Chapter-1-Exercises - liquidation PDF

| Title | Chapter-1-Exercises - liquidation |

|---|---|

| Author | Kim Ambrose |

| Course | Bachelor of Science in Accountancy |

| Institution | Polytechnic University of the Philippines |

| Pages | 20 |

| File Size | 351.7 KB |

| File Type | |

| Total Downloads | 21 |

| Total Views | 225 |

Summary

EXERCISESA. Tik, Tak and Toe, who share profits and losses in the ratio of 4:4:2, respectively, decideto liquidate their partnership on December 31, 2019. The condensed statement offinancial position is presented below just prior to liquidation.3T PartnershipStatement of Financial PositionDecember 3...

Description

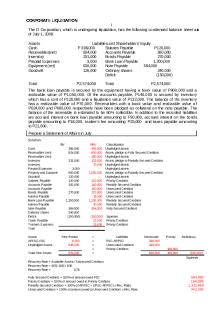

EXERCISES

A.

Tik, Tak and Toe, who share profits and losses in the ratio of 4:4:2, respectively, decide to liquidate their partnership on December 31, 2019. The condensed statement of financial position is presented below just prior to liquidation.

Cash Other Assets

3T Partnership Statement of Financial Position December 31, 2019 ASSETS LIABILITIES AND EQUITY P 40,000 Liabilities P 224,000 680,000 Tak, Loan 10,000 Toe, Loan 16,000 Tik, Capital 190,000 Tak, Capital 120,000 Toe, Capital 160,000

Total Assets

P 720,000

Total Liabilities and Equity

P 720,000

Instruction: Prepare a statement of Liquidation and the required journal entries for each of the following cases and supporting schedule of cash distribution, if necessary assuming cash is immediately distributed to the proper parties. Assume also that the deficient partner/s will invest cash which is then distributed as second payment to the proper parties.

Case A Case B

P 700,000 500,000

Case C Case D

P 370,000 340,000

Case E Case F

P 250,000 180,000

Case A 700,000

Profit and loss ratio Balances before liquidation Realization and distribution of gain Balances Payment of liabilities Balances Payment to

Cash

Other Assets

Liabilities

40,000

680,000

224,000

700,000

(680,000)

740,000 (224,000) 516,000 (516,000)

224,000 (224,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Tak Toe Tik 4 10,000 16,000 190,000

Capital Tak 4 120,000

Toe 2 160,000

8,000

8,000

4,000

10,000

16,000

198,000

128,000

164,000

10,000 (10,000)

16,000 (16,000)

198,000 (198,000)

128,000 (128,000)

164,000 (164,000)

partners Journal Entries Journal entries: a)

Sale of other assets and distribution of gain

Cash Other assets Tik, capital Tak, Capital Toe, Capital

700,000 680,000 8,000 8,000 4,000

b) Payment of liabilities Liabilities Cash c)

224,000 224,00

Payment to partners

Tak, loan Toe, loan Tik, Capital Tak, Capital Toe, Capital Cash

10,000 16,000 198,000 128,000 164,000 516,000

Case B 500,000

Profit and loss ratio Balances before liquidation Realization and distribution of loss Balances Payment of liabilities Balances Payment to partners

Cash

Other Assets

40,000

680,000

500,000

(680,000)

540,000 (224,000) 316,000 (316,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Liabilities Tak Toe 224,000

224,000 (224,000)

10,000

16,000

Tik 4 190,000

Capital Tak 4 120,000

(72 ,000)

(72,000)

(36,000)

Toe 2 160,000

10,000

16,000

118,000

48,000

124,000

10,000 (10,000)

16,000 (16,000)

118,000 (118,000)

48,000 (48,000)

124,000 (124,000)

Journal Entries a)

Sale of other assets and distribution of loss

Cash Tik, capital Tak, Capital Toe, Capital Other Assets

500,000 72,000 72,000 36,000 680,000

b) Payment of liabilities Liabilities Cash c)

224,000 224,00

Payment to partners

Tak, loan Toe, loan Tik, Capital Tak, Capital Toe, Capital Cash

10,000 16,000 118,000 48,000 124,000 316,000

Case C 370,000

Profit and loss ratio Balances before liquidation Realization and distribution of loss Balances Payment of liabilities Balances Offset Tak, Loan to Tak’s capital deficiency Balances Payment to

Cash

Other Assets

40,000

680,000

370,000

(680,000)

410,000 (224,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Liabilities Tak Toe 224,000

224,000 (224,000)

10,000

16,000

Tik 4 190,000

Capital Tak 4 120,000

(124,000)

(124,000)

(62,000)

Toe 2 160,000

10,000

16,000

66,000

(4,000)

98,000

186,000

10,000 (4,000)

16,000

66,000

(4,000) 4,000

98,000

186,000

6,000

16,000

66,000

98,000

(186,000)

(6,000)

(16,000)

(66,000)

(98,000)

partners Journal Entries a)

Sale of other assets and distribution of loss

Cash Tik, capital

370,000 124,000

Tak, Capital Toe, Capital Other Assets

124,000 62,000 680,000

b) Payment of liabilities Liabilities Cash

224,000 224,00

c) Offset loan to capital deficiency Tak, Loan 4,000 Tak, Capital

4,000

d) Payment to partners Tak, loan Toe, loan Tik, Capital Toe, Capital Cash

6,000 16,000 66,000 98,000 186,000

Case D 340,000

Profit and loss ratio Balances before liquidation Realization and distribution of loss Balances Payment of liabilities Balances Offset Tak, Loan to Tak’s capital deficiency Balances Payment to partners (See Schedule) Balances Additional investment of Tak Balances Payment to Partners

Cash

Other Assets

40,000

680,000

340,000

(680,000)

380,000 (224,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Liabilities Tak Toe 224,000

16,000

Capital Tak 4 120,000

(136,000)

(136,000)

(68,000)

Toe 2 160,000

10,000

16,000

54,000

(16,000)

92,000

10,000 (10,000)

16,000

54,000

(16,000) 10,000

92,000

156,000

16,000

54,,000

(6,000)

92,000

(156,000)

(16,000)

(50,000)

156,000

-

224,000 (224,000)

10,000

Tik 4 190,000

4,000

6,000

(90,000)

(6,000)

2,000

6,000

6,000

4,000

2,000

(6,000)

(4,000)

(2,000)

3T Partnership Accompany Statement of Liquidation January 1-31, 2020 Tik P 54,000

Tak (P 6,000)

P 54,000

(P6,000)

(4,000) P 50,000

6,000

Capital balances Add: loan balances Total partners’ Interest Restricted interests – possible loss to P 6,000 to Tik and Toe in the ratio of 4:2 if Tak fails to pay his deficiency Free interest – amount to be paid to partner

Payment to apply on: Loan Capital Cash settlement

P 50,000 P 50,000

Toe P 92,000 16,000 P 108,000 (2,000) P 106,000

P 16,000 P 90,000 P 106,000

Journal entries a)

Sale of other assets and distribution of loss

Cash Tik, Capital Tak Capital Toe, Capital Other Assets

340,000 136,000 136,000 68,000

d) Payment to partners with accompanying schedule Toe, loan Tik, Capital Toe, Capital Cash

c)

e) Additional investment of 224,000 224,000

Cash Tak, Capital

Offset loan to capital deficiency Tak, loan Tak, Capital

156,000

680,000

b) Payment of liabilities Jolly Liabilities Cash

16,000 50,000 90,000

6,000 6,000

f) Final payment to partners

10,000 10,000

Tik, Capital Toe, Capital Cash

4,000 2,000 6,000

Case E 250,000

Profit and loss ratio Balances before liquidation Realization and distribution of loss Balances Payment of liabilities Balances Offset Tak, Loan to Tak’s capital deficiency Balances

Payment to Partners ( see schedule) Balances

Cash

Other Assets

40,000

680,000

250,000

(680,000)

290,000 (224,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Liabilities Tak Toe 224,000

16,000

Capital Tak 4 120,000

(172,000)

(172,000)

(86,000)

Toe 2 160,000

10,000

16,000

18,000

(52,000)

74,000

10,000 (10,000)

16,000

18,000

(52,000) 10,000

74,000

66,000

16,000

18,000

(42,000)

74,000

(66,000)

(16,000)

66,000

-

224,000 (224,000)

10,000

Tik 4 190,000

(50,000)

(10,000)

(42,000)

14,000

3T Partnership Accompany Statement of Liquidation January 1-31, 2020

Capital balances Add: loan balances Total partners’ Interest Restricted interests – possible loss to P 42,000 to Tik and Toe in the ratio of 4:2 if Tak fails to pay his deficiency Balance Restricted Interests – possible loss to 10,000 to Toe if Tik fails to pay his deficiency Free interest – amount to be paid to owner

Tik P 18,000

Tak (P 42,000)

P 18,000

(P42,000)

(28,000) (10,000)

42,000

10,000

Toe P 74,000 16,000 P 90,000 (14,000) 76,000 (10,000) 66,000

Payment to apply on: Loan Capital Cash settlement

P 16,000 60,000 P 66,000

Journal entries a)

Sale of other assets and distribution of loss Cash Tik, Capital Tak Capital Toe, Capital Other Assets

250,000 172,000 172,000 86,000

Tik, Capital Toe, Capital Tak, Capital

c)

g)

Final Payment to partners

42,000

e) Additional loss to Toe due to Tik’s deficiency 224,000 224,000

Offset loan to capital deficiency Tak, loan Tak, Capital

28,000 14,000

680,000

b) Payment of liabilities Liabilities Cash

d) Additional loss to Partners due Tak’s deficiency

Toe, Capital Tik, Capital

10,000 10,00 0

f) Additional Investment of Tik and Tak

10,000 10,000

Cash Tik, Capital Tak, Capital

52,000 10,000 42,000

Toe, Capital Cash

52,000 52,000

Case F 180,000

Profit and loss ratio Balances before liquidation Realization and distribution of loss Balances Payment of liabilities Balances Offset Tak Loan to Tak’s capital deficiency Balances Additional Investment of Tik and Tak Balances Payment for liabilities Balances Payment to partners

Cash

Other Assets

40,000

680,000

180,000

(680,000)

3T Partnership Statement of Liquidation January 1-31, 2020 Loan Liabilities Tak Toe 224,000

10,000

Tik 4 190,000

Capital Tak 4 120,000

Toe 2 160,000

(200,000)

(200,000)

(100,000)

16,000

220,000 (220,000)

224,000 (220,000)

10,000

16,000

(10,000)

(80.000)

60,000

-

4,000

10,000 (10,000)

16,000

(10,000)

(80,000) 10,000

60,000

(10,000) 10,000

(70,000) 70,000

60,000

4,000 80,000

80,000 (4,000)

60,000 (4,000)

76,000 (76,000)

16,000 (16,000)

60,000 (60,000)

Journal entries a)

Sale of other assets and distribution of loss Cash Tik, Capital

180,000 200,000

Cash Tik, Capital

Tak Capital

200,000

Tak, Capital

Toe, Capital

100,000

Other Assets b)

d) Additional Investment of Tik, and Tak

Payment of liabilities Liabilities Cash

80,000 10,00 0 70,00 0

680,000 220,000 220,000

Payment of liabilities Liabilities Cash

4,000 4,000

c)

Offset loan to capital deficiency Tak, Loan Tak, Capital

B.

e. Payment to Partners

10,000 10,000

Toe, Capital Toe, Loan Cash

60,000 16,000 76,000

Doy, Rey, May and Fay are partners with capitals of P 22,000, P 20,600, P 27,400 and P 18,000 respectively. Doy has a loan balance of P 4,000. Profits and losses are shared 40%; 30%; 20%; 10% by Doy, Rey, May and Fay respectively. Assuming assets were sold and liabilities paid and the balance of cash showed P 24,000. Prepare a schedule showing how the P 24,000 will be distributed to the partners.

Total Debit = 24,000 Total Credit = 92,000 LOR = 68,000 Doy, Rey, May, Fay Partnership Accompany Statement of Liquidation January 1-31, 2020

Capital balances Add: loan balances Total partners’ Interest Loss on Realization Balances Additional Loss to Rey, May, and Fay in the ratio of 3:2:1 Balances

Doy P 22,000 4,000

Rey 20,600

May 27,400

Fay P 18,000

P 26,000 (27,200) (1,200) 1,200

20,600 (20,400) 200 (600) (400)

27,400 13,600 13,800 (400) 13,400

P 18,000 6,800 11,200 (200) 11,000

400

(267)

(133)

13,133

10,867

(13,133)

(10,867)

Additional Loss to May, and Fay in the ratio of 2:1 Balances Cash Settlement

C.

The partnership accounts of Guess, Jag and Levis are shown below as of December 31, 2019. Profits and losses are shared 50%; 30%; and 20%, respectively. Guess, Drawing (debit balance) Levis, Drawing (debit balance) Jag, Loan Guess, Capital Jag, Capital Levis, Capital

P (32,000) (12,000) 40,000 164,000 134,000 144,000

Total assets amounted to P 638,000, including cash of P 70,000, and P 200,000 worth of liabilities. On January 2019, the partnership was liquidated, and Jag received P 111,000 cash as final settlement. Required: 1. 2. 3.

The total loss from the liquidation of the partnership Prepare the statement of liquidation. Journal entries to record the liquidation. 1. Total Loss of the Partnership

Jag share in loss: 111,000 – 40, 000 = 71,000 71,000 - 134,000 = (63,000) Total Loss of the Partnership:

63,000/30% = 210,000

164,000

Guess, Capital Less Drawing

(32,000) 132,00 0 134,00 0

Jag, Capital Levi, Capital Less Drawing

144,000 (12,000)

132,00 0 398,00 0

Total

2. Prepare the Statement of Liquidation

Profit and loss ratio Balances before liquidation

Cash

Other Assets

70,000

568,000

Guess, Jag, Levi Partnership Statement of Liquidation January 1-31, 2019 Loan Liabilities Jag 200,000

40,000

Guess 5 132,000

Capital Jag 3 134,000

Levi 2 132,000

Realization and distribution of loss Balances Payment of liabilities Balances Payment to partners

358,000

(568,000)

428,000 (200,000)

200,000 (200,000)

228,000 (228,000)

(105,000)

(63,000)

(42,000)

40,000

27,000

71,000

90,000

40,000 (40,000)

27,000 (27,000)

71,000 (71,000)

90,000 (90,000)

3. Journal entries to record the liquidation.

a)

Sale of other assets and distribution of loss

Cash Guess, capital Jag, Capital

358,000 105,000 63,000

Levi, Capital

42,000

Other assets

568,000

b) Payment of liabilities Liabilities Cash c)

200,00

Payment to partners

Jag, loan Guess, Capital jag, Capital Levi, Capital Cash

D.

200,000

40,000 27,00 71,000 90,000 228,000

Red, White, and Blue are partners who share profits and losses 20%; 30%; and 50% respectively. The partners have decided to liquidate the partnership. Their capital accounts show the following balances: Red – P 60,000 credit; White – P 90,000 credit; Blue – P 30,000 debit. What is the amount of cash available for distribution?

Cash = 60,000 + 90,000 = 150,000

E.

Orange and Lemon share profits and losses equally. They decided to liquidate their partnership when their net assets amounted to P 260,000. Capital balances were P

170,000 and P 90,000, respectively. If the non-cash assets were sold for an amount equal to book value, what amount of cash should Orange and Lemon respectively received? Cash settlement of Orange: 170,000 Cash settlement of Lemon: 90,000

F.

The partnership of Anthony and Davis had an unprofitable year and agreed to liquidate their business on December 31, 2019. The Statement of Financial Position as of December 31, 2019 is presented below: ASSETS Cash Accounts Receivable P 80,000 Less Allowance for Bad Debts 20,000 Merchandise Inventory Prepaid Advertising Office Equipment P 100,000 Less Accumulated Depreciation 60,000 TOTAL ASSETS LIABILITIES AND EQUITY Accounts Payable Notes Payable (due October 31, 2020) Anthony, Capital Davis, Capital TOTAL LIABILITIES AND EQUITY

P

1,000

1,000

60,000 50,000 2,000

64,000 25,000 800

40.000 P 153,000

24,000 114,800

P 20,000 86,000

22,000 87,000

30,000 17,000 P 153,000

30,000 17,000 156,000

The information concerning liquidation are as follows: 1. Accounts receivable’s net carrying value plus 20% of the estimated bad debts were collected. 2. Merchandise inventory were realized for P 25,000 3. The contract for Prepaid Advertising has a cancellation value of P 800. 4. Office Equipment were realized equal to 60% of their book value. 5. Unrecorded Accounts Payable of P 2,000 were discovered. 6. Bank charges of P 1,000 was added to the note for early payment than the due date.

Anthony is personally insolvent. However, Davis’ personal assets exceeded his personal liabilities by P 4,000. Anthony and Davis share profits and losses 40%; 60%, respectively. Required: 1. Prepare a schedule showing the net amount of liquidation gain or loss. 2. Prepare a Statement of Liquidation. 3. Journal entries to record the liquidation.

1. Cash: 1,000 + 60,000 + 4,000 = 65,000 2. Merchandise Inventory Realization: 25,000, loss in the amount of 25,000 3. Prepaid Advertising: 800, loss in the amo...

Similar Free PDFs

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Partnership Liquidation

- 12 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporation liquidation

- 9 Pages

Corporate-liquidation compress

- 4 Pages

Liquidation-Format - guide fomat

- 2 Pages

Assignment 1 - Liquidation

- 2 Pages

Exemple de liquidation complexe

- 9 Pages

Chapter-1-Exercises - liquidation

- 20 Pages

5. Alternatives to Liquidation

- 2 Pages

Chapter 6 Partnership Liquidation

- 22 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu