EXAM 3 Review acg2071 PDF

| Title | EXAM 3 Review acg2071 |

|---|---|

| Author | Priscila Salvador |

| Course | Managerial Accounting |

| Institution | Indian River State College |

| Pages | 16 |

| File Size | 419.5 KB |

| File Type | |

| Total Downloads | 71 |

| Total Views | 128 |

Summary

exam 3 review indian state river college for ACG2071. Chapter 21 and 24...

Description

EXAM 3 - REVIEW

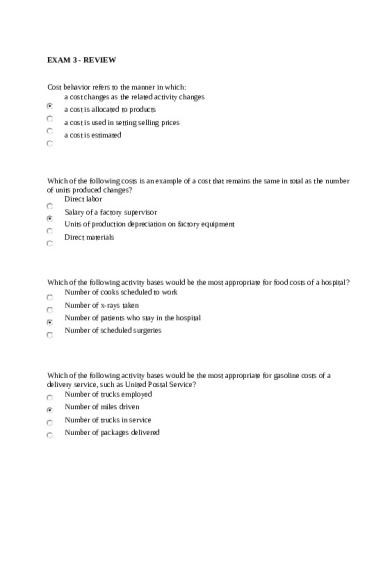

Cost behavior refers to the manner in which: a cost changes as the related activity changes a cost is allocated to products a cost is used in setting selling prices a cost is estimated

Which of the following costs is an example of a cost that remains the same in total as the number of units produced changes? Direct labor Salary of a factory supervisor Units of production depreciation on factory equipment Direct materials

Which of the following activity bases would be the most appropriate for food costs of a hospital? Number of cooks scheduled to work Number of x-rays taken Number of patients who stay in the hospital Number of scheduled surgeries

Which of the following activity bases would be the most appropriate for gasoline costs of a delivery service, such as United Postal Service? Number of trucks employed Number of miles driven Number of trucks in service Number of packages delivered

Costs that vary in total in direct proportion to changes in an activity level are called: fixed costs sunk costs variable costs differential costs

Which of the following is an example of a cost that varies in total as the number of units produced changes? Salary of a production supervisor Direct materials cost Property taxes on factory buildings Straight-line depreciation on factory equipment

Which of the following is NOT an example of a cost that varies in total as the number of units produced changes? Electricity per KWH to operate factory equipment Direct materials cost Insurance premiums on factory building Wages of assembly worker

Which of the following costs is a mixed cost? Salary of a factory supervisor Electricity costs of $3 per kilowatt-hour Rental costs of $10,000 per month plus $.30 per machine hour of use Straight-line depreciation on factory equipment

Marcye Co. manufactures office furniture. During the most productive month of the year, 3,500 desks were manufactured at a total cost of $84,400. In its slowest month, the company made

1,100 desks at a cost of $46,000. Using the high-low method of cost estimation, total fixed costs are: $56,000 $28,400 $17,600 cannot be determined from the data given

Given the following cost and activity observations for Bounty Company’s utilities, use the highlow method to calculate Bounty’ variable utilities costs per machine hour. Cost Machine Hours March $3,100 15,000 April

2,700

10,000

May

2,900

12,000

June

3,600

18,000

$10.00 $.67 $.63 $.11

Given the following cost and activity observations for Smithson Company’s utilities, use the high-low method to calculate Smithson’s fixed costs per month. Do not round your intermediate calculations.

Cost

Machine Hours

January

$52,200

20,000

February

75,000

29,000

March

57,000

22,000

April

64,000

24,500

$1,533 $2,530 $22,800 $50,600

Given the following cost and activity observations for Taco Company’s utilities, use the high-low method to calculate Taco’s variable utilities costs per machine hour. Cost

Machine Hours

May

$8,300

15,000

June

10,400

20,000

July

7,200

12,000

August

9,500

18,000

$10.00 $.60 $.40 $.52

The manufacturing cost of Prancer Industries for three months of the year are provided below:

Total Cost $ 60,700 80,920 100,300

April May June

Production 1,200 Units 1,800 2,400

Using the high-low method, the variable cost per unit, and the total fixed costs are: $32.30 per unit and $77,520 respectively. $33 per unit and $21,100 respectively. $32 per unit and $76,800 respectively. $32.30 per unit and $22,780 respectively.

Contribution margin is: the excess of sales revenue over variable cost another term for volume in the "cost-volume-profit" analysis profit the same as sales revenue

The contribution margin ratio is: the same as the variable cost ratio the same as profit the portion of equity contributed by the stockholders the same as the profit-volume ratio

If sales are $820,000, variable costs are 45% of sales, and operating income is $260,000, what is the contribution margin ratio? 45% 55%

62% 32%

What ratio indicates the percentage of each sales dollar that is available to cover fixed costs and to provide a profit? Margin of safety ratio Contribution margin ratio Costs and expenses ratio Profit ratio

A firm operated at 80% of capacity for the past year, during which fixed costs were $210,000, variable costs were 70% of sales, and sales were $1,000,000. Operating profit was: $90,000 $210,000 $590,000 $490,000

If sales are $425,000, variable costs are 62% of sales, and operating income is $50,000, what is the contribution margin ratio? 38% 26.8% 11.8% 62%

Variable costs as a percentage of sales for Lemon Inc. are 80%, current sales are $600,000, and fixed costs are $130,000. How much will operating income change if sales increase by $40,000? $8,000 increase $8,000 decrease $30,000 decrease

$30,000 increase

Spice Inc.'s unit selling price is $60, the unit variable costs are $35, fixed costs are $125,000, and current sales are 10,000 units. How much will operating income change if sales increase by 8,000 units? $150,000 decrease $175,000 increase $200,000 increase $150,000 increase

Zipee Inc.'s unit selling price is $90, the unit variable costs are $40.50, fixed costs are $170,000, and current sales are 12,000 units. How much will operating income change if sales increase by 5,000 units? $125,000 decrease $175,000 increase $75,000 increase $247,500 increase

If fixed costs are $250,000, the unit selling price is $125, and the unit variable costs are $73, what is the break-even sales (units)? 3,425 units 2,381 units 2,000 units 4,808 units

If fixed costs are $750,000 and variable costs are 60% of sales, what is the break-even point in sales dollars? $1,250,000 $450,000 $1,875,000

$300,000

If fixed costs are $500,000, the unit selling price is $55, and the unit variable costs are $30, what is the break-even sales (units) if fixed costs are increased by $80,000? 10,545 units 19,333 units 23,200 units 25,000 units

If fixed costs are $450,000, the unit selling price is $75, and the unit variable costs are $50, what are the old and new break-even sales (units) if the unit selling price increases by $10? 6,000 units and 5,294 units 18,000 units and 6,000 units 18,000 units and 12,858 units 9,000 units and 15,000 units

If fixed costs are $400,000 and the unit contribution margin is $20, what amount of units must be sold in order to have a zero profit? 25,000 units 10,000 units 400,000 units 20,000 units

If fixed costs are $561,000 and the unit contribution margin is $8.00, what is the break-even point in units if variable costs are decreased by $.50 a unit? 66,000 70,125 74,800 60,000

Which of the following conditions would cause the break-even point to increase? Total fixed costs decrease Unit selling price increases Unit variable cost decreases Unit variable cost increases

If fixed costs are $490,000, the unit selling price is $35, and the unit variable costs are $20, what is the break-even sales (units) if fixed costs are reduced by $40,000? 32,667 units 14,000 units 30,000 units 24,500 units

When the fixed costs are $120,000 and the contribution margin is $30, the break-even point is 16,000 units 8,000 units 6,000 units 4,000 units

The point where the sales line and the total costs line intersect on the cost-volume-profit chart represents: the maximum possible operating loss the maximum possible operating income the total fixed costs the break-even point

The point where the profit line intersects the horizontal axis on the profit-volume chart represents: the maximum possible operating loss the maximum possible operating income the total fixed costs the break-even point

The relative distribution of sales among the various products sold by a business is termed the: business's basket of goods contribution margin mix sales mix product portfolio

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are: Product Arks Bins

Unit Selling Price $120 80

What was Carter Co.'s sales mix last year? 20% Arks, 80% Bins 12% Arks, 28% Bins

Unit Variable Cost $80 60

Unit Contribution Margin $40 20

70% Arks, 30% Bins 40% Arks, 20% Bins

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are: Product Arks Bins

Unit Selling Price $120 80

Unit Variable Cost $80 60

Unit Contribution Margin $40 20

What was Carter Co.'s weighted average unit selling price? $200 $100 $ 80 $ 88

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are: Product Arks Bins

Unit Selling Price $120 80

Unit Variable Cost $80 60

What was Carter Co.'s weighted average variable cost? $140 $ 70 $ 64

Unit Contribution Margin $40 20

$ 60

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are: Product Arks Bins

Unit Selling Price $120 80

Unit Variable Cost $80 60

Unit Contribution Margin $40 20

What was Carter Co.'s weighted average unit contribution margin? $24 $60 $92 $20

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are: Product Arks Bins

Unit Selling Price $120 80

Unit Variable Cost $80 60

Unit Contribution Margin $40 20

Assuming that last year's fixed costs totaled $960,000, what was Carter Co.'s break-even point in units? 40,000 units 12,000 units 35,000 units

28,000 units

Which is the best example of a decentralized operation? One owner who prepares plans and makes decisions for the entire company. Each unit is responsible for their own operations and decision making. In a major company, operating decisions are made by top management. None of the above. All are examples of a centralized management.

All of the following are advantages of decentralization except: Managers make better decisions when closer to the operation of the company. Expertise in all areas of the business is difficult, decentralization makes it better to delegate certain responsibilities. Each decentralized operation purchases their own assets and pays for operating costs. Decentralized managers can respond quickly to customer satisfaction and quality service.

Which of the following is not one of the common types of responsibility centers? Cost Center Profit Center Investment Center Revenue Center

In a cost center, the manager has responsibility and authority for making decisions that affect: revenues assets both costs and revenues costs

The following is a measure of a manager’s performance working in a cost center. budget performance report rate of return and residual income measures divisional income statements balance sheet

In a profit center, the department manager has responsibility for and the authority to make decisions that affect: not only costs and revenues, but also assets invested in the center the assets invested in the center, but not costs and revenues both costs and revenues for the department or division costs and assets invested in the center, but not revenues

The costs of services charged to a profit center on the basis of its use of those services are called: operating expenses noncontrollable charges service department charges activity charges

Avey Corporation had $275,000 in invested assets, sales of $330,000, income from operations amounting to $49,500 and a desired minimum rate of return of 7.5%. The rate of return on investment for Avey Corporation is: 8% 10% 18% 7.5%

Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum rate of return of 15%. The profit margin for Mason is: 7.1% 20% 15.2% 14.1%

Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum rate of return of 15%. The investment turnover for Mason is: 1.08 .93 6.57 7.07

Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum rate of return of 15%. The residual income for Mason is: $0 $84,150 ($6,000)

$1,500...

Similar Free PDFs

EXAM 3 Review acg2071

- 16 Pages

LCHI476 Exam #3 - Exam Review

- 11 Pages

Exam 3 Review Math

- 2 Pages

Criminology exam 3 review

- 12 Pages

ACCT200 Exam 3 review

- 8 Pages

Exam 3 Review

- 6 Pages

Exam+3+Review+Handout

- 6 Pages

Exam 3 review

- 4 Pages

Exam Review sheet 3

- 8 Pages

Exam 3 Review

- 4 Pages

Review exam 3

- 6 Pages

- CNF Exam 3 Review

- 23 Pages

Exam 3 review

- 11 Pages

Exam 3 Review Notes

- 4 Pages

ACC201 Exam 3 Review

- 9 Pages

Patho Exam 3 Review

- 14 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu