Microeconomics Chapters 1-4 Review PDF

| Title | Microeconomics Chapters 1-4 Review |

|---|---|

| Course | Principles Of Microeconomics |

| Institution | Ohio State University |

| Pages | 10 |

| File Size | 172.5 KB |

| File Type | |

| Total Downloads | 68 |

| Total Views | 142 |

Summary

Principles Of Microeconomics

...

Description

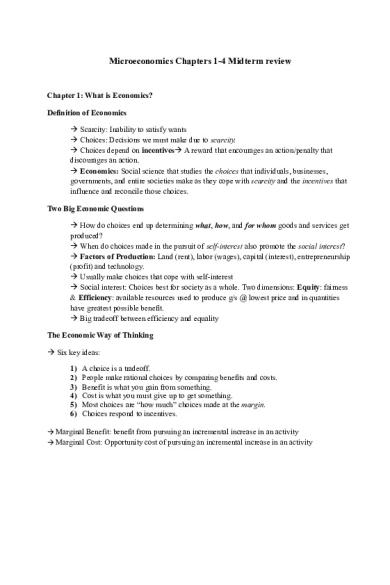

Microeconomics Chapters 1-4 Midterm review

Chapter 1: What is Economics? Definition of Economics Scarcity: Inability to satisfy wants Choices: Decisions we must make due to scarcity. Choices depend on incentives A reward that encourages an action/penalty that discourages an action. Economics: Social science that studies the choices that individuals, businesses, governments, and entire societies make as they cope with scarcity and the incentives that influence and reconcile those choices. Two Big Economic Questions How do choices end up determining what, how, and for whom goods and services get produced? When do choices made in the pursuit of self-interest also promote the social interest? Factors of Production: Land (rent), labor (wages), capital (interest), entrepreneurship (profit) and technology. Usually make choices that cope with self-interest Social interest: Choices best for society as a whole. Two dimensions: Equity: fairness & Efficiency: available resources used to produce g/s @ lowest price and in quantities have greatest possible benefit. Big tradeoff between efficiency and equality The Economic Way of Thinking Six key ideas: 1) 2) 3) 4) 5) 6)

A choice is a tradeoff. People make rational choices by comparing benefits and costs. Benefit is what you gain from something. Cost is what you must give up to get something. Most choices are “how much” choices made at the margin. Choices respond to incentives.

Marginal Benefit: benefit from pursuing an incremental increase in an activity Marginal Cost: Opportunity cost of pursuing an incremental increase in an activity

Chapter 2: The Economic Problem Production possibilities and Opportunity Costs Production possibility frontier: bonding between goods and services that can be produced and also those that cannot. (Focus on 2 goods, hold rest constant) Ceteris Paribus: A model economy in which everything remains the same (except 2). Production Efficiency: When we cannot produce more of one good, w/o producing less of another. (Points on PPF) Every choice along PPF requires a trade-off. If we make more X then we make less Y. Therefore opportunity cost of making X is Y Opportunity cost is a ratio, inverse relationship of two products. Outward bow of PPF (resources are not equally productive) means that as qProduced of each good , so does OC. Using Resources Efficiently All points on PPF= Efficient. PPF & Marginal Cost: PPF determines OC, MC of a g/s is OC of producing one more unit of it. Preferences & Marginal Benefit: Preferences= Person’s likes/dislikes. To describe preferences economists use MB and MB curve. Marginal benefit: benefit received from consuming one more unit of that good. MB is measured by amount that a person is willing to pay for additional unit of g/s. Principle of decreasing MB: More of a good=smaller MB (Less we are willing to pay) Marginal Benefit curve: shows relationship between MB of a good and quantity of good consumed Allocative Efficiency: When we cannot produce more of any one good without giving up some other good that we value more highly. (Point on PPF preferred above all points) Economic Growth Economic Growth: expansion of production possibilities, and increase in standard of living. Two key factors that influence economic growth: Technological Change: Development of new goods (better way to produce g/s) Capital Accumulation: Growth of capital resources (Including human capital) Cost of Economic Growth: Decrease current consumption of goods (OC).

Gains from trade Comparative Advantage: Performing activity at lower OC than anyone else. (Comparing OC) Absolute Advantage: Being more productive than others. (Comparing productivity) Economic Coordination Four Complimentary social institutions: Firms: Eco unit that hires factors of production & organizes factors to produce/sell goods/service. Markets: Arrangement that enables buyers/sellers to do business w/ ea other Property Rights: Social arrangements that govern ownership Money: Commodity or token accepted as means of payment

Chapter 3: Demand and Supply Market and Prices Market: Arrangement that enables buyers/sellers to do business with one another Competitive Market: many buyers and sellers, therefore no individual can influence Money Price: Amount of money needed to buy good Relative Price: Ratio of money price, to money price of OC (Next best alternative) In microeconomics no “money” everything is relative to other goods. The Market economy is criticized to sometimes be driven by the rich. Organized markets are necessary to keep high demand, ex// good institutions The government can help provide good infrastructure Demand Demand: Want it, can afford it, and have definite plan to buy it. Wants: Unlimited desires for goods/services, and demand affects decision of which wants to satisfy. Quantity Demanded: Amount of goods/services consumers plan to buy in a particular period of time, and at a particular price. For most goods we allocate (Limited Supply) and mechanism used is bidding. The Law of Demand Higher price of good= smaller qD & lower price of good= Larger qD Law of Demand results from: Substitution effect: When relative price (OC) of good rises, people seek substitutes, so qD of good/service decreases. Income effect: When price of good/service rises relatively to income, people can’t afford as much, thus demand decreases. Demand curve and Demand schedule Demand: Entire relationship b/w price of good and quantity demanded of good. Demand Curve: Relationship b/w quantity demanded of good and its price. A rise in price, brings decrease in qD’d and movement up along curve. A fall in price, brings increase in qD’d and movement down along curve. Willingness to pay measures the marginal benefit. As quantity increases marginal benefit declines.

A Change in Demand Demand increases Curve shifts right. Demand decreases Curve shifts left. Six main factors that influence Demand** Prices of related goods: When the price of substitute , or compliment demand Substitutes: Good that can be used in place of another good. Compliments: Good that is used in conjunction with another good. Expected future prices: If expected future price rises(), current demand increases, curve shifts to right. Income: When income , consumers buy more of most goods, and curve shifts right Normal Good: demand increases if income increases. Inferior Good: demand decreases if income increases. Neutral Good: No change in demand if income increases. Expected Future income and Credit: demand might increase now. Population: The larger the population, the greater the demand for all goods. Preference: People with the same income have different demands if they have different preferences. Supply Supply: Have resources to produce, can profit from producing, definite plan to sell it. (If others influence than shift in supply curve) Resources and technology determine what is possible to produce. Quantity Supplied: Amount producers plan to sell in a given time period at particular price. (Movement along supply curve, if other influences remain same) Market-oriented economies: What gets put in market is based on demand Law of Supply Higher price of good= greater qS’d and lower price of good= smaller qS’d Law results in marginal cost of producing good or service to increase as production increases. Producers will produce goods if marginal cost of production can get covered. Therefore, must sell at higher price, thus upward slope on supply curve. Supply Curve and Supply Schedule

Supply: Entire relationship b/w qS’d and price of good. Supply curve: Relationship b/w qS’d of good and its price, when all other factors constant.

Minimum supply price (Supply Curve) Quantity produced increased and marginal cost increases. Lowest price to sell unit rises. Lowest price is marginal cost. Producer surplus: If you get more money then what you should be getting. A Change in Supply When supply increases supply curve shifts right. When supply decreases supply curve shifts left. Influences other than price change; there is a change in supply. Thus, new supply curves. Six factors that influence Supply** Prices of factors of production: If production cost , minimum price supplier will accept per quantity also . A rise in cost of production, decreases supply and shifts supply curve left. Prices of related goods produced: Supply of good , if price of production for substitute falls. Supply of good , if price of complement rises. Substitute in production: Another good that can be made using same resources. Compliment in production: Must be produced together. Expected future prices: If EFP of good ,supply today decreases. (Curve shifts left) Number of suppliers: The larger the number of suppliers of a good, increase in supply. (Curve shifts right) Technology: Advances in technology create new products and lower the cost of producing existing products. Increase supply (Curve shifts right) State of Nature: Natural forces that influence production (Weather). Ex// Natural disaster decreases supply. (Curve shifts right)

Market Equilibrium Equilibrium: Opposing forces balance each other out. Price balances plans of buy/seller. No shortage or surplus. Equilibrium price: Price at which qD’d=qS’d Equilibrium quantity: The quantity bought and sold at equilibrium price. Predicting Changes in Price and Quantity Any price above equilibrium, surplus forces price down. Any price below equilibrium, shortage forces price up. A change in demand or supply changes the equilibrium price and quantity Change in demand with no change in supply: Demand increases movement up supply curve. Thus equilibrium price rises and equilibrium quantity increases. If demand decreases movement down supply curve and equilibrium price falls and equilibrium quantity decreases. If supply increases movement down supply curve and equilibrium price falls and equilibrium quantity increases. If supply decreases equilibrium movement up supply curve and equilibrium price rises and equilibrium quantity decreases.

Chapter 4: Elasticity Elasticity of Demand Price Elasticity of Demand Units free measure, of the responsiveness of qD of a good to change in price. Formula: % change in qD_ % change in Price To calculate the % change we determine average of both first (Initial price and new price). Substitutes play a big role in determining the price elasticity of demand. Average Price and Quantity By using the average we get same elasticity value regardless of price rise or fall. Units-Free Measure Elasticity is a ratio of percentages Minus sign and ElasticityIf price and quantity move in opposite directions, you will get a negative number. It is irrelevant because we only need to determine responsiveness (absolute value) Perfectly inelastic demand qD doesn’t change, but price changes. Demand curve is vertical, very rare. When the numerator and denominator are equal to each other, the price elasticity is 1. Therefore it is unit elastic. Inelastic= Less than 1 Elastic= Greater than 1 Inelastic demand % change in qD is smaller than % change in price (X1) [Prices above midpoint on demand curve] Total Revenue and Elasticity Total Revenue= Price of good x quantity sold When price changes, so does total revenue. Rise in price doesn’t always mean increase in revenue.

Total Revenue Test If demand is elastic, a 1% price cut increases the quantity sold by more than 1%, total revenue increases. If demand is inelastic, a 1% price cut increases the quantity sold by more than 1%, total revenue decreases. If demand is unit elastic, a 1% price cut increases the quantity sold by 1%, total revenue stays the same. Same results for expenditure as above. Factors that influence Elasticity of Demand 1) The closeness of substitutes: The closer the substitute, the more elastic. Necessities (Inelastic Demand Curve) Luxuries (Elastic Demand curve) 2) Proportion of Income spent on good: Greater the proportion of income spent on good, the larger elasticity of demand. 3) Time Elapsed since price change: More time to adjust to price change, or longer that a good can be stored w/o losing value, more elastic demand. Cross Elasticity of Demand Measure of responsiveness of good, to a change in substitute or compliment. Formula: % change in qD____________ % change in price of substitute/compliment The cross elasticity of demand for a substitute is positive. (Coke/Pepsi) The cross elasticity of demand for a compliment is negative. (Movies/Popcorn) Even if value is negative, the elasticity can still be determined using absolute value. Income Elasticity of Demand Measures how qD responds to a change in income. Formula: % change in qD__ % change in income IF: Income elasticity is greater than 1; income is elastic and is a normal good. Income elasticity is between 0 and 1; income is inelastic and is a normal good.

Income elasticity is less than 0; it is an inferior good. Income elasticity has no change, and income elasticity is 0; neutral good.

Elasticity of Supply qS depends on the price of a good that you are selling (Movement on supply curve) Slope of supply curve determines responsiveness of qS to change in price. Formula: % change in quantity supplied % change in price IF: Supply curve is vertical, & elasticity of supply is 0, then it is perfectly inelastic. Supply curve is linear and passes through origin, it is unit elastic. (Slope is irrelevant) Supply curve is horizontal & elasticity is infinite, then it is perfectly elastic. Factors that influence the Elasticity of Supply 1) Resource substitution possibilities Easier to substitute resources, the greater the elasticity of supply. 2) Time frame for supply decision The more time that passes after a change in price, the greater the elasticity of supply. Three types of time frames: Momentary supply: Perfectly inelastic, qS immediately following change in price is constant. NOT concrete (Minute, years etc.) Short-run supply is elastic. Long-run supply is most elastic....

Similar Free PDFs

Microeconomics Chapters 1-4 Review

- 10 Pages

Summary - Chapters 1-14

- 47 Pages

Chapters 14-19 Notes

- 10 Pages

Microeconomics Exam 2 Review

- 3 Pages

Microeconomics Final Review

- 27 Pages

Bio II Chapters Review

- 54 Pages

WEEK 10-HW- Chapters 13 and 14

- 13 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu