CONCEPTUAL FRAMEWORK Chapters 29-40 Problems PDF

| Title | CONCEPTUAL FRAMEWORK Chapters 29-40 Problems |

|---|---|

| Author | Yparraguirre, Carmel M. |

| Course | BS Accountancy |

| Institution | Misamis University |

| Pages | 43 |

| File Size | 2 MB |

| File Type | |

| Total Downloads | 691 |

| Total Views | 944 |

Summary

St. Paul University System8400 Surigao City, PhilippinesCARMEL M. YPARRAGUIRRE Myka Bianca G. Logronio, CPABSA – 202 Conceptual Framework and Accounting StandardsCHAPTER 33DISCONTINUED OPERATIONPROBLEMSProblem 33-1 (IFRS) On September 30, 2020, when the carrying amount of the net assets of a busines...

Description

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

CARMEL M. YPARRAGUIRRE Myka Bianca G. Logronio, CPA BSA – 202 Conceptual Framework and Accounting Standards

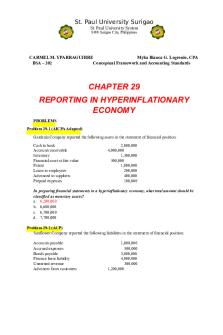

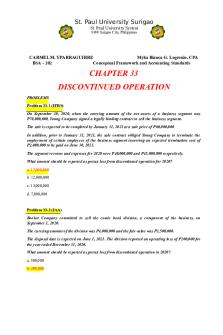

CHAPTER 33 DISCONTINUED OPERATION PROBLEMS Problem 33-1 (IFRS) On September 30, 2020, when the carrying amount of the net assets of a business segment was P70,000,000, Young Company signed a legally binding contract to sell the business segment. The sale is expected to be completed by January 31, 2021 at a sale price of P60,000,000 In addition, prior to January 31, 2021, the sale contract obliged Young Company to terminate the employment of certain employees of the business segment incurring an expected termination cost of P2,000,000 to be paid on June 30, 2021. The segment revenue and expenses for 2020 were P40,000,000 and P45,000,000 respectively. What amount should be reported as pretax loss from discontinued operation for 2020? a. 17,000,000 b. 12,000,000 c. 15,000,000 d. 7,000,000

Problem 33-2 (IAA) Booker Company committed to sell the comic book division, a component of the business, on September 1, 2020. The carrying amount of the division was P4,000,000 and the fair value was P3,500,000. The disposal date is expected on June 1, 2021. The division reported an operating loss of P200,000 for the year ended December 31, 2020. What amount should be reported as pretax loss from discontinued operation in 2020? a. 500,000 b. 200,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

c. 700,000 d. 0. Problem 33-3 (IFRS) Zebra Company is a diversified entity with nationwide interests in commercial real estate development, banking, mining and food distribution. The food distribution division was deemed to be inconsistent with the long-term direction of the entity. On October 1, 2020 the board of directors voted to approve the disposal of this division. The sale is expected to occur in August 2021. The food distribution had revenue of P35,000,000 and expenses of P27,000,000 for the period January 1 to September 30, and revenue of P15,000,000 and expenses of P10,000,000 for the period October 1 to December 31. The carrying amount of the division's net assets on December 31, 2020 was P55,000,000 and the fair value less cost of disposal was P60,000,000. The sale contract required Zebra to terminate certain employees incurring an expected termination cost of P4,000,000 to be paid by December 15, 2021. The income tax rate is 30%. What amount should be reported as income from discontinued operation for 2020?

a. 7,700,000 b. 8,300,000 c. 9,000,000 d. 6,300,000 Problem 33-4 (IAA) Enron Company decided on August 1, 2020 to dispose of a component of business. The component was sold on November 30, 2020. The net income for the current year included income of P5,000,000 from operating the discontinued segment from January 1 to the date of disposal. The entity incurred a loss on the November 30 sale of P1,000,000. What amount should be reported as pretax income or loss from discontinued operation for 2020?

a. 1,000,000 loss b. 5,000,000 income

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

c. 4,000,000 loss d. 4,000,000 income Problem 33-5 (AICPA Adapted) On December 31, 2020, Max Company committed to a plan to discontinue the operations of Underwear Division The fair value of the facilities was P1,000,000 less than carrying amount on December 31, 2020. The division was actually sold for P1,200,000 less than carrying amount in 2021 The division's operating loss for 2020 was P2,000,000. The entity estimated that the division's operating loss for 2021 would be P500,000. What amount should be reported as pretax loss from discontinued operation in 2020? a 3,000,000 b. 2,000,000 c. 1,000,000 d. 3,200,000 Problem 33-6 (IAA) Vernon Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components. The farm equipment component had been unprofitable and on September 1, 2020, the entity adopted a plan to sell the assets of the division. The actual sale was effected on December 15, 2020 at a price of P3,000,000. The carrying amount of the division's assets was P5,000,000. The farm equipment division incurred before tax operating loss of P1,500,000 from the beginning of the year through December 15, 2020. The entity's after-tax income from continuing operations is P9,000,000. The income tax rate is 30%. What amount should be reported as net income for the current year? a. 5,500,000 b. 6,550,000 c. 6,300,000 d. 7,600,000 Problem 33-7 Multiple choice (IFRS) 1. Which criterion does not have to be met in order for an operation to be classified as discontinued?

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

a. The operation shall represent a separate major line of business or geographical area b. The operation is part of a single plan to dispose of a separate major line of business or geographical area c. The operation is a subsidiary acquired exclusively with a view to resale. d. The operation must be sold within three months after the end of reporting period. 2. What is the presentation of the results from discontinued operation in the income statement? a. The entity shall disclose a single amount on the face of the income statement below the income from continuing operations. b. The amounts from discontinued operations shall be broken down over each category of revenue and expense. c. Discontinued operations shall be shown as a movement on retained earnings. d. Discontinued operations shall be shown as a line item after gross income with the related tax being shown as part of income tax expense. 3. Which statement is incorrect concerning the presentation of the discontinued operation in the statement of financial position? a. Assets of the component held for sale are presented separately under current assets. b. Assets of the component held for sale are measured at the lower between fair value less cost of disposal and carrying amount. c. Liabilities of the component held for sale are presented separately under current liabilities. d. Depreciable assets of the component held for sale shall be depreciated. 4. Which is not required for the results of a component of an entity to be classified as discontinued operations? a. Management must have entered into a sale agreement. b. The component is available for immediate sale. c. The operations and cash flows of the component shall be eliminated from the operations of the entity as a result of the disposal. d. The entity shall not have any significant continuing involvement in the operations of the component after disposal. 5. An entity manufactures and sells household products. The entity experienced losses associated with the small appliance group. Operations and cash flows for this group can be clearly distinguished from the rest of the entity's operations. The entity decided to sell the small appliance group.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

What is the earliest point at which the entity shall report the small appliance group as a discontinued operation? a. When the entity classifies it as held for sale, b. When the entity receives an offer for the segment. c. When the entity first sells any of the assets of the segment. d. When the entity sells the majority of the assets of the segment. Problem 33-8 Multiple choice (AICPA Adapted) 1.When a component of an entity was discontinued during the year, the loss on discontinued operation should. a. Exclude the associated employee relocation cost. b. Exclude operating loss for the period с. Include associated employee termination cost. d. Exclude associated lease cancelation cost. 2. When an entity decided to sell a business component, the gain on the disposal should be a. Presented as other income b. Presented as an adjustment to retained earnings c. Netted against the loss from operations of the component as a part of discontinued operations. d. Included in other comprehensive income

3. When a component of a business has been discontinued during the year, the loss on discontinued operations should a. Include operating loss of the current period b. Exclude operating loss during the period c. Be classified an extraordinary item. d. Be classified an operating item. 4. When a component of a business has been discontinued during the year, the operating loss of the component for the current year should be included in a. Income statement as part of revenue and expenses. b. Income statement as part of the loss on the discontinued operation.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

c. Income from continuing operations d. Retained earnings 5. When an entity discontinued an operation, the transaction should be reported as a. A prior period error b. Other income and expense item c. An amount after income from continuing operations and before net income d. Bulk sale of assets included in income from continuing operations.

CHAPTER 34 EXPLORATION AND EVALUATION OF MINERAL RESOURCES PROBLEMS Problem 34-1 (IFRS) Harriet Company is involved in the exploration for mineral rights. During the current year, the entity incurred the following expenditures: Exploratory drilling for minerals on site 2,000,000 Roads and infrastructure to access exploration site

3,500,000

Expenditures relating to the subsequent development of the resources What amount should be initially recognized as exploration asset? a. 2,000,000 b. 5,400,000 c. 5,500,000 d. 8,900,000

Problem 34-2 (IFRS)

3,400,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

Samantha Company is involved in the exploration for mineral resources. The accounting policy is to recognize exploration asset initially at cost. At the end of the current year, the following amounts were extracted from the financial statements: Trenching and sampling expenditure 1,000,000 Drilling rigs used for exploration, carrying amount Drilling rigs used for exploration, depreciation expense

2,000,000 300,000

What amount of intangible exploration asset should be recognized in the statement of financial position? a. 1,000,000 b. 1,300,000 c. 3,000,000 d. 0 Problem 34-3 (IFRS) During the current year, Longhorn Company incurred P5,000,000 in exploration cost for each of 20 oil wells drilled in the current year in West Mindanao. Of the 20 wells drilled, 14 were dry holes. The entity used the successful effort method of accounting. None of the oil found is depleted in the current year. What oil exploration expense should be reported in the income statement for the current year? a. 50,000,000 b. 30,000,000 c. 70,000,000 d. 0 Problem 34-4 (IFRS) During the current year, Prospect Company incurred P4,000,000 in exploration cost of 15 oil wells drilled in the current year. Of the 15 wells drilled, 10 were dry holes. The entity used the successful effort method of accounting. The entity depleted 30% of the oil discovered in the current year What amount of exploration cost would remain in the year-end statement of financial position? a. 42,000,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

b. 14,000,000 c. 20,000,000 d. 6,000,00 Problem 34-5 Multiple choice (IFRS) 1. Exploration and evaluation expenditures are incurred a. When searching for an area that may warrant detailed exploration even though the entity has not yet obtained the legal rights to explore a specific area. b. When the legal right to explore a specific area has been obtained but the technical feasibility and commercial viability of extracting a mineral resource are not yet demonstrable. c. When a specific area is being developed and preparations for commercial extraction are being made. d. In extracting mineral resource and processing the resource to make it marketable or transportable. 2. When is an entity required to recognize exploration and evaluation expenditure as an asset? a. When such expenditure is recoverable in future periods. b. When the technical feasibility and commercial viability of extracting the associated mineral resource have been demonstrated. c. when required by the entity's accounting policy for recognizing exploration and evaluation asset. d. Such expenditure is always expensed as incurred. 3. Which of the following expenditures would never qualify as an exploration and evaluation asset? a. Expenditure for acquisition of right to explore b. Expenditure for exploratory drilling c. Expenditures related to the development of mineral resource. d. Expenditures for activities in relation to evaluating the technical feasibility and commercial viability of extracting a mineral resource. 4. Which measurement model applies to exploration and evaluation asset subsequent to initial recognition? a. Cost model b. Revaluation model c. Cost model and revaluation model d. Recoverable amount model 5. Which type of expenditure is included in exploration and evaluation of mineral resources?

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

a. The extraction and processing of mineral resource for transport to market. b. The commercial review of possible areas for mineral extraction before bidding for the legal right to explore a specific area. c. The expenditure incurred after the technical feasibility and commercial viability of extracting a mineral resource are demonstrable. d. None of these should be included in exploration and evaluation expenditures.

Chapter 35 OPERATING SEGMENTS PROBLEMS Problem 35-1 (ACP) Aroma Company and its divisions are engaged solely in manufacturing operations. The entity reported the following segment profit (Loss) for the current year:

V

3,400,000

W

1,000,000

X

(2,000,000)

Y

400,000

Z

(200,000) 2,600,000

In the segment information for the current year, what are the reportable segments? a. V, W, X and Y b. V, W and X c. V and W d. V, W, X, Y and Z

Problem 35-2 (AICPA Adapted) Correy Company and its divisions are engaged solely in manufacturing operations.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

The following data pertain to the industries in which operations were conducted for the current year: Industry

Revenue

Profit 1,750,000

Assets

A

10, 000, 000

20,000,000

B

8,000,000

1,400,000

17,500,000

C

6,000,000

1,200,000

12,5000,000

D

3,000,000

550,000

7,500.000

E

4, 250,000

675,000

7,000,000

F

1,500,000

225,000

3,000,000

32,750,000

5,800,000

67,500,000

How many reportable segments does Correy have? a. Three b. Four c. Five d. Six Problem 35-3 (AICPA Adapted)

Aria Company and its divisions provided the following information for the current year: Sales to unaffiliated customers

20,000,000

Intersegment sales of products similar to those sold to unaffiliated customers Interest earned on loans to other operating segments

6,000,000 4,000,000

Aria Company and all of its divisions are engaged solely in manufacturing operations What is the minimum amount of segment revenue in order that a division can be considered a reportable segment? a 3,000,000 b. 2,600,000 c. 2,400,000 d. 2,000,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

Problem 35-4 (AICPA Adapted) In the income statement for the current year, Grum Company reported revenue P50,000,000, excluding intersegment sales P10,000,000, expenses P47,000,000 and net income P3,000,000. Expenses included payroll costs of P15,000,000 The combined identifiable assets of all operating segments at year-end totaled P40,000,000. 1. The entity should disclose major customer data if sales revenue to any single customer is at least what amount? a 5,000,000 b. 4,000,000 c. 6,000,000 d. 4,700,000 2. External revenue of reportable operating segments must be what amount? a. 22,500,000 b. 30,000,000 c. 33,750,000 d. 37,500,000 Problem 35-5 Multiple choice (PFRS 8) 1. If a financial report contains both the consolidated financial statements of a parent and the parent's separate financial statements, segment information is required in a. The separate financial statements only b. The consolidated financial statements only c. Both the separate and consolidated financial d. Neither the separate nor the consolidated financial statements. 2. An operating segment is a component of an entity. a. That engages in business activities from which it may earn revenue and incur expenses. b. Whose operating results are regularly reviewed by the entity's chief operating decision maker. c. For which discrete information is available. d. All of these characterize an operating segment.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

3. Which quantitative threshold is not a requirement in qualifying a reportable segment? a. The segment revenue, both external and internal, is 10% or more of the combined external and internal revenue of all operating segments. b. The segment profit or loss is 10% or more of the greater between the combined profit of profitable segments and combined loss of unprofitable segments. c. The segment assets are 10% or more of the combined assets of all operating segments. d. The segment assets are 20% or more of the combined assets of all operating segments. 4. An operating segment is considered reportable when any of the following conditions is met, except a. Segment revenue is 10% or more of the combined revenue of all segments b. Segment assets are 10% or more of the combined assets of all segments. c. Segment liabilities are 10% or more of the combined liabilities of all segments. d. Segment profit or loss is 10% or more of the combined profit of all segments that did not incur a loss. 5. Operating segments that do not meet any of the quantitative thresholds a. Cannot be considered reportable. b. Maybe considered reportable and separately disclosed if management believes that information about the segment would be useful to the statement users. c. May be considered reportable and separately disclosed if the information is for internal use only. d. May be considered reportable and separately disclosed if this is the practice within the economic environment, 6. Which statement is true concerning the 75% overall size test for reportable segments? a. The total external and internal revenue of all reportable segments is 75% or more of the entity's external revenue. b. The total external revenue of all reportable segments is 75% or more of the entity's external and internal revenue. c. The total external revenue of all reportable segments is 75% or more of the entity's external revenue. d. The total internal revenue of all reportable segments is 75% or more of the entity's internal revenue. 7. The term chief operating decision maker a. Refers to a manager with a specific title.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

b. Must be disclosed by title in the financial reporting for segments. c. Must be described in the disclosures for the financial reporting for segments. d. Refers to a function of allocating resources to the operating segments and assessing their performance. 8. Which statement is not true with respect to a chief operating decision maker? a...

Similar Free PDFs

Conceptual Framework

- 28 Pages

conceptual framework

- 4 Pages

Conceptual Framework

- 231 Pages

Conceptual Framework

- 2 Pages

Conceptual Framework

- 61 Pages

Conceptual Framework

- 6 Pages

Conceptual Framework

- 6 Pages

Conceptual Framework answer key

- 3 Pages

IASB - Conceptual Framework

- 5 Pages

Conceptual framework solutions

- 9 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu