Spectrans Solman-Partnership Liquidation (Dayag) PDF

| Title | Spectrans Solman-Partnership Liquidation (Dayag) |

|---|---|

| Course | Accounting For Special Transactions |

| Institution | New Era University |

| Pages | 19 |

| File Size | 450.1 KB |

| File Type | |

| Total Downloads | 190 |

| Total Views | 533 |

Summary

CHAPTER 21Problem I 1. A, B, C and D Partnership Statement of Liquidation January 1, 20x4 to May 31, 20xCashNon- Cash Assets LiabilitiesA, loan D, loanA, capital (40%)B, capital (20%)C, capital (20%)D, capital (20%) Balances before Liquidation 181,800 84,000 6,000 3,000 26,400 25, 20, 16, January Re...

Description

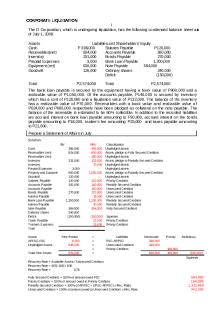

CHAPTER 21 Problem I 1. A, B, C and D Partnership Statement of Liquidation January 1, 20x4 to May 31, 20x4

Cash Balances before Liquidation January - Realization - Payment of expenses - Payment of liabilities Balances after Jan February - Realization - Payment of expenses - Payment of liabilities Balances before payment to partners Payment to Partners (Sch. 1) Balances after February March - Realization - Payment of expenses Balances before payment to partners Payment to Partners (Sch. 2) Balances after March April - Realization - Payment of expenses Balances before payment to partners Payment to Partners (Note 1) Balances after April May - Realization - Payment of expenses Balances before Offsetting Offset deficit vs. Loan Balances before payment Payment to Partners (Note 2)

NonCash Assets 181,800

72,000

Liabilities 84,000

A, loan 6,000

D, loan

A, capital (40%)

B, capital (20%)

C, capital (20%)

D, capital (20%)

3,000

26,400

25,800

20,400

16,200

(7,200)

(3,600)

(3,600)

(3,600)

( 480)

( 240)

( 240)

( 240)

______ 18,720

______ 21,960

______ 16,560

______ 12,360

(3,360)

(1,680)

(1,680)

(1,680)

( 528)

( 264)

(90,000)

(1,200) (66,000) 4,800

______ 91,800

21,600

(30,000)

(66,000) 18,000

_____ 6,000

_____ 3,000

(1,320) ______

______

______

_______

( 264) ______

( 264) ______

61,800

6,000

3,000

14,832

20,016

14,616

10,416

( 5,280)

______

______

_____

______

(5,280)

______

_____

1,800

61,800

6,000

3,000

14,832

14,736

14,616

10,416

19,200

(24,000)

(1,920)

( 960)

( 960)

( 960)

( 1,440)

______

______

_____

( 576)

( 288)

( 288)

( 288)

19,560

31,500

6,000

3,000

12,336

13,488

13,368

9,168

(18,360)

______

(2,736)

(3,000)

(5,688)

(5,568)

(1,368)

1,200

37,800

3,264

12,336

7,800

7,800

7,800

6,000

(19,800)

(5,520)

(2, 760)

(2,760)

(2,760)

(4,800)

______

(1,920)

( 960)

( 960)

( 960)

2,000

15,000

3,264

4,896

4,080

4,080

4,080

(1,500)

______

( 720)

( 360)

( 360)

( 360)

500

18,000

2,554

4,896

3,720

3,720

3,720

2,400

(18,000)

(6,240)

(3,120)

(3,120)

(3,120)

(18,000)

_______

7,080

(18,000)

( 960)

_____

( 384)

( 192)

( 192)

( 192)

1,440

2,554

( 1,728)

408

408

408

______

(1,728)

1,728

_____

______

_____

2,040

816

408

408

408

(2,040)

(816)

(408)

(408)

(408)

2. A, B, C and D Partnership Schedule of Safe Payments

Schedule 1 – February 28, 20x4 Computation of Distribution of Cash on February 28, 20x4

Balances before payment to partners: Loans Capital Total Interest Restricted interest for possible losses: Unrealized non-cash assets Cash withheld

A, capital (40%)

B, capital (20%)

C, capital (20%)

D, capital (20%)

6,000 14,832 20,832

20,016 20,016

14,616 14,616

3,000 10,416 13,416

P 61,800 1,800 P 63,600 (25,440) ( 4,608) 4,608

Restricted for possible insolvency of A (2:2:2) Restricted for possible insolvency of D (2:2) Restricted for possible insolvency of C Payment to partner (s) Applied to: Loans Capital

(12,720) 7,296 (1,536) 5,760 ( 420) 5,340 ( 60) 5,280

(12,720) (12,720) 1,896 696 (1,536) (1,536) 360 ( 840) ( 420) 840 ( 60) 60

-05,280 5,280

Schedule 2 – March 31, 20x4 Computation of Distribution of Cash on March 31, 20x4

Balances before payment to partners: Loans Capital Total Interest Restricted interest for possible losses: Unrealized non-cash assets Cash withheld

A, capital (40%)

B, capital (20%)

C, capital (20%)

D, capital (20%)

6,000 12,336 18,336

13,488 13,488

13,488 13,488

3,000 9,168 12,168

P 37,800 1,200 P 39,000 (15,600) 2,736

( 7,800) 5,688

( 7,800) 5,568

( 7,800) 4,368

2,736 ___-02,736

-05,688 5,688

-05,568 5,568

3,000 1,368 4,368

W, capital (20%)

Total

Applied to: Loans Capital

3. T, U, V and W Partnership Cash Payment Priority Program* January 31, 20x4

Interests T, capital (40%) Balances before liquidation: Loans Capital Total Interests Divided by: P & L %

6,000 26,400 32,400 __40%

U, capital (20%)

25,800 25,800 ___20%

V, capital (20%)

20,400 20,400 __20%

Payments W, capital (20%)

3,000 16,200 19,200 __20%

T, capital (40%)

U, capital (20%)

V, capital (20%)

Loss Absorption Abilities Priority I

81,000 129,000 102,000 96,000 ______ (27,000) _______ _______ 81,000 102,000 102,000 96,000 Priority II ______ ( 6,000) ( 6,000) _______ 81,000 96,000 96,000 96,000 Priority III ______ (15,000) (15,000) (15,000) _______ 81,000 81,000 81,000 81,000 ____-0*also known as Schedule of Cash Distribution Plan / Pre-distribution Plan.

5,400

5,400

1,200

1,200

3,000 9,600

3,000 4,200

2,400 3,000 3,000

9,000 16,800

4. Total Interests Divided by: P & L % Loss Absorption Abilities Order of Cash Distribution Vulnerability Rankings (1 Is most vulnerable)

T, capital (40%) P 32,400 ____40%

U, capital (20%) P 25,800 ____20%

V, capital (20%) P 20,400 ____20%

W, capital (20%) P 19,200 ____20%

P 81,000 (4)

P129,000 (1)

P 102,000 (2)

P 96,000 (3)

(1)

(4)

(3)

(2)

The vulnerability ranks indicate that partner T is most vulnerable to losses because his equity were reduced to zero with a partnership liquidation loss of P81,000. Partner U is least vulnerable because his equity is sufficient to absorb his share of liquidation losses up to P129,000. This interpretation helps explain why partner U received all the cash distributed to partner on the first installment distribution (August 20x4). Incidentally, the cash priority program developed will yield the same cash payment as the process of computing safe payments each time cash is available. The cash distribution under the cash priority program is as follows: Order of Cash Distribution 1. First P70,000 2. Next P 4,500 3. Next P2,000 4. Next P7,500 5. Remainder

Creditors 100%

T

U

V

W

40%

100% 50% 33 1/3% 20%

50% 33 1/3% 20%

33 1/3% 20%

The first P84,000 available is, of course paid to the creditors. Cash may be held back from distribution if it is anticipated that additional expenses will be incurred and unrecorded liabilities will be discovered. The distribution of cash in excess of the reserve amount proceeds as determined. Partner U will receive all of an additional ash up to P5,400. Additional cash in excess of P5,400 and up to P7,800 is distributed 50:50 to partners U and V. Any amount in excess of P7,800up to P16,800 is distributed 1: 1: 1 to partners U, V, and W, respectively. After P16,800 (P5,400 + P2,400 + P9,000) has been distributed to the partners, the capital accounts are in the desired profit and loss ratio of 4:2:2:2. Any further distributions to the partners are made in accordance with the profit and loss ratio. Even though both methods produce the same results, the cash payment priority program is more informative to both personal and partnership creditors, and to the partners. Interested parties now know the order in which the individual partners will receive cash and the amounts that each may receive at each period of the distribution process. One requirement that must be satisfied in the development of the advance plan is that the partners must share income in the same ratio that they share losses. If this were not the case

the potential amount of a new loss would need to be computed after every allocation to the partners’ capital accounts. This occurs because the allocation of liquidation gain alters the order of cash distribution computed in the priority program. Problem II ABC Partnership Statement of Partnership Realization and Liquidation For the period from January 1, 20x4, through March 31, 20x4 Capital Balances Other Accounts AA BB Cash Assets Payable 50% 30% Balances before Liquidation, 18,000 307,000 (53,000) (88,000) (110,000) January 1,20x4 January transactions: 1. Collection of accounts receivable at a loss of P15,000 51,000 (66,000) 7,500 4,500 2. Sale of inventory at a loss 38,000 (52,000) 7,000 4,200 of P14,000 3. Liquidation expenses paid (2,000) 1,000 600 4. Share of credit memorandum 3,000 (1,500) (900) 5. Payments to creditors (50,000) 50,000 55,000 189,000 -0(74,000) (101,600) Safe payments to partners (Schedule 1) (45,000) __ 26,600 10,000 189,000 -0(74,000) (75,000) February transactions: 6. Liquidation expenses paid (4,000) __ 2,000 1,200 6,000 189,000 -0(72,000) (73,800) Safe payments to partners (Schedule 2) -0__ ___ -0-06,000 189,000 -0(72,000) (73,800) March transactions: 8. Sale of M&Eq. at a loss of 146,000 (189,000) 21,500 12,900 P43,000 9. Liquidation expenses paid (5,000) 2,500 1,500 147,000 -0-0(48,000) (59,400) 10. Payments to partners (147,000) 48,000 59,400 Balances at end of liquidation, March 31, 20x4

-0-

-0-

-0-

-0-

CC 20% (74,000)

3,000 2,800 400 (600) (68,400) 18,400 (50,000)

800 (49,200) -0(49,200) 8,600

1,000 (39,600) 39,600

-0-

-0-

ABC Partnership Schedules of Safe Payments to Partners

Schedule 1: January 31, 20x4 Capital balances Possible loss: Other assets (P189,000) and possible liquidation costs (P10,000) Absorption of AA’s potential deficit balance BB: (P25,500 x 3/5 = P15,300) CC: (P25,500 x 2/5 = P10,200) Safe payment, January 31, 20x4

AA 50% (74,000)

BB 30% (101,600)

CC 20% (68,400)

99,500 25,500 (25,500)

59,700 (41,900)

39,800 (28,600)

15,300 -0-

(26,600)

10,200 (18,400)

Schedule 2: February 27, 20x4 Capital balances Possible loss: Other assets (P189,000) and possible liquidation costs (P6,000) Absorption of AA’s potential deficit balance: BB: (P25,500 x 3/5 = P15,300) CC: (P25,500 x 2/5 = P10,200) Safe payment, February 27, 20x4

(72,000)

(73,800)

(49,200)

97,500 25,500 (25,500)

58,500 (15,300)

39,000 (10,200)

15,300 -0-

10,200 -0-

-0-

Note that the computation of safe payments on February 27, 20x4, resulted in no payments to partners. This is due to the large book value of Other Assets still unrealized and the reservation of the $6,000 cash on hand for possible future liquidation expenses.

Problem III: Cash Distribution Plan PET Partnership Cash Distribution Plan June 30, 20x4 Loss Absorption Power PP

EE

TT

Profit and loss percentages

PP 50%

Preliquidation capital balances Loss absorption Power (Capital balances / Loss percent)

Capital Accounts

(110,000)

(150,000)

(120,000)

(110,000)

30,000 (120,000)

(120,000)

Decrease highest LAP to next highest: EE (P30,000 x .30)

Decrease LAPs to next highest: EE (P10,000 x .30) TT (P10,000 x .20)

(110,000)

30%

TT 20%

(55,000)

(45,000)

(24,000)

(55,000)

9,000 (36,000)

(24,000)

10,000

(110,000)

EE

3,000 10,000 (110,000)

(55,000)

(33,000)

2,000 (22,000)

Summary of Cash Distribution (If Offer of P100,000 is Accepted) Accounts Payable Cash available First Next Next Additional paid in P&L ratio

P106,000 (17,000) (9,000) (5,000) (75,000) P -0-

PP 50%

EE 30%

TT 20%

P17,000

______ P17,000

P37,500 P37,500

P 9,000 3,000

P 2,000

22,500 P34,500

15,000 P17,000

Problem IV PET Partnership Statement of Partnership Liquidation and Realization From July 1, 20x4, through September 30, 20x4

Preliquidation balances July: Assets Realized Paid liquidation costs Paid creditors Safe Payments (Sch. 1)

Cash 6,000 26,500 (1,000) (17,000) 14,500 (6,500) 8,000

August: Equipment withdrawn (allocate P6,000 gain) Paid liquidation costs Safe Payments (Sch. 2) September: Assets Realized Paid liquidation costs Payments to partners Postliquidation balances

Noncash Assets 135,000

Accounts Payable (17,000)

(36,000)

99,000 99,000

17,000 -0-0-

(4,000) (1,500) 6,500 (4,000) 2,500 75,000 (1,000) 76,500 (76,500) -0-

PP 50% (55,000)

Capital EE 30% (45,000)

4,750 500

2,850 300

1,900 200

(49,750)

(41,850) 6,500

(21,900)

(49,750)

(35,350)

(21,900)

(3,000)

(1,800)

8,800 300 (12,800)

4,000 200 (8.600) 8,600 -0-

95,000

-0-

750 (52,000)

95,000

-0-

(52,000)

450 (36,700) 4,000 (32,700)

-0-

-0-

-0-

-0-

10,000 500 (41,500) 41,500 -0-

6,000 300 (26,400) 26,400 -0-

(95.000)

TT 20% (24,000)

(12,800)

PET Partnership Schedules of Safe Payments to Partners Schedule 1: July 31, 20x4 Capital balances Possible loss on noncash assets (P99,000) Cash retained (P8,000)

PP 50% (49,750) 49,500 4,000 3,750

EE 30% (41,850) 29,700 2,400 (9,750)

TT 20% (21,900) 19,800 1,600 (500)

Absorption of Pen's potential deficit EE: P3,750 x .30/.50 TT: P3,750 x .20/.50

(3,750) 2,250

Absorption of TT’s potential deficit EE P1,000 x .30/.30 Safe payment Schedule 2: August 31, 20x4 Capital balances Possible loss on noncash assets (P95,000) Cash retained (P2,500)

-0-

(7,500)

-0-

1,000 (6,500)

(52,000) 47,500 1,250 (3,250)

Absorption of TTs’ potential deficit PP: P6,700 x .50/.80 EE: P6,700 x .30/.80

(36,700) 28,500 750 (7,450)

1,500 1,000 (1,000) -0-

(12,800) 19,000 500 6,700 (6,700)

4,188 938 (938)

Absorption of PPs potential deficit EE: P938 x .30/.30 Safe payment

-0-

2,512 (4,938)

-0-

938 (4,000)

-0-

Problem V DSV Partnership Statement of Partnership Realization and Liquidation — Installment Liquidation From July 1, 20x4, through September 30, 20x4 Capital Balances Noncash D S V Cash Assets Liabilities 50% 30% 20% Preliquidation balances, 6/30 50,000 670,000 (405,000) (100,000) (140,000) (75,000) July, 20x4: Sale of assets and distribution of P120,000 loss

Liquidation expenses Payment to creditors Payments to partners (Sch. 1) August, 20x4: Sale of assets & distribution of P13,000 loss Liquidation expenses Payments to partners (Sch. 2) September, 20x4: Sale of assets distribution of P70,000 loss

(510,000) 390,000 440,000 (2,500) 437,500 (405,000) 32,500 (22,500) 10,000

160,000

(405,000)

160,000

(405,000) 405,000 -0-

160,000

Payments to partners Postliquidation balances

36,000

24,000

(40,000) 1,250 (38,750)

(104,000) 750 (103,250)

(51,000) 500 (50,500)

(38,750)

(103,250) 22,500 (80,750)

(50,500)

3,900 (76,850) 750 (76,100) 13,700 (62,400)

2,600 (47,900) 500 (47,400) 5,800 (41,600)

21,000 (41,400) 2,400 (39,000) 1,500 (37,500) 37,500 -0-

14,000 (27,600) 1,600 (26,000) 1,000 (25,000) 25,000 -0-

160,000

-0-

22,000 32,000 (2,500) 29,500 (19,500) 10,000

(35,000) 125,000

-0-

125,000

-0-

6,500 (32,250) 1,250 (31,000)

125,000

-0-

(31,000)

55,000 65,000

(125,000) -0-

-0-

Allocate D's deficit to S and V Liquidation expenses

60,000

65,000 (2,500) 62,500 (62,500) -0-

-0-

-0-

-0-

-0-

-0-

-0-

(38,750)

35,000 4,000 (4,000) -0-0-0-0-

(50,500)

DSV Partnership Schedule of Safe Payments to Partners Schedule 1, July 31, 20x4: Capital balances, July 31, Before cash distribution Assume full loss of P160,000 on remaining noncash assets and P10,000 in possible future liquidation expenses Assume D's potential deficit must be absorbed by S and V: 30/50 x P46,250 20/50 x P46,250

D 50%

S 30%

V 20%

(38,750)

(103,250)

(50,500)

85,000 46,250

51,000 (52,250)

34,000 (16,500)

(46,250) 27,750 -0-

Assume V's potential deficit must be absorbed by S completely Safe payments to partners on July 31, 20x4

18,500 2,000

(24,500) 2,000

Schedule 2, August 31, 20x4: Capital balances, August 31, before cash distribution Assu...

Similar Free PDFs

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Franchise Problem Dayag

- 12 Pages

Partnership Liquidation

- 12 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Dayag - Job Order Costing

- 29 Pages

Chapter 16 Dayag

- 23 Pages

Corporation liquidation

- 9 Pages

Corporate-liquidation compress

- 4 Pages

Liquidation-Format - guide fomat

- 2 Pages

Advanced Accounting Antonio Dayag Solman

- 229 Pages

Assignment 1 - Liquidation

- 2 Pages

Exemple de liquidation complexe

- 9 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu