Shareholder\'s equity problems auditing prob PDF

| Title | Shareholder\'s equity problems auditing prob |

|---|---|

| Course | Accounting |

| Institution | Philippine School of Business Administration |

| Pages | 32 |

| File Size | 338.3 KB |

| File Type | |

| Total Downloads | 390 |

| Total Views | 605 |

Summary

VIII – AUDIT OF STOCKHOLDERS’ EQUITYPROBLEM NO. 1Alcoy Corporation’s post-closing trial balance at December 31, 2006 was as follows:Alcoy Corporation Post-Closing Trial Balance December 31, 2006Debit Credit Accounts payable P 495, Accounts receivable P 963, Reserve for depreciation 360, Reserve for ...

Description

VIII – AUDIT OF STOCKHOLDERS’ EQUITY PROBLEM NO. 1 Alcoy Corporation’s post-closing trial balance at December 31, 2006 was as follows: Alcoy Corporation Post-Closing Trial Balance December 31, 2006 Debit Accounts payable Accounts receivable Reserve for depreciation Reserve for doubtful accounts Premium on common stock Gain on sale of treasury stock Bonds payable Building and equipment Cash Cash dividends payable on preferred stock Common stock (P1 par value) Inventories Land Available-for-sale securities at fair value Trading securities at fair value Net unrealized loss on available-for-sale securities Preferred stock (P50 par value) Prepaid expenses Donated capital Stock warrants outstanding Retained earnings Treasury stock – common, at cost Totals

Credit P 495,000

P 963,000 360,000 54,000 1,800,000 450,000 720,000 1,980,000 396,000 7,200 270,000 1,116,000 684,000 513,000 387,000 45,000 900,000 72,000 800,000 208,000 415,800 324,000 P6,480,000

P6,480,000

At December 31, 2006, Alcoy had the following number of common and preferred shares: Common 900,000 270,000 252,000

Authorized Issued Outstanding

225

Preferred 90,000 18,000 18,000

The dividends on preferred stocks are P0.40 cumulative. In addition, the preferred stock has a preference in liquidation of P50 per share. QUESTIONS: Based on the above and the result of your audit, determine the following as of December 31, 2006: 1. Additional paid-in capital a. P3,213,000 b. P3,258,000

c. P3,050,000 d. P2,600,000

2. Total contributed capital a. P4,428,000 b. P4,220,000

c. P3,770,000 d. P1,170,000

3. Unappropriated retained earnings a. P415,800 b. P739,800

c. P91,800 d. P37,800

4. Total stockholders’ equity a. P4,266,800 b. P4,519,800

c. P4,888,800 d. P4,474,800

Suggested Solution: Question No. 1 Premium on common stock Gain on sale of treasury stock Donated capital Stock warrants outstanding Total additional paid-in capital

P1,800,000 450,000 800,000 208,000 P3,258,000

Question No. 2 Preferred stock (P50 par value) Common stock (P1 par value) Additional paid-in capital (see no. 1) Total contributed capital

P 900,000 270,000 3,258,000 P4,428,000

Question No. 3 Total retained earnings Less appropriation for treasury stock Unappropriated retained earnings 226

P415,800 324,000 P 91,800

Question No. 4 Total contributed capital (see no. 2) Retained earnings: Unappropriated (see no. 3) Appropriated for treasury stock Total Less : Treasury stock Net unrealized loss on AFS Total stockholders equity

P4,428,000 P 91,800 324,000 324,000 45,000

415,800 4,843,800 369,000 P4,474,800

Answers: 1) B; 2) A; 3) C; 4) D

PROBLEM NO. 2 Your audit client, Argao, Inc., is a public enterprise whose shares are traded in the over-the-counter market. At December 31, 2005, Argao had 3,000,000 authorized shares of P10 par value common stock, of which 1,000,000 shares were issued and outstanding. The stockholders’ equity accounts at December 31, 2005 had a following balances. Common stock Additional paid-in capital Retained earnings

P10,000,000 3,750,000 3,250,000

Transactions during 2006 and other information stockholders’ equity accounts were as follows:

relating

to

the

•

On January 2, 2006, Argao issued at P54 per share, 50,000 shares of P50 par value, 9% cumulative convertible preferred stock. Each share of preferred stock is convertible into two shares of common stock. Argao had 300,000 authorized shares of preferred stock. The preferred stock has a liquidation value equal to its par value.

•

On February 1, 2006, Argao reacquired 10,000 shares of its common stock for P16 per share.

•

On April 30, 2006, Argao sold 250,000 shares (previously unissued) of P10 par value common stock to the public at P17 per share.

•

On June 15, 2006, Argao declared a cash dividend of P1 per share of common stock, payable on July 15, 2006, to stockholders of record on July 1, 2006. 227

•

On November 10, 2006, Argao sold 5,000 shares of treasury stock for P21 per share.

•

On December 15, 2006, Argao declared the yearly cash dividend on preferred stock, payable on January 15, 2007, to stockholders of record on December 31, 2006.

•

On January 20, 2007, before the books were closed for 2006, Argao became aware that the ending inventories at December 31, 2005 were understated by P150,000 (after tax effect on 2005 net income was P90,000). The appropriate correction entry was recorded the same day.

•

After correcting the beginning inventory, net income for 2006 was P2,250,00.

QUESTIONS: Based on the above and the result of your audit, determine the following as of December 31, 2006: 1. Additional paid-in capital a. P5,700,000 b. P5,525,000

c. P5,500,000 d. P5,725,000

2. Unappropriated retained earnings a. P4,125,000 b. P4,035,000

c. P4,045,000 d. P3,955,000

3. Treasury stock a. P160,000 b. P 80,000

c. P55,000 d. P50,000

4. Total stockholders’ equity a. P22,190,000 b. P24,770,000

c. P24,690,000 d. P24,840,000

5. Book value per share of common stock a. P17.89 c. P17.71 b. P17.82 d. P15.41

228

Suggested Solution: Questions No. 1 to 4 Preferred stock Common stock Additional paid in capital Retained earnings: Appropriated Unappropriated Treasury stock Total SHE, 12/31/06

P 80,000 4,045,000

P 2,500,000 12,500,000 5,725,000

(1)

4,125,000 ( 80,000) P24,770,000

(2) (3) (4)

Prepare T-accounts for each component of the stockholders’ equity. Place the balances as of January 1, 2006, journalize the transactions affecting the SHE accounts, post the entries to the affected accounts, then extract the balances. Journal entries affecting the stockholders equity accounts during 2006: 1/2 Cash (50,000 shares x P54) P2,700,000 Preferred stock (50,000 shares x P50) P2,500,000 APIC - excess over par of preferred stock 200,000 2/1

Treasury stock (10,000 x P16) Cash

P 160,000 P 160,000

4/30 Cash (250,000 shares x P17) P4,250,000 Common stock (250,000 shares x P10) P2,500,000 APIC - excess over par of common stock 1,750,000 6/15

Retained earnings Dividends payable - common

P1,240,000* P1,240,000

* [(1,000,000 + 250,000 – 10,000) x P1]

11/10 Cash (5,000 shares x P21) P 105,000 Treasury stock (5,000 shares x P16) P APIC - from treasury stock transactions 12/15 Retained earnings (2,500,000 x 9%) Dividends payable - preferred

P 225,000

12/31 Inventory, 1/1/06

P 150,000 229

80,000 25,000 P225,000

Retained earnings Income tax payable

P 90,000 60,000

12/31 Income summary Retained earnings

P2,250,000 P2,250,000

12/31 Retained earnings P 80,000 Retained earnings - appropriated (cost of TS) P

80,000

Question No. 5 Total stockholders' equity (see no. 4) Less liquidation value of preferred stock Common stockholders' equity Divide by common shares outstanding Book value per share of common stock

P24,770,000 2,500,000 22,270,000 1,245,000 P 17.89

Answers: 1) D; 2) C; 3) B; 4) B, 5) A

PROBLEM NO. 3 The stockholders’ equity section of the Asturias Inc. showed the following data on December 31, 2005: Common stock, P3 par, 300,000 shares authorized, 250,000 shares issued and outstanding, P750,000; Paid-in capital in excess of par, P7,050,000; Additional paid-in capital from stock options, P150,000; Retained earnings, P480,000. The stock options were granted to key executives and provided them the right to acquire 30,000 shares of common stock at P35 per share. Each option has a fair value of P5 at the time the options were granted. The following transactions occurred during 2006: Feb.

1

Key executives exercised 4,500 options outstanding at December 31, 2005. The market price per share was P44 at this time.

Apr.

1

The company issued bonds of P2,000,000 at par, giving each P1,000 bond a detachable warrant enabling the holder to purchase two shares of stock at P40 each for a 1-year period. The bonds would sell at P996 per P1,000 bond without the warrant.

July

1

The company issued rights to stockholders (one right on each share, exercisable within a 30-day period) permitting holders to acquire one share at P40 with every 10 rights 230

submitted. All but 6,000 rights were exercised on July 31, and the additional stock was issued. Oct.

1

All warrants issued in connection with the bonds on April 1 were exercised.

Dec. 1

The market price per share dropped to P33 and options came due. Because the market price was below the option price, no remaining options were exercised.

Dec. 31

Net income for 2006 was P250,500.

QUESTIONS: Based on the above and the result of your audit, determine the following as of December 31, 2006: 1. Common stock a. P777,300 b. P848,700

c. P833,850 d. P850,050

2. Total additional paid-in capital a. P7,522,200 b. P8,402,800

c. P8,219,650 d. P8,419,450

3. Total contributed capital a. P8,299,500 b. P9,053,500

c. P9,269,500 d. P9,251,500

4. Retained earnings a. P580,500 b. P858,000

c. P730,500 d. P654,150

5. Total stockholders’ equity a. P10,000,000 b. P 9,784,000

c. P9,030,000 d. P9,982,000

Suggested Solution: Questions No. 1 to 5 Common stock Additional paid in capital Contributed capital Retained earnings Total SHE, 12/31/06

P

850,050 8,419,450 9,269,500 730,500 P10,000,000 231

(1) (2) (3) (4) (5)

Note: Follow the same approach in Problem no. 2. Journal entries affecting the stockholders equity accounts during 2006: 2/1 Cash (4,500 options x P35) P 157,500 APIC-stock options (4,500 x P5) 22,500 Common stock (4,500 shares x P3) P 13,500 APIC - excess over par 166,500 4/1 Cash P2,000,000 Bond discount [P2,000,000-(2,000xP996)] 8,000 Bonds payable P2,000,000 APIC-stock warrants 8,000 7/1 Memorandum: Issued rights to shareholders permitting holder to acquire for a 30-day period one share at P40 with every 10 rights submitted - a maximum of 25,450 shares (254,500 shares ÷ 10). 7/31 Cash {[25,450 - (6,000/10)] x P40} Common stock (24,850 shares x P3) APIC - excess over par

P

994,000 P 74,550 919,450

10/1 Cash (2,000 x 2 x P40) P 160,000 APIC-stock warrants 8,000 Common stock (2,000 shares x 2 x P3) P APIC - excess over par 12/1 APIC-stock options [P150,000-(4,500xP5)] APIC - expired stock options 12/31 Income summary Retained earnings

P

12,000 156,000

P 127,500 P 127,500 250,500 P250,500

Answers: 1) D; 2) D; 3) C; 4) C, 5) A

PROBLEM NO. 4 Balamban Corporation was authorized at the beginning of 2004 with 540,000 authorized shares of P100, par value common stock. At December 31, 2004, the stockholders’ equity section of Balamban was as follows: Common stock, par value P100 per share; authorized 540,000 shares; issued 54,000 shares 232

P5,400,000

Additional paid-in capital Retained earnings Total stockholders’ equity

540,000 810,000 P6,750,000

On May 10, 2005, Balamban issued 90,000 shares of its common stock for P10,800,000. A 5% stock dividend was declared on September 30, 2005 and issued on November 10, 2005 to stockholders of record on October 31, 2005. Market value of common stock was P110 per share on declaration date. The net income of Balamban for the year ended December 31, 2005 was P855,000. During 2006, Balamban had the following transactions; Feb. 15

Balamban reacquired 5,400 shares of its common stock for P95 per share.

May 15

Balamban sold 2,700 shares of its treasury stock for P120 per share.

Jun 30

Issued to stockholders one stock right for each share held to purchase two additional shares of common stock for P125 per share. The rights expire on December 31, 2006.

Aug. 15

45,000 stock rights were exercised when the market value of common stock was P130 per share.

Sep. 30

72,000 stock rights were exercised when the market value of the common stock was P140 per share.

Dec. 01

Balamban declared a cash dividend of P2 per share payable on January 15, 2007 to stockholders of record on December 31, 2006.

Dec. 15

Balamban retired 1,800 shares of its treasury stock and reverted them to an unused basis. On this date, the market value of the common stock was P150 per share.

Dec. 31

Net income for 2006 was P900,000.

QUESTIONS: Based on the above and the result of your audit, determine the following as of December 31, 2006: 1. Common stock a. P38,520,000

c. P38,340,000 233

b. P26,640,000

d. P38,250,000

2. Additional paid-in capital a. P8,329,500 b. P8,338,500

c. P5,413,500 d. P8,266,500

3. Retained earnings a. P1,080,000 b. P1,002,600

c. P1,017,000 d. P1,008,000

4. Treasury stock a. P18,000 b. P90,000

c. P85,500 d. P 0

Suggested Solution: Questions No. 1 to 4

Balances, 1/1/05 May 10, 2005 Sept. 30, 2005 Net income-2005 Balances, 12/31/05 Feb. 15 May 15 Aug. 15 Sep. 30 Dec. 01 Dec. 15 Net income-2006 Balances, 12/31/06

Common Stock P 5,400,000 9,000,000 720,000

APIC P 540,000 1,800,000 72,000

15,120,000

2,412,000

9,000,000 14,400,000

67,500 2,250,000 3,600,000

(180,000)

9,000

Retained Earnings P 810,000 (792,000) 855,000 873,000

Treasury stock P 0

0 513,000 (256,500)

(765,000)

P38,340,00 0

P8,338,50 0

(171,000) 900,000 P1,008,00 0

P 85,500

Answers: 1) C; 2) B; 3) D; 4) C

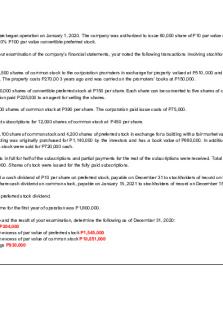

PROBLEM NO. 5 Bogo Corporation began operations on January 1, 2006. The company was authorized to issue 60,000 shares of P10 par value common stock and 120,000 shares of 10%, P100 par value convertible preferred stock.

234

In connection with your audit of the company’s financial statements, you noted the following transactions involving stockholders’ equity during 2006:

Jan.

1

Issued 1,500 shares of common stock to the corporation promoters in exchange for equipment valued at P510,000 and services valued at P210,000. The property costs P270,000 3 years ago and was carried on the promoters’ books at P150,000.

Jan. 31

Issued 30,000 shares of convertible preferred stock at P150 per share. Each share can be converted to five shares of common stock. The corporation paid P225,000 to an agent for selling the shares.

Feb. 15

Sold 9,000 shares of common stock at P390 per share. The corporation paid issue costs of P75,000.

May 30

Received subscriptions for 12,000 shares of common stock at P450 per share.

Aug. 30

Issued 2,100 shares of common stock and 4,200 shares of preferred stock in exchanged for a building with a fair market value of P1,530,000. The building was originally purchased for P1,140,000 by the investors and has a book value of P660,000. In addition, 1,800 shares of common stock were sold for P720,000 cash.

Nov. 15

Payments in full for half of the subscriptions and partial payments for the rest of the subscriptions were received. Total cash received was P4,200,000. Shares of stock were issued for the fully paid subscriptions. The balance is collectible next year.

Dec.

Declared a cash dividend of P10 per share on preferred stock, payable on December 31 to stockholders of record on December 15, and P20 per share cash dividend on common stock, payable on January 15, 2007 to stockholders of record on December 15.

1

Dec. 31

Paid the preferred stock dividend. Net income for the first year of operations was P1,800,000.

235

QUESTIONS: Based on the above and the result of your audit, determine the following as of December 31, 2006: 1. Common stock a. P204,000 b. P144,000

c. P264,000 d. P186,000

2. Paid-in capital in excess of par value of preferred stock a. P1,500,000 c. P1,275,000 b. P1,545,000 d. P1,860,000 3. Paid-in capital in excess of par value of common stock a. P 8,211,000 c. P11,121,000 b. P10,851,000 d. P10,032,000 4. Retained earnings a. P1,050,000 b. P1,170,000

c. P 930,000 d. P1,458,000

5. Total stockholders’ equity a. P17,295,000 b. P16,950,000

c. P15,810,000 d. P17,010,000

Suggested Solution: Questions No. 1 to 5 Preferred stock Common stock Subscribed common Additional paid in capital - preferred Additional paid in capital - common Retained earnings Total SHE, 12/31/06

P3,420,000 204,000 60,000 1,545,000 10,851,000 930,000 P17,010,000

(1) (2) (3) (4) (5)

Journal entries affecting the stockholders equity accounts during 2006: 1/1 Equipment P 510,000 Organization expenses 210,000 Common stock (1,500 shares x P10) P 15,000 APIC - excess over par of CS 705,000 1/31 Cash (30,000 shares x P150) 236

P4,500,000

Preferred stock (30,000 shares x P100) APIC - excess over par of PS APIC - excess over par of PS Cash

P3,000,000 1,500,000

P 225,000 P 225,000

2/20 Cash (9,000 shares x P390) P3,510,000 Common stock (9,000 shares x P10) P 90,000 APIC - excess over par of CS 3,420,000 APIC - excess over par of CS Cash

P

75,000 P

75,000

5/30 Subscriptions rec. (12,000 sh. x P450) P5,400,000 Subscribed common stock (12,000 shares x P10) P 120,000 APIC - excess over par of CS 5,280,000 8/30 Cash P 720,000 Common stock (1,800 shares x P10) P 18,000 APIC - excess over par of CS 702,000 Building P1,530,000 Common stock (2,100 shares x P10) P 21,000 APIC - excess over par of CS [(2,100 sh x P400*)-21,000] P 819,000 Preferred stock (4,200 shares x P100) P 420,000 APIC - excess over par of PS (balance) P 270,000 * (P720,000/1,800 shares)

Note: The fair value of the building should be allocated to the preferred stock and common stock based on fair values. The problem did not specifically mention the fair value of the common stock. However, on the same date the company issued 1,800 common shares for P720,000 cash. Therefore, common shares were selling at P400/share (P720,000/1,800). Since the fair value of the preferred stock is not determinable, it will be assigned the residual amount after deducting the fair value of common stock from the fair value of the building. 11/07 Cash Subscriptions receivable

P4,200,000

Subscribed common stock (120,000 x 1/2) P60,000 237

P4,200,000

Common stock

P

60,000

Note: Since the subscriptions receivable is collectible next year, it will be presented under current assets. Incidentally, if the subscriptions receivable is not collectible currently, it will be presented under stockholders’ equity.

12/01 Retained earning...

Similar Free PDFs

Shareholders equity part 2

- 15 Pages

Shareholders\' Equity Exam

- 5 Pages

Shareholders Equity - PICPA

- 6 Pages

Shareholders Equity Transactions

- 32 Pages

Audit- Shareholders- Equity

- 7 Pages

Auditing Problems

- 28 Pages

Auditing Problems

- 22 Pages

3145-2-prob - problems

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu