Final Team Report PDF

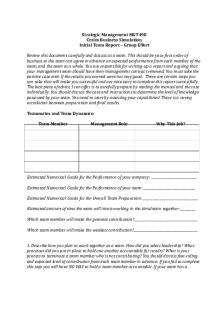

| Title | Final Team Report |

|---|---|

| Course | Strategic Business Writing |

| Institution | Indiana University Bloomington |

| Pages | 33 |

| File Size | 2.5 MB |

| File Type | |

| Total Downloads | 121 |

| Total Views | 152 |

Summary

The final report based on the company UNRL....

Description

q

UNRL x Streetwear

Utilizing Collaboration to Achieve a Common Goal

Andrew Kumar | Albara Alrohaili | Cole Marcuccilli Rodrigo Mongrut | Nalin Srivastava

Executive Summary At EY, we prioritize the development of tomorrow’s leaders through our partnership with rising organizations. UNRL operates daily with new customers, new projects, and partners. Generating more revenue is a priority for any company. UNRL is not an exception. However, unlike most companies, UNRL values its community, and they aspire to make a difference.

UNRL ensures its products are high quality and seeks “comfort, quality, and design” in all of them. Their main targets are athletes and men from the age of 18 to 24, and UNRL wishes them to get, as the brand name suggests, the UNRL experience. When we compared the items available on UNRL’s website to those available on rivals’ websites, including BYLT, Legends, and Cuts, we determined that UNRL’s most prominent issue is a lack of uniqueness. With minor design modifications, most of UNRL’s clothing designs can be found on their competitors’ websites. UNRL needs to provide customization and distinctiveness to their designs to cater to the Gen Z generation’s demand for individualism. We recommend collaborating with other streetwear labels. By doing so, UNRL would appeal to a younger, expanding clientele and help them stand out in a crowded field.

UNRL’s Current Strategy

Industry Breakdown The apparel industry continues to post gains, but year-over-year growth is expected to decelerate over the next few years through 2022. Activewear has remained a bright spot within the broader industry, consistently outpacing it in sales growth (Smith). The global athleisure market is projected to be worth $455.017 billion by 2026, with a CAGR of 6.71% (Research and Markets ltd, 2021). The athleisure industry is a sub-industry of the athletic apparel industry, valued at 113.4 billion dollars in the United States as of 2021(Shahbandeh, 2021). This industry is composed of big-name brands, with 45% of the market share going to the top four athleisure brands (Shahbandeh, 2020), and the remaining 55% going to smaller brands. Despite the large market share the top four businesses have, there is still heavy competition due to the low barriers of entry, allowing a large inflow of small companies to enter the industry.

Figure 1

UNRL Brand UNRL is a Midwest based clothing company founded by Travis Swan and Michael E. Jordan in the latter’s family basement. The company aims to provide comfortable clothing for a variety of physical activities while also being versatile enough for casual use. Their clothing features minimalistic designs with neutral colors. The majority of UNRL’s revenue comes from wholesale, with the rest of the 30% of its revenue coming from ecommerce. UNRL has experience with collaborations with other brands in the past, with the biggest names being the Minnesota Vikings and Barstool Sports.

Current Challenges After comparing the products that UNRL offers on their website to competitors such as BYLT, Legends, and Cuts, we have noticed that the main issue that UNRL faces is their lack of differentiation. Most of the clothes that UNRL offers can also be found on its competitors' sites without any significant changes in design. Another threat we have identified is the growing value of individuality and desire for personalization amongst younger generations. When describing the purchasing habits of Gen Z, Mintel states that “many of their choices are driven by this desire to stand out and express what makes them unique. Brands that can offer more personalization in their products can give Gen Zs something that is theirs alone” (Horton, 2021). UNRL’s base designs are very minimalistic, and their collaborations lack any real identity or personalization.

Our Recommendation

Collaborating with Streetwear Brands For UNRL to adapt to the changing trends of their target demographic, it needs to provide a level of personalization and uniqueness to their designs. While UNRL has done an effective job at catering to the minimalist style of millennials, the desire of individualism amongst the Gen Z generation cannot be ignored. To appeal to this trend, we suggest that UNRL place a larger emphasis on the collaborative aspect of their brand by partnering with streetwear brands to produce limited collections. This would not only allow UNRL to appeal to a younger growing demographic, but it would also allow UNRL to further differentiate themselves in its crowded industry.

Gen Z and Streetwear Culture

Streetwear: Cultural Movement Streetwear is built off both comfort and self-expression, with roots originating from hip-hop, skate, graffiti, and skating culture. So, it is no surprise that its audience is very popular with young adults under 30. Streetwear has adopted a more democratic model regarding newest trends and styles, with designers following styles that come from the street and the audience. By doing so, Streetwear has created a much higher level of authenticity compared to the rest of the fashion industry.

Figure 2

The high appeal of streetwear to the younger generation is one of the reasons behind its massive growth. The size of the global streetwear market is estimated to be at $185 billion by sales, making it about 10% of the entire global apparel and footwear market (Dutzler, 2019). Because of the wide appeal of Streetwear, all types of fashion brands from luxury brands like Gucci to outdoor brands like The North Face has taken steps to collaborate with streetwear brands.

Current Power of Gen Z Gen Z’s spending behavior creates an opportunity for UNRL to obtain a sizable revenue-generating consumer base. Gen Z people typically fund their purchases either from their parents’ money or through the income they get from their entry-level jobs, which might make the idea of them being a sizable revenuegenerating customer base counterintuitive. While Gen Zs tend to have lower disposable income due to their limited cash flow, they are willing to pay for the products they want. “Gen Z is definitely willing to spend on luxury, which is different than what you hear a lot of times out in the press” (Meet Generation Z: Shaping the future of Shopping 2020). Despite having financial issues, Gen Z is a high revenue-generating generation with a 143 billion dollars spending power (Raynor, 2021). This generation also prioritizes “spending on tangible items like clothing and accessories” (Horton, 2021). Having a population with high spending power, willingness to spend on highly priced products, and the priority to spend on clothing creates an opportunity for UNRL to take.

Figure 3

Future Power of Gen Z Gen Z currently must deal with their financial limitations and adapt in a manner that allows them to fulfill their wants and needs as best as they can. However, in ten years, this will not be as significant an issue as it currently is since the people who currently have entry-level jobs will most likely hold more lucrative jobs, and the younger Gen Z people who currently rely on their parents’ money will then hold entry-level jobs. With a steadier income, they will be able to spend more on non-essentials and higher quality products. At its current pace, Gen Z consumption is set to make Gen Z the dominant U.S. consumers, overtaking the millennials in the years to come. Gen Z is also close to overtaking the millennials as “the most populous generation in the U.S.” (How a 'youth boom' could shake up spending trends). Since Gen Z is on its way to becoming the most dominant population and getting to a position of financial stability, targeting them would secure UNRL a substantial portion of the market share for the future.

Differentiation and UNRL UNRL holds an advantage against other bigname brands like Nike and Under Armour in getting the Gen Z market share. As previously mentioned, Gen Z wants personalized products that set them apart from other people, which is hard to accomplish if they buy apparel big brands that most people already wear. This is one of the main reasons why “small brands are by far outpacing in terms of their share of growth across consumer categories. When we compare small versus large, it’s a substantial differential in terms of small brands really being able to grow way above their share” (Meet Generation Z: Shaping the future of Shopping 2020). Gen Z consumers seek small niche brands such as UNRL to cater to their personalization needs. The athleisure industry is flooded with similar products that are only differentiated in the quality of the product with minuscule design differences. While the product quality is hardly distinguishable by consumers when purchasing through UNRL’s online website, they can see the difference in design. Unique designs, which can be achieved by collaborating with streetwear brands, can give UNRL that competitive edge in the e-commerce space.

UNRL’s Hoodie Designs

Legend’s Hoodie Designs

Elevating UNRL’s Image

Utilizing Exclusivity For Gen Z, luxury isn’t defined by price. Instead, it’s about the quality of an item and other factors providing value over the rest of the market. These factors include exclusivity and scarcity, which can heavily influence the demand for an item. Collaborations are the perfect way to provide that feeling of exclusivity. Customers would be more inclined to purchase knowing that it is a limited release and that the specific design won’t ever be produced again, making the customers that buy from the collaboration one of the few people in possession of the limited item. Collaborating with established streetwear brands to produce limited designs would not only help bring more attention to UNRL’s “essential” models but would also bring in hype and excitement towards the brand.

This is how the Italian fashion brand Moncler was able to transform itself from a skiwear clothing brand on the brink of bankruptcy into a billion-dollar luxury company in just under 3 years. In 2018, their new CEO decided to implement a strategy that he called “The Genius Project.” This involved collaborating with eight different designers to produce a series of limited collections that would release once a month for eight months. This plan was an instant success, with each release selling out and generating millions of dollars worth of marketing, thus saving the company. UNRL can utilize the exclusivity gained from limited collaborations to increase the cool factor of its brand, like how Moncler revamped its public perception. Figure 4

Worldwide; Hypebeast; Strategy&; 2019; 40,960 respondents

JOSH LUBER CO-FOUNDER AND CEO OF STOCKX “As soon as supply is greater than demand, that product’s not scarce anymore. So it’s not cool to a certain group who wants that totally unique self-expression. They don’t want to possibly wear something that any person off the street can just walk in and buy. That cool 17-year-old kid doesn’t want to wear the same shoes that my mother wears ”

Reaching New Customers One of the problems we identified with UNRL is its low brand awareness compared to other more established brands in its industry. Customers can expect a certain level of quality from well-known brands such as Lululemon, Nike, and Champion. This is not because of the higher price tag but by the brand's general opinion and personal experiences. One survey showed that 81% of consumers said that they need to trust the brand before they buy from them (Edelman 2019). This is especially prevalent in e-commerce as many shoppers are apprehensive when purchasing products they cannot physically verify. So, when online shoppers are faced with the decision between buying from a mainstream brand and a brand that they are unfamiliar with, customers will most likely lean towards the bigger brand.

Reasons Why Consumers Trust Brands

Figure 5

When faced with uncertainty, consumers will most likely choose the product that will bring the most satisfaction for their money based on their judgment. This issue, however, can be overcome by pairing UNRL with other brands with an established reputation amongst consumers. By doing so, UNRL effectively removes the competitive advantage that the more prominent brands have over them. Once they are exposed to UNRL’s products’ high quality through the collaboration, they will likely expect the same from other products from UNRL that are not involved with the collaboration.

Responsive Designs The essence of any fashion brand is its product. Which is why it is crucial for brands to keep up with the changing fashion trends to retain their customers. The failure of companies to maintain their “cool” appeal can hurt their longevity with their younger audiences.

As mentioned earlier, the core of streetwear is largely democratic that draws its styles and designs from what people are already wearing “in the streets.” By doing so, streetwear has gained a sense of authenticity and trust from its consumers, which is why it is so popular amongst a generation that values authenticity and non-conformity over everything else. It is also why streetwear is not a fast fashion trend that will be outdated within a year but rather a cultural movement against the norm. Consulting branch Strategy conducted a study in 2021 about the streetwear movement, interviewing more than 40,000 consumers and 700 experts in the fashion industry. From that report, Strategy& revealed that 62% of their consumer respondents said streetwear products are always in style and that 76% of the industry respondents expect the streetwear market to continue growing within the next five years (Dutzler, 2021). This shows that streetwear is not a fad but is here to stay.

Figure 6

Competitor Spotlight: Champion Champion was once seen as a cheap brand that you would often find in the clothing sections of Walmart and Target. The popular Champion logo that we know today was embarrassing to wear during the early 2000s. Now, it is generally regarded as a high-end brand that is one of the leaders in the Athleisure industry. Things started to change for the brand in 2006 once its owner, the Sara Lee Corporation, announced HanesBrands Inc. would be Champion’s new parent company. Champion realized that they needed to fix their reputation and be seen as “cool” again. They decided that the best way was to be seen with the cool brands until they themselves were considered cool. In 2010, they partnered with the popular streetwear brand Supreme. They then followed it with collaborations with other streetwear/designer brands like UNDEFEATED, Off-White, BAPE, and Vetements creating premium streetwear collections with unique brand-specific twists. This year, Champion is on track to reach $1.9 billion in sales and is aiming to reach $2 billion in sales by 2022. Celebrities have also embraced the brand with influencers like Kylie Jenner choosing to wear the brand on her own.

Champion’s success with redefining its brand through collaborations without having to change its core designs on its site shows the importance of adapting to new trends. And by appealing to Gen Z’s desire for individualism, UNRL will be able to build upon Champion’s strategy to create a more distinct, culturally relevant image.

Potential Partners A successful collaboration needs more than just two logos on a shirt. It is a unique combination of both brands’ visions and values, which is why it is crucial for UNRL to choose brands with similar values to collaborate. One of the central values that define UNRL is its principle of being a positive influence in their community. With that in mind, we identified two streetwear brands with similar values that are likely to collaborate with UNRL. These two brands were Staple Pigeon and Brain Dead, chosen because of their dedication to giving back to their community. Staple Pigeon is a Midwest-based streetwear brand known as “the brand built from the streets of New York” and is very well known throughout the country. The creator of this brand, Jeff Staple, is actively involved in numerous social causes generating over $250,000 for the ACLU, Equal Justice Initiative, and Art Start organizations. Staple Pigeon has done numerous collaborations with other brands, including Nerd Unit, Nike, and SBTG- all of which have gone out of stock. We recommend partnering with the LA-based streetwear brand Brain Dead. This brand has raised over $500,000 for BLM causes through their fundraising release, similar to UNRL’s Change Starts With Me fundraiser. Brain Dead has sold-out collaborations with bra as The North Face, Converse, and Dickies. With some piece for over 4x the retail price on third-party platforms.

Implementation Strategy

Steps for Implementation There are three main steps required to release a hyped collection: establishing a partnership with a specific streetwear brand, working with that brand to brainstorm and develop new designs, and releasing the collection through a drop model. We will be describing the process of a potential collaboration between UNRL and Staple Pigeon as an example, even though it is worth noting that this process is generally applicable to any other streetwear brand.

Figure 7

Establishing a Partnership To establish a credible partnership with Staple Pigeon, UNRL needs to show them that the collaboration will be beneficial to their brand. Fortunately, many streetwear brands are eager to collaborate with athleisure brands to gain more exposure in that industry. Clare Varga, active director for global trend foresights business WGSN, explains that “Fashion brands are keen to move into this lucrative, growing sports sector, and one of the best ways to do that with credibility is to partner with a sports brand” (Fumo, 2015). By showing its established roots in the athleisure industry and their shared values in giving back to the community, UNRL can convince Staple Pigeon that a collaboration can be mutually beneficial. Staple Pigeon will provide its unique design perspective, while UNRL will be able to offer its knowledge of the athleisure industry and quality products.

New Design Development The next step is for UNRL and Staple Pigeon to work together to brainstorm and create unique designs for their collection. The collaboration should show a unique interpretation of both brands’ visions without straying too far from their authentic selves. While Staple Pigeon will be providing their design touch, it will be produced on UNRL’s clothing models.

Releasing the Collection After the collaboration pieces are produced and ready to be released, the final step is for UNRL to spread the word about the collaboration and sell it. Before they do that, they must effectively market the release to its target market to generate hype and excitement. Social media is very popular with the younger generations, so we recommend that UNRL utilize social media to market the release. As seen in the example below, we recommend UNRL to provide the drop information and a small story explaining the collaboration to further build authenticity.

UNRL will then have the sales start through the “drops model.” This is a popular direct-to-consumer strategy that many streetwear brands use to build a feeling of urgency and scarcity amongst their consumers. During “drops,” customers are recommended to make their purchases as quickly as possible before the item sells out. By doing this, customers can view this moment as a once-in-a-lifetime opportunity.

Conclusion

The athleisure industry is filled with close to identical products, making it a challenge for brands to stand out. UNRL is currently facing this issue; however, Five Guys Consulting believes UNRL can overcome this issue and walk towards the path of increased differentiating and consequently increased market share. Both goals can be achieved by shifting UNRL’s current focu...

Similar Free PDFs

Final Team Report

- 33 Pages

Cesim - Final Team Report

- 2 Pages

Cesim - Initial Team Report

- 2 Pages

Team Report - Grade: 8

- 16 Pages

Team Business Report

- 9 Pages

Cesim - Example Team Report

- 13 Pages

Beleza natural team report

- 8 Pages

TEAM 04 - Completed Report

- 33 Pages

Week 3 Team Final

- 3 Pages

ECON1193. Bstat 1-TEAM REPORT

- 26 Pages

Group Strategy Report Team 1

- 16 Pages

Diana TEAM Report - Grade: 7.8

- 18 Pages

Team Project Euro Disney Final

- 17 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu