ACCT1200(18) Lecture and Tutorial 3 Accounting Cycle 1 PDF

| Title | ACCT1200(18) Lecture and Tutorial 3 Accounting Cycle 1 |

|---|---|

| Author | Murad Aghazada |

| Course | Financial accounting |

| Institution | Koç Üniversitesi |

| Pages | 8 |

| File Size | 224.6 KB |

| File Type | |

| Total Downloads | 41 |

| Total Views | 155 |

Summary

Download ACCT1200(18) Lecture and Tutorial 3 Accounting Cycle 1 PDF

Description

LaiACCT1200/18 (lecture 3) ADA University, School of Business ACCT1200 Principles of Financial Accounting, Spring Semester 2018 Lecture 3 – Accounting Cycle 1

Reminder: objective of financial accounting – the reporting of financial results and financial position in the form of financial statements for the use of both insiders and outsiders.

The financial statements / reports include: profit and loss account; balance sheet; cash flow statement. Companies also include non-financial statements in their annual reports such as the chairman’s report; the directors’ report and the auditors’ report.

Financial statements are the end-products of the financial accounting process which is called the accounting cycle.

Overview of the accounting cycle: o In general, the accounting cycle consists of the following steps or processes: (a) Occurrence of transactions: transactions are financial or economic events which are measurable in monetary terms and recorded in the accounting books. Examples are cash and credit sales and purchases. What do you think should be the first transaction common to all business entities? (b) Recording of these transactions in journals or books of original entry – examples of books of original entry are sales journals, purchase journals, cash book. (c) Transferring or “posting” of the entries from the journals to the ledger accounts or ledger. The ledger account is a form of record used to record increases and decreases in a single item. In the ledger accounts, the items are separated and classified. (d) Balancing of the accounts in the ledger(s) at the end of the accounting period to determine debit or credit balances. (e) Preparing the trial balance – to prove the equality of debit and credit balances in the ledger. (f) Making end of the period adjustments – for example, the recording of depreciation as an expense at the end of the accounting period. (g) Preparing the financial statements – the profit and loss account and the balance sheet. (h) Closing the accounts – only the revenue and expense accounts will be closed. (i) Audit – after which the accounting cycle process repeats itself for a new accounting period.

1

LaiACCT1200/18 (lecture 3)

Classification of accounts – there are five (only five) elements or major categories of accounts, namely Assets, Liabilities, Equity (Capital), Expenses and Revenue.

Assets – resources owned by a business entity. Assets can be (a) tangible or intangible; (b) fixed (capital) or current. o Tangible assets – land, buildings, plant and machinery, vehicles, warehouses, office furniture and equipment, stocks (inventories), debtors (account receivables), money in the bank, cash. o Intangible assets – goodwill; patent rights; franchise rights.

Fixed assets – assets which will be used in the business for periods of more than a year. To allocate the total cost over its useful life, a tangible fixed asset is depreciated while an intangible fixed asset is amortized. Which accounting principle is being applied here? The two common methods of calculating depreciation are the straight-line method and the reducing balance method (more about these later). Current assets – a current asset is an asset which will be used up (or can be converted into cash) within the current accounting period (normally taken as a period of one year). Liquidity is the term used to describe how readily a current asset can be converted into cash. From the examples given above, can you now classify them into fixed and current assets.

● Liabilities – amounts owed by an entity to outside parties. Examples are loans from the bank, individuals, other corporations; bank overdrafts; creditors (accounts payable); taxes payable. Liabilities are also categorized into current (due in less than one year) or long-term (due in more than 1 year). ● Equity / capital is the investment made by the owners in the business. In the case of corporations, capital can be in the form of common shares (common stock), preferred shares, retained profit or reserves.

Examples of expenses (or revenue expenditures) are salaries & wages; office rental; payment for utilities, insurance, advertising, delivery; interest payment; depreciation / amortization.

Examples of revenue are sales, interest received, dividends received, commissions received.

Homework: Find out what is: capital expenditure, return inwards, return outwards, discount allowed, discount received? 2

Capital Expenditure- Capital expenditure, or CapEx, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment. CapEx is often used to undertake new projects or investments by the firm. This type of financial outlay is also made by companies to maintain or increase the scope of their operations Return inwards- Return inwards refer to the goods returned to an organization by its customers. They are goods which were sold, but usually, because of being unsatisfactory, were returned back by the customers. They are also called the Sales returns. Return outwards- Return outwards refer to the goods returned by an organization to its suppliers. They are goods which were purchased from suppliers, however, because of being unsatisfactory or a different reason were returned back to the suppliers, they are also called Purchase returns. Discount allowed- Discounts are very common in today’s business world, they are generally provided in lieu of some consideration which can range from timely payments to trade practices. While posting a journal entry for discount allowed “Discount Allowed Account” is debited. Discount allowed acts as an expense of the business Discount recieved- Discounts are a common thing in today’s world, they are generally given in lieu of some consideration which can range from prompt payments, trade practices, recoveries, etc. While posting the journal entry for discount received “Discount Received Account” is credited. Discount received is an income/gain for the business and is shown on the credit side of a profit and loss account. Trade discount is not shown in the main financial statements, however cash discount and other types of discounts are shown in books of accounts. Journal entry for discount received is usually a compound journal entry. LaiACCT1200/18 (lecture 3)

Double-entry rules – knowledge of the double-entry rules is required before recording can be made in the journals and ledgers. The rules of debit and credit (Pacioli’s rules) are as follows: Element or classification of account Asset Liability Equity Revenue Expense

Key Differences Between Debit and Credit

3

Debit +

Credit ─

─ ─ ─ +

+ + + ─

The difference between debit and credit can be drawn clearly on the following grounds: 1. Debit refers to the left side of the ledger account while credit relates to the right side of the ledger account. 2. In personal accounts, the receiver is debited whereas the giver is credited. 3. Whatever comes in, is debited in real account, while whatever goes out is credited in it. 4. For nominal account – all the expenses and losses are debited, however, all incomes and gains are credited. 5. The increase in debit is due to rise in cash, inventory, plant and machinery, land and building, expenses like salary, insurance, tax, dividend, etc. The increase in credit is due to rise in shareholders fund, membership fees, rental income, retained earnings, Account payable, etc.

Transaction analysis – beginners may find this useful before recording the entries in the journals / ledgers. The following steps are involved: (a) Determine the two accounts affected / involved. (b) Classify the two accounts according to the 5 elements identified as above. (c) Determine whether there is an increase or decrease in each of the two accounts. (d) Record the entries in the books of account according to the double-entry rules. o Examples: 1 January 2018 Adele started her business by depositing $10,000 in the bank. 2 January 2018 Bought office furniture costing $4,000 on credit from Mebel Co. 4 January 2018 Purchased goods costing $3,000 which was paid by check. 6 January 2018 Sold goods for $1,500 on credit to Gaga. 8 January 2018 Paid office rent for the first month of operation issuing a check for $800. 9 January 2018 Paid Mebel Co. $4,000 by check.

4

The transaction analyses for the first two transactions are as follows: Date Accounts Account Element Increase/decrease Debit/Credit 01.01 bank asset increase debit capital equity increase credit 02.01 furniture asset increase debit Mebel Co. liability increase credit 04.01 Purchases expences increase debit Bank/checks asset increase credit 06.01 Sales revenue increase credit Gaga asset increase debit 08.01 Office rent expenses increase debit Bank/check asset decrease credit 09.01 Mebel Co liability decrease debit Bank/check asset decrease credit Conduct a transaction analysis for the other transactions. As noted earlier, transaction analyses are helpful for beginners, seasoned book-keepers would perform them mentally, and so would you after a bit of practice.

Readings: o F Wood & A Sangster, Business Accounting 1, 13th edition, 2015, Pearson, chapters 1-4. o Leiwy, Danny and Perks, Robert; “Accounting: Understanding and Practice”, 4th edition, 2013, McGraw-Hill Education, chapter 9 LaiACCT1200/18 (tutorial 3) ADA University, School of Business ACCT1200 Principles of Financial Accounting, Spring Semester 2018 Tutorial 3 – Accounting Cycle 1

(a) Issue 1: What are the following accounts used for (a) capital; record the contributions or investments made by the owners in the business entity (b) trade creditors; used in a trading entity to record what the entity owes its suppliers for the goods purchased on credit. (Not used to record what the entity owes its suppliers for the supply of non-goods items). (c) trade debtors; record what is owed to a trading entity by its customers for the goods supplied to them on credit. (d) stock; record the value of closing stock at the end of the accounting period. There are no entries made for the movement of stock during the period, the value of the closing stock is normally obtained through physical counting. Closing stock at the end of one period becomes the opening stock of the next period(e) sales; record the revenue obtained from the main trading activity of the entity; will not include receipts from the sale of a vehicle used in the operation of the entity. (f) purchases; record the purchase of goods intended for resale by a trading entity. Will not include the purchase of items or assets used in the operations of an entity. (g) drawings; record the amount of cash (or goods) the owner (partners) has withdrawn from the sole proprietorship 5

(partnership). This term will not appear in company accounts because shareholders are paid dividends instead

Issue 2: What is the difference between (a) discounts allowed account and discounts received account? (b) sales returns(A sales return is merchandise sent back by a buyer to the seller, usually for one of the following reasons: Excess quantity shipped,Excess quantity ordered,Defective goods,Goods shipped too late,Product specifications are incorrect,Wrong items shipped) account and purchases returns(A purchase return transaction is when the buyer of merchandise, inventory, fixed assets, or other items sends these goods back to the seller. Excessive purchase returns can interfere with the profitability of a business, so they should be closely monitored. There are a number of reasons for purchase returns, such as:The buyer initially acquired an excessive quantity, and wants to return the remainder,The buyer acquired the wrong goods,The seller sent the wrong goods,The goods have proven to be inadequate in some way) account? a) Discounts allowed account - records cash discounts given to customers of the entity for prompt payment of any debt due to the entity.Discounts received account – records cash discounts received by the entity from its suppliers for prompt payment by the entity to its suppliers. b) Sales returns account – records the amount of goods returned by the customers of an entity. Will be deducted from the total sales figure to obtain “turnover”Purchases returns account – records the amount of goods returned to the suppliers by an entity.

Issue 3: From your understanding of the double-entry rules, can you explain why the bank credits your bank statement when you deposit cash into your bank account and debits your account when you withdraw cash from the ATM machine? From the perspective of the bank – when you deposit money into your account, the liability of the bank has increased (increase in liability account, credit); when you withdraw money from your account, liability of the bank decreases (decrease in liability account, debit).

Issue 4: (i) Posting the transactions in bookkeeping means: (a) making the first entry of a double entry transaction. (b) entering items in a cash book. (c) making the second entry of a double entry transaction. (d) transferring the entry from a journal to the ledger account. (ii) Amortization is; (a) the allocation of the cost of a tangible asset over its useful life. (b) the allocation of the cost of an intangible asset over its estimated life. 6

(c) the periodic / installment payment charged by a finance company for a loan taken from it. (d) none of the above.

Issue 5: Davies buys and sells goods on cash and credit terms. The following is a list of her transactions for January 2018: (a) Capital introduced by Davies and paid into the bank. Debit bank, credit capital (b) Goods purchased on credit terms from Swallow. Debit purchase, credit swallow (c) Goods sold to Hill for cash. Debit cash, credit sales (d) Cash paid for purchase of goods. Debit purchase, credit cash (e) Dale buys goods from Davies on credit. Debit dales(Trade deptor), credit sales (f) Motoring expenses paid by cheque. Debit motor expense, credit bank Required: State which account in Davies’ book of account should be debited and which account should be credited for each transaction. LaiACCT1200/18 (tutorial 3)

Issue 6: Harry started a new business on 1 January 2018. The following transactions cover his first three months in business: (a) Harry contributed an amount in cash to start the business. debit cash; credit capital. (b) He transferred some of the cash to a business bank account. debit bank; credit cash. (c) He paid an amount in advance by cheque for rental of business premises. debit prepayment of building rental; credit (d) Bought goods on credit from Paul. debit purchases; credit Paul. (e) Purchased a van paying by cheque. debit van; credit bank. (f) Sold some goods for cash to James. debit cash; credit sales. (g) Bought goods on credit from Nancy. debit purchases; credit Nancy. (h) Paid motoring expenses in cash. debit motor expenses; credit cash. (i) Returned some goods to Nancy. debit Nancy; credit purchases return (j) Sold goods on credit to Mavis. debit Mavis; credit sales. (k) Harry withdrew some cash for personal use. debit drawings; credit cash. (l) Bought goods from David paying in cash. debit purchases; credit cash. (m) Mavis returned some goods. debit sales return (return inwards); credit Mavis. (n) Sent a cheque to Nancy. debit Nancy; credit bank. (o) Cash received from Mavis. debit cash; credit Mavis. (p) Harry receives a cash discount from Nancy. debit Nancy; credit discounts received. (q) Harry allows Mavis a cash discount. debit discounts allowed; credit Mavis. (r) Cheque withdrawn at the bank in order to open a petty cash account.debit petty cash; credit bank. Required: State which account in Harry’s books of account should be debited and which account should be credited for each transaction.

7

Issue 7: You have just been recruited as the accountant of a new company which has not started operations yet. One of your immediate responsibilities is to set up the financial accounting system of the company. In setting up any financial accounting system, knowledge of the accounting cycle is essential. Briefly outline the steps / processes contained in the accounting cycle. Occurrence of financial or economic transactions. Recording of these transactions in journals or books of original entries. Transferring or ‘posting’ of the entries from the journals to the ledger accounts or ledger. Balancing the ledger accounts at the end of the accounting period to determine debit or credit balances. Making end of the period adjustments for depreciation, provision for bad and doubtful debts, accruals and prepayments. Preparing the trial balance. Preparing the financial statements – the profit and loss account and the balance sheet. Closing the revenue and expense accounts. Auditing the accounts by external auditors.

8...

Similar Free PDFs

Tutorial work - accounting cycle

- 1 Pages

Accounting Tutorial - Week 3

- 7 Pages

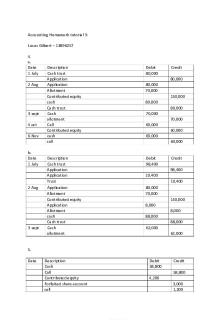

Accounting Homework tutorial 3

- 3 Pages

Accounting Cycle-5 - Cycle notes

- 13 Pages

Tutorial 1 Managerial accounting

- 5 Pages

Tutorial 3 - Lecture notes 3

- 5 Pages

Accounting Principles-Lecture 3

- 9 Pages

CNO cycle - Lecture notes 1

- 13 Pages

Completing the Accounting Cycle

- 152 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu