CONCEPTUAL FRAMEWORK. Chapters 33-36 Problems PDF

| Title | CONCEPTUAL FRAMEWORK. Chapters 33-36 Problems |

|---|---|

| Author | Yparraguirre, Carmel M. |

| Course | BS Accountancy |

| Institution | Misamis University |

| Pages | 38 |

| File Size | 1.5 MB |

| File Type | |

| Total Downloads | 496 |

| Total Views | 842 |

Summary

St. Paul University System8400 Surigao City, PhilippinesCARMEL M. YPARRAGUIRRE Myka Bianca G. Logronio, CPABSA – 202 Conceptual Framework and Accounting StandardsCHAPTER 29REPORTING IN HYPERINFLATIONARYECONOMYPROBLEMSProblem 29-1 (AICPA Adapted)Gardenia Company reported the following assets in the s...

Description

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

CARMEL M. YPARRAGUIRRE Myka Bianca G. Logronio, CPA BSA – 202 Conceptual Framework and Accounting Standards

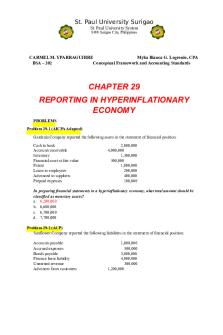

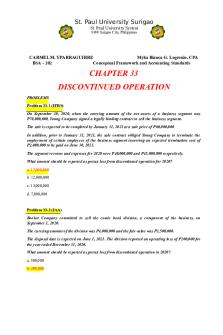

CHAPTER 29 REPORTING IN HYPERINFLATIONARY ECONOMY PROBLEMS Problem 29-1 (AICPA Adapted) Gardenia Company reported the following assets in the statement of financial position: Cash in bank Accounts receivable Inventory Financial asset at fair value Patent Loans to employees Advanced to suppliers Prepaid expenses

2,000,000 4,000,000 1,500,000 500,000 1,000,000 200,000 400,000 100,000

In preparing financial statements in a hyperinflationary economy, what total amount should be classified as monetary assets? a. 6,200,000 b. 6,600,000 c. 6,700,000 d. 7,700,000 Problem 29-2 (ACP) Sunflower Company reported the following liabilities in the statement of financial position: Accounts payable Accrued expenses Bonds payable Finance lease liability Unearned revenue Advances from customers

1,000,000 500,000 3,000,000 4,000,000 300,000 1,200,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

Estimated warranty liability Deferred tax liability

200,000 400,000

In preparing financial statements in a hyperinflationary economy, what total amount should be classified as monetary liabilities? a. 4,500,000 b. 8,500,000 c. 9,700,000 d. 8,900,000 Problem 29-3 (AICPA Adapted) Dahlia Company was formed on January 1, 2014. Selected balances from historical cost statement of financial position on December 31, 2020 were: Land purchased on January 2014 Investment in long-term bonds purchased on January 1, 2017 Long term debt issued on January 1, 2014

2,400,000 1,200,000 1,600,000

The general price index was 120 on January 1, 2014, 150 on January 1, 2017 and 300 on December 31, 2020. 1. What amount should be reported in a hyperinflationary statement of financial position for land? a. 2,400,000 b. 6,000,000 c. 4,800,000 d. 3,000,000 2. What amount should be reported in a hyperinflationary statement of financial position for investment in bonds? a. 3,000,000 b. 2,400,000 c. 1,200,000 d. 1,500,000 3. What amount should be reported in a hyperinflationary statement of financial position for a long-term debt? a. 4,000,000 b. 3,200,000 c. 2,000,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

d. 1,600,000 Problem 29-4 (IFRS) Veranus Company provided the following information on December 31, 2020: Property, plant and equipment Inventory Cash Share capital issued December 31, 2016 Noncurrent liabilities Current liabilities Retained earnings

900,000 2,700,000 350,000 400,000 500,000 700,000 2,350,000

The index numbers on December 31 are 2016 – 100, 2017 -130, 2018 – 150, 2019 – 240 and 2020 – 300. The property, plant and equipment were purchased on December 31, 2018. The noncurrent liabilities were loans raised December 31, 2019. 1. What is the amount of total assets after restatement for hyperinflation? a. 5,150,000 b. 3,950,000 c. 4,800,000 d. 4,850,000 2. What is the amount of total liabilities after restatement for hyperinflation? a. 2,400,000 b. 1,200,000 c. 1,325,000 d. 1,500,000 3. What is the balance of retained earnings after adjusting for hyperinflation? a. 2,350,000 b. 2,750,000 c. 3,550,000 d. 2,625,000 Problem 29-5 (AICPA Adapted) Mariposa Company reported the following property, plant and equipment on December 31, 2020: Year acquired Percent depreciated Cost Index number

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

2018 2019 2020

30 20 10

3,000,000 2,000,000 1,000,000

100 125 300

Depreciation is calculated at 10% straight line. A full year depreciation is charged in the year of acquisition and no depreciation in the year of disposal. There were no disposals in 2020. What amount of depreciation should be included in the 2020 income statement adjusted for hyperinflation? a.1, 480,000 b. 1,800,000 c. 1,620,000 d. 600,000 Problem 29-6 (AICPA Adapted) Acacia Company reported the following machinery on December 31, 2020: Cost Accumulated depreciation Acquired in December 2017 4,000,000 1,600,000 Acquired in December 2019 1,000,000 200,000

Carrying amount 2,400,000 800,000

Index numbers at the end of each year are 120 for 2017, 125 for 2019 and 350 for 2020. The machinery acquired in December 2017 was sold for ₱4,000,000. 1. What is the total carrying amount of machinery before disposal on December 31, 2020 adjusted for hyperinflation? a. 8,960,000 b. 7,800,000 c. 9,240,000 d. 3,200,000

2. What amount should be recorded as gain or loss on sale of machinery on December 31, 2020 adjusted for hyperinflation? a. 3,000,000 gain b. 3,000,000 loss c. 1,600,000 gain d. 1,600,000 loss Problem 29-7 Multiple choice (IFRS)

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

1. Hyperinflation is indicated by all of the following , except a. The general population prefers to keep wealth in nonmonetary assets. b. Interest rates, wages and prices are linked to a price index. c. The cumulative inflation rate over three years is approaching or exceeds 100%. d. All of these indicate hyperinflation 2. All would indicate that hyperinflation exists, except a. The general population regards monetary amounts in terms of relatively stable foreign currency. b. The cumulative inflation rate over three years is approaching, or exceeds 100%. c. Inflation rates have exceeded interest rates in three successive years. d. The general population prefers to keep wealth in nonmonetary assets. 3. In a hyperinflationary economy, monetary items a. Are not restated because they are already expressed in terms of the measuring unit current at ear-end. b. Are not restated. c. Are restated applying the general price index. d. Are restated applying the specific price index. 4. Which would indicate that hyperinflation exists? a. Sales on credit are at lower prices than cash sales. b. Inflation is approaching or exceeds 20% per year. c. Monetary items do not increase in value. d. People prefer to keep their wealth in nonmonetary assets or a stable foreign currency. 5. An entity that wishes to present information about the effect of changing prices in a hyperinflationary economy should report this information in a. The body of the financial statements b. The notes to financial statements c. Supplementary information to the financial statements d. Management report 6. For purposes of adjusting financial statements for changes in the general price level, monetary items consist of a. Assets and liabilities whose amounts are fixed by contract in terms of pesos. b. Assets and liabilities classified as current. c. Cash and cash equivalents plus all receivables with a fixed maturity date. d. Cash, other assets expected to be converted into cash, and current liabilities.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

7. All of the following are monetary items, except a. Trade payables b. Trade receivables c. Administration costs paid in cash d. Loan repayable at face amount 8. The financial statements of an entity that report in the currency of a hyperinflationary economy shall be stated in terms of a. Historical costs b. Current cost c. Fair value d. Measuring unit current at the end of reporting period. 9. The gain or loss on purchasing power in a hyperinflationary economy shall be included in a. Profit or loss and separately disclosed b. Retained earnings c. Equity d. Comprehensive income 10. In a hyperinflationary economy, amounts not expressed in the measuring unit current at the end of reporting period are restated by applying the a. General price index b. Specific price index c. Both general price index and specific price index d. Either general price index or specific price index Problem 29-8 Multiple choice (AICPA Adapted) 1. When computing information on a constant peso basis, which of the following is classified as nonmonetary? a. Allowance for doubtful accounts b. Accumulated depreciation – equipment c. Unamortized premium on bonds payable d. Advances to unconsolidated subsidiaries 2. When computing information on a constant peso basis, which of the following is classified as nonmonetary? a. Estimated warranty liability b. Accrued expenses c. Unamortized discount on bonds payable

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

d. Refundable deposit 3. When computing information on a constant peso basis, which of the following is classified as nonmonetary? a. Cash surrender value b. Long-term receivables c. Accrued loss on firm purchase commitment d. Inventory 4. When computing information on a constant peso basis, which of the following is classified as monetary? a. Goodwill b. Equipment c. Patent d. Allowance for doubtful accounts 5. Purchasing power gain or loss results from a. Monetary asset b. Monetary liability c. Monetary asset and monetary liability d. Nonmonetary asset and nonmonetary liability 6. During a period of inflation, an account balance remains constant. With respect to this account, a purchasing power loss will be recognized if the account is a a. Monetary asset b. Monetary liability c. Nonmonetary asset d. Nonmonetary liability 7. During a period of deflation, an entity would have the greatest gain in general purchasing power by holding a. Cash b. Property, plant and equipment c. Accounts payable d. Mortgage payable

8. During a period of deflation in which a liability account balance remains constant, which of the following occurs? a. A purchasing power loss if the item is a nonmonetary liability.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

b. A purchasing power gain if the item is a nonmonetary liability. c. A purchasing power loss if the item is a monetary liability. d. A purchasing power gain if the item is a monetary liability. 9. During a period of inflation in which a liability account balance remains constant, which of the following occurs? a. A purchasing power loss if the item is a nonmonetary liability. b. A purchasing power gain if the item is a nonmonetary liability. c. A purchasing power loss if the item is a monetary liability. d. A purchasing power gain if the item is a monetary liability. 10. During a period of inflation, an account balance remains constant. With respect to this account, a purchasing power gain is recognized if the account is a a. Monetary liability b. Monetary asset c. Nonmonetary liability d. Nonmonetary asset

CHAPTER 30 FIRST TIME ADOPTION OF PFRS Problem 30-1 Multiple choice (IFRS) 1. This is defined as the first annual financial statements in which an entity adopts PFRS by an explicit and unreserved statement of compliance with PFRS. a. PFRS financial statements b. First PFRS financial statements c. Opening PFRS statement of financial position d. First audited financial statements

2. An entity that presents first annual financial statements that conform with PFRS is known as a. An originating entity b. A provisional presenter c. A first time adopter

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

d. An initial reporter

3. What is the date of transition to PFRS? a. The beginning of the latest period in the most recent annual financial statements under previous GAAP b. The end of the latest period in the most recent annual financial statements under previous GAAP c. The beginning of the earliest period for which an entity presents full comparative information under PFRS d. The end of the earliest period for which an entity presents full comparative information under PFRS.

4. An entity is a first time adopter of PFRS. The most recent financial statements it presented under previous GAAP were on december 31, 2020. The entity adopted PFRSfor the first time and intended to present the first PFRS financial statements on December 31, 2021. The entity plans to present a two year comparative information for years 2020 and 2019. The opening PFRS statement of financial position should be prepared on a. January 1, 2020 b. January 1, 2018 c. January 1 2019 d. January 1, 2021

5. The statement of financial position at the date of transition to PFRS is best described as a. Provisional PFRS statement of financial position b. Closing PFRS statement of financial position c. Opening PFRS statement of financial position d. Originating PFRS statement of financial position

6. Under which of the following circumstances would an entity's current year financial statements not qualify as first PFRS financial statements? a. The entity prepared its financial statements in the previous year under PFRS for internal purposes.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

b. The entity prepared its financial statements in the previous year under its national GAAP. c. The entity prepared its financial statements in the previous year in conformity with all requirements of PFRS but did not contain an explicit and unreserved statement of compliance with PFRS. d. The entity prepared its financial statements in the previous year in conformity with all requirements of PFRS and contained an explicit and unreserved statement of compliance with PFRS.

7. Under what condition would an entity's current year financial statements qualify as first PFRS financial statements? a. When an entity prepared its most recent previous financial statements containing an explicit and unreserved statement of compliance with some but not all PFRS. b. When an entity prepared financial statements in the previous period under PFRS for consolidation purposes without preparing a complete set of financial statements. c. When an entity did not present financial statements in the previous period. d. All of these conditions would qualify the current year financial statements of an entity as first PFRS financial statements.

8. Which is not a required adjustment in an opening PFRS statement of financial position? a. Recognize all assets and liabilities required under PFRS b. Derecognize assets and liabilities not permitted by PFRS c. Disclose as comparative information all figures under previous GAAP alongside figures for the current year presented under PFRS. d. Measure all recognized assets and liabilities according to principles contained in PFRS

9. How should a first time adopter of PFRS recognize the adjustments required to present the opening PFRS statements of financial position? a. All of the adjustments should be recognized in profit or loss. b. Adjustments that are capital in nature should be recognized in retained earnings and adjustments that are revenue in nature should be recognized in profit or loss c. Current adjustments should be recognized in profit or loss and noncurrent adjustments should be recognized in retained earnings.

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

d. All of the adjustments should be recognized directly in retained earnings or, if appropriate in another category of equity. 10. Which of the following would be included in the first PFRS financial statements? a. Three statements of financial position at the end of current year, at the end of the prior year and at the date of transition to PFRS. b. Two statements of comprehensive income for the current year and prior year c. Two statements of changes in equity and two statements of cash flows for the current year and prior year d. All of these statements would be included in the first PFRS financial statements Problem 30-2 Multiple choice (IFRS) Universal Company is preparing to adopt IFRS for the first time on December 31, 2020. In preparing its opening statement of financial position on January 1, 2019, the entity identified the following differences between IFRS and its previous GAAP: a. Under the previous GAAP, the entity had recorded proposed dividends of P500,000 as a current liability. b. Under the previous GAAP, the entity had deferred advertising costs of P4,000,000. c. The entity did not recognize a provision for warranty of P1,500,000 because the concept of constructive obligation was not recognized under the previous GAAP. d. The entity incurred architect fees of P800,000 in the construction of a building which was put into service on January 1, 2018. Such costs were expensed immediately. The building had a useful life of 40 years.

CHAPTER 31 SHARE-BASED PAYMENT PROBLEMS Problem 31. 1 (IFRS) Ans: B. 500,000

Problem 31.2 AICPA Adapted) Ans: B. 400,000

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

Problem 31.3 (AICPA Adapted) Ans: A. 800,000

Problem 31.4 (IAA) Ans: B. 1,080,000

Problem 31.5 (AICPA Adapted) Ans: B. 100,000 Problem 31.6 (AICPA Adapted) 1. What amount should be reported as compensation expense for 2020? Ans: C. 50,000 2. What amount should be reported as compensation expense for 2021? Ans: A. 120,000 Problem 31-7 Multiple choice (PFRS 2) 1. Share options are what type of share-based payment transaction? A. Asset-settled share-based payment transaction B. Equity-settled share-based payment transaction C. Cash-settled share-based payment transaction D. Liability-settled share-based payment transaction 2. The total compensation expense in a share option plan is measured at A. Fair value of share options on date of grant B. Fair value of share options on date of exercise C. Intrinsic value of share options on date of grant D. Intrinsic value of share options on date of exercise 3. It is the difference between the fair value of the shares to which the counterparty has the right to subscribe and the price the counterparty is required to pay for those shares A. Fair value B. Intrinsic value

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

C. Market value D. Book value 4. The date on which total compensation expense is computed in a share option plan is the A. Date of grant B. Date of exercise C. Date when the market price coincides with the option price D. Date when the market price exceeds the option price 5. When issuing share options to employees, which of the following factors is most relevant in determining the accounting treatment? A. The par value of the shares issued B. The market value of the shares issued C. The authorized number of shares D. Whether the share options are issued in lieu of salary 6. For transactions with employees, the fair value of the equity instrument granted is measured on A. Exercise date B. Grant date C. End of reporting period D. Beginning of the year of grant 7. It is a contract that gives the employees the right, but not the obligation, to subscribe to the entity's shares at a fixed or determinable price for a specific period of time A. Share option B. Share warrant C. Share appreciation right D. Share split 8. In what circumstance is compensation expense immediately recognized under a share option plan? A. In all circumstances B. In circumstances when the options are exercisable within two years for services rendered over the next two years C. In circumstances when the options are granted for prior service and the options are immediately exercisable D. In no circumstances is compensation expense immediately recognized 9. Compensation expense resulting from a share option plan is generally A. Recognized in the period of exercise

St. Paul University Surigao St. Paul University System 8400 Surigao City, Philippines

B. Recognized in the period of the grant C. Allocated to the periods benefited by the employee's required service D. Allocated over the periods of the employee's service life to retirement 10. If there is an acceleration of vesti...

Similar Free PDFs

Conceptual Framework

- 28 Pages

conceptual framework

- 4 Pages

Conceptual Framework

- 231 Pages

Conceptual Framework

- 2 Pages

Conceptual Framework

- 61 Pages

Conceptual Framework

- 6 Pages

Conceptual Framework

- 6 Pages

Conceptual Framework answer key

- 3 Pages

IASB - Conceptual Framework

- 5 Pages

Conceptual framework solutions

- 9 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu