Corporate strategy directions PDF

| Title | Corporate strategy directions |

|---|---|

| Author | Ali Shah |

| Course | Global Strategy |

| Institution | Manchester Metropolitan University |

| Pages | 3 |

| File Size | 170.1 KB |

| File Type | |

| Total Downloads | 50 |

| Total Views | 157 |

Summary

chapter 1 ...

Description

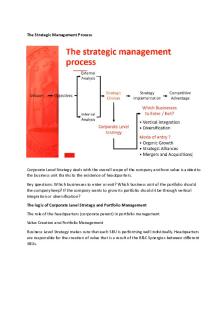

Corporate strategy directions

Diversification involves increasing the range of products or markets served by an organisation. Related diversification involves expanding into products or services with relationships to the existing business. Conglomerate (unrelated) diversification involves diversifying into products or services with no relationships to existing businesses. Market penetration implies increasing share of current markets with the current product range. This strategy: • builds on established strategic capabilities; • means the organisation’s scope is unchanged; • leads to greater market share and increased power vis-à-vis buyers and suppliers; provides greater economies of scale and experience curve benefits

Constraints on market penetration

Consolidation refers to a strategy by which an organisation focuses defensively on their current markets with current products. Retrenchment refers to a strategy of withdrawal from marginal activities in order to concentrate on the most valuable segments and products within their existing business. Product development is where an organisation delivers modified or new products (or services) to existing markets. This strategy: • involves varying degrees of related diversification (in terms of products); • can be expensive and high risk; • may require new resources and strategic capabilities; • typically involves project management risks.

Market development involves offering existing products to new markets. This strategy involves: • new users (e.g. extending the use of aluminium to the automobile industry); • new geographies (e.g. extending the market to new areas – international markets being the most important); • meeting the critical success factors of the market; • new strategic capabilities (e.g. in marketing). Conglomerate (or unrelated) diversification takes the organisation beyond both its existing markets and its existing products and radically increases the organisation’s scope. Potential benefits to an acquired business is that it gains from the reputation of the group and potentially lowers financing costs. Potential costs arise because there are no obvious ways to generate additional value....

Similar Free PDFs

Corporate strategy directions

- 3 Pages

Corporate objectives and strategy

- 14 Pages

Corporate Diversification Strategy

- 11 Pages

3. Corporate Level Strategy

- 18 Pages

8 Corporate Strategy Diversification

- 44 Pages

Riassunto corporate strategy -3

- 1 Pages

Riassunto corporate strategy -17

- 1 Pages

Assignment - Corporate Strategy

- 1 Pages

Wk 7 - corporate lvl strategy

- 4 Pages

CH 6 - Corporate Level Strategy

- 9 Pages

Chapter 6 - Corporate-Level Strategy

- 10 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu