Team Hypothesis BUS485 report Autumn 2017 PDF

| Title | Team Hypothesis BUS485 report Autumn 2017 |

|---|---|

| Author | Md Mejbahul Ali |

| Course | Business research |

| Institution | Independent University, Bangladesh |

| Pages | 35 |

| File Size | 1.3 MB |

| File Type | |

| Total Downloads | 88 |

| Total Views | 171 |

Summary

Bus report...

Description

REPORT ON ““D DETERMINATES O OFF SHAR ARE ICES OFF BANGLA LADE DESH SHII SH AR E PRIC ES O DE SH ERC IALL B BA KS”” COMMER CIA ANKS Submitted By: Team Hypothesis

Submitted to: Dr. Samiul Parvez Ahmed Assistant Professor, Dept. of Finance, IUB

Autumn, 2017 Date of Submission: 23th November 2017

School of Business, IUB Business Research Methods (BUS485)

Team Hypothesis

Name

ID

Md. Prayer Protik

1431337

Fatema Tuz Zohra

1130500

Intisar Obaid

1410457

Rafsun Juny Zahid

1431126

Urmila Saha

1431359

LETTER OF TRANSMITTAL

November 23rd 2017 Dr. Samiul Parvez Ahmed Assistant Professor, Department of Finance School of Business Independent University, Bangladesh.

Subject: Request for acceptance of a Report titled “Determinants of share prices of Bangladeshi commercial banks”.

Dear Sir,

It is a great pleasure for us to submit a research article on our research work to determinants of the market share prices of the Bangladeshi commercial banks, where we got to work with actual data over 5 years of 5 commercial banks from Bangladesh selected through random sampling. The group had completed this project as a partial fulfillment of the coursework of the ‘Business Research Methods’ (BUS 485).

The group has worked hard to finish the report properly with collection of valid information and proper statistical work. We will be very obliged if you kindly accept the submission of this report.

Sincerely……

Team Hypotheses.

ACKNOWLEDGEMENT Apart from the effort of the team members, the success of every project depends on the encouragement and guidelines of many others. We’d like to take this opportunity to express our gratitude to the people who have been gratitude to the people who have been instrumental in the successful completion of this research project.

We would like to show our greatest appreciation to our honorable faculty Dr. Samiul Parvez Ahmed. We feel motivated and encouraged by his enthusiasm and direct guidelines while doing the course work. Materializing this project would have been very difficult without his guidelines and encouragement.

The guidance and support received from all the people who contributed to this project was vital for the completion of the project. The team is grateful for all the support and guidance received.

Tab Table le o off Co Conte nte ntents: nts: ABSTRACT.................................................................................................................................................. 1 INTRODUCTION ........................................................................................................................................ 1 LITERATURE REVIWE ............................................................................................................................. 3 OBJECTIVES ............................................................................................................................................. 11 CONCEPTUAL FRAMEWORK ............................................................................................................... 12 RESEARCH METHODOLOGY................................................................................................................ 13 RESEARCH DESIGN ................................................................................................................................ 14 THE VARIABLES AND HYPOTHESES ................................................................................................. 15 ANALYSIS RESULTS .............................................................................................................................. 18 R VALUE (1 to -.1) .................................................................................................................................... 20 SUMMARY OF THE ANALYSIS ............................................................................................................23 HYPOTHESIS TESTING .......................................................................................................................... 24 CONCLUSION ........................................................................................................................................... 26 REFERENCES ...........................................................................................................................................27

ABSTRACT This study examines the determinants of share price of commercial banks listed on the Dhaka Stock Exchange Limited over the period of 2011 to 2015. Data were sourced from the annual reports of the sampled banks and analyzed using regression model. The results revealed that earning per share and price- earnings ratios have the significant positive association with share price. The rest of the determinants were found to have insignificant negative relationship with the market share prices without enough statistical evidence to come to a conclusion about their nature of relationship. The major conclusion of the study is that, earning per share and price-earnings ratio are the most influencing factors in determining share price in Bangladeshi commercial banks.

Key words: Share price, dividend payout ratio, dividend yield, earnings per share, price earnings ratio, size, determinants, and commercial banks.

INTRODUCTION Equity shares are one of the most sought-after mode of investment for the investors worldwide. At the same time, it is also serves as a source of finance for the capital requirements of firms. Returns from such equity investments are however subject to vary, depending upon the performance of the particular stock and movement in stock price. There are no foolproof indicators for stock price changes, they might occur due to the supply and demand forces. The factors behind the increase or decrease in the demand and supply of stock prices can be categorized into three main types: technical factors, fundamental factors and market sentiments. Despite the lack of any indicator for the stock price volatility, knowledge of such factors and their possible impact on share prices is very significant as it would give the firms and investors a proper idea of which factors to emphasis on while making decisions for such circumstances. The pioneering work on share price determinants by Collins (1957) for the US identified dividend, net profit, operating earnings and book value as the factors influencing share prices. Following Collins (1957) there have been various attempts to identify the determinants of share prices for different markets. The other empirical studies viz. Taulbee (2005), Nawazish (2008), Al-Shubiri 1|Page

(2010), Sharma (2011), Khan and Amanullah (2012), Srinivasan (2012), Malhotra and Tandon (2013), Almumani (2014) among others reveal that various factors in different markets determine the share price. Determining share prices is a complex and conflicting task. Shiller (1981) found that stock prices are not stable and fluctuate excessively in relation to the news about fundamentals (as dividends) primarily due to market irrationality. Thus, it is asserted that understanding the impact of various fundamental variables on stock price is very much helpful to investors as it will help them in taking profitable investment decisions. The present study deals with an attempt to analyze the determinants of share price of commercial banks on the basis of financial statements information in Bangladeshi context. The objective of this study is to examine the impact of the internal factor on the stock prices of Bangladeshi banks listed in the Dhaka Stock Exchange. In order to attain the mentioned objective, the following parts of this study is structured with a theoretical framework and reviews of literature; this section is followed by research methods used in the study. The second last section provides empirical results and discussion, and the final section offers conclusion of the study.

2|Page

Literature Review Size The ‘size’ of a company is not defined by only one measurable entity, but have various ones. It can be defined as the total employee number of the company, the total capital, the total asset, net sales, net worth etc. It depends on the researcher how they choose to define ‘size’ for a particular research. For this research paper, the ‘size’ of a company (Bank) is measured in terms of the total asset of the company. It is not clear if the size of a company will always result into profit or increase in share price. Though in common perception it might seem, the bigger the better. Not necessarily, size might not be correlated to the share prices as well. There have been numerous researches about the correlations of size to the share prices over the years amongst other variables. The study of Almumani (2014) on the determinants of equity share prices of the listed banks in Amman Stock Exchange was conducted using the empirical analysis on the data collected over 2005- 2011 of the respective banks. Ratio analysis, correlation and multiple regression model were used to find the individual as well as combined effects of the multiple factors on the dependent variable, the share prices of the banks. Size was found to have a correlation coefficient of 0.57 with the dependent variable, the market price of the shares. Empirical findings from the regression analysis on the relationship between size and share prices indicate that there is an inverse relationship between size and market Price of the shares. This is however evident in the t-statistics value of (-2.28 and P>|t| =.03). The study of Al – Shawawreh (2014) titled “The Impact of Dividend Policy on Share Price Volatility: Empirical Evidence from Jordanian Stock Market” was conducted on companies representing four different sectors. A sample of 53 companies were selected and multiple regression model was used to find the factors impacting the share prices using 13 years (20012013) of data. And amongst other variables, size was found to have a significant positive relationship with the volatility of the market share prices of the companies. But amongst all the control variables, size had the lowest positive correlation with the market share prices of the companies.

3|Page

The study of Sharif et al. (2015) conducting analysis on factors affecting stock prices specifically in matter of the Bahrain Case also considered size as one of the possible factors. The estimation method is based on pooled OLS regression with robust standard errors, fixed effects and random effects models. Eight firm specific variables had been studied to infer their impact on market price of shares in the respective market. The results indicate that amongst other variables firm size was a significant determinant of share prices in the Bahrain market. A high R2 (0.80) revealed under both the applied models further documents the significant impact of these variables on the market price of shares. The study of Sharma (2011) to find determinants of equity share prices in India however, found confusing results when it came to size as a determinant of share prices. The research was conducted on data from 1993-94 to 2008-09 financial periods. Size measured in terms of net worth and dividend payout showed a mixed trend. Size measured in terms of sale has a positive insignificant relationship with market price of share in almost all the years of understudy except 1998-99. For which, while drawing conclusion the author had ruled out size being a factor behind the market share prices in India. The study of Srinivasan (2012) on determinants of share prices in India using a panel data approach however, found size to be a significant factor behind the market share prices of companies of multiple industries including banking. The study employed panel data consisting of annual time series data over the period 2006-2011 and cross-section data pertaining to 6 major sectors of the Indian economy, including Banking. The panel data techniques, viz. Fixed Effects model and Random Effects model were employed to investigate the objective.

Dividend Payout Ratio Dividend payout ratio is the ratio of the amount of dividend paid to the shareholders relative to the net income. It is the fraction of earnings paid to shareholders in terms of dividend. It can be calculated by dividing the dividend per share with earning per share. Many researches have been done on the relationship between the share price and dividend payout ratio.

4|Page

The study of Botchwey (2014) found the impact of dividend payment and its relationship on the share price of some listed companies in Ghana stock exchange. For the study reason he selected Eco Bank, Cal Bank and Angelogold Ashanti from 36 companies listed in the Ghana stock exchange. In his study he found that dividend payout ratio increases the share price of the company. It means it has positive relationship with the share price. It’s a determinant of the share price. In his study he suggested that firms should pay more dividends, so that their share prices go up and the demand of shares increase. If firms pay low dividends their share prices go down as well as the demand. The study of Nishat & Irfan (2004) found the relationship between stock price volatility and dividend policy after controlling the firms Size, Earning volatility, Assets growth and leverage. They took sample of 160 listed companies in Karachi stock exchange and examined for a period from 1991 to 2000. They have done cross-sectional regression analysis of the relationship. They found that dividend yield and payout ratio have significant impact on the share price volatility. They have also found that size and leverage have positive and significant impact on share price volatility. The study of Habib et al. (2012) examined the relationship between dividend policy and share price volatility in Pakistan stock market. Cross sectional regression was used to find out the relationship of share price with dividend yield and payout ratio. They found that dividend payout ratio is negatively correlated, and dividend yield is positively correlated with share price. Their study showed that dividend yield and dividend payout ratio is the determinant of share price in Pakistan. The study of Iqbal et al. (2014) proves the relationship between the dividend payout and the share price. For that reason, they have used three banks of Pakistan which are Bank Al-Falah, UBL and MCB. They took data of five years (2008-2012) related to the payment of dividend and share price of the banking sector. They used descriptive statistics and regression analysis to find out the relationship. They found that earning per share has positive relation and dividend payment/ dividend payout ratio has negative relationship with share price. The study of Al-Shawahreh (2014) found the relationship between dividend policy and share price with a focus on companies represent for sector listed in Jordan share market. They have collected data from 53 companies and applied multiple regression to find out the relation. They 5|Page

have used data of 13 years 2001- 2013. They have used Dividend payout ratio, dividend yield, size, stock repurchase and stock dividend as independent variables. They found that share price has significant negative relationship with dividend payout ratio and very weak positive relationship between stock price and size of the firm. At last they conducted that dividend payout and stock dividend is the most significant determinants of share price.

Dividend Yield Dividend yield is a financial ratio that measures how much dividend a company pays relative to its share price. It’s represented as a percentage and can be calculated by dividing the annual dividends per share with the market price per share. Many researches have been done about the relationship between dividend yield and market price of share. The study of Masum (2014) showed the relationship between the share price and explanatory variables like: Earning per share, Return on equity, Retention ratio, dividend yield and profit after tax. He used panel data approach to explain the relation. He found that Earning per share, return on equity and Retention ratio have positive relationship with share price while the dividend yield and profit after tax has negative relationship with share price. The study of Bhattarian (2014) examined the determinates of share price of commercial banks listed in Nepal stock exchange limited over the period of 2006-2014. He used regression model to analyze data. He found that Earning per share and Price earnings ratios have significant positive relationship with the share price and dividend yield has significant negative relationship with share price. He noticed that dividend yield, earning per share and Price earnings ratio are the most significant factor of determining the share price. The study of Ponsian et al. (2015) identified the relationship between dividend policy and share price for companies listed on Dar Es Sallaam stock exchange. They have done the research based on the listed companies for the period of five years from 13 companies. They have used descriptive, regression and correlation method to measure the relationship. They found that Price earnings ratio, dividend payout ratio, earning per share have positive relationship with share price while dividend yield has negative relationship with share price.

6|Page

The study of Sharma (2011) found the relationship between the share price and some variables like: Book value per share, dividend per share, earnings per share, price earnings ratio, dividend yield, dividend payout ratio, size in terms of sale and net worth for the period 1993-94 to 2008-9. He found that Earning per share, dividend per share and book value per share has significant impact on the market price of share. He also found that dividend per share and earning per share being the strongest determinates of share price. The results of this study support liberal dividend policy and suggest companies to pay regular dividends. This policy will affect the market price of share positively. The study of Hussainey et al. (2010) examined the relationship between dividend policy and share price changes in UK stock market. They have used regression analysis model to find out the relationship between share price change and both dividend payout ratio and dividend yield. They found that dividend yield and stock price have a positive relationship and dividend payout ratio has a negative relationship with share price. They also found that firm’s growth rate, debt level, EPS and size has also a significant impact on the share price.

EPS EPS or Earning per share is the proportion of a company’s profit allocated to each outstanding common stock of the company. It works as an indicator of the company’s profitability. It can be calculated via a formula: (Net profit – Preferred dividends) / Number of common stock outstanding. A company should use weighted avg. number of common stock when calculating EPS, because the number of common stock can be changed overtime. There are 5 types of EPS like: Reported EPS, Ongoing EPS, Pro forma EPS, Headline EPS and Cash EPS. Many researches have been done on this topic and some of them are: The research of Arshad et al. (2015) identified the determinates of share price for the listed commercial banks of Karachi stock exchange for over the period 2013 to 2017. They have identified both internal and external factors that affect the stock price. They have used linear multiple regression analysis to determine whether the independent variables have any influence on the share price or not. They have used EPS, book to market value ratio, interest rate, GDP, price earnings ratio, dividend per share and leverage as independent variable. Market share price is the 7|Page

dependent variable. They found that EPS has more influence on share...

Similar Free PDFs

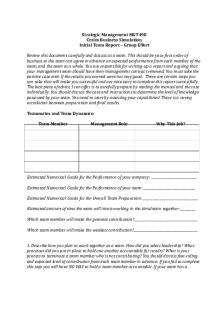

Cesim - Initial Team Report

- 2 Pages

Team Report - Grade: 8

- 16 Pages

Team Business Report

- 9 Pages

Cesim - Example Team Report

- 13 Pages

Beleza natural team report

- 8 Pages

TEAM 04 - Completed Report

- 33 Pages

Final Team Report

- 33 Pages

Cesim - Final Team Report

- 2 Pages

FINAL Exam 1 Autumn 2017, questions

- 16 Pages

ECON1193. Bstat 1-TEAM REPORT

- 26 Pages

Group Strategy Report Team 1

- 16 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu