Notes- alternatives to liquidation PDF

| Title | Notes- alternatives to liquidation |

|---|---|

| Author | jj sharp |

| Course | Business law |

| Institution | University of Leeds |

| Pages | 5 |

| File Size | 124.8 KB |

| File Type | |

| Total Downloads | 45 |

| Total Views | 131 |

Summary

qqqqqqqq...

Description

Alternatives to liquidation Administration This is a procedure which allows an independent insolvency practitioner to run, reorganise, and possibly sell a company that is suffering financial problems -

A key advantage of this procedure is that the administrator has the benefit of a moratorium (freeze on creditor actions) which allows them to operate unhindered by creditors

The purpose of administration IA 1986 schedule B1 para 3(1) states that the administrator has to complete their duties with the object of: a) Rescuing the company as an ongoing concern b) Achieving a better result for the company’s creditors as a whole than would be likely if the company were wound up c) Releasing property in order to make a distribution to one or more secured or preferential creditors The administrator must start with objective (a) then move down the list if this is not reasonably practicable Two routes into administration: The first is by a court order, made at an open hearing, upon a formal application to the court (IA 1986 Sch B1 para 10) by a specific person specified below The second is by filing at the court a set of prescribed documents, by: i. ii. iii.

The company (para 22(1)) Its directors (para 22(2)) The holder of a qualifying floating charge over the company’s assets (para 14)

What’s a qualifying floating charge A QFC is one where the charge document: -

States that para 14 of Sch B1 of the IA 1986 applies to it, and Purports to empower the holder of the floating charge to appoint an administrator of the company, or Purports to empower the holder of the floating charge to make an appointment which would be the appointment of an administrative receiver within the meaning given in s 29 (2) IA 1986, and Is a QFC which, on its own or with other security held by the same lender, relates to the whole, or substantially to the whole, of the company’s property (para 14(3))

The statutory moratorium Whichever route is taken, there will be a statutory moratorium throughout the administration (IA 1986 Sch B1 paras 42 and 43) -

This restricts the ability of third parties to enforce their right without the consent of the administrator It also prevents the commencement of any other insolvency procedures, such as the presentation of a winding up prepetition

The court route (1) The court will make an administration order only if it is satisfied that: a) The company is or is likely to become unable to pay its debts (statutory demand test see liquidation notes) b) The administration order is reasonably likely to achieve the purpose of administration, typically that administration would achieve a better result for the company’s creditors than would liquidation As soon as reasonably practicable after making the application, the applicant must specify: a) Any person who has appointed (or is entitled to appoint) an administrative receiver of the company b) Any qualifying floating charge holder (QFCH) who may be entitled to appoint an administrator c) Other persons specified by the IR 2016 The out of court route (2) This route allows lenders with a QFC easily to appoint administrators

The administrator has a duty to all the creditors, in comparison with a receiver, who in practical terms have a duty to only their appointer If there is another QFCH whose charge would have priority, then the lender cannot appoint an administrator until it has been given two business days’ written notice of its intention so to appoint -

This allows the holder of the prior charge to decide whether to appoint an administrator himself An interim moratorium exists whilst the other QFCH deliberates his options

The floating charge in question must be enforceable, this means the holder must be entitled under the loan agreement to enforce its security It is not possible for a QFCH to appoint an administrator out if court under IA 1986 Schedule 1B para 14 where there is a provisional liquidator, or an administrative receiver already appointed -

Or if the company is already being wound up It is only possible if it is being wound up by CVL or there is an administrator already proposed by the directors

Notice of appointment has to be filed at court by the lender together with various documents; the notice must include a statutory declaration by the lender to the effect that: a) The lender is the holder of a QFC in respect of the company’s property b) The floating charge has become enforceable c) The appointment is in accordance with IA 1986 Sch B1 Once the documents are filed at court the administration begins Appointment by the company or directors: The directors, or the company, will need to give notice to any QFCHs -

The QFCH will agree or will appoint an alternative administrator The moratorium comes into effect immediately when the notice of intention to appoint is filed at court

However, if it is the company that appoints, the first step will be to call a GM to seek members approval. If the directors approve a board resolution will be required The first stage of appointment is that notice is served on: a) The court b) Any QFCH c) Any lender entitled to appoint an administrative receiver (IA SCH B1 para 26) The directors must file a statutory declaration that: a) The company is unable to pay its debts b) The company is not in liquidation c) The restrictions in paras 23 to 25 do not apply (e.g. there has been no administration within the previous 12 months The administration process Once administration begins, the main moratorium comes into effect and begins to protect the company whilst the administrator tries to rescue it The administrator will put forward their proposals, the creditors may seek further details or may amend the proposals (IA Sch B1 para 53 (1) (b) -

The creditors have the final say on the administrator’s decisions An administrator can be replaced by the creditors if a majority (in value) of creditors vote for such

Effects the of administration order: -

Company is managed by the administrator Director’s powers cease, though they are still in office Moratorium continues Administrator controls the company’s assets (does not own them) Administrator carries out his proposals, which have been approved by the creditors

Powers of administrator They have statutory powers under IA 1986 Sch B1 and IR 2016: -

Remove and appoint directors (para 61) Call a meeting of creditors or members if required (para 62) Apply to the court for directions (para 63) Pay money to a creditor (para 65), but only with the court’s permission if it is an unsecured creditor Pay money to any party if it is likely to assist in the administration (para 66) Deal with property that is subject to a floating charge (para 70) Deal with property that is the subject of a hire-purchase agreement (para 72)

Like a liquidator, the administrator also has the power to investigate past transactions of the company and if necessary apply for them to be set aside or challenged -

They are also required to do anything necessary or expedient for the management of the affairs, business or property or the company

End of administration The administration may be ended (IA 1986, Sch B1): a)

automatically after one year from the date the administration took effect – this may be extended in certain circumstances (para 76); b) on application by the administrator to the court, under para 79, if: a. he thinks the purpose of administration cannot be achieved in relation to the company, b. he thinks the company should not have entered administration, c. a creditors’ meeting requires him to make an application, or d. he thinks that the purpose of administration has been sufficiently achieved in relation to the company; c) by termination where the object has been achieved (for an administrator appointed by the out-of-court route) (para 80); d) by the court ending the administration on the application of a creditor (para 81); e) by the court converting the administration into a liquidation, in the public interest (para 82); f) by the administrator converting the administration into a CVL (para 83); g) by the administrator dissolving the company where he believes there is no property which might permit a distribution to creditors (para 84); and (h) when the administrator resigns (para 87), is removed (para 88), ceases to be qualified (para 89) or is replaced by those who appointed him in the first place (paras 92, 93, 94) Pre-pack administration This occurs when a company is placed into administration and almost immediately its assets and business are sold by the administrator, often to the management of the insolvent company -

unsecured creditors are not consulted and are unlikely to be paid any of their debts

from 1 Jan 2009 administrators were bound by an additional statement if insolvency practice (SIP) -

administrator is required to disclose info such as valuations of the business

Company Voluntary Agreement (CVAs) A CVA is: (a) a written agreement dealing with the financial affairs of the company, and which binds all the relevant parties (usually the company and all its creditors), provided the statutory procedures are followed. It is sometimes referred to as a ‘statutory contract’ (b) likely to involve agreeing with the creditors that they will either: (i) wait longer to be paid; or (ii) accept payment of only part of their debt; or (iii) a combination of the two. (c) a relatively easy and comparatively low-cost procedure (d) available to directors, liquidators and administrators (e) typically used where the underlying business of the company is sound, but the company has hit a cash-flow problem. This could be because it has lost a key customer, or because a customer has itself become insolvent owing the company substantial sums of money, or simply because the company cannot afford to pay all of its suppliers at once.

Thus, the aim of a CVA is to prevent a liquidation, and to do so more cheaply than an administration. In a CVA, the creditors are unlikely to be paid in full, but they are likely to be paid more than had the company been put into liquidation -

it is a less complex process with little court involvement, so it is less costly than administration or liquidation

However, there is no guarantee that administration and/or liquidation will be avoided, as even with a CVA, trading may continue to falter and cash-flow problems may worsen, leading to a more serious financial situation and, ultimately, administration or liquidation Key features of CVA: It used to be possible to have a moratorium on creditor actions in the case of ‘small companies’, but this was repealed by the Corporate Insolvency and Governance Act 2020 Proposals must be approved by a majority of 75% or more in value of the creditors -

A CVA must also pass a second test in that it must also have been approved by 50% or over of non-connected creditors It is for the convenor or the chair of the meeting to decide if a creditor is connected or not

So all unsecured creditors get an opportunity to vote on whether to approve, reject or modify a CVA proposal -

Secured creditors cannot vote, except in relation to any part of their debt that is unsecured

All unsecured creditors who would have been entitled to vote are bound by the proposal as regards past debts but not future debts, the CVA does not affect the rights of secured creditors and preferential creditors, unless they agree Receivership Creditors who lend to companies will usually take security -

Such creditors may be able to appoint a receiver

There has to be loan involved for receivership to be a relevant cause of action, and a receiver is usually appointed when the company is not complying with the terms of the charge holder’s agreement This is not really an insolvency procedure, as a receiver may be appointed by a charge holder whenever the charge allows it to -

The receiver will be an insolvency practitioner, unless the appointment is of a Law of Property Act receiver

The role of the receiver is to take possession of the charged property and deal with it for the benefit of the charge holder only, this usually means selling it After this has been done, the receiver has no further interest in the company -

Though, if they are appointed under a floating charge, they do also have a duty to pay preferential creditors- IA 1986 s 40

LPA receivers A fixed charge holder may appoint a receiver to enforce its security. -

This type of receiver was traditionally appointed under the Law of Property Act 1925 (LPA), with the powers contained in that Act, and so is often referred to as an ‘LPA Receiver’. However, these days, the fixed charge holder would normally have express power to appoint in the charge document, and the powers and duties of the receiver would also be set out in that document.

An LPA Receiver is usually appointed with a view to selling the charged property so that the debt to the charge holder can be repaid. An LPA Receiver does not have to be a Licensed Insolvency Practitioner, and, indeed, they are often a surveyor or other suitable qualified professional Administrative receivers Administrative Receivers may be appointed under s 29 of the IA 1986, by a floating charge holder who has a floating charge over the company’s undertaking.

-

However, since implementation on 15 September 2003 of the reforms brought in by the Enterprise Act 2002, administrative receivership may be used only for floating charges created before that date (IA 1986, ss 72A– 72H)

The loan documentation will specify the events that will enable the lender to appoint an administrative receiver. They might include: (a) (b) (c) (d) (e) (f) (g) (h)

failure to meet a demand to pay capital or interest presentation of a winding-up petition presentation of a petition for administration or a CVA (see 19.7) the levying of distress or execution against the company’s assets failure to comply with restrictions in the loan documentation, e.g., by granting a new charge over assets the company ceasing to trade the assets being in jeopardy; or the inability of the company to pay its debts

The administrative receiver essentially takes over the running of the company, purely with a view to selling the charged assets, paying their own costs, and repaying the charge holder. Once they have done that, they will resign In theory, once the administrative receiver has completed their work, they return the company to the management of the directors, who may continue to run the business. In practice, however, this process is very frequently followed by liquidation, as there are often few useful assets left in the business once the charge holder has been paid....

Similar Free PDFs

5. Alternatives to Liquidation

- 2 Pages

Alternatives to Tariffs

- 4 Pages

40 alternatives to college

- 6 Pages

6. Alternatives to High Fantasy

- 16 Pages

Liquidation

- 4 Pages

Liquidation

- 4 Pages

Alternatives to the but for test

- 14 Pages

Evaluation Alternatives

- 3 Pages

Partnership Liquidation

- 12 Pages

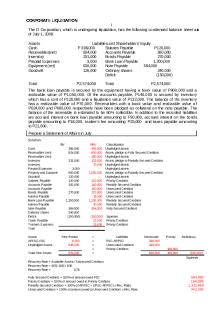

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu