Week 10 - Cost volume-profit analysis PDF

| Title | Week 10 - Cost volume-profit analysis |

|---|---|

| Author | Abby Faure |

| Course | Business Reporting and Analysis |

| Institution | Australian National University |

| Pages | 11 |

| File Size | 300 KB |

| File Type | |

| Total Downloads | 51 |

| Total Views | 146 |

Summary

Cost-volume-profit analysis...

Description

Week 10 – CVP Analysis, Cost behaviour, Relevant costing Introduction to CVP analysis - CVP (cost-volume profit) analysis is concerned with the change in profits in response to changes in sales volumes, costs and prices Cost behaviour - An understanding of the costs is important for basic CVP analysis - Examining cost behaviour enables us to consider: The way in which costs change The main factors that influence those changes - Costs can be broadly classified as: Fixed costs are costs that stay fixed (the same) in total when changes occur to the volume of activity Variable costs are costs that vary with the changes in the volume of activity Mixed costs Fixed costs Those costs which remain the same in total (within a given range of activity and timeframe) irrespective of the level of activity - When we consider levels of activity in terms of units of output: Fixed costs remain the same Fixed costs per unit will decrease as the number of units produced increases - Are likely to change as a result of inflation or general price increases - Are almost always ‘time-based’ i.e. they vary with the length of time concerned - Examples: depreciation, insurance, rent and salaries of permanent staff, overheads Variable costs Change in total as the level of activity changes - Are sometimes linear, i.e. there are the same per unit of production irrespective of the number of units produced - In some cases the line describing them is not straight, as higher volumes of activity may introduce economies of scale or shortage of inputs, thus changing the variable costs as production increases - Examples: costs as ingredients for a food manufacturer; fuel costs for a courier Mixed costs Semi-fixed (semi-variable) costs - These costs exhibit aspects of both fixed and variable costs - For analysis: it may be necessary to split the total cost into the fixed and the variable components - Examples: mobile phone bill, electricity bill, advertising costs Stepped costs - Costs can vary with activity in steps. They do not stay the same regardless of the level of output, but often increase to allow higher levels of output - They are fixed over a relevant range of activity/output, but can be treated as either variable costs or fixed costs - Examples: transportation costs, rent costs Break-even analysis - Simple form of CVP analysis relating to the calculation of the necessary levels of activity required in order to break even in a given period - Break-even occurs when total revenue and total costs are equal, resulting in zero profit: At the break-even point (where FC = fixed costs, VC = variable costs, and BEP = break-even point) 1. Revenues = FC + VC 2. (Revenue per unit x BEP) – (VC per unit x BEP) = FC 3. BEP = FC / (revenue per unit – VC per unit) 4. BEP = FC / contribution margin per unit Contribution margin The contribution margin per unit is the difference between the revenue per unit (sales price) and the variable cost per unit (marginal cost), which is effectively a contribution to fixed costs and profit.

Contributionmargin per unit=selling price−variable cos t

Related calculations: Contribution margin = revenues – variable costs Contribution margin = contribution margin per unit x units sold Contribution margin per unit = total contribution margin / units sold Contribution margin > fixed costs must be true in order to make profit Example: Advantage Tennis Coaching (see below) Selling price = $150 Variable costs = $25 + $35 + $30 = $90 Contribution margin per unit = $150 - $90 = $60 Break-even analysis for a single product

¿ costs ( $ ) =x break even ( units ) Contribution margin perunit ( ¿ player )( $ ) Example: Advantage Tennis Coaching Participation charge (parents to pay) Nomination fees Embossed kit bag Lunches and sports drinks Support coach Bus hire from Brisbane to Gold Coast

$150 per player $25 per player $35 per player $30 per player $1,200 for the event $600 for the event

Step 1: Calculate contribution margin per unit Contribution margin per unit (from above) = $60 Step 2: Calculate fixed costs FC = $1,200 + $600 = $1,800 Step 3: Calculate break-even point using formula above BEP = $1,800 / $60 = 30 units (players) Contribution margin ratio

Contribution margin perunit =contribution margin ratio Selling price per unit Example: Advantage Tennis Coaching Contribution margin per unit = $60 Selling price per unit = $150 Contribution margin ratio = $60/$150 = 0.40 or 40% Calculating total sales required to break even Method a) Break-even point (units) x selling price = total sales required Example: Advantage Tennis Coaching Break-even point (units) = 30 players Selling price = $150 Total sales required = 30 x $150 = $4,500 Method b) Fixed costs / contribution margin ratio (decimal) = total sales required Example: Advantage Tennis Coaching Fixed costs = $1,800 CM ratio = 0.40 Total sales = $1,800 / 0.40

= $4,500 Break-even analysis for multiple products Step 1: Calculate contribution margin per unit for each product Step 2: Identify the sales mix (Example: Candles are 30% because 60,000 is 30% of the total output of 200,000 units) Step 3: Calculate the (WACM) weighted average contribution margin (Example: 30% of the candle CM is 10 x 0.3 = 3.0) Step 4: Add the weighted average contribution margins together Step 5: Calculate break-even point = fixed costs / WACM per unit Step 6: Use the sales mix to determine how many of each product is required (Example: 30% sales mix with break-even point of 39,011 units = 39,011 x 0.3 = 11,703 units) Step 7: Calculate total contribution margin for each product, if total contribution margins of all products added together = annual fixed costs break-even point is correct Example: Annual volume in units Selling price per unit Variable costs per unit Annual fixed costs Annual volume in units Selling price per unit Variable costs per unit Contribution margin per unit Sales mix WACM Units required to break even Annual volume in units Selling price per unit Variable costs per unit Contribution margin Annual fixed costs Profit

Candle (C) 60,000 $25 $15

Soaps (S) 40,000 $40 $22

Detergents (D) 100,000 $20 $15

60,000 $25 $15 $10 30% 3.00

40,000 $40 $22 $18 20% 3.60

100,000 $20 $15 $5 50% 2.50

11,703 $25 $15 $117,030

7,802 $40 $22 $140,436

19,506 $20 $15 $97,530

Total 200,000

$355,000 200,000

9.10 39,011 39,011 $354,996 $355,000 $4 (due to rounding)

Profit should be 0 with no rounding involved. Multi-product CVP/break-even analysis is of value only when the sales mix is predictable and relatively constant. Statement of profit and loss To show the break-even point is correct Candles Soaps Sales volume at break-even 11,703 7,802 Revenue (sales volume x selling price) $292,575 $312,080 Less: Total variable costs $175,545 $171,644 Total contribution margin $117,030 $140,436 Less: Fixed costs Profit (due to rounding) Pre-tax profit For CVP analysis we need to use pre-tax profit (if it is mentioned):

Pretax profit=

after tax profit (1−income tax rate)

Example: Coconut Plantations Plans a desired after-tax profit of $200,000. Tax rate of 30%. After-tax profit = $200,000 Income tax rate = 0.30 Pre-tax profit = $200,000 / (1 – 0.3) = $200,000 / 0.7

Detergents 19,506 $390,120 $292,590 $97,530

Total

$354,996 $355,000 $4

= $285,714 (approx.) CVP analysis Key assumptions: - The behaviour of costs can be neatly classified as either fixed or variable - Cost behaviour is linear - FC remain ‘fixed’ over the time period and/or a given range of activity (relevant range) - Unit price and cost data remain constant over the time period and relevant range - For multi-product entities, the sales mix between the products is constant How to conduct a cost-volume profit (CVP) analysis Step 1: Determine break-even analysis (as above) Step 2: Assess margin of safety – difference between break-even volume and actual output, provides indication of risks involved Margin of safety - Excess of revenue above the break-even point - Provides an indication of how much revenue (sales in units) can decrease before reaching the breakeven point - If margin of safety is small – managers may put more emphasis on reducing costs and increasing sales to avoid potential loss - If margin of safety is large – managers have more confidence in making plans such as incurring additional fixed costs

Margin of safety ( units )=Actual∨estimated units of activity−units at break even point OR

Margin of safety ( revenues )= Actual∨estimated revenues−revenues at break even point Step 3: Determine activity level required to cover all costs associated with the business and generate a desired target profit

¿ costs+desired profit ( $ ) =x sales units ¿ earna desired profit Contribution margin perunit ( $ ) Example: Advantage Tennis Coaching Participation charge (parents to pay) Nomination fees Embossed kit bag Lunches and sports drinks Support coach Bus hire from Brisbane to Gold Coast Desired profit (pre-tax) Sales units required

$150 per player $25 per player $35 per player $30 per player $1200 for the event $600 for the event

= $600 = Fixed costs/contribution margin per unit = $(1800 + 600) / $60 = 40 players (units)

Step 4: Determine activity level required to cover all costs associated with the business if those costs are changing Example: Advantage Tennis Coaching If VC is increased to $10 per unit, and FC reduced by $20,000 Break-even point = $1600 / $50 = 32 units (or players) Operating leverage Operating gearing/leverage is the relationship between the total fixed and the total variable costs for some activity or the total costs - An activity with relatively high fixed costs compared with its variable costs is said to have high operating gearing - The level of operating leverage of an entity provides an understanding of the impact of the changes in sales on profit - Greater proportion of fixed cost in a firm compared with variable costs = more highly operating leveraged = riskier as fluctuations in sales correlate to fluctuations in profit

- A firm with low operating gearing is far more able to handle downturns in markets Example: Low fixed costs college High fixed costs college Operating gearing Low High Employment Mostly casual staff Mostly fulltime staff Tuition fee per student per week $300 $300 Variable expenses per student per $220 $110 week Fixed expenses (weekly) $3200 $7600 Breakeven point (students) BE = = 3200 / (320 – 220) = 7600 / (300 – 110) FC / (price – variable costs) = 40 = 40 Profit 0 0 Low fixed costs college Operating gearing Employment Tuition fee per student per week Variable expenses per student per week Fixed expenses (weekly) Profit (low FC, low operating leverage, is less volatile)

High fixed costs college

Low Mostly casual staff $300 x 32 = 9,600 $220 x 32 = 7,040

High Mostly fulltime staff $300 x 32 = 9,600 $110 x 32 = 3,520

$3200 (640)

$7600 (1,520)

Relevant information for decision making - Business decisions usually involve the selection of one alternative over another - To make sure decisions are based on the right information, the following must be identified where relevant: Relevant costs and relevant income: are those that differ among alternative courses of action Incremental costs and incremental income: the additional income/costs resulting from an alternative course of action Opportunity cost: the cost of forgoing benefits that would be available if the resources had been used in the next best alternative - When measuring costs for decision-making purposes, it is useful to identify relevant costs – the cost which is relevant to any particular decision – and exclude those costs that are not relevant to the decision - To be relevant, a cost must satisfy all of the following criteria Relate to the objectives of the business Be a future cost Vary with the decision Relevant costing is an analysis done in support of decision-making where only costs that vary with the decision should be included in the decision analysis Marginal analysis is an examination of the additional benefits of an activity compared to the additional costs incurred by that same activity. Companies use marginal analysis as a decision-making tool to help them maximise their potential profits.

Contribution margin per limiting factor Assessing the profitability of output when there are resource limitations - Firms have limited resources and several products - A production constraint can be a shortage of labour, raw materials, space or machinery that limits sales potential - Manage constraints: most effectively use the constrained resources – choose the best product mix when the constrained resource is maximised In order to calculate the most profitable mix of products/services, necessary to calculate the contribution margin per limiting factor. Example: Coconut Plantations Pty Ltd Table presents financial data on the company’s three products and the amount of machine time (machine hours) required to produce each. Products Candles Soaps Detergents 100,000 40,000 60,000 Budgeted sales next year $20 $40 $25 Selling price per unit $15 $22 $15 Variable costs per unit $5 $18 $10 Contribution margin per unit 1.5 hours 4 hours 1 hour Machine hours per unit 150,000 hours 160,000 hours 60,000 hours Total machine hours required = 370,000 hours Coconut plantations has only 270,000 machine hours available, and the entity is planning an advertising campaign for online customers. The marketing department wants to know which product should be promoted, as funds will only support one product. It is necessary to focus on the production limitation, machine hours, to determine how to maximise profits. Step 1: Calculate the contribution margin per machine hour for each product

Contributionmargin per machinehour =

contribution margin per unit machine hours required per unit

Candles Contribution margin per unit Machine hours per unit Contribution margin per machine hour

$10 1 hour $10 per hour

Soaps $18 4 hours $4.50 per hour

Detergents $5 1.5 hours $3.33 per hour

The CM/machine hour highlights that although soap provides the highest CM/unit ($18), it only provides a CM of $4.50/machine hour compared with the candle which provides a CM of $10/hour. Therefore, candles will maximise entity’s profit by providing $10 contribution margin per machine hour compared with the other products – should be the focus of the advertising campaign.

Machine hours per unit Total units in 270,000 hours Contribution margin per unit Total contribution

Candles 1 hour 270,000 $10 $2,700,000

Soaps 4 hours 67,500 $18 $1,215,000

Detergents 1.5 hours 180,000 $5 $900,000

If there was no machine hours constraint, most profitable product would be highest CM/unit = Soap.

Outsourcing decisions A make or buy decision requires an entity to choose whether to continue: 1. Producing a product component 2. Providing a service in-house It is important to identify both: - Avoidable costs – costs that will be avoided if an outsourcing decision is accepted - Unavoidable costs – costs that will be incurred regardless of the decision taken regarding outsourcing a product or service Relevant cost of making an item or providing a service internally is the cost that can be avoided by buying the item or service from outside the business - Unavoidable costs are not considered in the decision - Decision rules: compare the costs associated with two decisions Example: Outsourcing a business activity Gee Vesty accounting services – considering the outsourcing of the maintenance of clients’ accounting records to a local bookkeeper. Relevant information includes: - 1,600 billable hours/year currently being charged to clients for bookkeeping services provided - The charge-out rates are $200/hour for Gee Vesty’s consulting services and $50/hour for bookkeeping - An external bookkeeper has quoted $2,000 per week for 52 weeks - An analysis of the overhead costs identified that $500 could be avoided each week if the bookkeeping activity was outsourced By outsourcing the bookkeeping activity, capacity is made available to pursue the new business opportunities without eliminating the bookkeeping service currently provided to clients. Undertake financial analysis to identify the revenue and costs that will be affected by the outsourcing decision. Relevant costs and revenue Increase in revenue Billable hours 1,600 hours x $150 per hour ($200 - $50) Avoidable overhead costs ($500 x 52 weeks) Increase in cost Bookkeeping fee ($2,000 x 52 weeks) Net benefit to outsource

$240,000 $26,000 $266,000 $104,000 $162,000

Analysis indicates that the outsourcing will be favourable for the entity from a financial perspective, as it is expected that profits will increase by $162,000. The firm must also consider any qualitative factors that may affect the decision: - How reliable is the bookkeeper? - Does the person have the necessary experience? - Can the bookkeeper complete the assigned tasks within the timeframe expected by clients? - Will all billable hours currently charged to bookkeeping by taken up with consulting? Example: ‘Make or buy’ decision – outsourcing a component part Palamara Industries produces mobile phones specifically for hearing-impaired people. One of the components is a special flashing light that alerts the user to a call. The unit cost of making this light is as follows. Variable costs per unit Direct material Direct labour Indirect Total variable costs Total fixed costs Various

$0.80 $0.20 $0.10 $1.10 $60,000

Fleet Ltd has offered to supply 100,000 units of the light for $1.40 each. If the offer is accepted, $10,000 of the fixed costs can be eliminated. Wong Industrial has offered to lease the factory space currently used to produce the flashing light from Palamara Industries for $560 per week. The decision for Palamara Industries is whether to outsource production of the special fighting light component to Fleet Ltd and lease the factory space to Wong Industrial, or continue to manufacture the light in-house.

-

-

Of the fixed costs, $50,000 is irrelevant to the decision as it is a cost that will be incurred regardless of the decision made by Palamara Industries. E.g. the $50,000 would represent allocated costs such as factory rent, equipment depreciation and maintenance. If the $50,000 was included in the analysis, it would need to be assigned to both the make and buy options. The income from leasing the factory will be an opportunity cost if the flashing light is not outsourced, so it is relevant to this decision and reduces the cost of outsourcing the component part.

Step 1: Identification of relevant costs Cost to make Variable manufacturing costs ($1.10 x 100,000 units) Avoidable fixed costs Total relevant costs to make Cost to outsource Purchase price ($1.40 x 100,000 units) Less: Lease income ($560 per week x 52 weeks) Total relevant costs to outsource

$110,000 $10,000 $120,000 $140,000 ($29,120) $110,880

The financial analysis indicates that outsourcing will benefit Palamara by decreasing costs by $9,120 ($120,000 - $110,880) and thereby increasing profits by $9,120. Other factors by consider are whether Fleet Ltd can: - Deliver the lights when required - Manufacture to the same quality as that of Palamara Industries - Guarantee supply when required - Remain financially stable enough to enable ongoing supply Focusing on full costs, the financial analysis is as follows ($50,000 unavoidable cost is also included in the outsourcing option): Cost to make Variable manufacturing costs ($1.10 x 100,000 units) Fixed costs Total relevant costs to make Cost to outsource Purchase price ($1.40 x 100,000 units) Unavoidable fixed costs Less: Lease income ($560 pe...

Similar Free PDFs

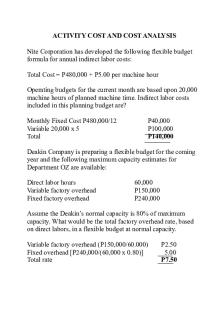

Activity COST AND COST Analysis

- 5 Pages

Cost Acctg Chapter 10

- 17 Pages

Tb ch03-cost-analysis

- 11 Pages

Cost control analysis

- 2 Pages

Cost volume profit analysis

- 11 Pages

Week 10

- 6 Pages

Cost Analysis Template for PDF

- 5 Pages

M7 Cost-Volume-Profit Analysis

- 2 Pages

Week 10 - Lecture notes 10

- 14 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu