Corporate Liquidation PDF

| Title | Corporate Liquidation |

|---|---|

| Course | Introduction To Financial Accounting |

| Institution | University of the Philippines System |

| Pages | 28 |

| File Size | 565.9 KB |

| File Type | |

| Total Downloads | 239 |

| Total Views | 282 |

Summary

CORPORATE LIQUIDATION1.) Quinte Company has become insolvent and a Statement of Affairs is being prepared. The following data were taken from the Statement of Affairs:ASSETS Pledged with Fully secured creditors P71, Pledged with Partially secured creditors 12, Free assets 11,LIABILITIES Partially se...

Description

CORPORATE LIQUIDATION 1.) Quinte Company has become insolvent and a Statement of Affairs is being prepared. The following data were taken from the Statement of Affairs: ASSETS Pledged with Fully secured creditors Pledged with Partially secured creditors Free assets

P71,000 12,500 11,000

LIABILITIES Partially secured With priority Fully secured Unsecured without priority

P20,000 3,000 60,000 18,000

What is the ESTIMATED DEFICIENCY to UNSECURED CREDITORS? a. P12,500 b. P15,500 c. P5,000 d. P6,500 2. & 3.) Items 2 & 3 are based on the following data: The trustee of Nalugina Corporation provided the following data about the Company’s financial position: BOOK VALUE Cash P20,000 Accounts Receivable-net 100,000 Inventories 150,000 Plant assets-net 250,000 TOTAL 520,000

ESTIMATED REALIZABLE VALUE P20,000 75,000 70,000 260,000

Preferred Creditors P70,000 Accounts Payable 150,000 (unsecured) Notes Payable 100,000 (secured by Accounts Receivable) Mortgage Payable 200,000 (secured by all Plant assets) TOTAL P520,000 In the event of liquidation: What is the ESTIMATED AMOUNT available to UNSECURED CREDITORS WITHOUT PRIORITY? a. P 85,000 b. P 80,000 c. P 90,000

d. P 175,000 What is the ESTIMATED DEFICIENCY in the payment of creditors? a. P175,000 b. P 80,000 c. P 95,000 d. P 90,000 4.) The following data were taken from the Statement of Realization and Liquidation of Maurin Corporation for the three month period ended December 31, 2008: Assets to be realized Assets acquired Assets realized Assets not realized Liabilities to be liquidated Liabilities assumed Liabilities liquidated Liabilities not liquidated Supplementary credits Supplementary charges

P55,000 60,000 70,000 25,000 90,000 30,000 60,000 75,000 85,000 78,000

What is the NET INCOME (loss) for the period? a. P28,090 b. (P28,000) c. (P35,000) d. P 7,000 5.) A Statement of Realization and Liquidation of Nino Jay Corporation has been prepared. Totals therefrom are as follows: Assets to be realized Assets acquired Assets realized Assets not realized Liabilities to be liquidated Liabilities assumed Liabilities liquidated Liabilities not liquidated Supplementary credits Supplementary charges

P 80,000 40,000 30,000 90,000 80,000 50,000 100,000 30,000 110,000 98,000

The ending balances of capital stock and retained earnings are P100,000 and P18,000 respectively How much was the ENDING BALANCE of CASH? a. P 35,000 b. P 45,000 c. P 58,000 d. P 59,000

6.) Russel Co. filed a voluntary bankruptcy petition on August 15, 2008 and the statement of affairs reflects the following amounts:

Assets: Assets with fully secured creditors Assets with partially secured creditors Free assets

Liabilities: Liabilities with priority Fully secured creditors Partially secured creditors Unsecured creditors

Book value

Estimated Current Value

P300,000

P370,000

180,000

120,000

420,000 P900,000

320,000 P810,000

P70,000 260,000 200,000 540,000 P1,070,000

How much was the NET FREE ASSETS? a. P 335,000 b. P 445,000 c. P 365,000 d. P 360,000 7.) Sheila May and Co. Inc. purchased a Cadillac automobile with little cash down and signed a note, secured by the Cadillac, for 48 easy monthly payments. When the company files for bankruptcy, the balance due on the Cadillac amount to P6, 000,000. The car has a book value of P8,000,000 and a net realizable value of P4,000,000. The unsecured creditors of Sheila May and Co. can expect to receive 50% of their claims period in the liquidation, the bank that holds the note on the Cadillac should receive: a. P6,000,000 b. 5,000,000

c. 4,000,000 d. 3,000,000

8.) The following data are provided by the Aiyannah Company Assets at book value Assets of net realizable value Liabilities at book value: Fully secured mortgage Unsecured accounts and notes payable Unrecorded liabilities: Interest on bank notes Estimated cost of administering estate

P150,000 105,000 60,000 70,000 500 6000

The court has appointed a trustee to liquidate the company.

The journal entry made by the trustee to record the assets and liabilities should include an estate deficit of: a. 31,500 b. 31,000 c. 25,500 d. 25,000 9.) Using the same information in number 8, the statement of affairs prepared by the trustee at this time should include an estimated deficiency to unsecured creditors of: a. 45,000 b. 39,000 c. 31,500 d. 25,000 10.) On December 18, 2011 the statement of affairs of Jammy Company which is in bankruptcy liquidation included the following: Assets pledged for fully secured liabilities Assets pledged for partially secured liabilities Free assets Fully secured liabilities Partially secured liabilities Unsecured liabilities with priority Unsecured liabilities without priority

P100,000 40,000 120,000 80,000 50,000 60,000 90,000

Compute the estimated amount to be paid to: Fully Secured Liabilities a.P80,000 b.64,000 c.80,000 d.80,000

unsecured liabilities w/priority P60,000 60,000 48,000 60,000

partially secured liabilities P50,000 48,000 60,000 48,000

unsecured liabilities w/o priority P70,000 88,000 72,000 72,000

11.) The creditors if the CBT Corporation agreed to a liquidation based on the statement of affairs suggested that unsecured creditors, without priority would receive approximately P.60 on the peso. The unsecured creditors are interested in determining whether the preliminary estimate still seems appropriate. The trustee was originally assigned noncash assets of P1,480,000 and creditors’ claims as follows: fully secured 670,000; partially secured P400,000; unsecured with priority P200,000; and unsecured without priority, P320,000. Assets with a book value of 45,000 and unsecured liabilities (without priority) of 35,000 were subsequently discovered. Assets with a total book value of P740,000 were sold for P715,000 net fully secured liabilities of P410,000 and partially secured liabilities of P280,000 were paid. Remaining liquidation expenses were estimated to be P30,000. Assume the remaining noncash assets have an estimated net realizable value as follows: Assets traceable to fully secured creditors Assets traceable to partially secured creditors Free assets

P240,000 110,000 382.000

Determining the revised estimate of the dividend to be received by unsecured creditors without priority: A. 100% B. 66.17% C. 45.97% D. Cannot be determined 12.) Debeethoven Corporation has been undergoing liquidation since January 1, as of March 31, its condensed statement of realization and liquidation is presented below: Assets: Assets to be realized Assets is acquired Assets realized Assets not realized

P1,375,000 750,000 1,200,000 1,375,000

Liabilities: Liabilities liquidated Liabilities not liquidated Liabilities to be liquidated Liabilities assumed

1,875,000 1,700,000 2,250,000 1,625,000

Revenues and expenses: Supplementary charges Supplementary credits

3,125,000 2,800,000

The net gain (loss) for three-month period ending March 31 is: A. P250,000 B. (325,000) C. P425,000 D. 750,000 13.) Using the same information on number 12, compute the ending cash balance of cash account assuming that common stock and deficits are P1,500,000 and P500,000 respectively. A. P425,000 B. P575,000 C. P1,325,000 D. P1.375,000 14.) Karent Company had severe financial difficulties and is considering the possibility of liquidation. At this time, the company has the following assets (stated at net realizable value) and liabilities. Assets (pledged against debts of P70,000) Assets (pledged against debts of P130, 000) Other assets Liabilities with priority Unsecured creditors

P116,000 50,000 80,000 42,000 200,000

In liquidation, how much would be paid to the partially secured creditors? a. P130,000 b. P50,000

c. P74,000 d. P200,000 15.) Fulgencio Company is to be liquidated and has the following liabilities: Income Taxes Notes payable (secured by land) Accounts payable Salary payable (evenly to 2 employees) Bonds Payable Administrative expenses for liquidation

P 8,000 120,000 83,000 6,000 70,000 20,000

The company has the following assets: Current Assets Land Bldg. & equipment

BOOK VALUE P 80,000 100,000 100,000

FAIR VALUE P 33,000 90,000 110,000

How much will the holders of notes payable collect following the liquidation? a. P 108,000 b. P 83,000 c. P 90,000 d. P 120,000 16.) The Gallardo Company owes P 200,000 on a note payable plus P 8,000 in interest to its bank. The note is secured by inventory with a book value of P 160,000 and a fair value of P 120,000. What amount will the bank received if unsecured creditors receive 75% of their claims? a. P 120,000 b. P 160,000 c. P 180,000 d. P 186,000 17.) Pascual Company has been forced into bankruptcy and liquidated. Unsecured claims will be paid at the rate of P 0.50 on the peso. Barber Co. holds a non- interest bearing note receivable from Pascual Co. in the amount of P 50,000, collateralized by machinery with liquidation value of P 10,000. The total amount to be realized by Barber Co. on this note receivable is a. P 35,000 b. P 30,000 c. P 25,000 d. P 10,000 18.) A review of the assets and liabilities of the MauMau Company, in bankruptcy on June 31, 2011, discloses the following: A mortgage payable of P 350,000 is secured by land and buildings valued at P 560,000 Notes payable of P 175,000 are secured by equipment valued at P 140,000 Assets other than those referred to, have an estimated value of P 157,500 Liabilities other than those referred to, total P 420,000, which included claims with priority of P 52,500. What is the estimated deficiency to unsecured creditors?

a. b. c. d.

P 87,500 P 35,000 P 402,500 P 315,000

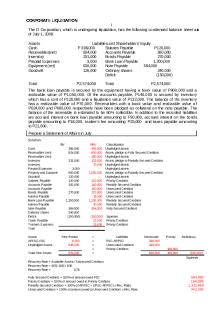

19. to 31.) Kelvin Company has decided to seek liquidation after previous restructuring and quasireorganization attempts failed. The company has the following condensed balance sheet as of May 1, 2011: ASSET Cash Receivable (net) Inventory Prepaid expenses Plant assets Goodwill Total

P 12,000 280,000 70,000 1,000 300,000 39,000 P702,000

LIABILITIES AND STOCKHOLDER’S EQUITY Accrued Payroll P 40,000 Loans from officer 50,000 Accounts payable 60,000 Equipment loans payable 360,000 Business loan payable 180,000 Common Stock 60,000 Deficit (48,000) Total P702,000 The equipment loan payable is secured by specific plant assets having a book value of P300,000 and a realizable value of P350,000. Of the accounts payable, P40,000 is secured by inventory which has a cost of P40,000 and a liquidation value of P44,000. The balance of the inventory has a realizable value of P32,000. Receivables with a book value and market value of P100,000 and P80,000 respectively have been pledged as collateral on the business loan payable. The balance of the receivables has a realizable value of P150,000. 19. Assuming trustee expenses of P12,000 in addition to recorded liabilities, which of the remaining unsecured creditors has the next highest order of priority. a. Accrued payroll c. Loan from officer b. Equipment loan payable d. Business loan payable 20. The realizable value of assets pledged with fully secured creditors is: a. P459,000 c. P40,000 b. P44,000 d. P489,000 21. Of those creditors who are partially secured, their unsecured amounts are: a. P430,000 c. P540,000 b. P110,000 d. P120,000 22. The total realizable value of free assets to unsecured creditors before unsecured creditors with priority is: a. P628,000 c. P220,000

b. P232,000

d. P198,000

23. The dividend to unsecured creditors or the expected recovery percentage of unsecured creditors (rounded) is: a. 90% c. 88% b. 100% d. 76% 24. Estimated deficiency to unsecured creditors is: a. P 0 c. P2,000 b. P22,000 d. P12,000 25. Estimated loss on asset disposition is: a. P51,000 c. P51,000 b. P 89,000 d. P90,000 26. Estimated gain as asset disposition is: a. P56,000 c. P52,000 b. P54,000 d. P 6,000 27. Estimated amount paid to unsecured creditors with priority is: a. P10,000 c. P40,000 b. P30,000 d. P110,000 28. Estimated amount paid to fully secured creditors is: a. P40,000 c. P470,000 b. P390,000 d. P430,000 29. Estimated amount paid to unsecured creditors without priority is: a. P70,000 c. P20,000 b. P61,600 d. P50,000 30. Estimated payment to partially secured creditors is: a. P358,000 c. P168,000 b. P526,800 d. P430,000 31. Estimated payment to creditors is (discrepancy is expected due to rounding off) a. P580,000 c. P571,000 b. P659,600 d. 668,400

MULTIPLE CHOICE PROBLEMS: KEY TO CORRECTIONS 1.) D. P6,500 2.) B. P80,000 3.) C. P95,000 4.) B. (P28,000) 5.) C. P58,000 6.) D. 360000 7.) B. 5,000,000 8.) C. 25,000 9.) C. (31,500)

10.) D. 80,000-60,000-48,000-72,000 11.) C. 45.97% 12.) C. 425,000 13.) C. 1,325,000 14.) C. 74,000 15.) A. P108,000 16.) D. 186,000 17.) B. 30,000 18.) B. 35,000 19.) A. Accrued Payroll 20.) B. 44,000 21.) B. 110,000 22.) D. 198,000 23.) C. 88% 24.) B. 22,000 25.) D. 90,000 26.) A. 56,000 27.) C. 40,000 28.) A. 40,000 29.) B. 61,600 30.) B. 526,800 31.) D. 668,400 32. – 34.) Rocket Bunny Corp. is experiencing financial difficulty and is in the process of liquidation. In its statement of financial position, the mortgage payable of P110, 000 is secured by the land with carrying amount of P100, 000 and fair market value of P105, 000. Accrued expenses total P15, 000 of which P10, 000 represents salaries of employees and the remainder is secured by the inventory with statement of financial position amounting to P132, 000. Estimated payment to partial creditors is P108, 250. The amount of total assets is P135, 000. 32. How much is the estimated recovery percentage? A. 60% B. 65% C. 70% D. 75% 33. How much is the estimated deficiency? A. 4,200 B. 3,600 C. 3,000 D. 4,800 34. How much is the payment to unsecured creditors without priority? A. 4,900 B. 5,250 C. 4,200 D. 4,550 SOLUTION:

PFSC PPSC

FA FSC W/P

PSC W/O

Total payment to PSC PPSC Bal. Estimated Recovery Without priority

108,250 105,000 3,250 ÷ 5,000 65%

Net free assets

12,000 × 65% 7,800

W/out priority Less: NFA Estimated deficiency

12,000 (7,800) 4,200

Unsecured creditors

7,000 × 65%

Payment to unsecured creditors w/out priority

4,550

35.) The accountant of Eternal Corp. prepared a statement of affairs. Assets which there are no claims or liens are expected to produce P700, 000. Unsecured of all classes totalled to P1, 050,000. The following data are claims deemed outstanding: a) Accrued Salaries, P15,000 b) Unrecorded notes for P10, 000, on which P600 of interest has accrued held by Everlasting Co. c) A note for P30, 000 secured by P40, 000 receivable, estimated to be 60% collectible held by Jones Co. d) A P15, 000 note, on which P300 interest has accrued held by Jay Pty. Property with a book value of P10, 000 and a market value of P18,000 is pledged to guarantee payment of principal and interest. e) Unpaid income taxes of P35,000 What is the amount realized by partially secured creditors?

a. b. c. d.

10,600 19,500 24,900 27,900

SOLUTION: Total Free Assets LESS: Unsecured claims with priority: Accrued salaries P15, 000 Unpaid income taxes 35,000 NET FREE ASSETS Divide by total unsecured claims without Priority: Total Unsecured claims of all classes (With or without priority) P1, 050,000 LESS: unsecured claims with Priority (accrued salaries and Unpaid taxes) 50,000 % of Recovery Realizable Amount of accounts receivable (60%*P40, 000) ADD: unsecured portion [(P30, 000-24,000)*65%] Amount realized by partially secured creditors

P700, 000

50,000 P650, 000

P1,000,000 65% P24, 000 3,900 P27,900

36. – 41.) The following data were taken from the statement of affairs for AL Company: Asset pledged for fully secured creditors (Fair Value P80, 000) Asset pledged for partially secured creditors (Fair Value P55, 000) Free Assets (Fair Value P40, 000) Unsecured Liabilities with priority Fully secured liabilities Partially secured liabilities Unsecured liabilities without priorities REQUIREMENTS: 36. Total Free Assets 37. Net Free Assets 38. Total Unsecured Liabilities 39. Estimated Deficiency to Unsecured Creditors 40. Expected Recovery Percentage 41. How much will be paid to each of the following:

P90, 000 85,000 70,000 7,000 30,000 60,000 112,000

a. Unsecured liabilities with priority b. Unsecured liabilities without priority SOLUTION: 37. Free Assets Add: Excess (80,000-30,000) Total free assets

40,000

38. Total free assets Less: Unsecured Liabilities with priority Net free assets

90,000

50,000 90,000

7,000 83,000

39. Unsecured Liabilities with priority Unsecured Liabilities without priority Total Unsecured Claims

7,000 117,000 124,000

40. Net free assets Less: Unsecured without priority Estimated Deficiency

83,000 117,000 (34,000)

Net Free Assets 41. Recovery Percentage = Unsecured liabilites wit h out priority

=

83,000 117,000

= .71 or 71%

42. A. Unsecured liabilities with priority can recover the full amount of 7,000 B. Unsecured liabilities without priority can recover 83,070. Total unsecured liabilities without priority x Recovery Percentage Will be paid

117,000 71% 83,070

43. – 45). Aila Gorgeous Company recently petitioned for bankruptcy and is now in the process of preparing a statement of affairs. The carrying values and estimated fair values of the assets of Aila Gorgeous Company are as follows:

Debts

of

Aila

Gorgeous

are

as

follows:

43. Based on the preceding information, what is the total amount of unsecured claims? A. $113,000 B. $126,000 C. $93,000 D. $121,000 44. Based on the preceding information, what estimated amount will be available for general unsecured creditors upon liquidation? A. $28,000 B. $93,000 C. $113,000 D. $121,000 45. Based on the preceding information, what is the estimated dividend percentage? A. 23 percent B. 93 percent C. 77 percent D. 68 percent

SOLUTION:

170,000.00

65,000.00

20,000.00 80,000.00

157,000.00

126,000.00

10,000.00

60,000.00

10,000.00 (121,000.00 93,000.00

)

77%

In 2014, Camel Corp. was forced into bankruptcy and begun to liquidate. The following selected account balances were taken from its statement of affairs: Asset pledged with partially secured creditors, Book Value P80, 000 Estimated Current Value P50, 000 Total Free Asset, Book Value P220, 000 Estimated Current Value P160, 000 Preferred Claims, Book Value P16, 000 Estimated Current Value 0 Partially secured liabilities Book Value P75, 000 Estimated Current Value P25, 000 Unsecured Liabilities Book Value P155, 000 Estimated Current Value P155, 000 46). What is the total amount available for payment of claims of unsecured creditors? a. b. a. b.

0 144,000 160,000 210,000

47.) What is the estimated amount of liquidating dividend per peso claim (rounded to the nearest centavo)? a. 0.80

b. 0,88 c. 1.03 d. 1.17 48.) What is the amount estimated deficiency to creditors? a. b. c. d.

180,000 160,000 144,000 36,000

SOLUTION: 46.) B.144, 000 Estimated current value of free assets LESS: preferred claims Total amount available to unsecured creditors

P160,000 16,000 P144,000

47.) A. P0 .80 Estimated current value...

Similar Free PDFs

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporate-liquidation compress

- 4 Pages

CORPORATE LIQUIDATION PROBLEMS

- 5 Pages

Module 5 - Corporate Liquidation

- 33 Pages

Module No 1 Corporate Liquidation

- 10 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Partnership Liquidation

- 12 Pages

Corporation liquidation

- 9 Pages

Liquidation-Format - guide fomat

- 2 Pages

Assignment 1 - Liquidation

- 2 Pages

Exemple de liquidation complexe

- 9 Pages

Chapter-1-Exercises - liquidation

- 20 Pages

5. Alternatives to Liquidation

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu