Shareholders Equity - Lecture notes 9 PDF

| Title | Shareholders Equity - Lecture notes 9 |

|---|---|

| Author | Billy Jean Roque |

| Course | Bachelor of Science in Accountancy |

| Institution | Mary the Queen College |

| Pages | 3 |

| File Size | 62.6 KB |

| File Type | |

| Total Downloads | 134 |

| Total Views | 316 |

Summary

Module 9 SHAREHOLDERS' EQUITYEXPECTED LEARNING OUTCOMESAfter reading this chapter, you should be able to(a) describe the types of transactions that affect shareholders’ equity: (b) cite the general internal control procedures relating to shareholders' equity; (c) state the auditor's principal object...

Description

Module 9 SHAREHOLDERS' EQUITY EXPECTED LEARNING OUTCOMES After reading this chapter, you should be able to (a) (b) (c) (d) (e) (f) (g)

describe the types of transactions that affect shareholders’ equity: cite the general internal control procedures relating to shareholders' equity; state the auditor's principal objectives in auditing equity; apply audit procedures to establish management's assertions on equity balances; prepare working papers to establish correct equity balances; formulate audit adjustments to bring equity accounts to correct balances; and evaluate the appropriateness of the presentation of equity in the financial statements.

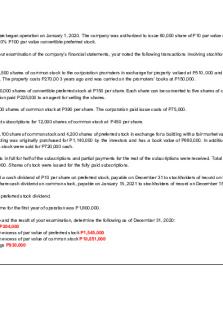

Transactions Affecting Equity Balances The equity accounts of the corporate form of business organization are accounted for and presented in the financial statements according to source. This type of presentation ensures that the corporation is in compliance with regulations prescribed by the corporation law and regulatory bodies and that it manages appropriately the funds entrusted by the shareholders, applying the principles of corporate governance. The most common transactions affecting the shareholders' equity are share capital transactions (new stock issuances, repurchase, and reissue), declaration and distribution of dividends, grants to and exercise by the holders of Share options and warrants, profit or loss, gains and losses recognized in other comprehensive income and prior period adjustments. Changes in the shareholders' equity accounts must be presented in a separate financial statement, the statement of changes in equity, which shows the beginning balances, the changes during the period and ending balances. Internal Control Strong internal control over shareholders' equity accounts focuses on the following: the proper authorization of transactions by the board of directors and corporate officers; the segregation of duties in handling shareholders' equity transactions, and the maintenance of adequate records, There are only a few transactions that affect share capital, but because of legality, these transactions must be extensively documented. Issuances and retirement of equity shares, and declarations and distributions of dividends should be formally authorized by the board of directors, and in some instances by the shareholders.

The entity shall maintain an independent registrar and stock transfer agent. In smaller companies that do not engage the services of an independent registrar and stock transfer agent, control is achieved by segregating the duties of authorization of transactions, custody of stock certificates, and record keeping of share capital transactions. For proper internal control, stock certificates should be sequentially numbered. Retired shares must be promptly cancelled and unissued certificates should be physically safeguarded. Detailed capital records such as stockholders' ledger, transfer journal, certificate control records, and general ledger control accounts must be maintained for various share capital transactions. Treasury shares must be physically safeguarded and adequately controlled entity's accountant should periodically analyze the shareholders' equity accounts and ensure that they are updated and reconciled to the general ledger,

Audit Objective The auditor's principal objectives in the examination of shareholders' equity accounts are

to consider internal control over shareholders' equity accounts: to determine the existence of recorded shareholders' equity; to establish the completeness of shareholders' equity transactions; to determine that the valuation of shareholders' equity is appropriate and accurate; an to determine that the presentation and disclosure of shareholders' equity is appropriate

Auditing Procedures The auditor should obtain an understanding of internal control procedures over equity transactions and shall examine articles of incorporation, by laws, and minutes of meetings of the board of directors. These documents become part of the permanent audit file and must provide information on the number of shares authorized and issued, the par value of the share capital, the dividend rates, policies on repurchases and sales of share capital. If the transactions affecting share capital are handled by independent external parties, the transaction execution is of less importance to the auditor. On the other hand, when share capital transactions are handled internally, the auditor would be concerned with control procedures over transaction authorization, execution and recording because inadequate segregation of duties could lead to fraud. The auditors usually use internal control questionnaire and narratives to identify deficiencies and to document procedures for transaction authorization, execution and recording. An auditor tests existence of share capital and occurrence of transactions by verifying shareholders' equity balances. The auditor examines the accounting records for equity

transactions, recomputes dividends, accounts for unissued or retired shares and reconciles the stock certificate book and stockholders' ledger with the general ledger control account. If detailed records and stock certificates are maintained externally, the auditor confirms shares outstanding with stock certificate registrars and transfer agents. To establish completeness and valuation, the auditor performs analytical review procedures and reconciles beginning balances of equity accounts to ending balances. The auditor has to review supporting documentation and authorizations for stock issuances, stock dividends and stock splits. The proceeds from issuance of shares as recorded in the cash receipts journal must be compared with the price per share on the date of issue and with the entries in the general ledger. The auditor has to determine whether the bonus issue (stock dividends) are recorded correctly in accordance with appropriate accounting principles. For treasury share transactions. The auditor has to examine supporting documentation and authorization; compare authorized number of shares and price per share with entries In the general ledger; compare disbursements for purchases with cash records; and determine that the basis of accounting is appropriate, Audit work on retained earnings involves the analysis of transactions affecting retained earnings, such as dividends, treasury shares, recapitalizations, and even appropriations. The auditor has to review the transactions affecting accumulated other comprehensive income. These include transactions affecting revaluation of property, plant and equipment and intangible assets (and the disposal of revalued property, plant and equipment and intangible assets), measurement and sale of available for sale securities (or financial assets at fair value through other comprehensive income), remeasurements of defined benefit asset or liability relating to employees' defined benefit retirement plans and translation adjustments of the assets and liabilities of foreign operations. The financial statements should contain a complete description of each issue of share capital, including such data as title of the issue; par value; number of shares authorized, issued, and in the treasury; call provisions; conversion provisions, shares reserved for stock options; and cumulative preference dividends in arrears. The auditor's documentation for shareholders' equity accounts should include the articles of incorporation, working paper for summary of changes in equity balances, minutes for authorization of dividends and any issue and purchase of share capital and confirmations with transfer agents or shareholders....

Similar Free PDFs

Shareholders equity part 2

- 15 Pages

Shareholders\' Equity Exam

- 5 Pages

Shareholders Equity - PICPA

- 6 Pages

Shareholders Equity Transactions

- 32 Pages

Audit- Shareholders- Equity

- 7 Pages

Equity - Lecture notes 3

- 8 Pages

Overall Equity Lecture Notes

- 59 Pages

Chapter 9 - Lecture notes 9

- 1 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu