INTERMEDIATE ACCOUNTING 3 Quiz 3.1 Shareholders\' Equity PDF

| Title | INTERMEDIATE ACCOUNTING 3 Quiz 3.1 Shareholders\' Equity |

|---|---|

| Course | Bachelor of Science in Accountancy |

| Institution | Polytechnic University of the Philippines |

| Pages | 5 |

| File Size | 111 KB |

| File Type | |

| Total Downloads | 333 |

| Total Views | 588 |

Summary

Quiz 3 Shareholders' EquityQUESTION 1When shares are issued for noncash consideration, the proceeds shall be measured at what amount? Correct answer: The fair value of the non-cash consideration receivedQUESTION 2 When shares are issued for services received, which is the least appropriate amount to...

Description

Quiz 3.1 Shareholders' Equity QUESTION 1 When shares are issued for noncash consideration, the proceeds shall be measured at what amount? Correct answer: The fair value of the non-cash consideration received

QUESTION 2 When shares are issued for services received, which is the least appropriate amount to consider? Correct answer: Book value of the shares issued

QUESTION 3 What does shareholders’ equity represent? Correct answer: A claim against the total assets of an entity

QUESTION 4 How should Treasury ordinary shares be recorded? Correct answer: Acquisition cost

QUESTION 5 What is the fixed share amount of shares indicated in the articles of incorporation? Correct answer: Par value shares

QUESTION 6 Which of the following is not stated in the Articles of incorporation? Correct answer: The place and manner of shareholders’ meeting

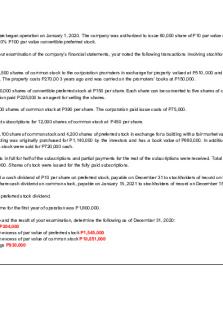

QUESTION 7 The related data of Marian Corporation: On August 1, 2020, the entity is authorized to issue 100,000 at P50 par value. On August 2, 2020, issued 20,000 shares for cash at P60 per share. On August 10, 2020, issued 8,000 shares for a property. The fair value of the share is P65 per share while the fair value of the property is P 500,000. On August 31, 2020, issued 1,000 shares in exchange for a legal service rendered. The usual legal fee per hour is P68 and the share was trading on a public exchange on that day at P62.

How much is the share premium? Correct answer: 312,000

QUESTION 8 The related data of Maria La Del Barrio Corporation: Authorized to issue 100,000 shares at P10 par value. On June 1, received a cash subscription of 25,000 shares for P 325,000. June 10, collected the full payment of the June 1 subscription. June 15, receive an additional subscription of 12,000 shares for P 180,000 and receive a 35% down payment on it.

How much is the contributed capital? Correct answer: 388,000

QUESTION 9 Rosalinda Corporation’s Shareholder’s equity for December 31, 2020: Issued shares Par value Share capital Share premium

20,000 ₱20 P 400,000 300,000

Retained earnings

780,000

Total

P 1,480,000

During 2021, the following transactions occur: The entity issued additional 5,000 shares at ₱30 per share. Acquired 2,000 own shares at ₱35 per share. Reissued 1,000 shares for P40 per share Reissued 500 shares for P24. Net income is P 395,800.

How much is the amount of retained earnings on December 31, 2021? Correct answer: 1,175,300

QUESTION 10 Rosalinda Corporation’s Shareholder’s equity for December 31, 2020: Issued shares Par value Share capital

20,000 ₱20 P 400,000

Share premium

300,000

Retained earnings

780,000

Total

P 1,480,000

During 2021, the following transactions occur: The entity issued additional 5,000 shares at ₱30 per share. Acquired 2,000 own shares at ₱35 per share. Reissued 1,000 shares for P40 per share Reissued 500 shares for P24. Net income is P 395,800.

How much is the Share premium on December 31, 2021? Correct answer: 350,000

QUESTION 11 Maria Mercedes Corporation’s Shareholder’s equity for December 31, 2020: Issued shares Par value Share capital

50,000 ₱25 P 1,250,000

Share premium

500,000

Retained earnings

1,500,000

Total

P 3,250,000

During 2021, the following transactions occur: Acquired 8,000 own shares for ₱45 per share. Reissued shares of 3,000 for P50. Retire 5,000 treasury shares. Net income is P 800,000.

How much are the retained earnings on December 31, 2021? Correct answer: 2,265,000

QUESTION 12 Marimar Company undertakes an initial public offering (IPO) for the listing & issuance of 75,000 new shares and listing of 25,000 old existing shares. The related data are as follows:

Publication fees Tax opinion Audit fee - share issuance

P 30,000 80,000 100,000

Fairness & valuation report 120,000 Listing fees

50,000

How much is the Share premium? Correct answer: 255,000...

Similar Free PDFs

Shareholders equity part 2

- 15 Pages

Shareholders\' Equity Exam

- 5 Pages

Shareholders Equity - PICPA

- 6 Pages

Shareholders Equity Transactions

- 32 Pages

Audit- Shareholders- Equity

- 7 Pages

Intermediate-Accounting 2nd-quiz

- 6 Pages

Intermediate Accounting 3 Reviewerr

- 47 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu