Riassunto corporate strategy -17 PDF

| Title | Riassunto corporate strategy -17 |

|---|---|

| Course | Economia aziendale c.i. |

| Institution | Università degli Studi di Palermo |

| Pages | 1 |

| File Size | 35.9 KB |

| File Type | |

| Total Downloads | 95 |

| Total Views | 146 |

Summary

riassunti di corporate strategy...

Description

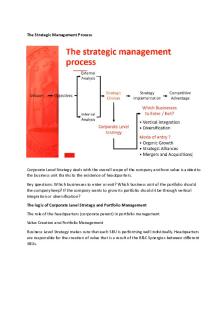

One obvious principle determining whether a firm should perform an activity or compete in a business is whether or not the firm possesses resources that provide a competitive advantage in that activity or business. When the firm's resources generate no unique value in a business, it should not enter that business (look triangle of corporate strategy). This, after all, is why a metal manufacturing company does not compete in the computer industry. The same argument is also true in the choice of vertical scope. Thus, the first determinant of the firm scope is simply whether or not the corporations resources create a competitive advantage in each business or activity. If they do, the firm should consider competing there. If they do not, the firm should not be active in that business unless other compelling reasons require it. Firm expansion (within an industry or across different industries) proceeds along the three dimensions of corporate scope: degree of vertical integration; geographic dimension and product-market combinations. We want to answer to following questions: What are the appropriate boundaries of a particular firm? What factors drive the choice between the market and the hierarchy? What is the best governance structure to exploit a given synergy? What phases compose the decisional process regarding the choice of the firms’ vertical scope? The industry value chain (or vertical industry structure) is the series of connected productive activities that must be carried out in order to pass from a set of raw materials to a specific end product. There are different types of industry value chains: ● Implosive: many materials for one product; ● Explosive: one material for different products; ● Linear: one material for one product, relationship 1:1. Every firm is part of one or more industry’s value chain within which it specializes in carrying out a certain number of connected and interlinked activities. The number of operations decides how integrated the firm is, but is also useful describe the degree of integration of a company in an industry. The firms’ degree of vertical integration is given by the number of operations that the firm carries out with respect to all the operations of the industry’s value chain. Numerically the firm’s degree of vertical integration is given by Iv = VA / VP where: VA = Value added and VP = Value of Production (sales). At the industry level is given by the sum of value added of each activity divided for the sum of value of production of each activity. To express evaluations on the rent generation capacity implications of different degrees of vertical integration, the following must be considered: − the attractiveness of the industries in the value chain; − the way they are positioned in the industry value chain; − the competitive structure of the industries upstream/downstream. Outsourcing and Offshoring are two alternatives firms can rely on instead of integrating vertically. Outsourcing: occurs when an organization hands over part of the value chain it owns to a different firm, while maintaining the number of business it is active in. In contrast, a divestiture occurs when the firm reduces the number of businesses it is active in by completely pulling out of a value chain and ceasing to offer the products from that value chain to the relevant customers....

Similar Free PDFs

Riassunto corporate strategy -17

- 1 Pages

Riassunto corporate strategy -3

- 1 Pages

Corporate objectives and strategy

- 14 Pages

Corporate strategy directions

- 3 Pages

Corporate Diversification Strategy

- 11 Pages

3. Corporate Level Strategy

- 18 Pages

8 Corporate Strategy Diversification

- 44 Pages

Assignment - Corporate Strategy

- 1 Pages

Wk 7 - corporate lvl strategy

- 4 Pages

CH 6 - Corporate Level Strategy

- 9 Pages

Chapter 6 - Corporate-Level Strategy

- 10 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu