Cost behaviour and CVP analysis PDF

| Title | Cost behaviour and CVP analysis |

|---|---|

| Author | Ahmed Amin |

| Course | marketing |

| Institution | King Saud University |

| Pages | 8 |

| File Size | 72.5 KB |

| File Type | |

| Total Downloads | 34 |

| Total Views | 450 |

Summary

Cost behavior, and Cost-volume-profit relationshipCost behavior:Costs are defined as variable or fixed with respect to a specific activity and for a given time period. It represents the resources sacrificed to achieve benefits. A variable cost changes in total in proportion to changes in the related...

Description

1

Cost behavior, and Cost-volume-profit relationship Cost behavior: Costs are defined as variable or fixed with respect to a specific activity and for a given time period. It represents the resources sacrificed to achieve benefits. A variable cost changes in total in proportion to changes in the related level of total activity or volume. A fixed cost remains unchanged in total for a given period despite wide changes in the related level of total activity or volume. Cost incurred by a business may be classified in various ways which are given below: 1. Fixed Cost 2. Variable cost 3. Semi-variable cost Cost-Volume-Profit Analysis: The cost volume-profit analysis is the analysis of three variables, viz., cost, volume and profit. In CVP analysis an attempt is made to measure variations of costs and profit with volume. The cost volume profit analysis helps the management in profit planning. In order to increase the profit, a concern must increase the output. When the output is at maximum, within the installed capacity it adds to the contribution. When the output increases, the fixed cost per unit decreases. Generally, cost may not change in direct proportion to the volume. Thus, a small change in the volume will affect the profit. The management is always interested in knowing that which product or product mix is most profitable, what effect a change in the volume of output will have on the cost of production and profit etc. All these problems are solved with the help of the cost-volume-profit analysis. To know the cost volume profit relationship, a study of marginal cost formulae, break-even analysis, and profit volume ratio is essential. Marginal Cost Equations: Marginal Cost = Prime cost + Variable overheads Sales = Variable Cost + Fixed Cost + Profit Sales – Variable cost = Fixed cost + Profit Sales – Variable cost = Contribution Contribution = Sales –Marginal cost Contribution = Fixed cost + Profit Contribution= Fixed cost – Loss

2 Profit = Contribution – fixed cost

Break – Even Point: Break - even point is that point on which sales revenue and costs are equal. At this point of activity, a producer neither earns any profit nor incurs any loss. That is why it is also called as “No profit, No loss point”. If sales exceed break-even point, profit arises and if sales fall below break-even point, loss emerges. Following are the formulae for calculating break-even point. BEP in Units = Total fixed cost / Contribution per unit or Fixed cost / Selling price per unit – Variable cost per unit BEP in Riyal (sales) = Fixed cost X Sales / Contribution or Fixed cost /Profit Volume ratio Profit Volume Ratio: Profit volume ratio, which is popularly known as P/V ratio, expresses the relationship of contribution to sales. Another name for this ratio is contribution-sales ratio, marginal-income ratio. The formula for computing the P/V ratio is given below: P/V Ratio = Contribution x 100 /Sales

or

P/V Ratio = Fixed cost + Profit x100 / Sales or P/V Ratio = Sales – Variable cost x100 /Sales or P/V Ratio = Change in Profit x100 / Change in Sales Margin of Safety: Margin of safety is an important concept in Marginal Costing. Actual sale minus break-even sale is known as the margin of safety. If the margin of safety is large, it is a sign of soundness of the business. The margin of safety is a reliable indicator of the business strength and soundness. Following are the formulae for calculating margin of safety: Margin of Safety = Actual Sales – BEP Sales, or Margin of Safety = Profit / P.V. Ratio , Questions: Q. 1. From the following information, find out the amount of profit earned during the year using marginal cost technique:

3 Fixed Cost SR 500,000 Variable cost SR 10 per unit Selling price SR 15 per unit Output level 150,000 units Q. 2. Calculate break- even point with the help of the following information: Variable cost per unit SR 12 Fixed expenses SR 60,000 Selling price per unit SR 18 Q. 3. A company estimates that next year it will earn a profit of SR 50,000. The budgeted fixed costs and sales are SR 250,000 and SR 993,000 respectively. Find out the break-even point for the company. Q. 4. From the following particulars, find out the selling price per unit if BEP is to be brought down to 9,000 units. Variable Cost per unit = SR 75 Fixed Expenses = SR 270,000 Selling Price per Unit = SR 100 Q. 5. From the following data, calculate break-even point expressed in terms of units and also the new BEP, if selling price is reduced by 10%. Fixed cost: Depreciation SR 100,000 Salaries SR 100,000 Variable expenses: Materials SR 3 per unit Labor SR 2 per unit Selling price SR 10 per unit Q. 6. Calculate Profit volume ratio with the help of the following information. Marginal Cost SR 2,400 Selling Price SR 3,000

4 Q. 7. The sales turnover and profits during two periods are as under: Period I : Sales SR 2,000,000 , Profits : SR 200,000 Period II: Sales SR 3,000,000 , Profits: SR 400,000 Calculate Profit volume ratio. Q. 8. The following data are obtained from the records of a company: First Year

Second Year

Sales

SR 80,000

SR 90,000

Profit

SR 10,000

SR 14,000

Calculate break - even point. Q. 9. From the following details find out; (a) Profit volume ratio , (b) BEP , (c) Margin of safety. Sales SR 100,000 Total Costs SR 80,000 Fixed Costs SR 20,000 Net Profit SR 20,000 Q10.The following information was obtained from a Company in a certain year: Sales SR 100,000 Variable Costs SR 60,000 Fixed Costs SR 30,000 Find out Profit volume ratio, Break-even point and margin of safety. Q. 11. The following information is obtained from a Company for 2006: Sales SR 20,000 Variable Costs SR 10,000 Fixed Costs SR 6,000 Find the Profit volume ratio, Break-even point and Margin of Safety at this level, and the effect of : (a) 20% decrease in fixed costs;

5 (b) 10% increase in fixed costs; ( c ) 10% decrease in variable costs; ( d) 10% increase In selling price; ( e) 10% decrease in selling price Q. 12. From the following information, prepare the Break-even chart. Fixed Cost = SR 2,000 Variable Cost =SR 0.50 per unit Sale SR 1 per unit Units produced and sold 2,000; 4,000; 6,000; 8,000; and 10,000.

Solution-1: Contribution = Selling price – variable cost (Marginal cost) Contribution = 2,250,000 -1,500,000 = SR 750,000 Profit = Contribution - Fixed cost Profit = 750,000 – 500,000 = SR 250,000 Solution-2: Break Eve Point (BEP) in Units = Fixed cost / Selling price per unit –variable cost per unit Break Eve Point (BEP) in Units = 60,000/18-12 = 10,000 Units BEP Sales = 10,000 x18 = SR 180,000 Solution-3:

BEP Sales = Fixed Cost xSales/Contribution

Contribution = Fixed cost +Profit ; 250,000+50,000= SR 300,000 BEP Sales= 250,000x993,000/300,000 = SR 827,500 Solution-4:

BEP in Units = Fixed Cost/ contribution per unit

Suppose Contribution per unit = X 9,000 = 270,000/x 9,000 x = 270,000 ; x = SR 30 per unit Contribution per unit = Selling price per unit – Variable cost per unit

6 30 = SP -75 ; SP =105 Solution-5:

BEP in Units = Fixed cost / SP – VC = 200,000 /10 -5 = 40,000 Units

If selling price is reduced by 10% New Selling Price = 10 – (10x10/100); 10-1 = SR 9 New BEP = Fixed Cost /New SP-VC ; 200,000 / 9-5 = 50,000 units Solution-6: Profit Volume Ratio = Contribution x100 /Sales Contribution = SP – M.C. ; 3,000 – 2,400 = 600 Profit Volume Ratio = 600 x100 /3,000 = 20% Answer-7: Profit Volume Ratio= Change in profit x100 / change in sales Profit Volume Ratio = 400,000 – 200,000 x 100 /3,000,000 – 2,000,000 = 20% , 200,000x100 / 1,000,000 = 20%

Answer-8: BEP Sales = Fixed Cost / P.V. Ratio P.V. Ratio = Change in Profit x 100 / Change in Sales = 14,000 – 10,000 x100 /90,000 -80,000 = 40% 4,000 x100 / 10,000 = 40 % Fixed Cost = Contribution – Profit Fixed Cost = ( 80,000 x40 /100 ) – 10,000 = 32,000 – 10,000 = 22,000 BEP Sales = 22,000 /40% = 22,000 x100 / 40 = SR 55,000

Answer-9: (a) P.V. Ratio = Contribution x100 / Sales; Variable cost = Total cost – Fixed cost ; 80,000 – 20,000 = 60,000 SR Contribution = Sales – Variable cost; 100,000 – 60,000 = 40,000 SR P.V. Ratio = 40,000 x100 /100,000 = 40% (b) BEP sales = Fixed cost /P.V.Ratio = 20,000 x100 /40 = 50,000 SR ( c) Margin of Safety = Profit /P.V. Ratio = 20,000 x100 /40 = 50,000 SR or Margin of Safety = Actual Sales – BEP Sales, 100,000 – 50,000 = 50,000 SR

7 Q. 10. (i) P.V. Ratio = 100,000 – 60,000 x100 /100,000= 40% (ii) BEP Sales = 30,000 x100 / 40 = 75,000 SR (iii)Margin of Safety = Actual Sales – BEP Sales; 100,000 – 75,000 = 25,000 SR Q.11. (a) P.V. Ratio = 20,000 – 10,000 x100 /20,000 = 50%, 10,000 x100 /20,000= 50% (b) BEP Sales = 6,000 x100 /50 = 12,000 SR ( c ) Margin of Safety = 20,000 – 12,000 = 8,000 SR (i) 20% decrease in fixed costs New fixed cost = 6,000 – (6,000 x20 /100)= 4,800 SR, 6,000 – 1,200 = 4,800 SR (a) P.V. Ratio= No change (b) BEP Sales = New Fixed cost / PV Ratio = 4,800 x100/ 50 = SR 9,600 ( c ) Margin of safety = 20,000 – 9,600 = 10,400 SR (iii) 10% decrease in Variable cost New Variable cost =10,000 - ( 10,000 x10 /100); 9,000 SR, 10,000 -1,000 = SR 9,000 (a) PV Ratio = 20,000 – 9,000 x 100/20,000 = 55%, 11,000 x100 /20,000 = 55% (b) BEP Sales = 6,000 x100 /55 = 10,909 SR ( c ) Margin of safety = 20,000 – 10,909 = 9,091 SR (iv) 10% increase in selling price New selling price = 20,000 + ( 20,000x10/100) = 22,000 SR, 20,000 +2,000 = 22,000 SR (a) PV Ratio = 22,000 –10,000 x 100/22,000 = 54.55%, 12,000 x100 /22,000 = 54.55% (b) BEP Sales = 6,000 x100 /54.55 = 10,999 SR ( c ) Margin of safety = 22,000 – 10,999 = 11,001 SR (V) 10% decrease in selling price New selling price = 20,000 - ( 20,000x10/100) = 18,000 SR, 20,000 -2,000 = SR18,000 (a) PV Ratio = 18,000 –10,000 x 100/18,000 = 44.44%, 8,000 x100 /18,000 = 44.44% (b) BEP Sales = 6,000 x100 /44.44 = 13,500 SR

8 ( c ) Margin of safety = 18,000 – 13,500 = 4,500 SR -----------------------------------------------...

Similar Free PDFs

Cost behaviour and CVP analysis

- 8 Pages

CVP Analysis - CVP

- 9 Pages

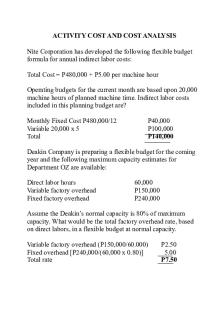

Activity COST AND COST Analysis

- 5 Pages

Makalah Cost Volume Profit (CVP

- 53 Pages

Cost Behaviour 1

- 4 Pages

Chapter 22 - CVP Analysis

- 52 Pages

CVP Analysis - MAS quiz

- 48 Pages

442821756 CVP Analysis docx

- 2 Pages

4.1 cvp2 - CVP Analysis

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu