ADM 2350 - Syllabus PDF

| Title | ADM 2350 - Syllabus |

|---|---|

| Course | Financial Management |

| Institution | University of Ottawa |

| Pages | 14 |

| File Size | 462.8 KB |

| File Type | |

| Total Downloads | 3 |

| Total Views | 151 |

Summary

Download ADM 2350 - Syllabus PDF

Description

É CO L E D E G E STIO N TELFER SCHO O L O F MAN AG E ME N T

FINANCIAL MANAGEMENT ADM2350-Q00 Winter 2021 Professor

Harshit Rajaiya, Ph.D.

Office

DMS 7163

E-mail

[email protected] For security purposes, a student must only use his or her uOttawa e-mail address when communicating with the professor. E-mails sent from other accounts will not be answered.

Class Location

Online through Teams/Zoom. More information will be posted on Brightspace.

Class Hours

Monday 2:30 PM to 3:50 PM, Thursday 4:00 PM to 5:20 PM

Online Office Hours

Monday, 4 PM to 5 PM or by appointment Amlan Datta, [email protected] *

Teaching Assistant *Please reach out to Amlan using the above email id only Online Tutorials (a.k.a. DGD)

Thursday 5:30PM-6:50PM The first online tutorial is scheduled for Thursday, January 21. More information will be posted on Brightspace.

Approach to Distance Learning

Synchronous course delivery (with availability of recordings)

Prerequisite(s)

ADM 1340, ADM 2303, ECO 1102, ECO 1104

Program of study

BCom mandatory course

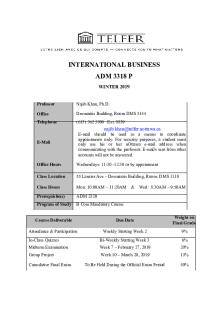

Course Deliverable Individual participation in online discussions*

Due Date

Weight on Final Grade

Answer: Thursday of each week, 5:00 PM 10%

Comment(s): Friday of each week, 5:00 PM

Four Quizzes

Final exam**

Monday, February 1 Monday, March 1 Monday, March 22 Thursday, April 8

10% each (total 40%)

To be announced (TBA)

50%

* See course policies below for details. ** Final exam is cumulative.

Note that it is not possible to submit extra course work in order to improve your mark. COURSE DESCRIPTION The course provides candidates with a framework with which to analyze corporate investment and financing decisions and understand how financial decisions affect firm value. Topics covered include time value of money, stock and bond valuation, project evaluation techniques, cost of capital, cash flow estimation, project risk analysis, real options, company valuation, dividend policy, and capital structure decision. The primary objective of this course is to introduce the main theories and applications of corporate finance. COURSE CONTRIBUTION TO PROGRAM LEARNING GOALS The Telfer School of Management has implemented an ongoing Assurance of Learning Process in each of its core programs to ensure that upon graduation, candidates have successfully achieved key learning outcomes and skills from the Program. This course contributes to the achievement of the following B.Com Learning Goals: LG1 Understand, Apply, and Integrate Core Management Disciplines and LG2 Demonstrate Critical Thinking and Decision Making Skills. COURSE LEARNING OBJECTIVES A principal role of general managers is to make decisions that will enhance the probability of success of a firm’s strategy that is formulated to maximize shareholder wealth. The general manager’s actions are further constrained by the objectives of other stakeholders of the firm. Given this constrained environment, the manager’s decision-making process is governed by functional knowledge; uncertainty and asymmetric information; game theoretic principles and logical thinking. This course contributes to this important aspect in the development of a general manager’s perspective by integrating the main issues in corporate finance with core principles of financial and managerial accounting and quantitative methods. Specifically, the course aims to increase students` understanding of: The investment decision-making process and why financial metrics alone are insufficient. The role of risk in the pricing of securities. The link between accounting information and valuation. The Canadian institutional environment within which financial decisions must be made.

2

APPROACH TO DISTANCE LEARNING This course is delivered in a synchronous format, i.e. lectures on MS Teams (which will be recorded) and organized by modules. The content of the course will also be posted on Brightspace (i.e., power point slides, videos, articles). The course also contain weekly synchronous tutorials animated by the teaching assistant starting from January 21, 2021. To promote discussion, each week, students are required to participate in online discussions to respond to questions posted by the professor. The discussions are monitored by the professor and the teaching assistant. Participations to online discussions are due by the Friday of each week at 5:00 PM (See course policies below for details). TEXTBOOK/COURSE PACKAGE Required Textbook Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, and Gordon Roberts, Fundamentals of Corporate Finance, 10th Canadian Edition, McGraw-Hill Ryerson, 2019. The textbook can be purchased online via www.uottawashop.ca.

Other recommended material Subscription to Wall Street Journal, the Economist and/or Financial Times. Some other excellent financial magazines such as Fortune, Forbes and Business Week also provide good applications of what you will learn in the course. Students are also encouraged to visit the following websites to further their command of some of the concepts covered in this course:

www.teachmefinance.com : for additional illustration of concepts covered in class. www.investopedia.com: for general finance topics. www.cfo.com: for current updates and discussions of financial challenges facing corporations www.sternstewart.com/ : for corporate valuation news, techniques and developments www.tvmcalcs.com: for time value calculations using Microsoft Excel and financial calculators.

Course Website The course website (via Brightspace) provides valuable information related to the course. On the website you will find, among others:

Lecture slides; Announcements; Assignments; Discussions; Posted articles from academic and financial press.

FINANCIAL CALCULATOR: A financial calculator is strongly recommended (but not required) for this course. Recommended calculators are the Texas Instruments BAIIPLUS™ and the Sharp EL-738. Both are widely available (e.g.,

3

online or at the University Bookstore, the Agora Bookstore, Staples or the Laurier Office Mart). Some of the questions can only be answered with a financial calculator or excel. Optional Other Resources: William F. Rentz & Alfred L. Kahl, How to Solve Time Value of Money Problems with the BAIIPlus Calculator, 2015. Available from Amazon or https://www.createspace.com/5646041 ISBN 9781515273479. Alfred L. Kahl & William F. Rentz, How to Solve Time Value of Money Problems with MS Excel, 2015. Available from Amazon or https://www.createspace.com/5793533 ISBN 9781517758264. COURSE ATTENDANCE As stated above, this course is delivered in a synchronous format, and so it is expected that student attend all classes. Further, starting from Week # 2, student who fails to complete three (or more) participations in online discussions will receive a grade of ZERO on the individual participations in online discussions (worth 10% of the total grade) and this regardless of the quality of her/his completed participations. An incomplete participation in online discussions is defined as follows: -

There are two parts in the online discussion participation activities: (1) each student should submit his/her own answer by Thursday 5 PM, (2) each student should provide at least one comment by Friday 5 PM.

-

If a student fails to do (1) OR (2) then his/her participation is considered incomplete.

Note that each incomplete participation will lead to 1% deduction from the 10% weight allocated to the individual participations in online discussions. THERE WILL BE NO EXCEPTIONS! Students are expected to write (or submit) all course deliverables as scheduled according to this Course Outline. Medical absences (with the appropriate medical certificate) are the only acceptable reasons for failure to hand-in or complete a requirement of this course at the specified time. COURSE POLICIES 1. Office Hours: I encourage you to attend my online office hours if you have any questions about the content of the course. 2. Individual participation in online discussions: This course requires you to participate in online discussions on various types of questions posted by your professor on Brightspace at the start of the week. Each student should submit his/her own answer by the Thursday 5:00 PM of each week. Comments on at least one answer posted by other group members should be submitted by the Friday of each week at 5:00 PM. You are automatically enrolled into a group. The groups may change based on additional registrations. The first discussion in this course (in Module 1) is an online introduction designed to help you get acquainted with your group members. There is no due date for the first discussion. You are divided into groups in order to enhance your learning. You can acquire new knowledge and understanding by independent reading and problem solving. However, you learn more and learn faster as a member of a group. This kind of learning process works best when participants are

4

fully prepared for discussions. To meet this expectation, you must complete all assigned readings in advance of the online discussions. For each discussion, you are required to post one initial response and post feedback to at least one other students’ postings. Make sure that you support your statements with demonstrated research and sources. The objective is to learn something new and provide added learning opportunities to your group members. Please avoid rephrasing someone else answer as it will defeat the purpose of online discussions and will adversely affect your participation mark. The discussions are monitored by the professor and the teaching assistant. The assessment of the individual participation in discussions will be based on the quality and frequency of your participation. This is an individual mark and will therefore vary within the group, depending on the contributions of its members. Quality is more important than quantity. As stated above, starting from Week # 2, student who fails to complete three (or more) participations in online discussions will be receive a grade of ZERO on the individual participation in online discussions (worth 10% of the total grade) and this regardless of the quality of her/his completed participations. An incomplete participation in online discussions is defined as follows: -

There are two parts in the online discussion participation activities: (1) each student should submit his/her own answer by Thursday 5 PM, (2) each student should provide at least one comment by Friday 5 PM.

-

If a student fails to do (1) OR (2) then his/her participation is considered incomplete.

Note that each incomplete participation will lead to 1% deduction from the 10% weight allocated to the individual participations in online discussions. 3. Individual Quizzes: The quizzes are designed to give you practice applying the concepts learned in the course. They are primarily a learning tool rather than a means of assessment. Late quizzes will not be accepted. Due dates are indicated above (under “Course Deliverable”). 4. Missed Exam and other deliverables: For a missed final examination, medical certificates must be submitted along with a deferred exam application and a medicate certificate form to the Student Services Centre (DMS1100) of the Telfer School of Management. Please visit the following webpage to download the form and carefully read the directives. For other missed deliverables, the original medical certificates can be submitted directly to the Professor. Late submissions are not tolerated. Exceptions are made only for illness (backed by original medical certificates) or other serious situations deemed as such by the professor. Religious absences: If a religious holiday or a religious event will force you to be absent during an evaluation, it is your responsibility to inform your professor as early as possible. THERE WILL BE NO EXCEPTIONS! Students are expected to write (or submit) all course deliverables as scheduled according to this Course Outline. Medical absences (with the appropriate medical certificate) are the only acceptable reasons for failure to hand-in or complete a requirement of this course at the specified time. 5. E-mail: Always use your university account and identify the course number and section. Emails from non-university accounts will not be answered. I read and respond to student e-mails within a

5

timeframe of two business days. Please note that office hours will be used to answer questions you may have with regard to course content and materials. METHODS USED TO EVALUATE STUDENT PERFORMANCE Course Deliverable Individual participations in online discussions *

Weight 10%

Individual Quizzes

40%

Final exam **

50%

TOTAL

Due Date Answer: Thursday of each week, 5:00 PM Comment(s): Friday of each week, 5:00 PM Monday, February 1 Monday, March 1 Monday, March 22 Thursday, April 8 To be announced by the registrar

100%

TENTATIVE COURSE SCHEDULE Week/ Module

Topics

Readings

1 (Jan 11 and Jan 14)

Introduction to Corporate Finance

Chapter 1

2 (Jan 18 and Jan 21)

Time Value of Money

Chapter 5

3 (Jan 25 and Jan 28)

Discounted Cash Flow Valuation

Chapter 6

4 (Feb 1 and Feb 4)

Bonds: Valuation, Features and Price Reporting

Chapter 7

5 (Feb 8 and Feb 11)

Stock Valuation

Chapter 8

6 (Feb 22 and Feb 25)

Capital Budgeting: Investment Appraisal Techniques

Chapter 9

7 (Mar 1 and Mar 4)

Capital Budgeting: Making Capital Investment decisions

Chapter 10

Quizzes

Quiz 1 on Feb 1

Quiz 2 on Mar 1

6

8 (Mar 8 and Mar 11)

Project Analysis and Evaluation

Chapter 11

9 (Mar 15 and Mar 18)

Risk and Return I

Chapter 12

10 (Mar 22 and Mar 25)

Risk and Return II

Chapter 13

11 (Mar 29 and Apr 1)

Cost of Capital

Chapter 14

Raising Capital

Chapter 15

12 (Apr 8 and Apr 12)

Quiz 3 on Mar 22

Quiz 4 on Apr 8

THE COURSE OUTLINE IS A GUIDE ONLY. ACTUAL MATERIAL COVERED IN CLASS MAY NOT EXACTLY FOLLOW THE COURSE SCHEDULE RECORDINGS OF SESSIONS Class sessions may be recorded, and your image, voice and name may be disclosed to classmates. Note that by remaining in sessions that are being recorded, you are agreeing to the recording.

TECHNICAL REQUIREMENTS AND SUPPORT The course requires that you to have a laptop or desktop computer with a reliable, high-speed Internet connection that allows you to watch videos, participate in discussion forums, upload images and use your uOttawa Google Drive. Video conferencing software (MS Teams, Adobe Connect, Zoom ) is used for meeting with the instructor-- so you will need to have a webcam and audio/voice capabilities through your computer. MS Teams, Adobe Connect, and Zoom work on mobile/smart phones as well. If you experience difficulties with Brightspace or with logins to any uOttawa systems, please do not contact the instructor or the course TA until you have tried to solve the problem through the IT supports in place at the University. For all questions related to Brightspace, call the support line between 8 AM and 8 PM (Eastern) at 1-866811-3201 OR submit an online request using this form 24 hours a day. For any other IT related issues, please contact IT services. They have a helpdesk that you can call, or you can submit a service ticket with a specific request 24 hours a day. For problems connecting to the library services, you can also contact the Morisset Help Desk.

7

EXPECTATIONS FOR STUDENT PARTICIPATION Please refer the course policies for detail COURSE CONDUCT The Telfer School of Management prides itself on a strong sense of shared values drawing upon principles of respect, integrity, professionalism and inclusion to guide interactions inside and outside the classroom. The Telfer School strives to provide a well-rounded and outstanding education enriched through experiential learning and a positive student experience. You are encouraged to familiarize yourself with our expectations related to course conduct at the Telfer School. Please refer to our Statement of Shared Rights and Responsibilities. PREVENTION OF SEXUAL VIOLENCE The University of Ottawa is committed to a safe and healthy campus for work, for study and for campus community life for all members of the University community. The University, as well as various employee and student groups, offer a variety of services and resources to ensure that all uOttawa community members have access to confidential support and information, and to procedures for reporting an incident or filing a complaint. For more information, please visit uOttawa Sexual violence: support and prevention. LANGUAGE & WRITING You will be judged on your writing abilities on all written deliverables. It is recommended to take the appropriate measures to avoid mistakes such as spelling, syntax, punctuation, inappropriate use of terms, etc. Professors show a marked bias for a movement from theory/definition (textbook, supplementary readings, class discussion) to your own words to a concrete example. In other words, make a clear reference to an accepted theoretical foundation, then explain it in your own words and then provide a concrete example to support your idea (from a case study, from a class discussion, from a real life situation that you have observed, from history,…). In the event of poor language quality, you may be penalized up to 15% to the professor’s discretion. Please see the “Writing Resources”. INTELLECTUAL PROPERTY 1) All materials prepared by the course professor, including lab manuals, class handouts and exam papers, are protected by copyright. Copying or scanning them or posting them on a website is therefore a violation of copyright and is illegal. (2) All rights reserved. No part of this document may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission from the instructors.

8

ACADEMIC INTEGRITY Academic Regulation 14 defines academic fraud as “any act by a student that may result in a distorted academic evaluation for that student or another student. Academic fraud includes but is not limited to activities such as: a) Plagiarism or cheating in any way; b) Submitting work not partially or fully the student’s own, excluding properly cited quotations and references. Such work includes assignments, essays, tests, exams, research reports and theses, regardless of whether the work is written, oral or another form; c) Presenting research data that are forged, falsified or fabricated; d) Attributing a statement of fact or reference to a fabricated source; e) Submitting the same work or a large part of the same piece of work in more than one course, or a thesis or any other piece of work submitted elsewhere without the prior approval of the appropriate professors or academic units; f) Falsifying or misrepresenting an academic evaluation, using a forged or altered supporting document or facilitating the use of such a document; g) Taking any action aimed at falsifying an academic evaluation.”1 The Telfer School of Management does no...

Similar Free PDFs

ADM 2350 - Syllabus

- 14 Pages

ADM 3318 Course Syllabus

- 10 Pages

PAM 2350 Prelim 1

- 17 Pages

Exemplu calcul salarii 2350

- 2 Pages

NRSG 2350 Drug Card ketorlac

- 1 Pages

Caso adm

- 4 Pages

ADM 1450 TP1 - ADM 1450 TP1

- 1 Pages

Calendario 2021 siste adm

- 5 Pages

![[TP3] ADM 82.5%](https://pdfedu.com/img/crop/172x258/d19kvvmnjm5p.jpg)

[TP3] ADM 82.5%

- 11 Pages

Adm 1703Travail note 1

- 14 Pages

Exercícios de Direito Adm

- 6 Pages

ADM - TP 3

- 10 Pages

Math 2350 assignment 3 - n/a

- 16 Pages

Adm financ heriberto Fernandez

- 98 Pages

Controle Adm-convertido

- 7 Pages

RELATÓRIO PARCIAL ESTÁGIO ADM

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu