Exam December 2017, questions PDF

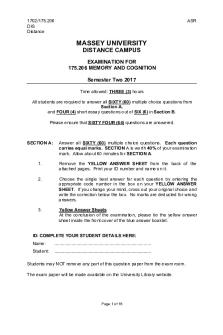

| Title | Exam December 2017, questions |

|---|---|

| Course | Finance and Investment Management |

| Institution | Imperial College London |

| Pages | 7 |

| File Size | 151.4 KB |

| File Type | |

| Total Downloads | 13 |

| Total Views | 145 |

Summary

Mock Exam Practice for Corporate Finance...

Description

Candidate Name: CID Number: Delete above box if NOT MCQ.

MSc Management Examinations MOCK EXAM For internal Students of Imperial College of Science Technology and Medicine. This paper also forms part of the examination for the Associateship.

FINANCE (BS0907) CLOSED BOOK. You may use the attached formula sheet. Instructions Answer ALL questions. Section A - 10 Multiple Choice Questions The marking system for Section A is as follows: • • • •

You can score a total of 50 points for Section A. You score 5 points for each correct answer. 1.25 points are deducted for each incorrect answer. You score zero for each blank answer.

Answer Section A on the separate multiple-choice answer sheet provided. You must choose only one answer per question. You may only use college-approved calculators. Section B - 2 long questions that require detailed answers. The marking system for Section B is as follows: • •

You can score a total of 50 points for Section B. You score zero for each blank or incorrect answer.

Answer Section B in the answer booklet provided.

Page 1 of 7

MCQ1:

(5 Marks)

Michigan Motor Company considers the production of a new electric car. This will require new investments and promises new benefits. Which of the following cash flows should not be treated as an incremental cash flow when deciding whether to go ahead with the electric car project? a) The consequent reduction in the sales of the company’s existing gasoline models. b) The expenditure on new plants and equipment. c) The reduction in taxes resulting from the additional annual depreciation charges. d) The feasibility study costs that have been incurred to assess the viability of the new project. e) The cost of new spare parts inventory.

MCQ2:

(5 Marks)

Suppose we observe the following spot interest rates: Year 1 2 3 4

Spot Interest Rates 4% 5% 5% 4%

The price of a 4-year bond with face value of £100 that pays coupons annually with a coupon rate of 6% is closest to a) b) c) d) e)

£ 103 £ 110 £ 97 £ 107 £ 100

MCQ3:

(5 Marks)

Consider two stocks X and Y. Stock X has an expected return of 8% and stock Y has an expected return of 5%. The beta of stock X is twice as high as the beta of stock Y, and the expected return on the market portfolio is 5%. The riskfree rate is closest to a) b) c) d) e)

0.5% 1% 2% 3% 4%

Page 2 of 7

MCQ4:

(5 Marks)

The internal rate of return (IRR) of an investment opportunity that requires £100 deposit today and pays £250 two years from today is closest to a) b) c) d) e)

58% 150% 100% 158% 40%

MCQ5:

(5 Marks)

Example.com expects to have EBIT of £ 50,000 each year starting next year and continuing forever. The firm currently has no debt and its cost of equity is 20%. The corporate tax rate is 30%. The value of Example.com today is closest to a) b) c) d) e)

£ 175,000 £ 130,000 £ 92,800 £ 361,000 £ 250,000

MCQ6:

(5 Marks)

A higher depreciation charge ... a) b) c) d)

does not affect the firm’s unlevered or levered free cash flows. decreases both the firm’s unlevered and levered free cash flows. increases both the firm’s unlevered and levered free cash flows. increases the firm’s levered free cash flow, but does not affect the firm’s unlevered free cash flow. e) increases the firm’s levered free cash flow and decreases the firm’s unlevered free cash flow.

MCQ7:

(5 Marks)

You are given the following information about a company: Market value of equity = 30 million; market value of debt = 20 million; cost of equity = 15%; cost of debt = 9%; equity beta = 1.4; tax rate = 35%. The after-tax weighted average cost of capital (WACC) of the company is closest to a) b) c) d) e)

11.34% 12.60% 12.97% 13.32% 12.00% Page 3 of 7

MCQ8:

(5 Marks)

Which of the following statements is true? a) When a firm increases leverage, both debt and equity become riskier. Since the cost of capital for the entire firm is a weighted average of the costs of debt and equity, a firm with higher leverage has a higher cost of capital than a comparable firm with lower leverage. b) Everything else being equal, a levered firm with a high tax rate is more valuable than a levered firm with a low tax rate due to the tax deductibility of interest payments. c) An increase in accounts receivable from 2015 to 2016 increases the firm’s free cash flow in 2016. d) The NPV of a project that generates a positive cash flow in year 0 and a negative cash flow in year 1 is an increasing function of the discount rate. e) In frictionless capital markets, if a firm spends the same amount of money to pay dividends or to repurchase shares, the impact on its stock price will be the same.

MCQ9:

(5 Marks)

A share of stock sells for $100 today. It will pay a dividend of $9 per share at the end of the year. Its beta is equal to 1. Using the following information, the price at which an one-year investor expects to sell the stock at the end of the year is closest to Security Risk-free asset Market Portfolio a) b) c) d) e)

Expected Return 10% 18%

Beta 0 1

$ 109 $ 101 $ 118 $ 110 $ 100

MCQ10:

(5 Marks)

A firm borrows $ 50 million for one year (i.e., the firm is levered for one year only) at an interest rate of 9%. If the corporate tax rate is 35%, the present value of the interest tax shield is closest to a) b) c) d) e)

$ 5.2 million $ 17.5 million $ 4.1 million $ 1.4 million $ 19.4 million End of Section A. Section B continues on the next page. Page 4 of 7

SECTION B: LONG QUESTIONS This section is NOT multiple choice. Detailed answers to ALL questions must be given in your answer booklets. Question 11:

(25 Marks)

Hyperion, Inc. is considering the introduction of a new high-speed color printer, the Hyper 500, in the market. The company’s marketing department has already carried out extensive consumer research on the potential demand for the new printer. The total cost of this research has been £ 80,000. Based on this research, the company is now considering investing in a new manufacturing machine that has an estimated life of three years. The cost of the machine is £ 105,000 and the machine will be depreciated using the straight-line method over its three-year life. It will have no salvage value after three years. The machine will result in sales of 2,000 printers in year 1. Sales are estimated to grow by 10% each year in years 1, 2 and 3. The price that the company will charge its customers is £100 per printer and is expected to remain constant. The printers have a cost per unit to manufacture of £60 each. Installation of the machine and the resulting increase in manufacturing capacity will require an increase in various net working capital accounts in years 1 to 3 inclusive. It is estimated that the company will need to hold 25% of its annual sales revenues in account receivables, and that account payables will remain outstanding for 30 days each year. Net working capital will be fully recovered in year 4. The company’s tax rate is 35%, and the required cost of capital for this project is estimated to be 10% per annum. a) Calculate the incremental cash flows of the project. [7 marks] b) What is the Net Present Value (NPV) of the project? Should the company undertake the project according to the NPV rule? [5 marks] c) One of the managers is concerned that the introduction of the new printers will reduce the sales revenues from the company’s existing printers by £50,000 per year. Furthermore, he estimates that if the company does not introduce the new printer, then a competitor will do so and the revenues from the company’s existing printers in years 1, 2 and 3 will be reduced by £ 50,000 per year anyway. How does this information affect the company’s decision whether to undertake the project or not? [6 marks] d) Another manager thinks that the payback period rule is more appropriate to evaluate this project. If the company requires all projects to have a payback period (without discounting) of two years or less, will it undertake this project? Explain whether you would advise the manager to follow the NPV rule or the payback period rule. [7 marks]

Page 5 of 7

Question 12:

(25 Marks)

Below you will find the income statement and the balance sheet for Apple Inc. for the years 2015 and 2016. All numbers in the tables are in thousands.

Income Statement Sales COGS Depreciation EBIT Interest Taxable Income Taxes Net Income

2015 2016 800 1250 250 350 50 100 500 800 100 100 400 700 160 280 240 420

Balance Sheet Assets Cash Accounts Receivable Inventory Total Current Assets Property & Equipment Goodwill Total Assets Liabilities Accounts Payable Short-term Debt Total Current Liabilities Long-term debt Total Liabilities Stockholder’s Equity

2015

2016

100 250 100 450 2000 150 2600

150 400 200 750 2050 140 2940

200 100 300 1000 1300 1300

250 300 1000 1300 1640

The capital expenditures of Apple Inc. in 2016 were 200,000. Assume that the total unlevered cash flows of Apple Inc. will grow at the rate of 30% for the next three years (until 2019), and afterwards the growth rate will drop to 3%. You also have the following information: •

The company has 1 million shares outstanding in December, 2016.

•

The corporate tax rate is 40%.

•

Because Apple Inc. has a short history, you do not have enough data to compute its equity beta. However, a comparable publicly traded company Orange Inc. has an equity beta of 1.2 and a leverage (debt-to-value) ratio D/V=0.5. The tax rate for Orange Inc. is also 40%. The target leverage ratio of Apple Inc. is D/V = 0.3.

•

The risk-free rate is 4%, and the market risk premium is 6%.

•

You estimated the cost of debt for Apple Inc. to be 5%.

a) Forecast the unlevered free cash flows of Apple Inc. in years 2016, 2017, 2018 and 2019. [6 marks] b) What is the beta of Orange Inc.’s assets? [4 marks] Page 6 of 7

c) Estimate the weighted average cost of capital for Apple Inc. [6 marks] d) What is the present value of Apple Inc.’s future free cash flows at the beginning of 2017 (i.e., there is no cash flow today and the next cash flow arrives in one year)? [5 marks] e) Using your answer in part (d) and the information in the balance sheet, estimate the stock price of Apple Inc. at the beginning of 2017. [4 marks]

Page 7 of 7...

Similar Free PDFs

Exam December 2017, questions

- 7 Pages

Exam 6 December 2017, questions

- 9 Pages

Exam Paper December 2017

- 2 Pages

Exam 9 December 2017

- 8 Pages

Exam December 2010, questions

- 14 Pages

Exam 1 December, questions

- 16 Pages

Exam December, questions

- 1 Pages

Exam 12 December, questions

- 5 Pages

Exam 6 December 2015, questions

- 8 Pages

Exam 17 December 2019, questions

- 41 Pages

Exam 10 December 2013, questions

- 4 Pages

Exam 8 December 2015, questions

- 5 Pages

Exam 7 December 2010, questions

- 4 Pages

Exam 12 December 2016, questions

- 2 Pages

Exam 16 December 2019, questions

- 5 Pages

Exam 20 December 2005, questions

- 33 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu