Module No 1 Corporate Liquidation PDF

| Title | Module No 1 Corporate Liquidation |

|---|---|

| Course | basic accounting |

| Institution | Bataan Peninsula State University |

| Pages | 10 |

| File Size | 204.5 KB |

| File Type | |

| Total Downloads | 446 |

| Total Views | 768 |

Summary

Module No. 1 (Week 1 to Week 2)Corporate LiquidationLearning Objectives: At the end of the module, the students should be able to: Identify the classification of assets and liabilities in a corporate liquidation Compute for the Net Free Assets, expected recovery percentage and the amount of settl...

Description

Module No. 1 (Week 1 to Week 2)

Corporate Liquidation

Learning Objectives: At the end of the module, the students should be able to:

Identify the classification of assets and liabilities in a corporate liquidation Compute for the Net Free Assets, expected recovery percentage and the amount of settlement for each type of creditors under corporate liquidation Prepare Statement of Affairs and Statement of Realization and Liquidation

Lecture Notes: Financially Distress Corporation are those who suffered business failure due to incompetent management, poor operating control, inadequate financing, fraud or other unexpected adverse events in the company. A financially distress corporation may undergo either of the following: a. Quasi – reorganization b. Troubled Debt Restructuring c. Liquidation. Reports prepared by a corporation undergoing liquidation 1. Statement of Affairs – this statement is prepared as of a given point in time. The purpose of this statement is to show the assets and liabilities of the debtor from a liquidation point of view. Thus, the assets displayed in the statement of affairs are valued at net realizable value. The following are the classification of assets and liabilities: a. Assets pledged with fully secured creditors – the estimated cash proceeds are equal to or more than the amount of the secured claim b. Assets pledged with partially secured creditors – the estimated cash proceeds are less than the amount of the secured claim c. Free assets – any assets that has not been used to secure the payment of any of the company’s liabilities, and also includes the excess of the realizable values of assets pledged to fully secured creditors over the realizable values of related liabilities for which these assets have been pledged. d. Secured liabilities – liabilities that are covered by a collateral asset. It may be categorized as fully secured liabilities or partially secured liabilities i. Fully secured liabilities – the realizable value of the pledged assets is equal to or more than the amount claimed. ii. Partially secured liabilities – these are liabilities secured by assets with a realizable value less than the amount claimed. e. Unsecured liabilities – thee are partially secured by assets with a realizable value less than the amount claim. It may be either with or without priority. i. Unsecured liabilities with priority – these are liabilities not secured by any assets, but are mandated by law to be paid first in full ahead of any other unsecured liabilities. Examples are: administrative Expenses, taxes, salaries and wages, benefits, liquidation expenses. ii. Unsecured liabilities without priority – any other type of unsecured liabilities

A c c o u n ti n g f o r S p e c i a l T r a n s a c ti o n s ( M o d u l e 1 )

Page

1|

10

Expected Recovery Percentage – is the percentage claim of unsecured liabilities and non-priority claims to the net free assets of the corporation. The formula is shown below: Expected Recovery Percentage = Net Free Assets / Unsecured and Non-Priority Claims 2. Statement of Realizations and Liquidation – this is the accomplishment statement of the trustee in handling the liquidation. It is intended to show the actual transactions toward the liquidation of the debtor’s estate. The summary of the statement of realization and liquidation is presented as follows:

DEBITS

CREDITS

Assets to be realizeda Assets acquiredb

Assets realizedc Assets not realizedd

Liabilities liquidatedg Liabilities not liquidatedh

Liabilities to be liquidatede Liabilities assumedf

Supplementary chargesi

Supplementary creditsj

Net loss on realization and liquidation

Net gain on realization and liquidation

The detailed explanation of the items in the statement of realization and liquidation: a. Assets to be realized – total non-cash assets at the beginning of liquidation b. Assets acquired – new assets acquired during the liquidation period. c. Assets realized – the cash realized (proceeds) from the sale of non-cash during the liquidation period. d. Assets not realized – total non-cash assets at the end of the liquidation period (remaining non-cash assets). e. Liabilities to be liquidated – total liabilities at the beginning of liquidation f. Liabilities assumed – new liabilities incurred during the liquidation period. g. Liabilities liquidated – total cash payment for the liquidation of liabilities h. Liabilities not liquidated – total liabilities at the end of the liquidation period (remaining liabilities). i. Supplementary charges – expenses incurred during the liquidation period (excluding loss on realization and write-off). j. Supplementary credits – revenues earned during the liquidation period (excluding gain on assets realization and liability settlement). Guide in Preparation of ‘Statement of Realization and Liquidation’ A. Transactions not involving cash i. Sales on account – it will be posted in the assets acquired for the Accounts Receivable (debit) and credited as supplementary credits (for Sales account). ii. Purchase on account – it will be posted in the liabilities assumed for the Accounts Payable (credit) and debited as supplementary debits (for Purchase/Inventory account). B. Transactions involving cash i. Cash receipts are to be reported as assets realized or supplementary credit, whichever is appropriate . ii. Cash payments are to be reported as liabilities liquidated or supplementary charges, whichever is appropriate.

A c c o u n ti n g f o r S p e c i a l T r a n s a c ti o n s ( M o d u l e 1 )

Page

2| 10

Difference of Statement of Affairs and Statement of Realization and Liquidation 1. The ‘Statement of Realization and Liquidation’ reports the actual liquidation results while the ‘Statement of Affairs’ is of a pro-forma nature and is based on estimates. 2. The ‘Statement of Realization and Liquidation’ provides ongoing reporting of the trustees activities and is updated through the liquidation process, while the ‘Statement of Affairs’ is a summary of the estimated results of a completed situation. Process of corporation liquidation 1. Sell all Non-cash assets at fair market value 2. Pay all the liabilities. a. Fully secured liabilities b. Secured portion of partially secured liabilities c. Unsecured liabilities with priority d. Unsecured without priority and the unsecured portion of partially secured liability using the expected recovery percentage

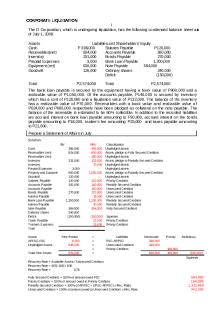

Sample Problems Problem I. The Rodriguez Corporation is undergoing liquidation and has the following

condensed Statement of Financial Position as of December 31, 2020: Assets Cash Receivables Merchandise Inv. Prepaid Expenses Building (net) Goodwill Total Assets

₱

₱

1,998,500 5,964,000 1,400,000 43,750 6,037,500 962,500 ________ 16,406,250

Liabilities and Equity Salaries Payable ₱ Accounts Payable Bond Payable Bank Loan Payable Note Payable Ordinary Shares Deficit Total Liab. and Equity ₱

875,000 1,898,750 7,000,000 3,850,000 1,400,000 2,100,000 ________ 17,123,750

Additional information

The bonds payable are secured by the building having a realizable value of ₱6,300,000 Of the accounts payable, ₱ 1,050,000 is secured by ¼ of the receivable which is estimated to be 20% uncollectible. The remainder in the book value of the receivables which has a realizable value of ₱ 4,112,500 is used to secure the bank loan payable. The merchandise has a realizable value of ₱927,500 In addition to the recorded liabilities are accrued interest on bonds payable amounting to ₱ 70,000 and trustee expenses amounting to ₱43,750 and taxes ₱52,500

Requirements: a. Compute for the settlement to fully secured creditors, partially secured creditors, unsecured creditors with priority, and unsecured creditors without priority. b. Prepare Statement of Affairs

A c c o u n ti n g f o r S p e c i a l T r a n s a c ti o n s ( M o d u l e 1 )

Page

3| 10

Solution Requirement (a) Step 1: Compute for the total net realizable value of assets

Assets Cash Receivables Merchandise Inv. Prepaid Expenses Building (net) Goodwill Total Assets

₱

₱

Book Value 1,998,500 5,964,000 1,400,000 43,750 6,037,500 962,500 16,406,250

Net Realizable Value ₱ 1,998,500 5,305,300* 927,500 ------6,300,000 -----₱ 14,531,300

Reference second bullet third bullet see note below first bullet see note below

Supporting Computation for Receivables

¼ of Receivables ¾ of Receivales

₱ 1,491,000 4,473,000 ₱ 5,964,000

₱ ₱

1,192,800 4,112,500 5,305,300

80% collectible

Additional note: Prepaid Expenses and Goodwill has no net realizable value because prepaid expenses are deemed consumed, and Goodwill to be written off, hence zero.

Step 2: Classify the liabilities as fully secured, partially secured, unsecured with priority, or unsecured without priority Liabilities Book Value Salaries Payable ₱ 875,000 Accounts Payable 1,898,750 Bond Payable 7,000,000 Bank Loan Payable 3,850,000 NotesPayable 1,400,000 Additional expenses/liabilities

Classification with priority fully**/without prio. partially secured fully secured without priority

Accrued interest Trustees’ expenses Taxes

without priority with priority with priority Total

70,000 43,750 52,500

Priority 875,000 1,050,000 6,300,000 3,850,000

Non-prio 848,750 700,000 1,400,000 70,000

43,750 52,500 12,171,250

3,018,750

**The Accounts Payable amounting to ₱ 1,050,000 was secured by Receivable (see Step 1), since

the amount of collateral (Accounts Receivable) is greater than the amount of liability (Accounts Payable), the liability is fully secured. Also, the remaining balance of Accounts Payable is deemed treated as unsecured liability because it does not have collateral.

Step 3: Compute for the Net Free Assets Total Assets at Net Realizable Value (Step 1)

₱

Less: Liabilities (with security and priority) (Step 2) Net Free Assets

₱

14,531,300 12,171,250 2,360,050 ***

***Detailed illustration of payments can be seen in Step 5 A c c o u n ti n g f o r S p e c i a l T r a n s a c ti o n s ( M o d u l e 1 )

Page

4| 10

Step 4: Compute for the Expected Recovery percentage ₱

Net Free Assets (Step 3) Divide by: Unsecured liabilities (Step 2)

2,360,050 3,018,750

Expected Recovery Percentage

78.18%

Step 5: Pay the creditors in the following order: Fully secured creditors, Secured portion of the partially secured creditors, unsecured creditors with priority (these steps were already done in Step 2, for comprehensive discussion, this will be discussed again in this step), lastly unsecured portion of partially secured creditors and unsecured creditors without priority using the expected recovery percentage.

Net Realizable Value of Assets

₱

14,531,300

₱

(4,900,000)

a. Payment of Fully Secured Creditors (Step 2) (@ 100%) Portion of Accounts Payable ₱ 1,050,000

Bank Loan Payable Total payment for Fully Secured Creditors

3,850,000

b. Payment of Partially Secured Creditors (Step 2) (@100% and ER%) Secured portion of Bonds Payable ₱ 6,300,000 Recovery of unsecured portion Unsecured portion* ₱ 700,000 Accrued interest 70,000 Total ₱ 770,000 x ER% 78.18% 601,990* Total payment for Partially Secured Creditors ₱

(6,901,990)

* ₱ 7,000,000 – 6,300,000 = ₱ 700,000 / rounded off to nearest tens

c. Payment of Unsecured creditors with priority (Step 2) (@100%) Salaries Expenses ₱ 875,000 Trustees’ expenses 43,750 Taxes 52,500 Total payment for unsecured creditors with priority ₱

(971,250)

d. Payment of Unsecured creditors without priority (@ER %) Unsecured Liability Book Value at ER% (78.18%) Accounts Payable ₱ 848,750 ₱ 663,550* Notes Payable 1,400,000 1,094,520 Total payment for unsecured creditor without priority

₱

(1,758,073)

*rounded-off to nearest tens

A c c o u n ti n g f o r S p e c i a l T r a n s a c ti o n s ( M o d u l e 1 )

Page

5| 10...

Similar Free PDFs

Module No 1 Corporate Liquidation

- 10 Pages

Module 5 - Corporate Liquidation

- 33 Pages

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporate-liquidation compress

- 4 Pages

CORPORATE LIQUIDATION PROBLEMS

- 5 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Assignment 1 - Liquidation

- 2 Pages

Chapter-1-Exercises - liquidation

- 20 Pages

Chapter 1 Partnership Liquidation

- 16 Pages

Partnership Liquidation

- 12 Pages

Corporate Finance Chapter 1

- 41 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu