Shareholders equity part 2 PDF

| Title | Shareholders equity part 2 |

|---|---|

| Author | Aira Rhialyn Mangubat |

| Course | Business Administration |

| Institution | Lyceum of the Philippines University |

| Pages | 15 |

| File Size | 184.3 KB |

| File Type | |

| Total Downloads | 478 |

| Total Views | 825 |

Summary

II. Retained Earnings 1. Net income or Loss 2. Dividend Distribution 3. Prior Period Errors 4. Change in Accounting Policy 5. Reclassification of other Components of OCI 6. Other Capital AdjustmentsRetained Earnings Appropriated , Unappropriated , Deficit ( debit balance) or Accumulated Loss Appro...

Description

II.

Retained Earnings 1. Net income or Loss 2. Dividend Distribution 3. Prior Period Errors 4. Change in Accounting Policy 5. Reclassification of other Components of OCI 6. Other Capital Adjustments

Retained Earnings Appropriated , Unappropriated , Deficit ( debit balance) or Accumulated Loss Appropriation (limits the declaration of dividend) a.Legal Appropriation – Legal Capital cannot be returned to shareholders (Trust Fund Doctrine), Appropriation for treasury Shares b. Contractual – Bonds and Preferred Shares ( Appropriation for Sinking Fund, Aprropriation for Bond Redemption) c.Voluntary- Management discretion such as Plant expansion, Contingencies, increase in working capital Dividends – Distribution of earnings or capital to shareholders. Out of Earnings – From Unrestricted Retained Earnings or Premium on Par Value (Share Dividend). Three Dates on Dividend. Liability shall be at the date of declaration. a. Cash Dividend – most common standing alone as “dividend” implies Cash. A. Peso Per Share B. Percentage of par or stated value. b. Property Dividend – Dividend in kind or Non-Cash Assets. It is initially recorded at fair value of the non-cash asset distributed and adjusted the same directly to Retained Earnings until it will be distributed. The difference between the book value and the fair value at the date of distribution is closed to Profit or Loss (IFRIC 17). For Non Current Assets to be Distributed, it will be valued at lower of book value or fair value less cost to distribute, an impairment loss will be adjusted. c. Choice of Cash or Non-Cash - A probability will be used and adjustments to equity or retained earnings will be done upon the actual choice. d. Scrip Dividend – is like a note as a formal evidence of indebtedness to pay a sum of money in the future. This is with interest. e. Bond Dividend – just like scrip dividend, a formal indebtedness with interest. f. Share Dividend (Stock). It must be entity’s own share. How Much will be capitalized? a. Small – less than 20% of the outstanding shares ( fair or pay whichever is higher at the date of declaration) b. Large - 20% or more – (Par or Stated value) g. Fractional Share Dividend – a. Entity will issue warrants b. Entity will pay cash ( only when the source is retained earnings but not from the share premium) h. Treasury Shares as Share Dividend – The cost will be charged to retained earnings. i. When shareholders elect to received cash in lieu of share, the optional cash dividend shall be capitalized from retained earnings. j. Share Dividend are declared from the proposed increase of authorized shares but not yet approved by SEC, this should not be reflected in FS but in the notes. k. In a close corporation , the amount capitalized from the Retained Earnings is only at par or stated value. Out of Capital ( liquidating dividend) – For Wasting Asset Companies ( Retained Earnings + Accumulated Depletion – Capital Liquidated ) Dividend as Expense – For redeemable Preferred Shares 1.

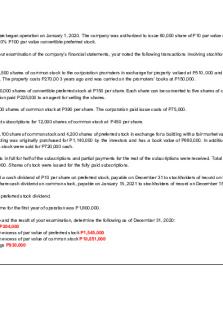

On January 1, 2016, Dodd, Inc., had the following accounts before closing entries are made.

Share capital—ordinary, P10 par value, authorized 200,000 shares; issued and outstanding 120,000 shares P 1,200,000 Share premium—ordinary 150,000 Retained earnings 700,000 Sales 5,000,000 Cost of Goods Sold 3,000,000 Operating Expenses 900,000 Dividend 500,000 Tax Rate 30% What was the balance of Retained Earnings after closing entries a. P700,000 b. P 1,800,000 c. P 1,470,000 d. P 970,000 2.

On January 1, 2016, Dodd, Inc., has the following Equity before dividend was declared : Share capital—ordinary, P10 par value, authorized 200,000 shares; issued 120,000 shares, 110,000 shares outstanding P1,200,000 Subscribed Share capital 200,000 Share premium—ordinary 150,000 Retained earnings 700,000 Treasury Share, at cost 200,000 If Dodd, Inc. will declare a 20% cash dividend, Retained Earnings will be decreased by how much? a. P220,000 b. P240,000 c. P260,000 d. P200,000

3.

Pierson Corporation owned 10,000 units of inventory. These items were purchased in 2014 for P90,000. On November 15, 2015, Pierson declared a property dividend of one unit of inventory for every ten shares of Pierson held by a shareholder. On that date, when the market price of inventory was P14 per unit. On December 31, 2015 the market price is P 15 per unit and on February 1, the settlement date, the market price is P12 per unit. There were 90,000 shares of Pierson outstanding. What gain and net reduction in retained earnings would result from this property dividend? Gain Net Reduction in Retained Earnings a. P0 P126,000 b. P30,000 P135,000 c. P27,000 P108,000 d. P27,000 P 81,000

4.

Stinson Corporation owned 30,000 shares of Matile Corporation. These shares were purchased in 2014 for P270,000. On November 15, 2016, Stinson declared a property dividend of one share of Matile for every ten shares of Stinson held by a shareholder. On that date, when the market price of Matile was P14 per share, there were 270,000 shares of Stinson outstanding. What gain and net reduction in retained earnings would result from this property dividend? Gain Net Reduction in Retained Earnings a. P0 P243,000 b. P0 P378,000 c. P135,000 P108,000 d. P135,000 P243,000 d (P270,000 ÷ P10) P14 = P378,000 [P14 – (P270,000 ÷ 30,000)] 27,000 = P135,000 P378,000 – P135,000 = P243,000.

5.

Winger Corporation owned patent with a carrying value of P 900,000. On December 1, 2015 the company declared the patent as property dividend to its shareholders where on this date the market value is P 800,000. On December 31, 2015, the market value increased to P 1,000,000 and on

January 31,2016, the distribution date, the market value became P 980,000.What would be the net reduction in Winger’s equity as a result of the above transactions? a. P 900,000.b. P 980,000. c. P1,000,000. d. P 800,000.

12.1.2015

Retained Earnings 800,000 Dividend Payable

800,000

Patent for Distribution 800,000 Impairment Loss 100,000 Patent 900,000 12.31.2015

Retained Earnings 200,000 Dividend Payable 200,000 Patent for Distribution 100,000 Gain on Recovery of Impairment loss 100,000

1.31.2016

6.

Dividend Payable 20,000 Retained Earnings

20,000

Dividend Payable 980,000 Patent held for Distribution 900,000 Pierson Corporation owned 10,000 units of inventory. These items were purchased in 2014 for P90,000. On November 15, 2015, Pierson declared a property dividend of one unit of inventory for every ten shares of Pierson held by a shareholder. On that date, when the market price of inventory was P14 per unit. The shareholders have alternative to receive cash of P 1 per share. Pierson estimated that 60% will opt to receive cash. If there were 90,000 shares of Pierson outstanding as of this time and shareholders opted to receive the inventory rather than cash, What is the (loss) or gain on distribution of dividend? a. P (54,000) b. P 54,000 c. P 21,600 d. P (21,600)

Inventory – 90,000/10 = 9,000 x 14 = 126,000 x .4 = Cash - 90,000 x P1 x .60 =

50,400 54,000 104,400

Retained Earnings 104,400 Dividend Payable 104,400 Dividend Payable Loss on Distribution Inventory

7.

104,400 21,600 126,000 Gain on Distribution

80,000

On January 1, 2016, Dodd, Inc., has the following Equity before dividend was declared : Share capital—ordinary, P10 par value, authorized 200,000 shares; issued 120,000 shares, 110,000 shares outstanding P1,200,000 Subscribed Share capital 200,000 Share premium—ordinary 150,000 Retained earnings 700,000 Treasury Share, at cost 200,000 If Dodd, Inc. will declare a 20% cash dividend and issue a corresponding 12% short term note. After three months, the company paid its shareholders. How much is the total payment? a. P220,000 b. P267,800 c. P260,000 d. P200,000

For numbers 8 to 11 Rensing, Inc., has P800,000 of 8% preference shares and P1,200,000 of ordinary shares outstanding, each having a par value of P10 per share. No dividends have been paid or declared during 2014 and 2015. As of December 31, 2016, it is desired to distribute P488,000 in dividends. 8. How much will the preference and ordinary shareholders receive if the preference is noncumulative and nonparticipating. Preference Ordinary a. P 64,000 P 424,000 b. P192,000 P 296,000 c. P 272,000 P 216,000 d. P 224,000 P 264,000 9. How much will the preference and ordinary shareholders receive if the preference is cumulative and nonparticipating. Preference Ordinary a. P 64,000 P 424,000 b. P192,000 P 296,000 c. P 272,000 P 216,000 d. P 224,000 P 264,000 10. How much will the preference and ordinary shareholders receive if the preference is cumulative and fully participating. Preference Ordinary a. P 64,000 P 424,000 b. P192,000 P 296,000 c. P 272,000 P 216,000 d. P 224,000 P 264,000 11. How much will the preference and ordinary shareholders receive if the preference is cumulative and participating to 12% total. Preference Ordinary a. P 64,000 P 424,000 b. P192,000 P 296,000 c. P 272,000 P 216,000 d. P 224,000 P 264,000 (a) Current year’s dividend (8% of P800,000) Remainder to ordinary

Preference P 64,000 P 64,000

Ordinary P — 424,000 P424,000

Total P 64,000 424,000 P488,000

(b)

Preference Dividends in arrears, 8% of P800,000 for two years P128,000 Current year’s dividend 64,000 Remainder to ordinary P192,000

Ordinary P — — 296,000 P296,000

Total P128,000 64,000 296,000 P488,000

(c)

Preference Dividends in arrears, 8% of P800,000 for two years P128,000 Current year’s dividend 64,000 Participating dividend 10% (P200,000 ÷ P2,000,000) 80,000 P272,000

Ordinary P — 96,000 120,000 P216,000

Total P128,000 160,000 200,000 P488,000

(d)

Preference Dividends in arrears, 8% of P800,000 for two years P128,000 Current year’s dividend 64,000 Participating dividend (4%) 32,000 Remainder to ordinary — P224,000

12.

On June 30, 2016, when Ermler Co.’s stock was selling at P65 per share, its equity accounts were as follows: Share capital—ordinary (par value P50; 60,000 shares issued) P3,000,000 Share premium—ordinary 600,000 Retained earnings 4,200,000 If a 100% share dividend were declared and distributed, share capital—ordinary would be a. P3,000,000. b. P3,600,000. c. P6,000,000. d. P7,800,000. c

13.

Total P128,000 160,000 80,000 120,000 P488,000

(60,000 P50) + P3,000,000 = P6,000,000.

The equity section of Gunkel Corporation as of December 31, 2015, was as follows: Share capital—ordinary, par value P2; authorized 20,000 shares; issued and outstanding 10,000 sharesP 20,000 Share premium—ordinary 30,000 Retained earnings 75,000 P125,000 On March 1, 2016, the board of directors declared a 15% share dividend, and accordingly 1,500 additional shares were issued. On March 1, 2016, the fair value of the share was P6 per share. For the two months ended February 28, 2016, Gunkel sustained a net loss of P10,000. What amount should Gunkel report as retained earnings as of March 1, 2016? a. P62,000. b. P56,000. c. P69,000. d. P72,000. b

14.

Ordinary P — 96,000 48,000 120,000 P264,000

P75,000 – P10,000 – (1,500 P6) = P56,000.

The equity of Howell Company at July 31, 2016 is presented below: Share capital—ordinary, par value P20, authorized 400,000 shares; issued and outstanding 160,000 shares P3,200,000 Share premium—ordinary 160,000 Retained earnings 950,000 P4,310,000 On August 1, 2016, the board of directors of Howell declared a 15% share dividend on ordinary shares, to be distributed on September 15th. The market price of Howell’s ordinary shares was P35 on August 1, 2016, and P38 on September 15, 2016. If only 80% of the dividend relates to a full shares issued and that 75% of the fractional warrants were exercised, What is the amount of the debit to retained earnings as a result of the declaration and distribution of this share dividend? a. P480,000. b. P840,000. c. P912,000. d. P600,000. Retained Earnings (160,000 x .15 x 35) 840,000 Share Dividend Distributable ( 160,000 x .15 x 20) 480,000 Share Premium 360,000 Share Dividend Payable Share Capital(160,000x.15xP20x.8) Fractional Warrants Outstanding

480,000

Fractional Warrants Outstanding 96,000 Share Capital ( 96,000 x .75) 72,000 Share Premium Unexercised Warrants 24,000

384,000 96,000

15.

On January 1, 2016, Dodd, Inc., has the following Equity before dividend was declared : Share capital—ordinary, P10 par value, authorized 200,000 shares; issued 120,000 shares, 110,000 shares outstanding P1,200,000 Subscribed Share capital 200,000 Share premium—ordinary 150,000 Retained earnings 700,000 Treasury Share, at cost 200,000 If Dodd, Inc. will declare 1 treasury share as share dividend for every 20 shares held, during which the market price of its stock is P 25 per share, Retained Earnings will be decreased by how much? a. P130,000 b. P162,500 c. P65,000 d. P110,000

16.

During 2017, Rod Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2015 – P60,000 understated; 2016 – P75,000 overstated. Rod Company uses the periodic inventory system to ascertain year-end quantities that are converted to peso amounts using the FIFO cost method. By how much would retained earnings at January 1, 2017 be misstated prior to any adjustments for these errors and ignoring income taxes? a. P75,000 overstatedb. P75,000 understated c.P15,000 overstated d.P15,000 understated

17.

After the issuance of its 2016 financial statements, Amethyst, Inc. discovered a computational error of P150,000 in the calculation of its December 31, 2016 inventory. The error resulted in a P150,000 overstatement in the cost of goods sold for the year ended December 31, 2016. In October 2017, Amethyst paid the amount of P500,000 in settlement of litigation instituted against it during 2016. Ignore income taxes. By how much should the December 31, 2016 retained earnings balance be adjusted in the 2017 statement of changes in equity? a. P150,000 increase b. P150,000 decrease c. P350,000 increase d. P350,000 decrease

Treasury Shares a. Entity’s own share b. Issued and reacquired c. Not Cancelled It can be reissued at a discount without any discount liability Legal limitations : Unrestricted Retained Earnings – It should be restricted equal to the cost of treasury shares. RE cannot be declared as dividend until the Treasury shares will be reissued. The cost method is used ( for non-cash consideration, the cost is equal to the carrying value of the non-cash asset surrendered. PAS 32 states that no gain or loss shall be recognized upon purchase, sales, issue or cancellation of entity’s equity instruments. Par Value Method (Retirement Method)- debit Treasury Shares (at par), then charge to Premium for the difference of actual cost. Reissue a. Reissue at more than cost – Share Premium Treasury b. Reissue at less than cost – Share Premium from treasury of the same class, Retained Earnings Retirement – a. If the cost of TS is lower than the par or stated value (GAIN) to Share Premium Treasury b. If the cost is higher (LOSS) charged to a. Premium Original Issuance on Prorata basis b. Premium from Treasury c. Retained Earnings. It is required to be disclosed ( number of shares, retained earnings restrictions) 18. Five years ago, Dunn Trading Co. issued 2,500 ordinary shares. The shares have a P2 par value and sold at that time for P12 per share. On January 1, 2015, Dunn Trading Co. Purchased 1,000 of these shares for P24 per share. On September 30, 2015, Dunn reissued 500 of the shares for P28 per share. The journal entry to record the reissuance will include a. A debit to Treasury Shares P12,000. b. A credit to Share Premium—Treasury P2,000. c. A credit to Treasury Shares P14,000. d. A credit to cash P14,000.

b

(P28 – P24) 500 = P2,000.

19. Pember Corporation started business in 2009 by issuing 200,000 shares of P20 par ordinary shares for P36 each. In 2014, 20,000 of these shares were purchased for P52 per share by Pember Corporation and held as treasury shares. On June 15, 2015, these 20,000 shares were exchanged for a piece of property that had an assessed value of P810,000. Perber’s shares are actively traded and had a fair price of P60 on June 15, 2015. The cost method is used to account for treasury shares. The amount of share premium—treasury resulting from the above events would be a. P800,000. b. P480,000. c. P390,000. d. P160,000. d

(P60 – P52) 20,000 = P160,000.

20. Gannon Company acquired 6,000 shares of its own ordinary shares at P20 per share on February 5, 2010, and sold 3,000 of these shares at P27 per share on August 9, 2015. The fair value of Gannon’s ordinary shares was P24 per share at December 31, 2014, and P25 per share at December 31, 2015. The cost method is used to record treasury shares transactions. What account(s) should Gannon credit in 2015 to record the sale of 3,000 shares? a. Treasury Shares for P81,000. b. Treasury Shares for P60,000 and Share Premium—Treasury for P21,000. c. Treasury Shares for P60,000 and Retained Earnings for P21,000. d. Treasury Shares for P72,000 and Retained Earnings for P9,000. b

3,000 P20 = P60,000; 3,000 P7 = P21,000.

21. An analysis of equity of Hahn Corporation as of January 1, 2015, is as follows: Share capital—ordinary, par value P20; authorized 100,000 shares; issued and outstanding 90,000 shares P1,800,000 Share premium—ordinary 900,000 Retained earnings 760,000 Total P3,460,000 Hahn uses the cost method of accounting for treasury shares and during 2015 entered into the following transactions: Acquired 2,500 of its shares for P75,000. Sold 2,000 treasury shares at P35 per share. Sold the remaining treasury shares at P20 per share. Assuming no other equity transactions occurred during 2015, what should Hahn report at December 31, 2015, as total share premium? a. P895,000 b. P900,000 c. P905,000 d. P915,000 c

P900,000 + (2,000 P5) – (500 P10) = P905,000.

22. Percy Corporation was organized on January 1, 2015, with an authorization of 1,200,000 ordinary shares with a par value of P6 per share. During 2015, the corporation had the following capital transactions: January 5 issued 675,000 shares @ P10 per share July 28 purchased 90,000 shares @ P11 per share December 31 sold the 90,000 shares held in treasury @ P18 per share Percy used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of share premium as of December 31, 2015? a. P-0-. b. P2,070,000. c. P2,700,000. d. P3,330,000. d 23.

(675,000 P4) + (90,000 P7) = P3,330,000.

On December 1, 2016, Abel Corporation exchanged 20,000 shares of its P10 par value ordinary shares held in treasury for a used machine. The treasury shares were acquired by Abel at a cost of P40 per share, and are accounted for under the cost method. On the date of the exchange, the ordinary shares had a fair value of P55 per share (the shares

were total equity will P1,100,000.

originally issued at P30 per share). As a result of this exchange, Abel’s increase by a. P200,000. b. P800,000. c. d. P900,000. c

24.

20,000 P55 = P1,100,000.

Five years ago, Dunn Trading Co. issued 2,500 ordinary shares. The shares have a P2 par value and sold at that time for P12 per share. On January 1, 2015, Dunn Trading Co. purchased 1,000 of these shares for P24 per share. On September 30, 2015, Dunn reissued 500 of the shares for P28 per share. Dunn used the Par Value method of accounting treasury shares. How much is the balance of Share Premium – Treasury. a. P25,000 b. P15,000. c....

Similar Free PDFs

Shareholders equity part 2

- 15 Pages

Shareholders\' Equity Exam

- 5 Pages

Shareholders Equity - PICPA

- 6 Pages

Shareholders Equity Transactions

- 32 Pages

Audit- Shareholders- Equity

- 7 Pages

Minority shareholders

- 23 Pages

2 Module - Equity Investments

- 12 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu