CMA Part2 MCQ3 PDF

| Title | CMA Part2 MCQ3 |

|---|---|

| Course | Accountancy |

| Institution | University of the Philippines System |

| Pages | 77 |

| File Size | 1.4 MB |

| File Type | |

| Total Downloads | 171 |

| Total Views | 226 |

Summary

[Fact Pattern #1] The information that follows pertains to Devlin Company.Statement of Financial Position as of May 31 (in thousands) Year 2 Year 1Assets Current assets Cash $ 45 $ 38 Trading securities 30 20 Accounts receivable (net) 68 48 Inventory 90 80 Prepaid expenses 22 30 Total current assets...

Description

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[Fact Pattern #1] The information that follows pertains to Devlin Company. Statement of Financial Position as of May 31 (in thousands)

Income Statement for the year ended May 31 (in thousands)

Year 2 Year 1 Assets Current assets Cash Trading securities Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments, at equity Property, plant, and equipment (net) Intangible assets (net) Total assets Liabilities Current liabilities Notes payable Accounts payable Accrued expenses Income taxes payable Total current liabilities Long-term debt Deferred taxes Total liabilities Equity Preferred stock, 6%, $100 par value, cumulative Common stock, $10 par value Additional paid-in capital -common stock Retained earnings Total equity Total liabilities and equity

$ 45 30 68 90 22 $255 38 375

$ 38 20 48 80 30 $216 30 400

80 $748

45 $691

$ 35 70 5 15 $125 35 3 $163

$ 18 42 4 16 $ 80 35 2 $117

$150 225

$150 195

114 96 $585 $748

100 129 $574 $691

Net sales Costs and expenses Costs of goods sold Selling, general, and administrative Interest expense Income before taxes Income taxes Net income

Year 2 Year 1 $480 $460 330 52

315 51

8 $ 90 36

9 $ 85 34

$ 54

$ 51

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[1] Gleim #: 3.1.1 -- Source: CMA 697 2-14 (Refers to Fact Pattern #1) Assuming there are no preferred stock dividends in arrears, Devlin Company’s return on common equity for the year ended May 31, Year 2, was A. B. C. D.

6.3% 7.5% 7.8% 10.5% Answer (A) is incorrect. Average total assets are based on 6.3%. Answer (B) is incorrect. Net income divided by average total assets equals 7.5%. Answer (C) is incorrect. Net income divided by beginning total assets equals 7.8%. Answer (D) is correct. The return on common equity equals income available to common shareholders divided by average common equity. Net income available to common shareholders is $45 [$54 – ($150 par value of preferred stock × 6%)]. Average common equity is $429.5 {[$574 – $150 preferred stock) + ($585 – $150 preferred stock)] ÷ 2}. Thus, the return is 10.5% ($45 ÷ $429.5).

[2] Gleim #: 3.1.2 -- Source: CMA 697 2-17 (Refers to Fact Pattern #1) Devlin Company’s rate of return on assets for the year ended May 31, Year 2, was A. B. C. D.

7.2% 7.5% 7.8% 11.2% Answer (A) is incorrect. The figure of 7.2% uses ending total assets instead of average total assets. Answer (B) is correct. The rate of return on assets equals net income divided by average total assets. Accordingly, the rate of return is 7.5% {$54 ÷ [($748 + $691) ÷ 2]}. Answer (C) is incorrect. Net income divided by beginning total assets equals 7.8%. Answer (D) is incorrect. The return on sales is 11.2%.

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[Fact Pattern #2] The Statement of Financial Position for King Products Corporation for the fiscal years ended June 30, Year 2, and June 30, Year 1, is presented below. Net sales and cost of goods sold for the year ended June 30, Year 2, were $600,000 and $440,000, respectively. King Products Corporation Statement of Financial Position (in thousands) June 30 Cash Marketable securities (at market) Accounts receivable (net) Inventories (at lower of cost or market) Prepaid items Total current assets

Year 2 $ 60 40 90 120 30 $ 340

Year 1 $ 50 30 60 100 40 $280

Land (at cost) Building (net) Equipment (net) Patents (net) Goodwill (net) Total long-term assets Total assets

200 160 190 70 40 $ 660 $1,000

190 180 200 34 26 $630 $910

Notes payable Accounts payable Accrued interest Total current liabilities

$

46 94 30 $ 170

$ 24 56 30 $110

Notes payable, 10% due 12/31/Year 7 Bonds payable, 12% due 6/30/Year 10 Total long-term debt Total liabilities Preferred stock -- 5% cumulative, $100 par, nonparticipating, authorized, issued and outstanding, 2,000 shares Common stock -- $10 par, 40,000 shares authorized, 30,000 shares issued and outstanding Additional paid-in capital -- common Retained earnings Total equity Total liabilities & equity

20 30 $ 50 $ 220

20 30 $ 50 $160

200

200

300 150 130 $ 780 $1,000

300 150 100 $750 $910

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[3] Gleim #: 3.1.3 -- Source: CMA 1296 2-19 (Refers to Fact Pattern #2) Assuming that King Products Corporation’s net income for the year ended June 30, Year 2, was $70,000 and there are no preferred stock dividends in arrears, King Products Corporation’s return on common equity was A. B. C. D.

7.8% 10.6% 10.9% 12.4% Answer (A) is incorrect. The percentage 7.8% includes preferred equity in the denominator. Answer (B) is correct. The preferred stock dividend requirement is $10,000 ($200,000 par value × 5%), so the net income available to common shareholders is $60,000 ($70,000 NI – $10,000). The return on common equity equals income available to common shareholders divided by the average common equity. Given that preferred equity was $200,000 at all relevant times, beginning and ending common equity was $550,000 ($750,000 total – $200,000) and $580,000 ($780,000 total – $200,000), an average of $565,000 [($580,000 + $550,000) ÷ 2]. The return on common equity was therefore 10.6% ($60,000 ÷ $565,000). Answer (C) is incorrect. Using beginning-of-the-year equity results in 10.9%. Answer (D) is incorrect. Not subtracting the preferred dividend requirement from net income results in 12.4%.

[4] Gleim #: 3.1.4 -- Source: CIA 1194 IV-14 If Company A has a higher rate of return on assets than Company B, the reason may be that Company A has a profit margin on sales, a asset-turnover ratio, or both.

A. B. C. D.

List A

List B

Higher Higher Lower Lower

Higher Lower Higher Lower

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

Answer (A) is correct. The return on assets equals the product of the profit margin and the asset turnover.

If one company has a higher return on assets than another, it may have a higher profit margin, a higher asset turnover, or both. Answer (B) is incorrect. A higher profit margin on sales or a higher asset-turnover ratio may explain a higher return on assets. Answer (C) is incorrect. A higher profit margin on sales or a higher asset-turnover ratio may explain a higher return on assets. Answer (D) is incorrect. A higher profit margin on sales or a higher asset-turnover ratio may explain a higher return on assets. [Fact Pattern #3] The financial statements for Dividendosaurus, Inc. for the current year are as follows:

Balance Sheet Cash Accounts receivable Inventory Net fixed assets Total Accounts payable Long-term debt Capital stock Retained earnings Total

Statement of Income and Retained Earnings $100 Sales 200 Cost of goods sold 50 Gross profit 600 Operations expenses $950 Operating income Interest expense $140 Income before tax 300 Income tax 260 Net income 250 Plus Jan. 1 retained earnings $950 Minus dividends Dec. 31 retained earnings

[5] Gleim #: 3.1.5 -- Source: CIA 596 IV-38 (Refers to Fact Pattern #3) Dividendosaurus has return on assets of A. B. C. D.

21.1% 39.2% 42.1% 45.3%

$ 3,000 (1,600) $ 1,400 (970) $

430 (30) $ 400 (200) $ 200 150 (100) $ 250

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

Answer (A) is correct. The return on assets is the ratio of net income to total assets. It equals 21.1% ($200 NI ÷ $950 total assets). Answer (B) is incorrect. The ratio of net income to common equity is 39.2%. Answer (C) is incorrect. The ratio of income before tax to total assets is 42.1%. Answer (D) is incorrect. The ratio of income before interest and tax to total assets is 45.3%. [6] Gleim #: 3.1.6 -- Source: CIA 596 IV-40 (Refers to Fact Pattern #3) Dividendosaurus has a profit margin of A. B. C. D.

6.67% 13.33% 14.33% 46.67% Answer (A) is correct. The profit margin is the ratio of net income to sales. It equals 6.67% ($200 NI ÷ $3,000 sales). Answer (B) is incorrect. The ratio of income before tax to sales is 13.33%. Answer (C) is incorrect. The ratio of income before interest and taxes to sales is 14.33%. Answer (D) is incorrect. The ratio of gross profit to sales is 46.67%.

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[Fact Pattern #4] Lisa, Inc. Statement of Financial Position December 31, Year 2 (in thousands) Assets Current assets Cash Trading securities Accounts receivable (net) Inventories (at lower of cost or market) Prepaid items Total current assets Long-term investments Securities (at cost) Property, plant, & equipment Land (at cost) Building (net) Equipment (net) Intangible assets Patents (net) Goodwill (net) Total long-term assets Total assets Liabilities & shareholders’ equity Current liabilities Notes payable Accounts payable Accrued interest Total current liabilities Long-term debt Notes payable 10% due 12/31/Year 9 Bonds payable 12% due 12/31/Year 8 Total long-term debt Total liabilities Shareholders’ equity Preferred - 5% cumulative, $100 par, nonparticipating, 1,000 shares authorized, issued and outstanding Common - $10 par 20,000 shares authorized, 15,000 issued and outstanding shares Additional paid-in capital - common Retained earnings Total shareholders’ equity Total liabilities & equity

Year 2

Year 1

$ 30 20 45 60 15 170

$ 25 15 30 50 20 140

25

20

75 80 95

75 90 100

35 20 330 $500

17 13 315 $455

$23 47 15 85

$12 28 15 55

10 15 25 $110

10 15 25 $ 80

$100

$100

150 75 65 $390 $500

150 75 50 $375 $455

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[7] Gleim #: 3.1.7 -- Source: CMA 693 2-6 (Refers to Fact Pattern #4) Assuming that Lisa, Inc.’s net income for Year 2 was $35,000, and there were no preferred stock dividends in arrears, Lisa’s return on common equity for Year 2 was A. B. C. D.

7.8% 10.6% 10.9% 12.4% Answer (A) is incorrect. Including the $100,000 of preferred stock in the denominator results in 7.8%. Answer (B) is correct. The preferred stock dividend requirement is 5%, or $5,000 (5% × $100,000). Deducting the $5,000 of preferred dividends from the $35,000 of net income leaves $30,000 for the common shareholders. The firm began the year with common equity of $275,000 and ended with $290,000. Thus, the average common equity during the year was $282,500. The return on common equity was 10.6% ($30,000 ÷ $282,500). Answer (C) is incorrect. The beginning shareholders’ equity of $275,000 is based on 10.9%. Answer (D) is incorrect. Total net income of $35,000 is based on 12.4%.

[Fact Pattern #5] Jensen Corporation’s board of directors met on June 3 and declared a regular quarterly cash dividend of $.40 per share for a total value of $200,000. The dividend is payable on June 24 to all stockholders of record as of June 17. Excerpts from the statement of financial position for Jensen Corporation as of May 31 are presented as follows. Cash Accounts receivable (net) Inventories Total current assets

$ 400,000 800,000 1,200,000 $2,400,000

Total current liabilities

$1,000,000

Assume that the only transactions to affect Jensen Corporation during June are the dividend transactions.

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[8] Gleim #: 3.1.8 -- Source: CMA 685 4-26 (Refers to Fact Pattern #5) Jensen’s total stockholders’ equity would be A. B. C. D.

Unchanged by the dividend declaration and decreased by the dividend payment. Decreased by the dividend declaration and increased by the dividend payment. Unchanged by either the dividend declaration or the dividend payment. Decreased by the dividend declaration and unchanged by the dividend payment. Answer (A) is incorrect. A dividend declaration reduces retained earnings and total stockholders’ equity. The subsequent payment will have no effect on stockholders’ equity because only cash and dividends payable are reduced. Answer (B) is incorrect. A dividend declaration reduces retained earnings and total stockholders’ equity. The subsequent payment will have no effect on stockholders’ equity because only cash and dividends payable are reduced. Answer (C) is incorrect. A dividend declaration reduces retained earnings and total stockholders’ equity. The subsequent payment will have no effect on stockholders’ equity because only cash and dividends payable are reduced. Answer (D) is correct. A dividend declaration reduces retained earnings and thus total stockholders’ equity. The subsequent payment will have no effect on stockholders’ equity since only cash and dividends payable are reduced.

[9] Gleim #: 3.1.9 -- Source: CMA 685 4-27 (Refers to Fact Pattern #5) If the dividend declared by Jensen Corporation had been a 10% stock dividend instead of a cash dividend, Jensen’s current liabilities would have been A. B. C. D.

Unchanged by the dividend declaration and increased by the dividend distribution. Unchanged by the dividend declaration and decreased by the dividend distribution. Increased by the dividend declaration and unchanged by the dividend distribution. Unchanged by either the dividend declaration or the dividend distribution. Answer (A) is incorrect. A stock dividend requires transfer of an amount from retained earnings to paid-in capital. Consequently, no liability accounts are affected by either the declaration or the distribution of a stock dividend. Answer (B) is incorrect. A stock dividend requires transfer of an amount from retained earnings to paid-in capital. Consequently, no liability accounts are affected by either the declaration or the distribution of a stock dividend. Answer (C) is incorrect. A stock dividend requires transfer of an amount from retained earnings to paid-in capital. Consequently, no liability accounts are affected by either the declaration or the distribution of a stock dividend. Answer (D) is correct. A stock dividend requires transfer of an amount from retained earnings to paid-in capital. Consequently, no liability accounts are affected by either the declaration or the distribution of a stock dividend.

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[Fact Pattern #6] The data presented below show actual figures for selected accounts of McKeon Company for the fiscal year ended May 31, Year 1, and selected budget figures for the Year 2 fiscal year. McKeon’s controller is in the process of reviewing the Year 2 budget and calculating some key ratios based on the budget. McKeon Company monitors yield or return ratios using the average financial position of the company. (Round all calculations to three decimal places if necessary.)

Current assets Noncurrent assets Current liabilities Long-tem debt Common stock ($30 par value) Retained earnings

5/31/Year 2

5/31/Year 1

$210,000 275,000 78,000 75,000 300,000 32,000

$180,000 255,000 85,000 30,000 300,000 20,000

Year 2 Operations Sales* Cost of goods sold Interest expense Income taxes (40% rate) Dividends declared and paid in Year 2 Administrative expense

$350,000 160,000 3,000 48,000 60,000 67,000

*All sales are credit sales. Current Assets Cash Accounts receivable Inventory Other

5/31/Year 2 $ 20,000 100,000 70,000 20,000

5/31/Year 1 $10,000 70,000 80,000 20,000

[10] Gleim #: 3.1.10 -- Source: CMA 688 4-8 (Refers to Fact Pattern #6) The Year 2 return on equity for McKeon Company is A. B. C. D.

0.040 0.221 0.240 0.361

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

Answer (A) is incorrect. Return on equity equals net income divided by average stockholders’ equity. Answer (B) is correct. Return on equity equals net income of $72,000 ($350,000 sales – $160,000 CGS – $3,000 interest expense – $48,000 taxes – $67,000 administrative expenses) divided by the average stockholders’ equity (yield or return ratios are based on average financial position in these questions). The average equity of $326,000 is found by averaging the $320,000 sum of the common stock and retained earnings at May 31, Year 1, with the $332,000 ending balance. Dividing the $72,000 net income by $326,000 produces a rate of return of 22.1%. Answer (C) is incorrect. Return on equity equals net income divided by average stockholders’ equity. Answer (D) is incorrect. Return on equity equals net income divided by average stockholders’ equity. [11] Gleim #: 3.1.11 -- Source: Publisher In the current year, Griffin Inc. had $15 million in sales, while total fixed costs were held to $6 million. The firm’s total assets at year-end were $20 million and the debt/equity ratio was calculated at 0.60. If the firm’s EBIT is $3 million, the interest on all debt is 9%, and the tax rate is 40%, what is the firm’s return on equity? A. B. C. D.

11.16% 14.4% 18.6% 24.0% Answer (A) is correct. The first step is to determine the amount of equity. If the debt/equity ratio is .6, then the calculation is .6E + E = $20 million. Thus, E (equity) equals $12.5 million. Debt is therefore $7.5 million. At 9%, interest on $7.5 million of debt is $675,000. Earnings before taxes are $2,325,000 ($3,000,000 EBIT – $675,000 interest). At a 40% tax rate, taxes are $930,000, which leaves a net income of $1,395,000. Return on equity is calculated by dividing the $1,395,000 by the $12,500,000 of equity capital, giving an ROE of 11.16%. Answer (B) is incorrect. A failure to deduct interest expense results in 14.4%. Answer (C) is incorrect. A failure to deduct income taxes results in 18.6%. Answer (D) is incorrect. Using the wrong amount of equity results in 24.0%.

Gleim CMA Test Prep: Part 2: Financial Decision Making (104 questions)

[Fact Pattern #7] Excerpts from the statement of financial position for Landau Corporation as of September 30 of the current year are presented as follows. Cash Accounts receivable (net) Inventories

$ 950,000 1,675,000 2,806,000

Total current assets Accounts payable Accrued liabilities Total current liabilities

$5,431,000 $1,004,000 785,000 $1,789,000

The board of directors of Landau Corporation met on October 4 of the current year and declared the regular quarterly cash dividend amounting to $750,000 ($.60 per share). The dividend is payable on October 25 of the current year to all shareholders of record as of October 12 of the current year. Assume that the only transactions to affect Landau Corporation during October of the current year are the dividend transactions and that the closing entries have been made. [12] Gleim #: 3.1.12 -- Source: CMA 1289 4-15 (Refers to Fact Pattern #7) Landau Corporation’s total equity was A. B. C. D.

Unchanged by the dividend declaration and decreased by the dividend payment. Decreased by the dividend declaration and increased by the dividend payment. Unchanged by either the dividend declaration or the dividend payment. Decreased by the dividend declaration and unchanged by the dividend payment. Answer (A) is incorrect. The declaration of a cash dividend reduces equity. Answer (B) is incorrect. The payment of a cash dividend decreases assets and liabilities, but ha...

Similar Free PDFs

CMA Part2 MCQ3

- 77 Pages

CMA-book-preview - cma review

- 14 Pages

Cma part 2 - CMA Sample Questions

- 160 Pages

MCQ3 A - Tutorial

- 4 Pages

Linguagem C avançada - Part2

- 10 Pages

CMA P2 Risk Management

- 29 Pages

LAW CMA 3

- 196 Pages

IMA CMA Handbook

- 13 Pages

Cour droit de l\'entreprise CMA

- 60 Pages

Gathering Data Part2 notes

- 8 Pages

Detailed Lesson Plan PART2

- 5 Pages

Week 1 part2

- 19 Pages

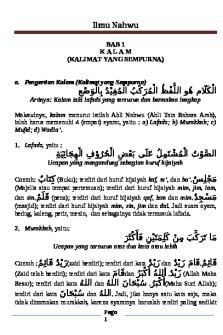

Ilmu Nahwu PART2 ISI

- 328 Pages

CMA Sample Questions and Essays

- 12 Pages

Résumé cours opération part2

- 25 Pages

Design Report Rubric part2

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu