ISLM model - Lecture notes 3-5 PDF

| Title | ISLM model - Lecture notes 3-5 |

|---|---|

| Course | Intermediate Macroeconomics |

| Institution | University of Melbourne |

| Pages | 4 |

| File Size | 171.4 KB |

| File Type | |

| Total Downloads | 93 |

| Total Views | 135 |

Summary

ISLM model notes...

Description

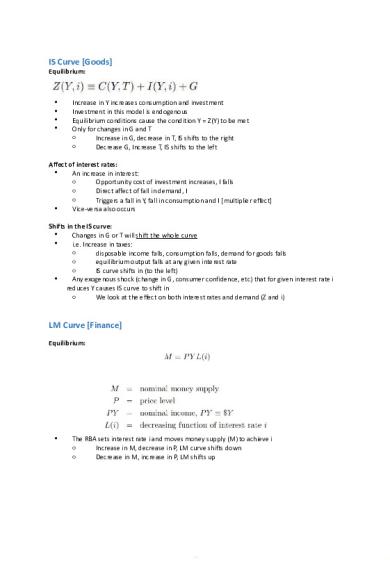

IS Curve [Goods] Equilibrium:

Increase in Y increases consumption and investment Investment in this model is endogenous Equilibrium conditions cause the condition Y = Z(Y) to be met Only for changes in G and T o Increase in G, decrease in T, IS shifts to the right o Decrease G, Increase T, IS shifts to the left

Affect of interest rates: An increase in interest: o Opportunity cost of investment increases, I falls o Direct affect of fall in demand, I o Triggers a fall in Y, fall in consumption and I [multiplier effect] Vice-versa also occurs Shifts in the IS curve: Changes in G or T will shift the whole curve i.e. Increase in taxes: o disposable income falls, consumption falls, demand for goods falls o equilibrium output falls at any given interest rate o IS curve shifts in (to the left) Any exogenous shock (change in G, consumer confidence, etc) that for given interest rate i reduces Y causes IS curve to shift in o We look at the effect on both interest rates and demand (Z and i)

LM Curve [Finance] Equilibrium:

The RBA sets interest rate i and moves money supply (M) to achieve i o Increase in M, decrease in P, LM curve shifts down o Decrease in M, increase in P, LM shifts up

Shifts in LM Changes in i will shift the LM curve: [interest rate target] o decreasing i by the Reserve Bank, an expansionary monetary policy, shifts LM curve down o increasing i by the Reserve Bank, a contractionary monetary policy, shifts LM curve up

IS-LM

Equilibrium in the Goods and Financial Markets

When supply of goods = demand of goods

And, the supply of real money = demand for real money

Each point on either curve relates to when that market is in equilibrium o When both curves intersect, both markets are in equilibrium

Fiscal Policy

A fiscal contraction, decreases G and or increases T o Reduces budget deficit A fiscal expansion, increases FG and or decreases T o Increases deficit Effect on model: (IS) Start at point A. Output Y and interest rate i' such that supply of goods equals demand for goods Taxes increase from T to T' Increase in taxes lowers disposable income, lowers consumption and so output (reinforced by multiplier effect) IS curve shifts to left from IS to IS' Effect on model: (LM) Start at point A. Output Y and interest rate ¯i such that supply of money equals demand for money Taxes increase from T to T' Position of LM curve unchanged --> movement along curve

Monetary Policy Monetary contraction -- increase in i Monetary expansion, decrease in i Affects the position of the LM curve, not the IS curve Effect on model: Position of LM curve changes. Shifts down for decrease and shifts up for increase in interest rates Position of IS curve unchanged, movement along See changes in Y

Effectiveness of the model: Slope of the IS curve determines how effective the model is The flatter the slope, the larger change in Y o IS curve is steep when investment demand is very interest-insensitive o If so, a given decrease in i leads to a small increase in investment demand I and a small increase in output Y

Monetary / Fiscal Policy Interactions Which policy mix of expansionary and contractionary policies will guide the economy? o Both monetary and fiscal policies can interact to assist with redirecting the macroeconomy o They can operate in opposite directions as well Germany and France Recessions Both France and Germany went into recession in late 2001 o After the dot com bubble Policy responses o Germany Contractionary fiscal policies Expansionary monetary policy by the European Central Bank (ECB) o France Much less contractionary fiscal policy Same expansionary monetary policy by the ECB

Historic Australian Policy Mixes

Howard-Macfarlane policy mix I (1996-2002) Large amounts of Fiscal Debt Large CAD so increasing national debt o Fiscal contraction through a succession of budgetary surpluses, G...

Similar Free PDFs

ISLM model - Lecture notes 3-5

- 4 Pages

Ferro scan - Lecture notes 35

- 2 Pages

Article 32-35 - Lecture notes 5

- 3 Pages

Biology Lecture 35

- 1 Pages

Bio 35 Lecture 2

- 3 Pages

BOT model - Lecture notes 1

- 2 Pages

CAPM Model - Lecture notes 1

- 7 Pages

OSI Model - Lecture notes 5

- 3 Pages

Sector Model - Lecture notes 22

- 1 Pages

Lin al notes 35

- 4 Pages

Ch. 35 Notes

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu