Liquidation PDF

| Title | Liquidation |

|---|---|

| Course | Corporate Law |

| Institution | University of Melbourne |

| Pages | 4 |

| File Size | 128.7 KB |

| File Type | |

| Total Downloads | 37 |

| Total Views | 174 |

Summary

summary for liquidation...

Description

**ss588FA-SS588FJ provides a number of different types of antecedent transaction STEP 1: IDENTIFY THE TYPE OF TRANSACTION S588FA - Unfair preferences S588FA(1) an unfair preference is a transaction between a coy and a creditor which results in the creditor receiving more money than would have been received if the creditor had proved their debt in the coy’s winding up Relevant case: Airservices Australia v Ferrier – there is an unfair preference only if the net effect of the series of transactions results in a creditor’s position being improved OR S588FB uncommercial transaction S588FB a transaction is said to be an uncommercial transaction if it may be expected that a reasonable person in the coy’s circumstances would not have entered into it having regard to: The benefits generated from the transaction The detriment to the coy of entering the transaction The respective benefits to other parties if the transaction of entering into it Eg. - Giving gifts or benefits to the coy’s directors, or their families or friends, paid for out of coy’s funds - Coy’s asset acquisition from the coy’s directors, or their families or friends at lower/inflated prices Relevant cases: Re Pacific Hardware Brokers (Qld) Pty Ltd – director of an insolvent coy used coy’s funds to purchase an engagement ring for his fiancé.

Demondrille Nominees Pty Ltd v Shirlaw – director entered into contract that does not bring benefit to the coy OR Unreasonable director-related transactions – s 588FDA pg936 Transaction is an unreasonable director-related Transaction if transaction made by company to – director or ‘close associate of director’ )s 9 definition) Reasonable person would NOT have entered into transaction – The word “transaction” includes payments and share/option issue E.g. A few months before the company’s liquidation, its directors approved the payment of extremely large bonuses to the company’s two joint managing directors. S588FDA (1)(A) Under s588FE(6A), transaction is Voidable if entered into during 4 years ending on relation-back day no need to prove company insolvent overlap with uncommercial transactions, director’s duty not to prejudice creditors interests

STEP 2: PROVE THAT IT IS AN INSOLVENT TRANSACTION S588FC a transaction is an insolvent transaction if: It is an UNFAIR PREFERENCE or UNCOMERCIAL TRANSACTION The coy was insolvent at the time of entering into the transaction or became insolvent because of the transaction STEP 3: PROVE THAT IT IS A VOIDABLE TRANSACTION S588FE this is a voidable transaction which the insolvent transaction was entered into during a period before the winding up begin

For unfair preference s588FE(2): To a related entity during the 4 years ending on the relation-back day To a non-related entity during the 6 months ending on the relation-back day For uncommercial preference s588FE(3): To a related entity during the 4 years ending on the relation-back day To a non-related entity during the 2 years ending on the relation-back day Hence, Transactions are voidable by liquidatorv (when they meet the above 2 elements) STEP 4: STATE THE COMPENSATIONS IF THE TRANSACTIONS ARE ESTABLISHED S588FF - Compensation For unfair preferences: S588FF(1)(a) court orders that the creditor repay the unfair preference to the coy For uncommercial preferences: Liquidator may set aside uncommercial transaction under S588F and recover funds from the other party to the transaction: - S588M – court may order that the directors compensate the coy - S588F(1)(b) – court may order the recipient of the gift transfer the asset to the coy OR - S588F(1)(c) – court may order the recipient of the gift to repay to the coy the amount which fairly represents the benefits the person has received STEP 5: DEFENCES APPLIED (What transaction not voidable?) S588FG - Defences

S588FG(2) a court must not make an s588FF order if: - S588FG(2)(a) – the person became a party to the transaction in good faith o Downey v Aira Pty Ltd – the test of “good faith” can be satisfied if the creditor can prove that they did not believe the coy was insolvent or would become insolvent by paying the creditor - S588FG(2)(b) – at the time of becoming a party to the transaction, the person had no reasonable grounds for suspecting that the coy was insolvent and a reasonable person in the person’s circumstances would have no such grounds for so suspecting Case:Mann v Sangria o Roufeil v Gliderol International Pty Limited – this defence cannot be established where the court say that a reasonable person in the creditor’s position would have suspected that the debtor coy was insolvent. - S588FG(2)(c) – the person has provided valuable consideration under the transaction or has changed their position in reliance on the transaction...

Similar Free PDFs

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Partnership Liquidation

- 12 Pages

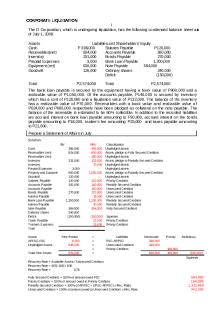

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporation liquidation

- 9 Pages

Corporate-liquidation compress

- 4 Pages

Liquidation-Format - guide fomat

- 2 Pages

Assignment 1 - Liquidation

- 2 Pages

Exemple de liquidation complexe

- 9 Pages

Chapter-1-Exercises - liquidation

- 20 Pages

5. Alternatives to Liquidation

- 2 Pages

Chapter 6 Partnership Liquidation

- 22 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu