TAX QUIZ 4 T F MCQ hhka;sjdj PDF

| Title | TAX QUIZ 4 T F MCQ hhka;sjdj |

|---|---|

| Author | bebe leng |

| Course | Accountancy |

| Institution | Polytechnic University of the Philippines |

| Pages | 60 |

| File Size | 1.1 MB |

| File Type | |

| Total Downloads | 398 |

| Total Views | 704 |

Summary

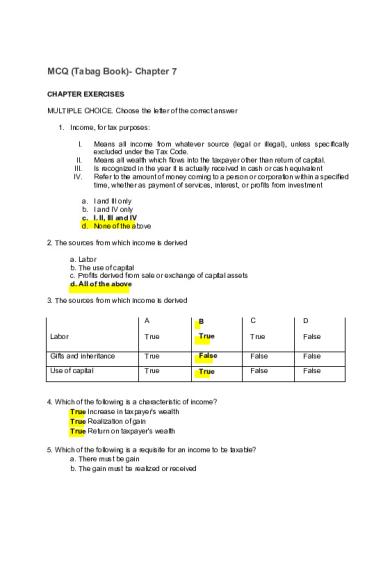

MCQ (Tabag Book)- Chapter 7CHAPTER EXERCISESMULTIPLE CHOICE. Choose the letter of the correct answer Income, for tax purposes: I. Means all income from whatever source (legal or illegal), unless specifically excluded under the Tax Code. II. Means all wealth which flows into the taxpayer other than r...

Description

MCQ (Tabag Book)- Chapter 7 CHAPTER EXERCISES MULTIPLE CHOICE. Choose the letter of the correct answer 1. Income, for tax purposes: I. II. III. IV. a. b. c. d.

Means all income from whatever source (legal or illegal), unless specifically excluded under the Tax Code. Means all wealth which flows into the taxpayer other than return of capital. Is recognized in the year it is actually received in cash or cash equivalent Refer to the amount of money coming to a person or corporation within a specified time, whether as payment of services, interest, or profits from investment l and Ill only I and IV only I. II, III and IV None of the above

2. The sources from which income is derived a. Labor b. The use of capital c. Profits derived from sale or exchange of capital assets d. All of the above 3. The sources from which income is derived A

B

C

D

Labor

True

True

True

False

Gifts and inheritance

True

False

False

False

Use of capital

True

True

False

False

4. Which of the following is a characteristic of income? True Increase in taxpayer's wealth True Realization of gain True Return on taxpayer's wealth 5. Which of the following is a requisite for an income to be taxable? a. There must be gain b. The gain must be realized or received

c. The gain must not be excluded by law from taxation d. All of the above 6. Which of the following is not an income for income tax purposes? a. Gain derived from labor. b. Return on capital. c. Excess of selling price over cost of assets sold d. Gift Received 7. Which of the following is not an income for income tax purposes? a. Collection of loans receivable b. Condonation of debt for services rendered C. Excess of selling price over the cost of an asset sold d. None of the above 8. Which of the following is not a characteristic of income? a. Increase in taxpayer's wealth. b. Realization or receipt of gain. c. Earnings constructively received. d. Return of taxpayer's wealth. 9. Which is not a valid definition of income? a. Income is the return from capital invested. b. Income is a fund at one distinct point of time. flows into the taxpayer other C. Income means all wealth which than a mere return of capital. d. Income means cash or its equivalent unless otherwise specified. 10. The share in the profits of a partner in a general professional partnership is regarded as received by him and thus taxable although not yet distributed. This principle is known as a. Actual receipt of income b. Advance reporting of income c. Accrual method of accounting d. Constructive receipt 11. Which of the following is considered or construed as an example of "constructive receipt"? a. Retirement benefits, pensions, gratuities b. Fees paid to a public official c. Interest coupons that have matured and are payable but have not been cashed d. Deposits for rentals to answer for damages, restricted as to use 12. Constructive receipt occurs when the money consideration or its equivalent is placed at the control of the person who rendered the service without restrictions by the payor. The following are examples of constructive receipts, except

a. A security deposit to insure the faithful performance of certain obligations of the lessee to the lessor. b. Deposit in banks which are made available to the seller of services without restrictions; c. Issuance by the debtor of a notice to offset any debt or obligation and acceptance thereof by the seller as payment for services rendered; d. Transfer of the amounts retained by the payor to the account of the contractor. 13. There is constructive receipt of income when: a. Payment is credited to payee's account b. Payment is set aside for the payee, or otherwise made available so the payee may draw upon it at any time, or so payee could have drawn upon it during the taxable year notice of intention to withdraw had been given without substantial limitations c. Both "a" and "b” d. Neither "a" nor "b" 14. As a rule, income from whatever source is taxable. Income from whatever source may come from: I. Gains arising from expropriation of property II. Gambling gains III. Income from illegal business or from embezzlement IV. Recovery of receivables previously written off V. Tax refunds VI. Compensation for injury suffered VII. Gratuitous condonation of debt a. b. c. d.

I and II only I, IV and V only I, IV, V and VI only I, II, II, IV and V only

15. When different types of income are subject to common tax rate, the tax system is described as a. Global tax system b. Gross income tax system c. Scheduler tax system d. Final tax system 16. Situs of taxation on income from sale of property purchased. a. Place of the seller b. Place of sale C. Place of buyer d. As determined by the Commissioner

17. Which of the following test of source of income is incorrect? a. Interest income - residence of the debtor b. Income from services - place of performance c. Royalties - place of use of intangible d. Gain on sale of real property - place of sale. 18. Situs of taxation on income from sale shares of a domestic corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines C. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without the Philippines depending where the shares are kept 19. Situs of taxation on income from sale shares of a foreign corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines C. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without the Philippines depending where the shares are kept 20. Pedro earned interest income from a promissory note issued to him by Juan, a resident of California, U.S.A. Assuming that Pedro is a nonresident citizen, the interest income is a. Subject to basic income tax b. Subject to final tax c. Not subject to income tax d. Partly subject to scheduler and partly subject to final tax 21. It is important to know the source of income for tax purposes (i.e., from within or without the Philippines) because: a. Some individual and corporate taxpayers are taxed on their worldwide income while others are taxable only upon income from sources within the Philippines b.The Philippines imposes income tax only on income from sources within C. Some individual taxpayers are citizens while others are aliens D. Export sales are not subject to income tax 22. Situs, for taxation purposes will depend upon various factors, including I. The nature of the tax and the subject matter thereof.

II. The possible protection and benefit that may accrue both to the government and to the taxpayer. III. Domicile or residence IV. Citizenship V. Source of income a. I and V only b. I, III and IV only c. I, II, IV and V d. I, II, III, IV and V 23. Which of the following taxpayers is taxable on income from all sourceswithin and outside the Philippines? a. Domestic corporation b. Resident foreign corporation c. Resident citizen d. Both "a" and "C" 24. Which of the following is NOT true about source of income? a. In case of income derived from labor, source is the place where the labor is performed. b. In case of income derived from use of capital, source is the place where the capital is employed. c. In case of profits from the sale or exchange of capital assets, source is the place or transaction occurs. d.None of the above 25. Which income from sources partly within and partly outside the Philippines is allocated on the time basis? a. Income of the international shipping corporation with vessels touching Philippine ports b. Income of a telegraph company with transmission from the Philippines to points abroad c. Income from goods produced in whole or in part in the Philippines and sold in a foreign country, or vice-versa d. Income from personal services performed in part in the Philippines and in part abroad 26. All of the following are correct except one. Which is the exception? a. The source of interest income is the country where the debtor resides. b. The source of interest income is the country where the creditor resides. C. Rents or royalties are considered derived from the country where the property is located. d. Income from personal services is considered derived from the county where the services were rendered.

27. Statement 1: A gain from sale of shares of a domestic corporation shall be considered derived from the Philippines regardless of where the shares were sold. Statement 2: A gain from a sale of shares of a foreign corporation shall be considered derived from the country where the corporation was created or organized. a. Statements 1 & 2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement d. Statements 1 and 2 are true 2 is true 28. Which of the following is not an income derived from sources within the Philippines for income tax purposes? a. Interests derived from bonds issued by a foreign corporation b. Interest on notes or other interest-bearing obligations of residents c. Both "a" and "b" d. Neither "a" nor "b" 29. Which of the following statements is correct with respect to valuation of income? a. The amount of income recognized is generally the value received or which the taxpayer has a right to receive. b. If the services were rendered at a stipulated price, in the absence of any evidence to the contrary, such price shall be presumed to be the fair market value of the compensation received c. Transfer of land made by a person to another in payment of services rendered in the form of attorney's fees shall be considered as part of the gross income of the latter valued at either the fair market value or the zonal valuation, whichever is higher, in the taxable year received. d. All of the above 30. A cash dividend of P100,000 received by a taxpayer in 2020 from a foreign corporation whose income from Philippine sources was 40% of its total income is Statement 1: partly taxable if he is a resident citizen. Statement 2: Partly taxable if he is a non-resident alien WC a Statements 1 & 2 are false b. Statement 1 is true but statement 2 is false c. Statement 1 is false but statement 2 is true d. Statements 1 and 2 are true 31. Using the above data which of the following is correct? The cash dividend is a Exempt from income tax if he is a resident citizen b. Party taxable if he is a resident alien c. Taxable in full if he is a nonresident citizen

d. Exempt from income tax if he is a nonresident alien 32 A taxpayer is employed by a shipping company touching Philippine and foreign ports In 2020, he received a gross payment for his services rendered of P300,000 In that year, the vessels on board or which he rendered services has a total stay in Philippine ports of four months. His gross income from the Philippines was a P300,000 b. 0 c. P150,000 d. P100,000 33. Assume the following: Gain on sale of personal property purchased in the Philippines and sold in Hongkong Compensation received for personal services in the Philippines Rent income from real property in Malaysia Gain from sale in the Philippines of shares of a foreign corporation

P400,000 200,000 300,000 100,000

Deductions identified with Philippine income Foreign income Deductions unidentified with any particular income

80,000 120,000 30,000

The Philippine net income is a P220.000 b. P211.000 c. P190.000 d. P111 000 34. An operator of an illegal horse betting business has the following data during 2020 taxable year: Receipt from illegal bets Rent of space where bets are received, gross of 5% withholding tax Salaries of assistants, gross of creditable withholding tax Bribe money to obtain protection from arrest and prosecution How much is the taxable income a. P380,000 c. P180,000 b. P330,000 d. P150,000 Use the following data for the next two (2) questions:

P600,000 120,000 100,000

A resident alien had the following data for the year: Gross income, Philippines P2,000,000 Business expenses P1,200,000 Dividends received: From domestic corporation (net) 60% of its income came from the Philippines 40% of its income came from the Philippines

90,000 72,000

From domestic corporation (gross) 60% of its income came from the Philippines 40% of its income came from the Philippines

50,000 40,000

35. The taxpayer’s taxable income is a. P750,000 c. P796,000 b. P830,000 d. P800,000 36. The final withholding taxes on dividends amount to a. P16,200 c. P25,200 b. P18,000 d. P26,000 Use the following data for the next two (2) questions: F5 Corporation, a domestic corporation had the following data during the calendar year Gross Income, Philippines Allowable itemized deductions/expenses

P10,000,000 4,000,000

Dividend income FROM: a) Domestic corporation

1,000,000

b) Foreign corporation 80% of its gross income were derived from the Philippines

1,000,000

c) Foreign corporation. 60% of its gross income were derived from the Philippines

800,000

d) Foreign corporation, 25% of its gross income were derived from the Philippines

400,000

37. The taxable income is a. P9,200,000 b. P7,500,000 c. P8,200,000 d. P7.430,000

38. Assume that F5 Corporation is a resident foreign corporation, how much is the taxable income? a. P9,200,000 b. P7,500,000 c. P8,200,000 d. P7,280,000 39. How much is the total income tax expense of Lenovo? a. P200,000 b. P400,000 c. P320,000 d. P272,000 40. Assuming Lenovo is a domestic corporation, how much is its total income tax expense of Lenovo? a. P200,000 b. P560,000 c. P740,000 d. P680,000 41. The amount of income subject to tax should be: a. P0 b. P120,000 c. P180,000 d. P300,000 42. Sandara is subject to: a. Basic income tax on P180,000 b. Basic income tax on gross income of P300,000 C. Final withholding tax of 25% on P180,000 d. Final withholding tax of 25% on gross income of P300,000

43. Assuming Super Bowl is a domestic corporation, the amount of income subject to tax should be: a. P0 c. P180.000 b. P120,000 d. P300,000 44. Sandara, a nonresident citizen, received a dividend income of Kle

P300,000 in 2020 from Super Bowl Corporation, a foreign corporation doing business in the Philippines. The gross income of the foreign corporation from sources within and without the Philippines for the past three years preceding 2020 were provided as follows:

Source

2017

2018

2019

Philippines

14,000,000

10,000,000

12,000,000

Abroad

10,000,000

16,000,000

18,000,000

The amount of income subject to tax should be: a PO b. P135,000 c.P165,000 d. P300,000

T OR F (Tabag Book) - Chapter 8 1-25 Ange 1-2 Belle 3-4, 25 Cess 5-6 Celine 7-8 Chantal 9-10 Dianne 11-12 Ekai 13-14 Jai 15-16 Jem 17-18 Jen 19-20 Liah 21-22 Stacy 23-24 TRUE OR FALSE Write True if the statement is correct, otherwise, write False TRUE 1. Exclusion refers to income received or earned but is not taxable because it is exempted by law or by treaty. FALSE 2. Tax exempt income and receipts are required to be included in the income tax return. True 3. A government agency or instrumentality performing governmental function is exempt from taxation. False 4. Local government's operation of a public market is exempt from taxation. False 5. All associations or corporations enumerated under Sec. 30 of the NIRC on exempt association are automatically exempt from income tax. True 6. Exemption from tax is a privilege viewed with disfavor by the state. As such a taxpayer, to become exempt, must comply with the requirements for tax exemption by laws or regulations. False 7. Stipends received by resident physicians during their intensive training in the residency program of a hospital are subject to basic and final withholding taxes. True 8. Remuneration for services constitutes compensation income even if the relationship of employer and employee does not exist any longer at the time when payment is made between the person in whose employ the services had been performed and the individual who performed them. True 9. In general, fixed or variable allowances which are received by a public officer or employee or officer or employee of a private entity, in addition to the regular compensation,

fixed for his position or office, is compensation subject to income tax and consequently, creditable withholding tax on compensation income. True 10. Representation and Transportation Allowances (RATA) granted under Section 34 of the General Appropriations Act to certain officials and employees of the government are considered reimbursements for the expenses incurred in the performance one's duties rather than as additional compensation. TRUE. 11. Excess of RATA, if not returned to the employer, constitutes compensation income of the employee. TRUE. 12. COLA of minimum wage earners is exempt from income tax. True 13. Fees received by professionals in their practice of profession are treated as business income. False 14. Bad debts written off constitute income when recovered in the year of write off. False 15. Refund of Special Assessment is subject to basic Tax. False 16. Taxable Tax Refunds must be reported in the year they were received or the year they were refund was ordered at the option of the tax payer. True 17. Prizes less than P10,000 are taxable the same manner as business income False 18. Gifts, bequests and devises are subject to basic tax. False 21. Proceeds of life insurance policies paid to the heirs or beneficiaries upon the death of the insured under an agreement to pay interest only the interest thereon shall be excluded from the gross income True 22. Indebtedness condoned is taxable income of the debtor if it results to acquisition of something of exchangeable value in addition to what he has before the condonation False 23. Gain on court-approved debt restructuring is subject to basic tax. True 24. Obligations of the lessor to third persons paid or assumed by the lessee in consideration of a lease contract is part of the former’s taxable rental income. False 25. Advance rentals representing option money as well as security deposits to insure faithful performance of certain obligations of the lessee are considered part of the lessor's taxable income.

MCQ (Tabag Book) -Chapter 8 MULTIPLE CHOICE. Choose the letter of the correct answer.

Compensation Income, Pension and Retirement Benefit 1. Compensation income is earned when an employer-employee relationship exists. Which of the following income represents income earned through employee-employer relationship? I. II. III. IV.

Professional fees Wages Pension pay Capital gain

a. I only b. I and Ill only c. Il and Ill only d. I, II, III and IV 2. Which of the following compensation will be subject to graduated rates? a. Basic salary whether or not the employee is a minimum wage earner b. Basic salary only if the employee is not a minimum wage earner c. 13" month pay and other benefits not exceeding P82,000 d. Fringe benefits received by supervisory or managerial employee 3. Which of the following does not represent compensation income? I. Honorarium as a guest speaker II. Emergency leave pay III. Vacation and sick leave pay IV. Tips or gratuities accounted for by the employee to the employer a. I only b. IV only c. I and IV only d. None of the above 4. Tips or gratuities paid directly to an employee by a customer of the employer which are not accounted for by the employee to the employer are Statement 1: Considered passive income Statement 2 Considered income subject to schedular rate. Statement 3. Subject to creditable withholding tax a. ...

Similar Free PDFs

TAX QUIZ 4 T F MCQ hhka;sjdj

- 60 Pages

Contingent Liabilities - T/F

- 2 Pages

TAX QUIZ - Taxation Quiz

- 48 Pages

uji t f chi.docx

- 1 Pages

Domande elementi t. f

- 37 Pages

Quiz MCQ - MKT MCQ

- 7 Pages

Financial Statement Analysis T/F

- 5 Pages

Quiz 4 vat business tax 1322

- 3 Pages

ACCT 2082 - Practice T/F

- 4 Pages

BUSINESS TAX QUIZ

- 11 Pages

Midterm QUIZ TAX1 - tax

- 5 Pages

Midterm QUIZ TAX2 - tax

- 6 Pages

Quiz 2 TAX Reviewer

- 13 Pages

TAX Quiz 27 - tax lecture notes

- 2 Pages

Chapter 4 MCQ - Practice MCQ

- 13 Pages

MCQ-Clustering - Clustering QUIZ

- 33 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu