CORPORATE LIQUIDATION PROBLEMS PDF

| Title | CORPORATE LIQUIDATION PROBLEMS |

|---|---|

| Course | BS Accountancy |

| Institution | Batangas State University |

| Pages | 5 |

| File Size | 56.5 KB |

| File Type | |

| Total Downloads | 147 |

| Total Views | 330 |

Summary

AssessmentExercise 1 The following information were taken from the Statement of Affairs of ABC Corp. as August 31, 2011: Fully secured creditors P 60,Partially secured creditors 120,Unsecured liabilities with priority 14,Unsecured liabilities without priority 224,Assets pledged with fully secured cr...

Description

Assessment Exercise 1 1. The following information were taken from the Statement of Affairs of ABC Corp. as August 31, 2011: Fully secured creditors Partially secured creditors

Unsecured liabilities with priority

P 60,000 120,000

14,000

Unsecured liabilities without priority

224,000

Assets pledged with fully secured creditors (FMV P150,000)

180,000

Assets pledged with partially secured creditors (FMV P104,000)

148,000

Free assets (FMV P80,000)

140,000

Compute the following: ●

The

amount that will be paid to fully secured creditors is

●

The

amount that will be paid to unsecured creditors with priority is

●

The

amount to be paid to partially secured creditors is

●

The

amount to be paid to unsecured creditors is

2. On December 31, 2011, Gorilla Company was experiencing financial difficulties and entered into a debt restructuring agreement with the creditor. The creditor restructured the obligation as follows:

●

The

principal was reduced from P10,000,000 to P9,800,000

●

Forgave

●

Extended

the accrued interest of P1,200,000. the maturity date from December 31, 2011 to December 31, 2014.

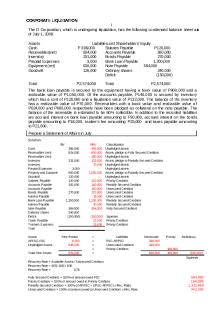

● R educed the interest from 12% to 10%. Interest is payable on December 31, 2012, 2013 and 2014. How much should the creditor report as loss on debt restructuring? (Ignore income taxes and carry present value factors to 5 decimal places.) 3. Kent Co. filed a voluntary bankruptcy petition on August 15, 2008, and the statement of affairs reflects the following amounts: Assets

Pledged with fully secured creditors

Book value

Estimated Market value

P300,000

P370,000

Pledged with partially secured creditors

180,000

120,000

Free Assets

420,000

320,000

Liabilities With priority

70,000

Fully secured

260,000

Partially secured

200,000

Unsecured

540,000

What amount of cash will be available for unsecured creditors?

4. The balance sheet of Evergreen Company at June 30, 2012 contains the following items:

Assets Cash

P

80,000

Accounts receivable (net)

140,000

Inventories

100,000

Land

260,000

Building – net

200,000

Machinery – net

120,000

Patent

100,000

Total

P1,000,000

Liabilities and Stockholders’ Equity Accounts Payable

P

220,000

Wages Payable

120,000

Taxes Payable

20,000

Mortgage Payable

300,000

Interest on Mortgage Payable Notes Payable – unsecured

Interest Payable - unsecured Capital Stock

30,000 100,000

10,000 400,000

Retained Earnings (deficit) Total

(200,000) P1,000,000

The company is in financial difficulty, and its stockholders and creditors have requested a statement of affairs for planning purposes. The following information is available: 1. The company estimates that P126,000 is the maximum amount of collectible for the accounts receivable. 2. Except for 20% of the inventory items that are damaged and worth only P4,000, the cost of other items is expected to be recovered in full. 3. The land and building have a combined appraisal value of P340,000 and are subject to the P300,000 mortgage and related accrued interest. 4. The appraised value of the machinery is P40,000.

Compute the following: ●

How

much is the net free assets?

●

How

much is the total unsecured liabilities with priority?

●

How

much is the total unsecured liabilities without priority?

●

Compute

the estimated settlement per peso of unsecured creditors.

Exercise 2 1. Kwell Co. owes Kuto Bank P4,000,000 plus accrued interest of P360,000. The unamortized discount on the loan is P80,000. The debt is a 10-year, 12% loan. During 20x1, Kwell’s business deteriorated due to loss of demand for its services. On December 31, 20x1,

Kuto Bank agrees to accept old equipment and cancel the entire debt. The equipment has a cost of P12,000,000, accumulated depreciation of P8,800,000 and fair value of P3,600,000. How much is the gain (loss) on the extinguishment of the debt?

2. On December 31, 20x1, Cassy Co. issued 10,000 shares with par value of P400 per share in settlement of a P4,000,000 loan payable with a related unamortized discount of P80,000, and accrued interest of P360,000. On December 31, 20x1, the shares are selling at P480 per share. How much is the gain(loss) on the extinguishment of the debt?

3. On December 31, 20x1, Basty Co. agreed to the following modification of its existing liability. ●

Reduced

●

Forgave

●

Extended

●

Reduced

the principal on the loan of P20,000,000 to P16,000,000.

the accrued interest of P2,400,000. the maturity date from December 31, 20x2 to December 31, 20x4. the loan’s nominal interest rate of 12% to 10%.

Interest is payable annually at each year end. The original effective interest rate of the debt instrument for both Basty and its creditor, the Bank, is 12%. The prevailing market rate of interest as of December 31, 20x1 is 11%. How much is the gain (loss) on the extinguishment of the debt?...

Similar Free PDFs

CORPORATE LIQUIDATION PROBLEMS

- 5 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporate-liquidation compress

- 4 Pages

Module 5 - Corporate Liquidation

- 33 Pages

Problems on Liquidation

- 5 Pages

Module No 1 Corporate Liquidation

- 10 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Partnership Liquidation

- 12 Pages

Corporation liquidation

- 9 Pages

Liquidation-Format - guide fomat

- 2 Pages

Assignment 1 - Liquidation

- 2 Pages

Exemple de liquidation complexe

- 9 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu