Class #9 Ch 14 Notes Part 3 with solutions PDF

| Title | Class #9 Ch 14 Notes Part 3 with solutions |

|---|---|

| Author | bob sacamano |

| Course | Monsters/Madness 20th C. Film |

| Institution | Dalhousie University |

| Pages | 8 |

| File Size | 506.4 KB |

| File Type | |

| Total Downloads | 60 |

| Total Views | 133 |

Summary

sssssssssssssssssssssssss s sx ss ss c cs csc vss s s s css cs scs c cssc css c css cs ccs cs...

Description

Classes #9 _Oct 8

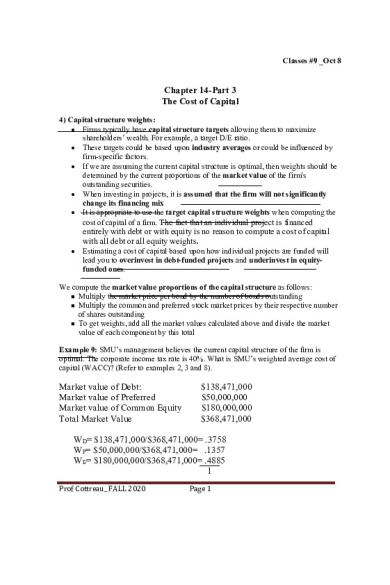

Chapter 14-Part 3 The Cost of Capital 4) Capital structure weights: • Firms typically have capital structure targets allowing them to maximize shareholders’ wealth. For example, a target D/E ratio. • These targets could be based upon industry averages or could be influenced by firm-specific factors. • If we are assuming the current capital structure is optimal, then weights should be determined by the current proportions of the market value of the firm's outstanding securities. • When investing in projects, it is assumed that the firm will not significantly change its financing mix • It is appropriate to use the target capital structure weights when computing the cost of capital of a firm. The fact that an individual project is financed

entirely with debt or with equity is no reason to compute a cost of capital with all debt or all equity weights. •

Estimating a cost of capital based upon how individual projects are funded will lead you to overinvest in debt-funded projects and underinvest in equityfunded ones.

We compute the market value proportions of the capital structure as follows: n Multiply the market price per bond by the number of bonds outstanding n Multiply the common and preferred stock market prices by their respective number of shares outstanding n To get weights, add all the market values calculated above and divide the market value of each component by this total Example 9: SMU’s management believes the current capital structure of the firm is optimal. The corporate income tax rate is 40%. What is SMU’s weighted average cost of capital (WACC)? (Refer to examples 2, 3 and 8).

Market value of Debt: Market value of Preferred Market value of Common Equity Total Market Value

$138,471,000 $50,000,000 $180,000,000 $368,471,000

WD= $138,471,000/$368,471,000= .3758 WP= $50,000,000/$368,471,000= .1357 WE= $180,000,000/$368,471,000= .4885 1 Prof%Cottreau_%FALL%2020%

Page%1%

Cost of Debt RD = 10% Cost of Preferred RP = 12% Cost of Common Re = 13.8% WACC = (.3758)(.10)(1-.40) + (.1357)(.12)+ (.4885)(.138) =.1062 or 10.62% Flotation Costs and NPV • When firms issue new securities, they incur issuance costs. • Underwriting costs, issuing expenses, and sales to the public at a discount reduce the net proceeds the firm receives. • To account for these costs, we compute the weighted average flotation costs (fa) and adjust the total amount of funds needed for the project. Weighted average flotation cost (fA) —sum of all flotation costs as a percent of the amount of security issued, multiplied by the target structure weights.

Step 1: Calculate the weighted average flotation costs: fa = WDfD + WPfP + WEfE , where: WD , W P , WE : are the weights of debt, preferred equity, and common equity, respectively fD, fP, fE: are the flotation costs of debt, preferred equity, and common equity, respectively Step 2: Determine the total amount of funds that are needed to be raised to cover the flotation costs as well as project costs:

Amount raised = Amount needed (1 – fa) Retained earnings component of equity: • While new debt and equity issues would be subject to flotation costs, the retained earnings component of equity would not. • Whenever external financing is used, there is an additional flotation cost associated with that financing, and that cost is a relevant cash outflow for capital budgeting purposes *Note, fe will be zero if the firm is using internally generated common equity. **To simplify things, we are assuming that flotation costs are expensed. Example 10: West Minster Properties is considering a project which has an initial start up cost of $840,000. The firm maintains a debt-equity ratio of .60. The flotation cost of debt is 8

Prof%Cottreau_%FALL%2020%

Page%2%

percent and the flotation cost of equity is 13 percent. The firm has sufficient internally generated equity to cover the equity cost of this project. (Ignore taxes) a) What is the initial cost of the project including the flotation costs?

Solution: Flotation(Costs(for(Debt(=(8%( Flotation(Costs(for(new(Common(=(13%( Since(the(firm(has(sufficient(internal(equity(available(to(finance(the( project,(they(will(not(have(to(issue(new(common(shares.( The(market(value(weights(are:(( ( D/E(=(.6( Therefore(when(Debt(=(.60(Equity(=(1( Wd(=(.6/(1.6( =(.375( ( We(=(1/1.6=.625( ( Weighted(average(flotation(cost( (fA)(=(.375(8%)(+(.625((0%)(=(3%((( Total Amount raised = Amount needed (1 – fa)

$840,000/(1-.03)= $865,979.38

b) What is the initial cost of the project including the flotation costs if there are no internally generated funds available?

c) Solution: f A = WD f D + WP f P + WE f E Amount needed = (1- f A )( Amount Raised)

Weighted(average(flotation(cost( ( (fA)(=(.375(8%)(+(.625((13%)(=(11.125%((( Total Amount raised = Amount needed Prof%Cottreau_%FALL%2020%

Page%3%

(1 – fa)

$840,000/(1-.11125)= $945,147.68

Example 11: Suppose Green Gables Inc. is considering opening another office. The expansion will cost $50,000 and is expected to generate after-tax cash flows of $10,000 per year in perpetuity. The firm has a target debt/equity ratio of .50. New equity has a flotation cost of 10% and a required return of 15%, while new debt costs 5% to issue and has a required return of 10%. The firm has a tax rate of 34%. Assume this project will not alter the risk of the firm, flotation costs are expensed, and the firm does not have enough internally generated funds to finance the equity portion of the project. a. Calculate the WACC

Solution: (D/E(=(.5( Therefore,(when(Debt(=(.50(Equity(=(1( WD= .5/1.5= .3333 WE= 1/1.5= .6667 1 Cost of Debt RD = 10% Cost of Common Re = 15% WACC = (.3333)(.10)(1-.34) + (.6667)(.15) =.122 or 12.2%

b.

Calculate the weighted average flotation costs

Solution: Flotation(Costs(for(Debt(=(5%( Flotation(Costs(for(new(Common(=(10%( ( Weighted(average(flotation(cost( (fA)(=(.3333(5%)(+(.6667((10%)(=(8.33%((( c. Calculate the NPV of the project. Prof%Cottreau_%FALL%2020%

Page%4%

Solution: Net Present Value of the project: Step 1: Initial investment: Cost of the asset

-$50,000

Flotation Costs: Total Amount raised = Amount needed (1 – fa)

$50,000/(1-.0833)= $54,543.47 Flotation Costs = $54,543.47 - $50,000 =$4,543.47 After- tax flotation costs = $4,543.47(1-.34) = Total initial investment

Alternative Solution: Step 1: Initial investment: Cost of the asset Flotation Costs:

-2,998.69 -$52,998.69

-$50,000

$50,000/(1-.0833)= $54,543.47 Flotation Costs = $54,543.47 - $50,000 Tax Shield from amortizing F/C =$4,543.47 x 34% = Total initial investment Step 2: Present Value of After-tax cash flows $10,000/.122 = 81,967.21

-$4,543.47 + 1,544.78 -$52,998.69

Step 3: NPV = -$52,998.69+ $81,967.21 = $28,968.52

Example 12: Osprey Inc. currently has $15,000,000 in bonds outstanding with a coupon rate of 5.5% (semi-annual payments) and 10 years to maturity. The bonds are currently selling at a quoted price of 92. The company also has 12,000 shares of 5 percent preferred stock outstanding ($100 par), currently selling for $93 per share. In addition, the company has 350,000 common shares outstanding, selling for $55 per share. The firm has a tax rate of Prof%Cottreau_%FALL%2020%

Page%5%

35% and a beta of 1.25. You have observed the following from the market: an 8 % market risk premium and 4.5% risk-free rate. Flotation cost to issue new preferred share is 5%, new debt is 3%, and new common share is 7%. The firm has sufficient internally generated funds available. a) Calculate the discount rate the firm should use to evaluate projects with the same level of risk as the firm.

Solution: Market Value of Debt = $15,000,000 (0.92) = $13,800,000 Note: We also could have determined the number of bonds outstanding x price per bond $15,000,000 x $920 = $13,800,000 $1000 Market Value of Preferred = 12,000($93) = $1,116,000 Market Value of Common= 350,000($55) = $19,250,000 And the total market value of the firm is: V = $13,800,000+ $1,116,000+ $19,250,000 = $34,166,000 WD= $13,800,000/$34,166,000 = .4039 WP= $1,116,000/$34,166,000 = .03266 WE= $19,250,000/$34,166,000 = .5634 1 Cost of Debt( RD) : Market price per bond (MV) = 92%(1,000) = $920 C = 5.5%(1,000)/2 = $27.50 T = 10 years x 2 = 20 periods to maturity FV = $1,000 é ($1, 000 - $920)ù YTM approx

ê $27.50 + 20 ë = é 920 +1,000 ù êë úû 2

ú û

=

$31.50 = 3.28125% 960

RD (Before tax cost of debt) = 3.28125% x 2 = 6.5625% (with a financial calculator…answer is 3.303%x2 = 6.606%) Cost of preferred stock ( RP) Dps = 5%($100) = $5 Market price of preferred stock = $93 RP = $5/$93 = .0538 or 5.38% Cost of common equity ( RE) Prof%Cottreau_%FALL%2020%

Page%6%

E (Ri ) = R f + ëé E (RM ) - R f ûù ´ b i

RE = 4.5% + 1.25(8%) = .1450 or 14.50% WACC = (.4039)(.065625)(1-.35) + (.03266)(.0538)+ (.5634)(.145) =(.4039)(.04265625) + (.03266)(.0538)+ (.5634)(.145) = .0172289 + .0017571+ .081693 = .10068 or 10.068% b) Osprey Inc. is considering purchasing a new machine that will cost $550,000 plus an additional $125,000 in installation costs. Management expects to make an initial investment in working capital of $110,000, which will be recovered at the end of the economic life of the project. Assume flotation costs are expensed. What is the total initial investment for this project?

Solution: Step 1: Determine the weighted average flotation costs: Flotation(Costs(for(Debt(=(3%( Flotation(Costs(for(Preferred(=(5%( Flotation(Costs(for(new(Common(=(7%( Since(the(firm(has(sufficient(funds(available(from(internal(funds(to( finance(the(project,(they(will(not(have(to(issue(new(common(shares.( Using(the(market(value(weights(calculated(above:( ( Weighted(average(flotation(cost( (fA)(=(.4039(3%)(+(.03266(5%)(+(.5634((0%)(=(1.375%((( Step 2: Initial Investment = Cost of equipment Installation Costs Working capital Incremental capital cost

-$550,000 -125,000 -110,000 -$785,000

Flotation costs: Total Amount raised = Amount needed (1 – fa)

$785,000/(1-.01375)= $795,944.23 Prof%Cottreau_%FALL%2020%

Page%7%

=$795,944.23 - $785,000 = $10,944.23 After tax flotation costs = $10,944.23 (1-.35) = -$7,113.75 Total initial investment -$792,113.75 Alternative solution: Flotation costs = Tax shield = $10,944.23x35% = Net Flotation Costs

Prof%Cottreau_%FALL%2020%

-$10,944.23 +3,830.48 - $7,113.75

Page%8%...

Similar Free PDFs

Chapter 9 (Part 1) - Class Notes

- 6 Pages

Ch.3 Class Notes - Lecture note 3

- 20 Pages

Ch 9 solutions

- 35 Pages

Ch 14 Part Solution - P14

- 1 Pages

Chapter 14 - class notes

- 4 Pages

Chapter 14 class notes

- 15 Pages

9:11 Class Notes

- 2 Pages

Ch. 14 Notes

- 5 Pages

Ch 14 notes

- 3 Pages

Micro Chp. 3 class notes 9 13

- 5 Pages

Chapter 9 - class notes

- 7 Pages

Chapter 9 Class Notes

- 2 Pages

Ch 9 - Ch 9 Chapter Notes

- 23 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu