Shareholders\' Equity Exam PDF

| Title | Shareholders\' Equity Exam |

|---|---|

| Course | Bachelor of science in accountancy |

| Institution | Cagayan State University |

| Pages | 5 |

| File Size | 126.4 KB |

| File Type | |

| Total Downloads | 661 |

| Total Views | 946 |

Summary

Problem 1Ekkans Corporation was incorporated in 2019. During 2019, the company issued 100,000 shares of P par value ordinary shares for P27 per share. During 2019, Ekkans Corporation had a profit of P250, and paid dividends of P28,000.During 2020, the company had the following transactions:1/2. Issu...

Description

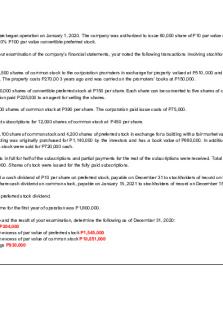

Problem 1 Ekkans Corporation was incorporated in 2019. During 2019, the company issued 100,000 shares of P1 par value ordinary shares for P27 per share. During 2019, Ekkans Corporation had a profit of P250,000 and paid dividends of P28,000. During 2020, the company had the following transactions: 1/2.

Issued 10,000 shares of P100 par value cumulative preference share at par. The preference shares are convertible into five ordinary shares and had a dividend rate of 6%.

3/1.

Issued 3000 ordinary shares for legal service performed. The value of the legal service was P100,000. The shares are actively traded on a stock exchange and valued on 3/1 at P32 per share.

7/1.

Issued 40,000 ordinary shares for P42 per share.

10/1.

Repurchased 16,000 treasury shares for P34 per share.

12/1.

Sold 3,000 treasury shares for P29 per share.

12/30. Declared and paid a dividend of P0.20 per share on ordinary shares and a 6% dividend on the preference shares. During 2020, Ekkans Corporation had a profit of P380,000. Compute: 1. Total share premium as of December 31, 2020 a. 4,333,000 b. 1,733,000 c. 4,337,000 2. Total retained earnings as of December 31, 2020 a. 501,000 b. 516,000 c. 602,000 3. Total equity as of December 31, 2020 a. 5,535,000 b. 5,539,000 c. 5,621,000 4. Basic earnings per share for the year 2020 a. 3.20 b. 1.60 c. 2.69 5. Diluted earnings per share for the year 2020 a. 2.11 b. 1.48 c. 2.25

d. 4,348,000 d. 279,000 d. 5,550,000 d. 2.11 d. 1.90

Problem 2 A partial list of the accounts and ending account balances taken from the post-closing trial balance of ALPHA Corporation on December 31, 2019 is shown as follows: Account Accumulated Profits-unappropriated Bonds Payable Ordinary shares subscribed Long term investments in equity securities APIC on ordinary shares Premium on bonds payable

Amount 410,000 220,000 50,000 210,000 460,000 30,000

Authorized ordinary at P10 par value Preference shares subscribed APIC on preference shares Authorized preference shares at P50 par value Gain on sale of treasury shares Unrealized increase in value of securities available for sale Ordinary share warrants outstanding Unissued ordinary shares Unissued preference shares Cash dividends payable-preference Donated Capital Reserve for bond sinking fund Reserve for depreciation Revaluation increment in properties Subscription receivable-preference (long term) Subscription receivable-common (long term)

900,000 45,000 112,000 400,000 4,000 3,000 20,000 500,000 100,000 50,000 25,000 220,000 150,000 100,000 15,000 20,000

Compute:

6. Ordinary shares issued 7. Preference shares issued 8. APIC 9. Total contributed capital 10. Total legal capital 11. Total shareholders' equity

A 950,000 445,000 592,000 1,332,00 0 1,395,00 0 2,744,00 0

B 900,000 400,000 596,000 1,352,00 0 1,300,00 0 2,244,00 0

C 450,000 345,000 621,000 1,377,00 0

D 400,000 300,000 651,000 1,381,00 0

795,000 2,114,00 0

700,000 2,144,00 0

Problem 3 The stockholders’ equity of the WPC as of December 31, 2013 was as follows: Common stock, P10 par, P2,500,000 authorized 300,000 shares; 250,000 shares issued and outstanding Paid-in capital in excess of par 3,750,000 Retained earnings 1,800,000 On June 1, 2014, WPC reacquired 40,000 shares of its common stock at P40 per share. The following transactions occurred in 2014 with regard these shares: July 1 July 15 Aug 15

Sold 15,000 treasury shares at P45. 2 for 1 share split Sold 34,000 treasury share at P15.

Sept 1 Retired 2,000 shares. Based on the information provided, determine the correct balances of the following:

12. Treasury stock 13. Common Stock 14. Paid-in capital in excess of par 15. Paid-in capital from treasury stock 16. Retained earnings

A 310,000 2,490,00 0 3,750,00 0

B 280,000 2,500,00 0 3,720,00 0

C 130,000 2,460,00 0 3,735,00 0

D 205,000 2,210,00 0 3,810,00 0

150,000 1,690,00 0

60,000 1,810,00 0

75,000 1,825,00 0

0 1,905,00 0

Problem 4 On January 2019, Pandora Corp. granted to 600 employees, 100 share options each exercisable after 3 years, subject to the employees staying with the company until the end of 2021. Options can be exercised if share price increases from P40 at the beginning of 2019 to above P60 at the end of 2021. The share options can be exercised at any time during the next five years that is by the end 2026. The company estimates the fair value of the share options on the grant date at P5 per option, this estimate takes into account possibility that the share price will exceed P60 per share at the end of 2021, thus options are exercisable and the possibility that the share price will not exceed P60 at the end of 2021, thus the share options will be forfeited. The following information are deemed relevant: Fair value of Fair value of Actual no. of Estimated shares options employees number of actually leaving additional the company employees during the year expected to leave the company by the end of 2021 Dec 31,2019 P48 P4 5 45 Dec 31,2020 44 3 20 35 Dec 31,2021 56 0 30 Requirements: 17. What is the compensation expense in 2019? a. 100,000 b. 91,667 c. 88,333 d. none 18. What is the compensation expense in 2020? a. 100,000 b. 91,667 c. 88,333 d. none 19. What is the compensation expense in 2021? a. 92,500 b. 91,667 c. 88,333 d. none 20. What is the ordinary share options outstanding as of December 31, 2020? a. 180,000 b. 191,667 c. 188,333 d. none Problem 5

Sotto, Inc. began operations in January 2019, and reported the following results for each of its three years of operations. 2019 P300,000 net loss 2020 30,000 net loss 2021 3,950,000 net income At December 31, 2021, the company’s capital accounts were as follows: 5% cumulative preference shares, par P 6,000,000 value P100; authorized ,100,000 shares; issued and outstanding, 60,000 shares Ordinary shares, par value P10, 8,000,000 authorized, 1,000,000 shares; issued and outstanding, 800,000 shares Sotto, Inc. has never paid a cash or stock dividend and there has been no change in the capital accounts since it began operations. 21. What is the book value of the preference shares on December 31, 2021? a. P105 b. P110 c. P100 d. P115 22. What is the book value of the ordinary shares on December 31,2021? a. P13.40 b. P14.52 c. P14.15 d. P13.78 Assume that the preference shares have a liquidation value of P105 per share 23. What is the book value of the preference shares on December 31,2021? a. P115 b. P120 c. P110 d. P105 24. What is the book value of the ordinary shares on December 31,2021? a. P13.78 b. P14.15 c. P13.40 d. P13.02 Problem 6 Vivico Corporation has incurred losses from operations for many years. At the recommendation of the newly hired president, the board of directors voted to implement a quasi-reorganization, subject to shareholders’ and creditors’ approval. Immediately, prior to the quasi-reorganization, on June 30, 2016, Vivico ‘s statement of financial position was as follows:

Assets Current Assets Property, plant and equipment (net) Other noncurrent assets Total Assets

1,375,000 3,375,000 500,000 5,250,000

Liabilites & Shareholder's Equity Total Liabilities 1,500,000 Ordinary Shares, P10 par 4,000,000 Share Premium 750,000 (1,000,000 Retained earnings ) Total Liabilities & Shareholders' Equity 5,250,000

The shareholders and creditors approved the quasi-reorganization effective July 1, 2016, to be accomplished by a reduction in property, plant and equipment (net) of P875,000, a reduction in other noncurrent assets of P375,000, and reduction in par value from P10 to P5. 25. Vivico’s July 1, 2016, statement of financial position after the quasi-reorganization should show total assets of a. P4,000,000 b. P2,500,000 c. P4,375,000 d. P3,875,000 26. The balance in the share premium account after the quasi-reorganization on July 1, 2016 should be a. P750,000 b. P2,000,000 c. P500,000 d. P0 27. Vivico’s deficit after the quasi-reorganization on July 1, 2016, should be a. P1,000,000 b. P250,000 c. P500,000 d. P0 Problem 7 Vicente Company has been paying regular quarterly dividends to its shareholders. The following equity transactions are shown in the company’s books: Jan 1. P2 par value ordinary shares; (1,600,000 shares outstanding; 3,000,000 shares authorized) Feb 15 Issued 100,000 new shares at P5. Mar. 31 Paid quarterly dividends of P2,550,000. May 13 P2,000,000 of P1000 bonds were converted to ordinary shares at the rate of 100 shares per P1,000 bond. June 16 Issued an 11% stock dividend. 30 Paid quarterly dividends. The dividend per share is the same as that paid in the first quarter. No other equity transactions occurred after June 30. 28. What is the amount of dividend per share that Vicente paid on March 31? a. P1.50 b. P0.85 c. P1.59 d. P1.70 29. What is the amount of dividends that Vicente will have to pay in the third quarter in order to pay the same dividend rate as that paid in previous quarters? a. P2,850,000 b. P2,997,000 c. P3,163,500 d. P3,585,300 30. What is the total amount of dividends to be paid during the current year? a. P10,305,900 b. P12,040,500 c. P13,305,900 d. P12,654,000...

Similar Free PDFs

Shareholders\' Equity Exam

- 5 Pages

Shareholders equity part 2

- 15 Pages

Shareholders Equity - PICPA

- 6 Pages

Shareholders Equity Transactions

- 32 Pages

Audit- Shareholders- Equity

- 7 Pages

Equity notes exam

- 5 Pages

Equity Notes-Exam

- 7 Pages

Minority shareholders

- 23 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu