5. Alternatives to Liquidation PDF

| Title | 5. Alternatives to Liquidation |

|---|---|

| Course | Commercial Law |

| Institution | University of Strathclyde |

| Pages | 2 |

| File Size | 94.5 KB |

| File Type | |

| Total Downloads | 92 |

| Total Views | 156 |

Summary

Download 5. Alternatives to Liquidation PDF

Description

Alternatives to Liquidation (Business Law and Practice – p315 – 322) Administration What is it? An independent insolvency practitioner (an administrator) is brought in to run, reorganise, and possibly sell the company as a going concern. Administrators have a wide range of powers including: o Removal and appointment of directors. o Ability to pay money to creditors and other parties. o Deal with company property, including property which is subject to charges (fixed charges with the court’s permission). How is it By court order: o Will make an order if satisfied that the company is or is likely to Commenced ? become unable to pay its debts. o The administration order is reasonably likely to achieve the purpose of administration i.e. a better result than liquidation. By appointment by the directors: o Must give notice to any Qualifying Floating Charge Holders. They can agree or appoint an alternative administrator. o Directors will file a notice of intention with the court and any QFCH, and file a Statutory Declaration. By appointment by a QFCH. Pros Statutory Moratorium o IA 1986, Sch B1, para 42 and 43 o Prevents creditors from taking enforcement actions e.g. petitioning for winding up. o Gives administrators breathing space where they can operate free from creditor pressure. Expertise of an independent insolvency practitioner . Possible to arrange a pre-pack administration where the business is quickly sold as a going concern. Cheaper to go straight to administration rather CVA >> Administration if the CVA fails to save the company. Cons

More costly than a CVA. Stigma: can damage the company’s reputation in the eyes of its customers etc. May encourage the company’s debtors to hold on to their debts as far as possible.

Company Voluntary Arrangement A written agreement between the company and its creditors. Normally will involve the creditors agreeing to a combination of o Waiting longer to be paid o Accepting part payment of their debt. Voluntary agreement with the company’s creditors. Requires the support of 75% of the unsecured creditors to approve the process.

Useful if the company is merely suffering cash-flow problems e.g. because a key customer has been lost. Prevents liquidation more cheaply than administration. o Less formalities. o Do not have to pay administrators fees. Creditors are likely to be paid more than they would be if the company went into liquidation because the process is simpler and less expensive than administration or liquidation. Moratorium only available for small companies (s328 CA 2006) Directors remain in control of the company. No guarantee administration/liquidation may be avoided. May just delay the inevitable. Creditors are unlikely to be paid in full. Voluntary, so may not be possible to agree. Do not get the benefit of the expertise of an independent insolvency practitioner to rescue the company. No moratorium....

Similar Free PDFs

5. Alternatives to Liquidation

- 2 Pages

Alternatives to Tariffs

- 4 Pages

40 alternatives to college

- 6 Pages

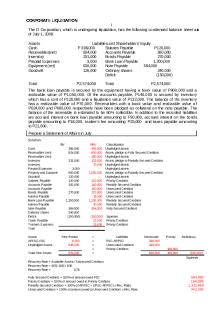

Module 5 - Corporate Liquidation

- 33 Pages

6. Alternatives to High Fantasy

- 16 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Alternatives to the but for test

- 14 Pages

Evaluation Alternatives

- 3 Pages

Partnership Liquidation

- 12 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu