PR 21-4A - accounting homework answer PDF

| Title | PR 21-4A - accounting homework answer |

|---|---|

| Author | Elaine Lopez |

| Course | Prin Of Managerial Accounting |

| Institution | University of North Georgia |

| Pages | 2 |

| File Size | 60 KB |

| File Type | |

| Total Downloads | 45 |

| Total Views | 128 |

Summary

accounting homework answer...

Description

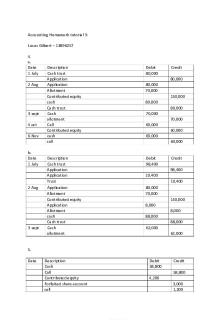

Prob. 21–4A (FIN MAN); Prob. 7–4A (MAN) 1. Bridgeport Housewares Inc. Cash Budget For the Three Months Ending November 30 September

October

November

$ 30,000

$ 31,500

Estimated cash receipts from:

Cash sales a Collection of accounts receivable Total cash receipts

$ 25,000 228,000

229,500

$253,000

$259,500

$ 288,000

256,500

$120,000

$124,000

$ 134,000

42,000

48,000

51,000

Less estimated cash payments for: b

Manufacturing costs

Selling and administrative expenses Capital expenditures

200,000

Other purposes: Income tax

55,000

Dividends

25,000

Total cash payments

$162,000

$227,000

$ 410,000

Cash increase or (decrease) Plus cash balance at beginning of month

$ 91,000 40,000

$ 32,500 131,000

$(122,000) 163,500

Cash balance at end of month

$131,000

$163,500

$ 41,500

Less minimum cash balance Excess or (deficiency)

(50,000) $ 81,000

(50,000) $113,500

(50,000) $

(8,500)

Prob. 21–4A (FIN MAN); Prob. 7–4A (MAN) (Concluded) Computations: a

Collections of accounts receivable: July

September

October

2

sales……………………………………

September

168,000

2 3 4 5 6 b

3

$ 72,000

4

sales………………………………… $228,000

5

157,500

$ 67,500 6 189,000

$229,500

$256,500

sales……………………………………

Total…………………………………………… 1

November

$ 60,000

sales…………………………………………

August

October

1

$200,000 × 30% = $60,000 $240,000 × 70% = $168,000 $240,000 × 30% = $72,000 $250,000 × 90% × 70% = $157,500 $250,000 × 90% × 30% = $67,500

$300,000 × 90% × 70% = $189,000 P ayments for manufacturing costs: Payment of accounts c payable, beginning of month balanc …………………………… e d Payment of current month’s cost …………… Total…………………………………………… c

September

October

November

$ 40,000 80,000

$ 20,000 104,000

$ 26,000 108,000

$120,000

$124,000

$134,000

Accounts payable, September 1 balance = $40,000 ($150,000 – $50,000) × 20% = $20,000 ($180,000 – $50,000) × 20% = $26,000

d

($150,000 – $50,000) × 80% = $80,000 ($180,000 – $50,000) × 80% = $104,000 ($185,000 – $50,000) × 80% = $108,000

2.

The budget indicates that the minimum cash balance will not be maintained in November. This is due to the capital expenditures requiring significant cash outflows during this month. This situation can be corrected by borrowing and/or by the sale of the marketable securities, if they are held for such purposes. At the end of September and October, the cash balance will exceed the minimum desired balance, and the excess could be considered for temporary investment....

Similar Free PDFs

ARCH 214a Final

- 37 Pages

Homework 06 answer - hw6_ans

- 2 Pages

Managerial accounting homework

- 1 Pages

Accounting Homework tutorial 3

- 3 Pages

My Accounting Lab Homework

- 18 Pages

Hw accounting - homework

- 9 Pages

Chapter 5 Accounting homework

- 4 Pages

Accounting Answer Key 2

- 5 Pages

COST Accounting 5 - Answer

- 36 Pages

Answer key accounting process

- 4 Pages

Answer sheet for 1a - homework

- 5 Pages

Assignment 1 Answer - Homework 1

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu