Module 5 - Corporate Liquidation PDF

| Title | Module 5 - Corporate Liquidation |

|---|---|

| Course | Advance Accounting |

| Institution | New Era University |

| Pages | 33 |

| File Size | 2.2 MB |

| File Type | |

| Total Downloads | 340 |

| Total Views | 966 |

Summary

Introduction/Overview This module demonstrates an understanding of corporations suffers from liquidation and reorganization. At the end of this module, the learners will be able to account for corporate liquidation and identify the instances of corporate reorganization. Learners are also expected to...

Description

1. Introduction/Overview This module demonstrates an understanding of corporations suffers from liquidation and reorganization. At the end of this module, the learners will be able to account for corporate liquidation and identify the instances of corporate reorganization. Learners are also expected to describe accounting for corporate liquidation and reorganization and prepare a statement of affairs. 2. Learning Outcomes 1. 2.

Describe the accounting for corporate liquidation and reorganization. Prepare a statement of affairs.

3. Corporate Liquidation A company may suffer from continued losses from operations, overextended credit to customers, poor management, or working capital, failure to react to changes in economic conditions, inadequate financing, and a host of other reasons for not sustaining a viable economic position. The most common reason why corporations liquidate is insolvency. A corporation is insolvent when its total liabilities exceed its total assets, thereby resulting in financial difficulty in paying off debts. Under the Insolvency Act of the Philippines, insolvency may be either: a.

Voluntary — the insolvent corporation voluntarily applies a petition to a court of law to be discharged from its liabilities; or

b.

Involuntary — three or more creditors of the insolvent corporation file a petition to a court of law for the adjudicati0fl of the corporation as insolvent.

Insolvency is different from illiquidity. Illiquidity is the inability to pay off debts because of a shortage in cash or Other liquid assets, while insolvency is the total inability to pay off debts because of a lack of assets. Among the possible recourse of an insolvent corporation are the following: a.

Liquidation

b.

Reorganization

Corporate liquidation Liquidation - is the termination of business operations or winding up of affairs. It is a process by which assets are into cash, liabilities are settled, and any remaining distributed to the owners.

Measurement basis The PFRSs are applicable only to "going concern" entities. Thus, the measurement bases prescribed in the PFRSs do not apply to liquidating entities, for liquidating entities, the appropriate measurement bases are realizable value (estimated selling price less disposal costs) for assets and expected net settlement the amount for liabilities.

Financial reports Liquidating entities usually prepare the following financial reports: 1.

Statement of affairs

2.

Statement of realization and liquidation

Additional statements, such as note disclosures and summary of cash receipts and disbursements may also be prepared.

4. Statement of Affairs A statement of affairs shows the financial position of a liquidating entity — the assets that are available for sale, the claims of creditors to be settled and the claims of the owners. It is similar to a regular Statement of financial position or balance sheet, except that assets are measured at realizable values (and liabilities at expected net settlement amounts), and the presentation is different.

Assets in the statement of affairs are classified into the following: 1. Assets pledged to fully secured creditors- these are assets with realizable values equal to or greater than the expected net settlement amounts of the related liabilities for which the assets have been pledged as security.

Example: Building with a realizable value of P1,000,000, pledged as security for a bank loan of P800,000. The bank (creditor) is fully secured because it is guaranteed full payment for the loan. After the bank is paid, the P200,000 excess is available to unsecured creditors. Assets pledged to partially secured creditors — these are assets with realizable values less than the expected net settlement amounts of the related liabilities for which the assets have been pledged as security. 2.

Example: Equipment with a realizable value of P500,000 that secures a bank loan of P800,000. The bank is partially secured because it is guaranteed only P500,000 out of the P800,000 loan balance. The deficiency on the loan payment must come from the proceeds of other assets. Free assets — these are assets that have not been pledged as security for liabilities. These also include the excess of assets pledged to fully secured creditors over the related liabilities. 3.

Example: Cash of P10,000 that can be used at the discretion of the entity. Another example is the “P200,000 excess" in #1 above.

Liabilities in the statement of affairs are classified into the following: liabilities with priority — these are liabilities that although not secured by any asset, are mandated by law to be paid first before other unsecured liabilities. Examples include payables for:

1. Unsecured

a. Administrative,

expenses, e.g., filing fees, attorney's fees, referee's fees, trustee's fees, and other direct costs of the insolvency proceedings

b. Unpaid c. Taxes

employee salaries and other benefits

and assessments

secured creditors — these are liabilities secured by assets with sufficient realizable values (see discussion on Assets pledge to fully secured creditors).

2. Fully

secured creditors — these are liabilities secured by assets with insufficient realizable values (see discussion on Assets pledged to partially secured creditors of the P800,000 loan, P500,00 is a secured. claim while P300,000 is an unsecured).

3. Partially

4. Unsecured

liabilities without priority - all other liabilities not classifiable under (1), (2) or (3) above.

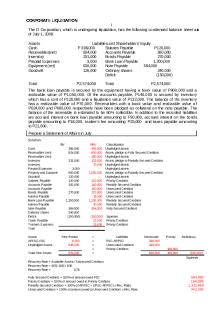

5. Illustration Illustration: Statement of affairs ABC Co. has filed for voluntary insolvency and is going to liquidate. ABC's statement of financial position prior to the liquidation process is shown below:

Additional information: The following were determined before the start of the liquidation process: a. Only 76% of the accounts receivable is collectible. b. P10,000 interest is receivable on the note. c. The inventory has an estimated selling price 420,000 of estimated costs to sell of P10,000. d. The prepaid assets are non-refundable. e. The land and building have fair values of P800,000, respectively, but ABC Co. at a package price of P2,600,000. f. The equipment has an estimated net selling 200,000 g. Administrative expenses of P30,000 incurred in the liquidation process. h. The accrued expenses include accrued salaries of P25,000 i. P15,000 interest is payable on the loan j. All the other liabilities are stated at their expected net settlement amounts. Requirements: Prepare the statement of affairs as of January q, 20x1.

Solution: Step 1: Restate the assets and liabilities Assets are restated to realizable values, and liabilities to expected net settle amounts. The difference represents the estimated deficiency in the settlement to creditors and owners.

•

The land and building are restated to realizable values rather than fair values. Fair value favors "going concern" while realizable value normally reflects a price in a forced sale transaction, which is the case for a liquidating entity.

•

The unrecorded assets and liabilities (i.e., interest receivable, Interest payable and estimated administrative expenses) are recognized.

•

The difference between the restated assets and liabilities represents the estimated deficiency in the settlement of unsecured non-priority creditors. If a deficiency exists, the claims of unsecured creditors without priority will not be paid in full.

Step 2: identify the classification of the assets and liabilities Assets

LIABILITIES

Step 3: (Optional) Estimated recovery percentage At this point, we can compute for the estimated recoveries of the creditors and owners. Since we have identified a deficiency in Step 2, the unsecured creditors without priority will not be paid in full. The payments to them can be determined using the estimated recovery percentage. The formula for this percentage is as follows: Estimated recovery percentage of unsecured creditors without priority

Estimated recovery percentage of unsecured creditors without priority

=

_____Net free assets_____ Total Unsecured Liabilities Without Priority

70%

The estimated amounts to be recovered by each class of creditor are computed as follows:

Notes: The computation of the estimated recovery of the partially Secured creditors is elaborated below:

In case of liquidation, all the creditors must be paid first before the owners. In this illustration, the unsecured creditors without priority can only be paid partially; therefore, none will be paid to the shareholders. Alternative solution: Estimated recovery

Estimated recovery percentage = (907,200/ 1,296,000) = 70% The formula for estimated recovery percentage is derived as follows: the proceeds from the sale of assets are used to settle first all secured and priority claims any remaining amount (i.e., net free assets) is use to pay unsecured non-priority liabilities. That remaining amount divided by the unsecured non-priorities represent the estimated recovery percentage. Sometimes, this estimated recovery is stated in peso ratio, e.g., 70% recovery means that for every peso claim only 70 centavos will be paid. Step 4: Statement of affairs The statement of affairs is prepared as follow ABC CO. Statement of affairs as of January 1 20x1

Assets pledge to fully secured creditors:

Assets pledge to partially secured creditors:

Free assets:

Unsecured liabilities with priority:

Fully secured creditors:

Partially secured creditors:

Unsecured creditors:

Statement of realization and liquidation The liquidation process may take some time before it is completed. Therefore, there is a need to provide periodic financial reports that show information on the progress of the liquidation process, most especially when the winding up of affairs is entrusted to a receiver. These financial reports take the form of a statement of realization and liquidation.

The statement of realization and liquidation is depicted like a T-account. This presentation originated in the U.S as a legally oriented form.

• • •

Debits

Credits

Assets to be realized

Assets realized

Assets acquired

Assets not realized

Liabilities liquidated

Liabilities to be liquidated

Liabilities not liquidated

Liabilities assumed

Supplementary expenses

Supplementary income

Assets to be realized — represents the total non-cash assets available for disposal as at the beginning of the period. This is measured at book value (carrying amount). Assets acquired — represents previously unrecorded assets that were recognized during the period. Similar terms are "additional assets" or "new assets." Assets realized represents the actual net proceeds from the conversion of non-cash assets into cash during the period. Assets not realized — the unsold non-cash assets as at the end of the period, measured at book value.

• • • • •

Liabilities to be liquidated represents the total liabilities to be settled as at the beginning of the period. This is measured at book value. Liabilities assumed represents previously unrecorded liabilities that were recognized during the period. Similar terms are "additional liabilities" or "new liabilities." Liabilities liquidated — represents the actual net settlement amounts of liabilities paid during the period. Liabilities not liquidated — the unpaid liabilities as at the end of the period, measured at book value. Supplementary expenses / income income and expenses realized/incurred during the period.

Assets and liabilities transferred to the receiver/trustee are presented separately from newly acquired (assumed) assets (liabilities) in order to highlight the receiver/trustee's accountability. Actual amounts received (paid) on the sale of assets (settlement of liabilities) are also presented. The assets and liabilities are measured at book values in order to highlight the actual gains or losses from sale of assets and settlement of liabilities (i.e., actual receipt/payment less carrying amount of asset/liability equals gain or loss). Because the beginning and ending balances of the assets and liabilities and the additions there to are stated at book values, while disposals and settlements are stated at actual amounts, the total debits and total credits in the T-account will naturally not balance. The difference (balancing figure) represents the net gain or loss on the sale of assets and settlement of liabilities during the period. This is similar to the procedure applied to an "income summary" account.

Illustration: Statement of realization and liquidation ABC Co. is going to liquidate. A receiver/trustee will administer the liquidation. ABC's financial position on Jan. 1, 20x1, before the start of the liquidation process, is summarized below Book value

Additional information a.

P10,000 interest is receivable on the note and P15,000 interest is payable on the loan.

b.

Administrative expenses of P30,000 are expected to be incurred in the liquidation process.

The entry in the books of the receiver to record the transfer of custody over the assets and liabilities of ABC Co. is as follows:

Notes: •

The receiver records the assets and liabilities at book values rather than realizable values and expected net settlement amounts.

•

The unrecorded interests are not included in the opening entry above. These are recorded separately and identified as "new" assets and liabilities as follows:

• •

The estimated administrative expenses are not recorded. These are recorded only when actually paid. Actual liquidation costs and gains and losses are subsequently recorded directly to the "estate" account. If this account has a debit balance, it is referred to as "estate deficit;" if credit balance, as "estate equity."

A statement of realization and liquidation shows information on the progress of the liquidation process. Accordingly, it is prepared at the end of each period (contrast this to the statement of affairs). The following transactions occurred during the period: a.

Only P165,000 were collected on the accounts receivable. The remainder was written-off.

b.

The interest on the note was collected in full, but only 90%??} was collected on the principal. The remainder was written-off'

c.

Half of the inventory was sold for P300,000. Actual costs to sell were P5,000.

d.

The prepaid assets were written-off.

e.

The land and building were sold for

f.

The equipment was sold for P220,000.

g.

Of the total accrued expenses, only the accrued salaries of P25,000 were paid. The balance remains outstanding.

h.

The current tax payable was paid in full.

i.

The interest and the principal on the loan were paid in

j.

The note payable was settled for P220,000. The lender canceled the balance.

k.

Administrative expenses of P27,000 were paid.

Journal entries (books of the receiver):

The amounts to be presented in the statement of realization and liquidation are identified as follows: • • •

Assets to be realized are P3,660,000 the book value of non-cash assets transferred by ABC Co. to the receiver (P3.7M total assets less P40,000 cash). Assets acquired are P10,000, the unrecorded interest receivable. Assets realized are equal to the actual net proceeds from the conversation of the non- cash assets into cash

,

165,000 100,000 295,000 2,600,000 220,000 3,380,000 Assets not realized are P265,000, the book value of the unsold inventory (P530,000 x 50%). • • •

Liabilities to be liquidated are P3,871,000, the book value of the liabilities transferred by ABC Co. to the receiver. Liabilities assumed are P15,000, the unrecorded interest payable. Liabilities liquidated are equal to the actual payments on the' liabilities:

e.

Payment for accrued salaries

25,000

f.

Payment for current tax payable

350,000

g.

Payment for interest and loan

2,015,000

h.

Payment for note payable

220,000

Liabilities liquidated

2,610,000

•

Liabilities to be liquidated is equal to the book value of the unpaid liabilities:

Accrued expenses (221K – 25K accrued salaries)

196,000

Account payable

1,000,000

Liabilities to be liquidated

1,196,000

• • •

Supplementary expenses is P27,000 the administrative expenses paid during the period . There is no supplementary income during the period. The net gain (loss) during the period computed as follows:

•

The statement of realization and liquidation is prepared as follows:

•

Additional Analyses and Reconciliations

Breakdown of net gain using separate T-accounts

(a)

Excess of total debits (book value) over total credits (net proceeds)

(b)

Excess of total credits (book value) over total debits (amount paid)

Net Loss on Sale of Assets

(25,000)

Net Gain on Settlement of Liabilities 80,000 Net Expenses

(27,000)

Net Gain During the Period

28,000

Breakdown of net gain on a per account basis:

Ending Balance of Cash

Ending Balance of Estate Equity (Deficit)

Additional illustrations: The succeeding illustrations aim to provide the serious student additional learning materials on the accounting for corporate liquidation. If you are not that type of student, you are still welcome to study these illustrations.

Illustration 1: Recovery of claims by order of priority ABC Co.'s statement of affairs indicates that unsecured creditors without priority with total claims of P180,000 can expect to recover P72,000 if all the assets were sold. Among the creditors of ABC Co. are the following: • • • •

Government: taxes payable of P100,000, inclusive of P20,000 assessments and surcharges. XYZ bank: loan payable of P1,000,000 and accrued interest of P50,000, backed by collateral security with realizable value of P1,200,000. Alpha Financing Co.: loan payable of P800,000 backed collateral security with realizable value of P500,000. Mr. Bombay: loan payable of P250,000 and accrued interest P50,000. No collateral security.

Requirements: how much is the expected recovery of each of the creditors listed above? Solution: Claim ·

Estimated recovery

100%

100,000

100%

1,050,000

Government –

unsecured liability with 100,000 priority 1,050,000 · XYZ Bank – fully secured ·

Recovery percentage

Alpha financing co.

– partially creditors

secured

500K+(300K x 40%)

800,000

620,000

· Mr. Bombay – 40% unsecured 300,000 120,000 liability without priority v (estimated recovery percentage= 72,000 / 1...

Similar Free PDFs

Module 5 - Corporate Liquidation

- 33 Pages

Module No 1 Corporate Liquidation

- 10 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporate-liquidation compress

- 4 Pages

CORPORATE LIQUIDATION PROBLEMS

- 5 Pages

5. Alternatives to Liquidation

- 2 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Partnership Liquidation

- 12 Pages

Module 5

- 5 Pages

Module 5

- 22 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu