objectives and strategy

- 14 Pages

Corporate strategy directions

- 3 Pages

3. Corporate Level Strategy

- 18 Pages

Riassunto corporate strategy -3

- 1 Pages

Riassunto corporate strategy -17

- 1 Pages

Assignment - Corporate Strategy

- 1 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu